Sources of Risk, Return, and Diversifi ...

Hedge funds function as investment vehicles designed to minimize market exposure and returns... Read More

Alternative investments, such as hedge funds, private equity, and real estate, possess unique characteristics that must be considered when assessing their performance relative to other investments or more traditional asset classes like stocks and bonds over time. These features include:

These features, highlighted in previous lessons, must be incorporated into the performance appraisal for alternative investments.

Review performance appraisal of alternative investments with a free trial.Alternative investment returns typically deviate from a normal distribution. This necessitates using different measures of risk and return than those used for more traditional asset classes. For example, the standard deviation, a common measure of risk for traditional investments, might not be appropriate for alternative investments due to their non-normal return distributions.

Traditional asset classes, such as public equity and debt securities, are standardized claims that do not require any further capital commitments and provide identical claims to periodic cash

flows. For instance, if you buy shares of a company like Apple or Microsoft, you are entitled to a share of the company’s profits in the form of dividends. Similarly, suppose you buy a bond issued by a company or a government. In that case, you are entitled to receive periodic interest payments and the return of the principal amount at the end of the bond’s term.

The prices of these publicly traded securities are often continuously quoted on stock exchanges, making it easy to compare their performance over a specific period. Large peer groups of similar investments are available, and common indexes like the S&P 500 or the FTSE 100 are used to benchmark returns. This makes the performance appraisal of publicly traded securities straightforward to implement and evaluate.

On the other hand, alternative investments are customized investments. Their distinctive features complicate the performance appraisal between investments and across asset classes. These features include:

For instance, a private equity investment may require additional capital commitments at various stages of the investment, and the return on investment may depend on the successful execution of a business plan or a successful exit strategy such as an IPO or a sale to another company. Similarly, a hedge fund investment may involve complex strategies such as short selling or leverage, and the performance appraisal may need to consider the risk-adjusted return and the impact of fees and expenses.

Therefore, while traditional asset classes offer simplicity and standardization, alternative investments offer the potential for higher returns and diversification benefits but at the cost of higher complexity and risk.

When evaluating alternative investments, it’s crucial to focus on four key areas:

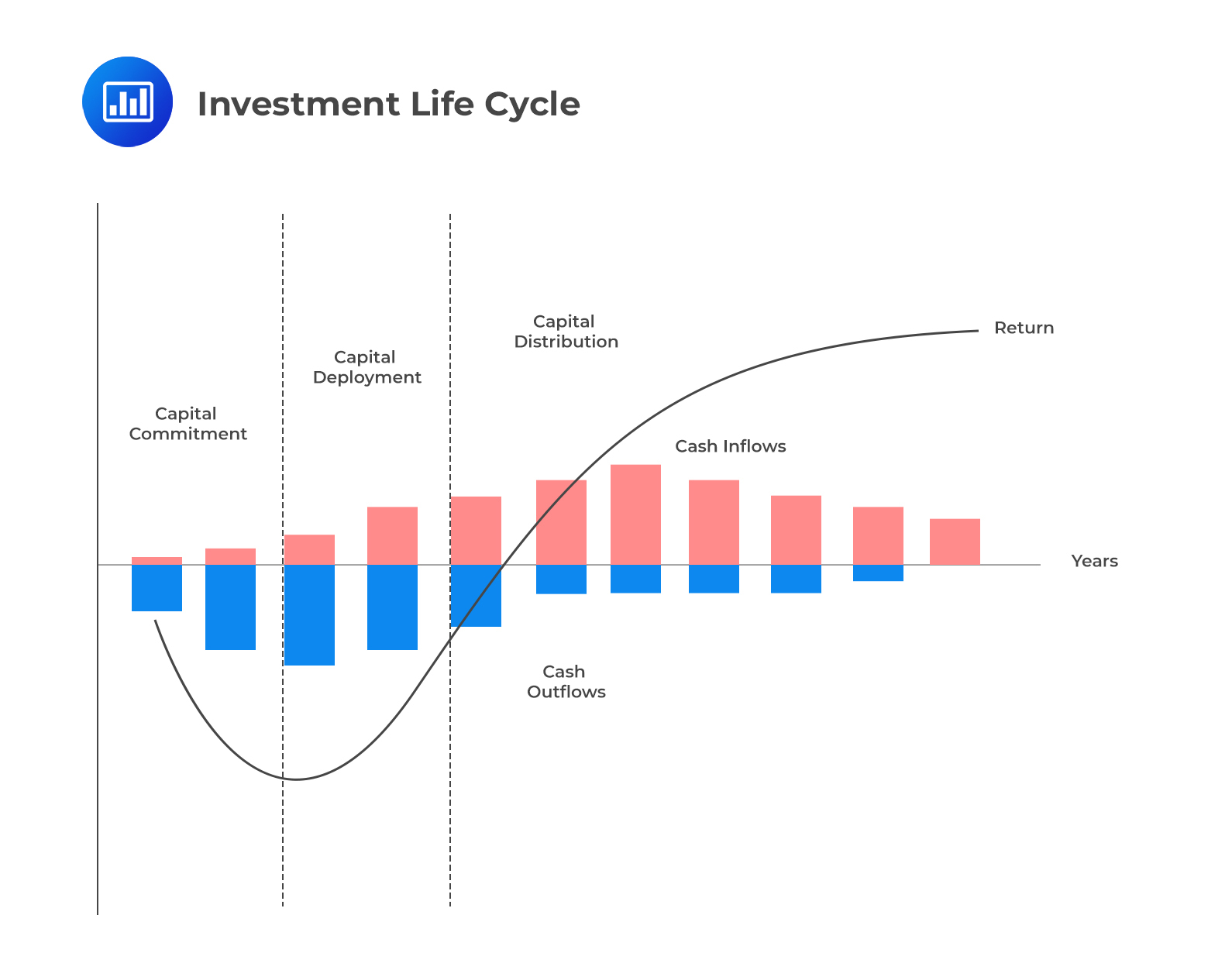

Alternative investments usually involve a longer investment life cycle with distinct phases characterized by net cash outflows and inflows. These are shown in the following diagram (J-curve):

The J-curve effect represents the initial negative return in the capital commitment phase followed by an acceleration of returns through the capital deployment phase. Returns often level off as capital is distributed to investors, investments are sold, and the fund is closed.

Each of the investment life cycles is discussed below:

The internal rate of return (IRR) is often used as an initial approach to calculate investment returns for these investments, which include private equity and real estate investments. The Internal Rate of Return (IRR) considers both the timing and magnitude of cash flows invested in an investment as well as the timing and magnitude of cash flows generated by the investment, including any tax benefits.

IRR calculations involve certain assumptions about a financing rate for outgoing cash flows and a reinvestment rate for incoming cash flows. The IRR is the critical metric for assessing longer-term alternative investments in private equity and real estate.

The IRR can be calculated as follows:

$$0 = \sum_{t=0}^{T} \frac{CF_t}{(1+IRR)^t}$$

Multiple of invested capital (MOIC) or money multiple is the ratio of the total value of the distributions and assets yet to be sold (residual asset values) to an initial investment. MOIC does not consider the timing of the cashflows, but it is easy to calculate and understand. A MOIC of 3x implies that an investor earned three times the initial investment. Time is very significant in MOIC. For instance, a MOIC of 3x achieved in 2 years is more beneficial than the same MOIC achieved in 30 years.

$$MOIC = \frac{\text{(Realized Value of Investment + Unrealized Value of Investments)}}{\text{Total Amount of Invested Capital}}$$

MapleLeaf Ventures started a fund with a capital commitment of CAD 400 million. The fund calls in CAD 200 million at the end of Year 1. By the end of Year 5, CAD 900 million is distributed back to its investors, and the fund retains an asset value of CAD 300 million.

After five years, the calculated MOIC for MapleLeaf Ventures is approximately \(2\times\). This implies that for every dollar (or, in this case, Canadian dollar) invested into the fund, the investors received back approximately two times throughout the investment period (in this case, five years). The result suggests a successful investment strategy, as the fund was able to return close to double the capital that was initially invested.

