Features and Investment Characteristic ...

Private debt refers to the various forms of debt provided by investors directly... Read More

Alternative investments offer investors portfolio diversification opportunities and potentially high returns on a risk-adjusted basis. As such, many investors may neglect the apparent risks and instead focus only on the expected returns. Alternative investments are associated with the following risks:

Therefore, pre-investment alternative investment analysis is more of a qualitative than a strictly quantitative evaluation. The evaluation also depends on the objectives of an investor. Nevertheless, alternative investment analysis should not focus only on the total return but also on risks and portfolio-level correlation benefits.

The Sharpe ratio is the portfolio risk premium divided by the portfolio risk. That is,

$$\text{Sharpe ratio}=\ \frac{R_p-\ R_f}{\sigma}$$

Where:

\(R_p\) = Expected portfolio return.

\(R_f\) = Risk-free rate of return.

\(\sigma) = Standard deviation of the portfolio.

A major downside of the shape ratio is that it assumes that returns are normally distributed. The return profiles of alternative investments are often asymmetric and skewed due to underlying risks such as illiquidity and poor portfolio transparency. As such, the Sharpe ratio is a less effective measure of alternative investment performance.

The Sortino ratio is better than the Sharpe ratio because it focuses on the performance relative to downside volatility. As such, it captures the effect of skewness and kurtosis.

$$\text{Sharpe ratio}=\ \frac{R_p-\ R_f}{\text{Downside deviation of the portfolio}}$$

The Calmar Ratio and MAR Ratio are improved substitutes for the Sharpe ratio. They are used when evaluating the performance of alternative investments by comparing performance to a drawdown. A drawdown is the net asset value’s peak-to-trough (high-to-low) percentage decline (NAV). A portfolio’s maximum drawdown (MDD) is the largest loss an analyst can observe between a portfolio’s peak and trough before a new peak is reached.

The Calmar ratio compares the average annual compounded return to the maximum drawdown risk. Analysts use the prior three years of performance to calculate the Calmar ratio. The higher the Calmar ratio, the better the performance of an alternative asset.

A variation of the Calmar ratio is the MAR ratio, which uses an entire investment history and the maximum drawdown.

