Principles of Capital Allocation

Capital Allocation Principles Although the known analytical tools and investment decision criteria are... Read More

A firm’s capital structure is the mix of debt and equity it uses to finance its investments. A capital structure decision aims to determine the financial leverage to maximize a company’s value by minimizing the weighted average cost of capital (WACC).

Franco Modigliani and Merton Miller (1958) argue that a firm’s choice of capital structure (how it finances its operations through debt and equity) does not affect its value under certain conditions. According to their theory, the firm’s value is determined by the present value of its expected future cash flows, which are discounted using the Weighted Average Cost of Capital (WACC).

Franco Modigliani and Merton Miller suggested the following assumptions for Proposition I:

Although these assumptions are unrealistic, Modigliani and Miller’s school of thought is that investors can create capital structures they prefer. Management’s capital structure does not matter because investors can change it at no cost.

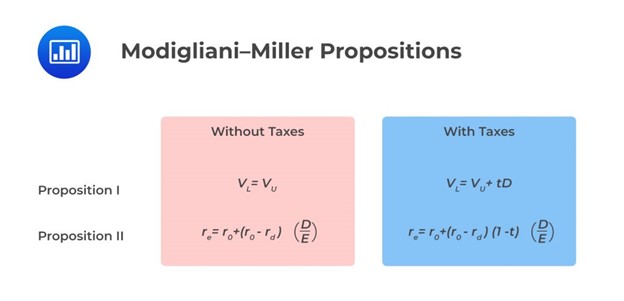

MM Proposition I, in the absence of taxes, states that a company’s market value is not influenced by its capital structure (the mix of debt and equity it uses for financing). This means that the value of a firm with debt (a levered firm) is the same as that of a firm without debt (an unlevered firm).

$$ \text{Value of levered firm }\left(V_L\right)=\text{value of an unlevered firm } \left(V_U\right) $$

The above relationship implies that cash flows, not capital structure, determine a company’s value. Additionally, assuming no taxes, a company’s capital structure does not affect its WACC.

Assume management has set a company’s capital structure to consist of 50% debt and 50% equity. Further, assume that the investor prefers the company’s capital structure to be 60% debt and 40% equity. The investors will use borrowed money to finance their share purchase so that the ownership of the company’s assets reflects 60% debt financing. The importance of the Modigliani and Miller theory is that managers cannot use capital structure to change a firm’s value.

Here, Franco Modigliani and Merton Miller remove a few assumptions from Proposition I and state that the cost of equity is a linear function of a company’s debt/equity ratio.

According to this proposition, the cost of equity increases as a company uses debt financing to maintain a constant WACC. The risk of equity is contingent on business risk and financial risk. Business risk determines the cost of capital, while capital structure determines financial risk.

Mathematically, MM Proposition II without taxes implies that the cost of equity is a linear function of a company’s D/E ratio:

$$

r_e=r_0+(r_0-r_d)\frac{D}{E} $$

Where:

\(r_e\)= The cost of equity.

\(r_0\)= The cost of capital for a company financed only by equity.

\(r_d\)= The cost of debt.

\(D\)= The market value of debt.

\(D\)= The market value of equity.

From the formula above, the following must be true:

Example: MM Proposition II Without Taxes

Genghis Investment has an all-equity capital structure. Its characteristics are as follows:

The value of Genghis and its cost of equity assuming MM Proposition II without taxes is closest to:

Solution

$$ V=\frac{EBIT}{r_{WACC}}=\frac{\$6,000}{0.12}=\$ 50,000 $$

When Genghis issues the debt, it pays 6% interest on the debt.

$$ \text{Interest Payment}=0.06\left(\$18,000\right)=\$1,080 $$

Using the MM proposition II, the cost of Genghis’ equity is given by:

$$ r_e=r_0+(r_0-r_d)\frac{D}{E} $$

Where:

$$ E=V-D=\$50,000-\$18,000=\$32,000 $$

So,

$$ r_e=0.12+\left(0.12-0.06\right)\frac{\$18,000}{\$32,000}=0.15375=15.38\% $$

Genghis makes $1,080 to debtholders and \(\$6,000-1,080=\$4,920\) to equity holders. The value of debt is calculated as follows.

$$ V=D+E=\frac{\$1,080}{0.06}+\frac{\$4,920}{0.1538}=\$50,000 $$

A tax shield is the deliberate use of taxable expenses to offset taxable income. The interest expense on debt provides a tax shield that results in savings that enhance the value of a company. Ignoring the practical realities of bankruptcy and financial distress costs, the value of a company increases with increased debt levels. The level of tax benefit reduces the actual cost of debt.