This is after accounting for capital calls, management fees, investor distributions, and the remaining asset value. However, it’s important to note that while MOIC provides a valuable snapshot of the overall return, it does not account for the time value of money. Therefore, it’s often used with other metrics, such as the Internal Rate of Return (IRR), to give a more comprehensive view of investment performance.

Alternative investments, such as hedge funds, private equity, and real estate, often use borrowed funds to enhance investment returns. This financial leverage can amplify both gains and losses by enabling investors to take a market position larger than the committed capital. For instance, a real estate investor might use a mortgage to finance a portion of a property purchase, thereby increasing the potential return on their capital.

Assuming an investor has a cash investment \(V_c\) with a periodic rate of return \(r\) and is able to borrow at a periodic rate of \(r_b\) to increase the investment size by borrowed funds of \(V_b\), the leveraged rate of return \(r_L\) for the period can be calculated as follows:

$$r_L = \frac{r \times (V_c + V_b) – (V_b \times r_b)}{V_c}$$

The relationship between the cash portfolio return, rc, and the leveraged rate of return, rL, can be shown as follows:

$$r_L = r + \frac{V_b}{V_c} (r – r_b)$$

Quercus Capital Fund, a private equity fund with a capital of USD200 million, often employs leverage to invest in a mix of convertible bonds.

Scenario 1: Given that Quercus’s underlying positions yield a return of 10% and the fund leveraged an additional USD100 million at a borrowing cost of 3%, the leveraged return is:

\[ V_c = 200 \]

\[ V_b = 100 \]

\[ r_L = 0.10 + \left( \frac{100}{200} \right) (0.10 – 0.03) = 13.5% \]

Scenario 2: If Quercus’s underlying positions suffer a loss of 3% and the fund borrowed USD100 million at 3%, the leveraged return is:

\[ V_c = 200 \]

\[ V_b = 100 \]

\[ r_L = -0.03 + \left( \frac{100}{200} \right) (-0.03 – 0.03) = -6% \]

The second scenario showcases the risks associated with leverage. When the investment strategy doesn’t pan out as expected, leverage can significantly magnify losses. As shown in this example, we can see that leverage is a double-edged sword. While it has the potential to magnify returns in favorable conditions, it can also amplify losses when things don’t go as planned. Investors and fund managers using leverage need to be aware of these risks and ensure they have risk management strategies to mitigate potential downsides.

Hedge funds leverage their portfolios using derivatives or borrowing capital from prime brokers. They negotiate margin requirements, interest, and fees in advance of trading. In a standard margin financing arrangement, the prime broker lends shares, bonds, or derivatives to the hedge fund, while the hedge fund deposits cash or other collateral into a margin account, typically based on specified fractions of the investment positions.

The margin account represents the hedge fund’s net equity in its positions. The minimum margin required depends on the riskiness of the investment portfolio and the creditworthiness of the hedge fund. For example, a hedge fund might use borrowed funds to take a larger position in a particular stock, potentially amplifying its returns if the stock price increases.

Suppose the margin account or the hedge fund’s equity in a position falls below a designated threshold. In that case, the lender triggers a margin call and asks the hedge fund to provide additional collateral. Failing to meet margin calls can exacerbate losses, as the hedge fund may need to sell the losing position. This liquidation can result in further losses if the order size is substantial enough to impact the security’s market price before the fund can adequately exit the position.

Alternative assets, including real estate, private equity, and hedge funds, are often illiquid. This makes it challenging to assess their performance over time and draw comparisons with traditional assets. All investments must be recorded at their fair value, a market-based measure that reflects the assumed exit price for a seller. Although interim accounting values may not be as crucial during periods without expected cash flows, relying solely on these can give investors a misleading sense of stability and a low correlation to other assets.

There is a three-level hierarchy when measuring the fair value of assets:

Level 1: This includes quoted prices of assets in active markets that may be accessed at the measurement date. They include exchange-traded public equity securities, where observed closing market prices are used

Level 2: These are asset/ liability inputs other than those in Level 1 that are directly or indirectly observable. They include over-the-counter interest rate derivatives, where a pricing model based on quoted market prices is used.

Level 3: These are unobservable inputs used to measure the value of assets/liabilities with little to no market activity as of the measurement date. These include private equity or real estate investments, where fair is based on cash flow projection based on available market participant assumptions.