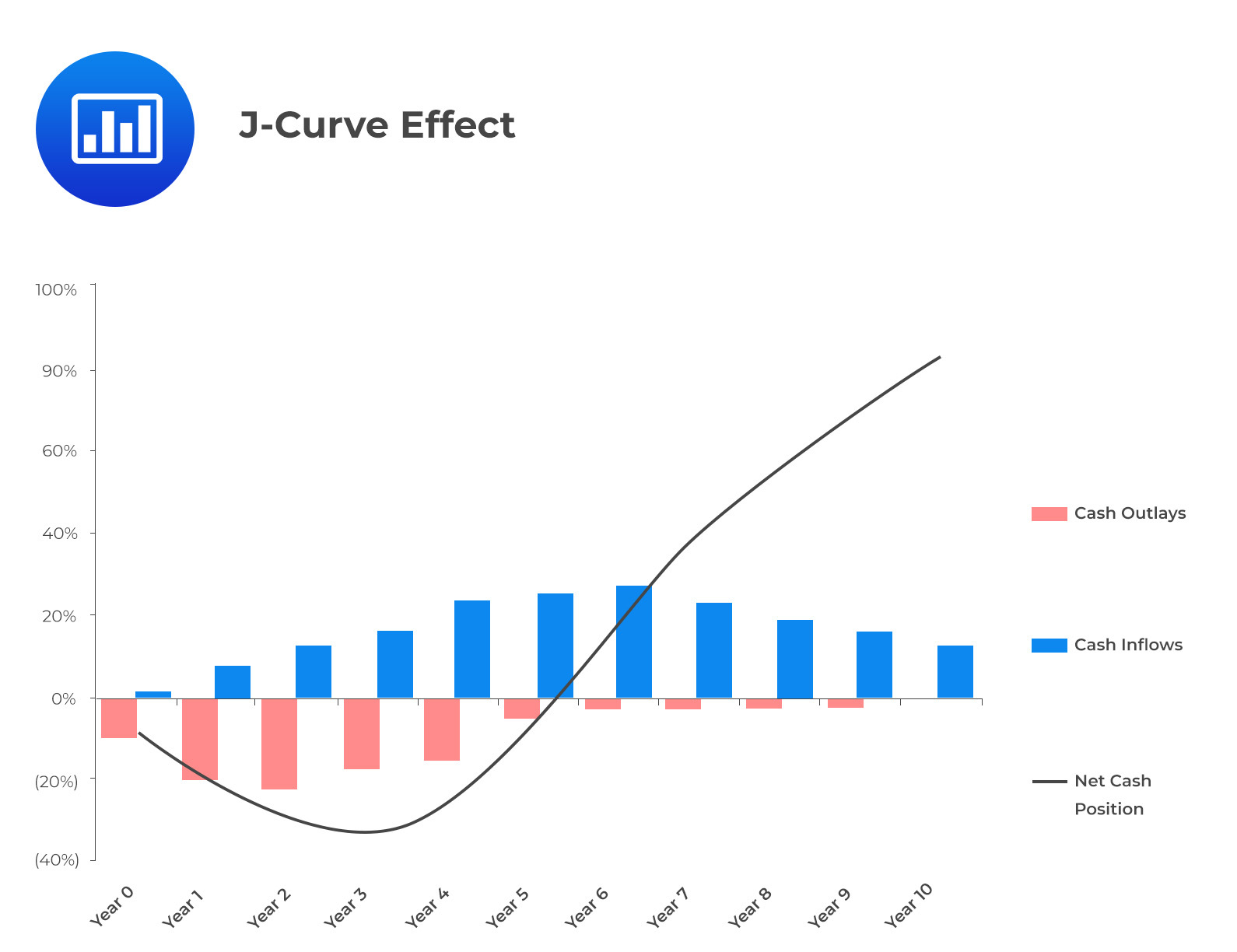

Private equity and real estate investments involve vast amounts of initial capital commitments (outlays), with the cash inflows happening later during the investment life cycle. Notably, actual cash flows lag that commitment since capital calls are staggered over time, creating a J-curve effect.

Primary valuation techniques in real estate and private equity include the internal rate of return (IRR) and the multiple invested capital (MOIC) or money multiple on total invested capital. Others include quartile ranking and cape rates.

Both private equity and real estate involve cashflows, whose timing is crucial in investment decisions. As such, IRR qualifies as a suitable performance valuation tool.

The internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. For a project with one initial outlay, the IRR is the discount rate that makes the present value of the future after-tax cash flows equal to the investment outlay.

The IRR solves the equation:

$$\sum_{i=1}^{n}{\frac{CF_t}{\left(1+IRR\right)^t}- \text{Initial investment}=0}$$

Where:

\(CF_t\) = Cashflow at time \(t\).

An investment is suitable if its IRR exceeds the required rate of return. The opposite is true.

IRR is a suitable performance valuation tool for long-term investments such as private equity and real estate.

Multiple of invested capital (MOIC) or money multiple is the ratio of the total value of the distributions and assets yet to be sold (residual asset values) to an initial investment. MOIC does not consider the timing of the cashflows, but it is easy to calculate and understand. A MOIC of 3x implies that an investor earned three times the initial investment. Time is very significant in MOIC. For instance, a MOIC of 3x achieved in 2 years is more beneficial than the same MOIC achieved in 30 years.

MOIC is calculated as follows:

$$\text{MOIC}=\frac{\text{(Realized value of investment + Unrealized value of investment}}{\text{(Total amount of invested capital)}}$$

Real estate investors use a measure called the cap rate. This is calculated as net operating income divided by a property’s market value.

$$\text{Cap rate} = \frac{\text{Net operating income}}{\text{Market value of property}}$$

This measure is usually used to assess the ability of fund managers. Quartile ranking shows the performance of fund managers relative to a group of peer investment vehicles created with the same investment features and approximately the same timing (same vintage year).

A cap rate is used to assess the performance of real estate managers. The cap rate is the ratio of actively earned annual rent less any unoccupied property to the initial price paid for the property.

Hedge funds achieve higher returns by using leverage. Leverage allows the fund to take larger positions relative to its committed capital. This is done by borrowing capital or using derivatives.

Besides being a reason hedge funds achieve a high return, leverage is also a reason for the funds’ significant losses since it comes with increased risks. Examination of the Sharpe ratio, Sortino ratio, or any other metric may not reveal the application of leverage.

The way portfolios are marked to market is another qualitative factor that should be considered. Particularly, this applies when trading less liquid securities.

Proper valuations are essential for calculating performance. The frequency at which alternative investments are valued varies. For hedge funds, assets are initially valued internally and subsequently regularly confirmed by an external administrator. These valuations may use market values or estimated values of their positions. Occasionally, some positions may be highly illiquid or non-traded. Such investments may not have reliable market values, so estimation would be required.

Redemptions frequently occur when hedge funds are performing poorly. This may compel fund managers to liquidate positions at disadvantageous prices while incurring transaction costs. Funds may charge redemption fees to discourage redemptions and require notice periods and lockup periods. In addition, funds may prop a gate that limits or restricts redemptions for a period of time.

Question

Which of the following is least likely a risk associated with alternative investments?

A. Limited transparency.

B. Low portfolio-level liquidity.

C. Unlimited redemption.

Solution

The correct answer is C.

In alternative investments, redemption may be limited. Alternative investments are associated with the following risks:

- Low transparency. (Option A.)

- Complex strategies and products.

- Low liquidity on a portfolio basis. (Option B.)

- Regular use of leverage and, sometimes, derivatives.

- Differentiation and diversification challenges.

- Compulsory/obligatory fees.

- Investment portfolios with specialized niche products mainly experience mark-to-market issues.

- Limited redemption may be limited. Also, eventual redemption may put pressure on a portfolio.