Note that,

$$ \text{After-tax cost of debt}=\text{Before-tax cost of debt}\times(1-\text{marginal tax rate}) $$

According to MM Proposition I, with taxes, the value of the levered company is greater than that of the all-equity company by an amount equal to the corporate tax rate multiplied by the value of the debt (tD).

The MM Proposition I with taxes is:

$$ \begin{align*} V_L & =V_U+tD \\

\Rightarrow V_L & \gt V_U \end{align*} $$

Where:

\(V_L\)= Value of the levered firm (debt in the capital structure).

\(V_U\)= Value of the unlevered firm (no debt in the capital structure).

\(t\) = Marginal tax rate.

\(tD\) = Present value of the debt tax shield.

In summary, under MM Proposition I with taxes:

By introducing taxes, the WACC is adjusted to reflect the impact of the tax benefit:

$$ r_e=r_0+(r_0-r_d)(1-t)\frac{D}{E} $$

We can see that the WACC for a company with debt is lower than the WACC for companies without debt. Therefore, debt financing is highly beneficial when considering taxes and ignoring financial distress and bankruptcy costs. The firm’s optimal capital structure is still 100% debt.

In summary, if MM Proposition II with taxes holds, then the following must be true:

Example: MM Proposition I and II With Taxes

Let us use the example of Genghis Investments.

The value of Genghis is calculated as follows:

$$ V_U=\frac{EBIT(1-t)}{WACC}=\frac{\$6,000(1-0.3)}{0.12}=\$35,000 $$

The value of Genghis when it issues $18,00 in debt and buys back shares:

$$ V_L=V_U+t_D=\$35,000+0.3\left(\$18,000\right)=\$40,400 $$

The value of equity after buyback is $40,400–$18,000=$22,400$40,400–$18,000=$22,400, and levered equity is:

$$ r_e=0.12+\left(0.12-0.06\right)\left(1-0.3\right)\frac{\$18,000}{\$22,400}=0.15375=15.38\% $$

So that,

$$ \begin{align*} V_L & =D+E=\frac{r^{dD}}{r^d}+\frac{(EBIT-r^{dD})(1-t)}{r_e}\\ & =\frac{\$1,080}{0.06}+\frac{(\$6,000-\$1,080)(1-0.3)}{0.15375} \\ & =\$40,400 \end{align*} $$

The WACC of a levered Genghis is:

$$ \begin{align*} r_{WACC} &=\left(\frac{\$18,000}{\$40,400}\right)06\left(1-0.3\right)+\left(\frac{\$22,400}{\$40,400}\right)0.15375 \\ & =0.1039=10.39\% \end{align*} $$

Therefore,

$$ V_L=\frac{EBIT(1-t)}{WACC}=\frac{\$6,000(1-0.3)}{0.1039}\approx \$40,400 $$

Financial distress is the increased uncertainty about a company’s capability to fulfill its commitments due to reduced profitability or current financial losses.

The disadvantage of operating and financial leverage is that the earnings are magnified downwards during an economic slowdown. Lower earnings put companies in financial distress, which adds costs.

The costs of financial distress can be classified as direct or indirect. Some direct costs include actual cash expenses (such as administrative costs) associated with bankruptcy. In contrast, indirect costs include agency costs associated with the debt, forgone investment opportunities, and impaired ability to conduct business.

Companies with assets with a ready secondary market have lower costs associated with financial distress. On the other hand, companies with fewer tangible assets have less liquidity and higher costs associated with financial distress. The probability of bankruptcy increases as the degree of leverage increases.

Question

Which of the following is most likely true about the effect of asymmetric information on the cost of equity?

- Companies with lower asymmetry of information have a greater likelihood of agency cost.

- Some degree of asymmetric information exists because investors never have as much information as managers.

- Managers choose financing methods according to a hierarchy that prefers the method with the most potential information content.

Solution

The correct answer is B.

Managers have more information about the company’s current performance and its future potential investments than investors.

A is incorrect. Companies with lower asymmetry of information have less likelihood of agency costs.

C is incorrect. Managers choose financing methods according to a hierarchy that prefers the method with negligible potential information content.