While traditional asset classes often rely on Level 1 inputs, valuing private equity, real estate, and other infrequently traded assets using Level 3 inputs presents greater challenges.

Interim accounting values may hold less significance for partnerships during periods with no expected cash flows in or out. Over time, the absence of new market information can anchor the value of these long-term investments near their initial cost, adjusting the carrying value only when impairments or realization events occur. This relatively stable accounting approach may create a perception of lower correlation and reduced volatility compared to other investments. However, a more realistic assessment may arise if managers are compelled to liquidate a portfolio prematurely.

In Level 3 asset pricing, regardless of the model employed by a manager in such situations, it is essential to independently test, benchmark, and calibrate the model to industry-accepted standards to ensure consistency in the approach.

Due to the potential for conflicts of interest when estimating value, hedge funds must establish in-house valuation procedures, communicate them to clients, and consistently adhere to them.

Nevertheless, it’s crucial for alternative asset investors to focus on the nature of assets that can only be valued on a “mark-to-model” basis. Such models may reflect imperfect theoretical valuations rather than true liquidation values. The illiquid nature of these assets means that estimates, rather than observable transaction prices, often contribute to their valuation. Consequently, returns may appear more stable or inflated, while the true volatility of returns may be understated.

In conclusion, any investment vehicle heavily reliant on Level 3 priced assets warrants increased scrutiny and due diligence.

Unlike traditional asset classes such as stocks and bonds, which typically involve a flat management fee, alternative investments often impose additional performance fees. These fees are calculated as a percentage of the fund’s periodic returns. This unique fee structure can make the performance appraisal of alternative investments challenging to generalize due to the variability of results based on the timing and nature of an investor’s involvement in a particular vehicle.

Let’s consider an example to illustrate this point. Suppose an investor decides to invest substantial capital in a hedge fund during its early stages. In this case, the investor might face significantly lower incentive fees due to the fund’s initial growth phase. The fund manager may offer lower fees to attract more capital. Alternatively, if the investor is willing to accept more stringent restrictions on redemptions, such as lock-up periods, they may also be offered lower fees.

On the other hand, consider an investor who enters a private equity fund following a significant drop in its value. If the fund’s value increases, the investor may be subject to performance fees. However, an earlier investor who experienced a sharp decrease in value from its peak might be exempt from such fees for the same period. Many alternative investment funds use a ‘high-water mark’ or ‘hurdle rate’ mechanism to ensure that performance fees are only charged on net gains.

Question

An investor is considering entering a private equity fund following a significant drop in its value. The equity has a hurdle rate and high-water mark provisions. If the fund’s value increases after his investment, what might be the most likely impact on the performance fees he is subject to and why?

- The investor may be subject to performance fees, typically charged on net gains following a significant drop in the fund’s value.

- The investor may be exempt from performance fees, as these are typically waived for investors who enter the fund following a significant drop in value.

- The performance fees will remain unchanged regardless of the fund’s value, as alternative investment fees are typically flat and do not vary with the fund’s performance.

The correct answer is A.

When an investor enters a private equity fund following a significant drop in its value, he may be subject to performance fees if the fund’s value increases after his investment. Many alternative investment funds use a ‘high-water mark’ or ‘hurdle rate’ mechanism to ensure that performance fees are only charged on net gains. The high-water mark is the highest value that the fund has reached in the past.

The fund manager only earns a performance fee when the fund’s value exceeds its previous high-water mark. Therefore, if the fund’s value increases after the investor’s entry, the fund may reach a new high-water mark, and the investor may be subject to performance fees.

B is incorrect. While it might seem fair to exempt investors who enter the fund following a significant drop in its value from performance fees, this is typically not the case. The high-water mark or hurdle rate mechanism ensures that performance fees are charged on net gains, regardless of when an investor enters the fund. Therefore, if the fund’s value increases after the investor’s entry, he may still be subject to performance fees.

C is incorrect. While some alternative investment funds may charge flat fees, they commonly charge performance fees that vary with the fund’s performance. Therefore, the investor’s performance fees may change if the fund’s value increases after his investment.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.