Hedge Fund Fees

Management and Incentive Fees Hedge fund fees are usually two-fold: management fees and... Read More

Private debt refers to the various forms of debt provided by investors directly to private entities. The expansion of the private debt market in the past decade has been largely driven by private lending funds. After the 2008 financial crisis, banks were more cautious in lending due to stricter regulations. This created an opportunity for private lending funds to step in and provide the necessary capital to businesses.

There are four primary methods of private debt investing: Direct lending, mezzanine loans, venture debt, and distressed debt.

Venture debt is private funding given to start-ups or early-stage firms that may generate small or negative cash flow. Companies may seek venture debt, often in the form of a line of credit or term loan, to obtain additional financing without further diluting shareholder ownership. For example, a tech startup might seek venture debt to fund its research and development activities without having to give up more equity.

Venture debt can complement existing equity financing, allowing current shareholders to maintain ownership and control for a longer period. It may carry additional features that compensate the investor/lender for the increased risk of default or for the start-up and early-stage companies that lack substantial assets for debt collateral.

Direct lending involves private debt investors offering capital to borrowers directly. In return, the private debt investors receive interest, the original principal, and other required repayments. Private debt is like a typical bank loan since it has a fixed structure of payments. It is a senior and unsecured loan containing covenants to protect the lender and the borrower.

In direct lending, a private equity firm collects funds from investors seeking higher-yielding debt. The fund managers then use the funds to grant loans to entities such as private equity funds. The interest rate in private equity is relatively higher since the entities seeking capital lack an alternative to bank loans-usually, banks may have denied them loans.

Direct lending may be done through a leveraged loan. In the case of a leveraged loan, private debt firms borrow to fund a private debt and then extend a loan to another borrower. A leveraged loan has the potential to increase private debt firms’ returns.

Mezzanine debt is a private debt subordinate to senior secured debt but senior to equity in the borrower’s capital structure. In other words, mezzanine debt is a pool of extra funds available to borrowers above senior secured debt. Mezzanine debt is usually common in financing leveraged buyouts (LBOs), recapitalization exit plans, acquisitions, and similar structures.

Mezzanine debts are riskier than senior secured debts since they are unsecured. As such, the interest rate investors charge in mezzanine debt is higher and may involve options for equity participation. Other features of mezzanine loans are the warrants or conversion rights, which allow for equity participation – converting debt into equity or buying a borrower’s equity in particular conditions.

Distressed debt investors buy the debt of mature companies battling financial challenges such as bankruptcy, defaulting on debt, or nearing default. Distressed debt is usually appropriate for companies experiencing temporary cash flow difficulties but that have good business plans, remain afloat, and later succeed. As such, distressed debt investors purchase the debt and actively involve themselves in running the company in a bid to restructure and revive it.

Investors concentrating on distressed debt need to develop specialized knowledge related to assessing the likelihood of default and the possible recovery rates. Bankruptcy procedures can be lengthy, complex, and capital-intensive.

Similarly, distressed debt investors need to understand how to restructure companies and restructure debt. For instance, an investor might buy the distressed debt of a struggling retail chain, betting that the company can turn its fortunes around or that the recovery rate on the debt will be high enough to make the investment profitable.

Unitranche debt is made of a combined or hybrid loan structure. It is a blend of different tranches of unsecured and secured debts that collectively form a single loan with a single, blended interest rate that falls between the interest rates of secured and unsecured debts. As such, unitranche is ranked between senior and subordinated debts.

For example, a private debt firm might extend a unitranche loan to a healthcare company looking to acquire a competitor, combining secured debt (backed by the company’s assets) and unsecured debt (not backed by any collateral) into a single loan with a blended interest rate.

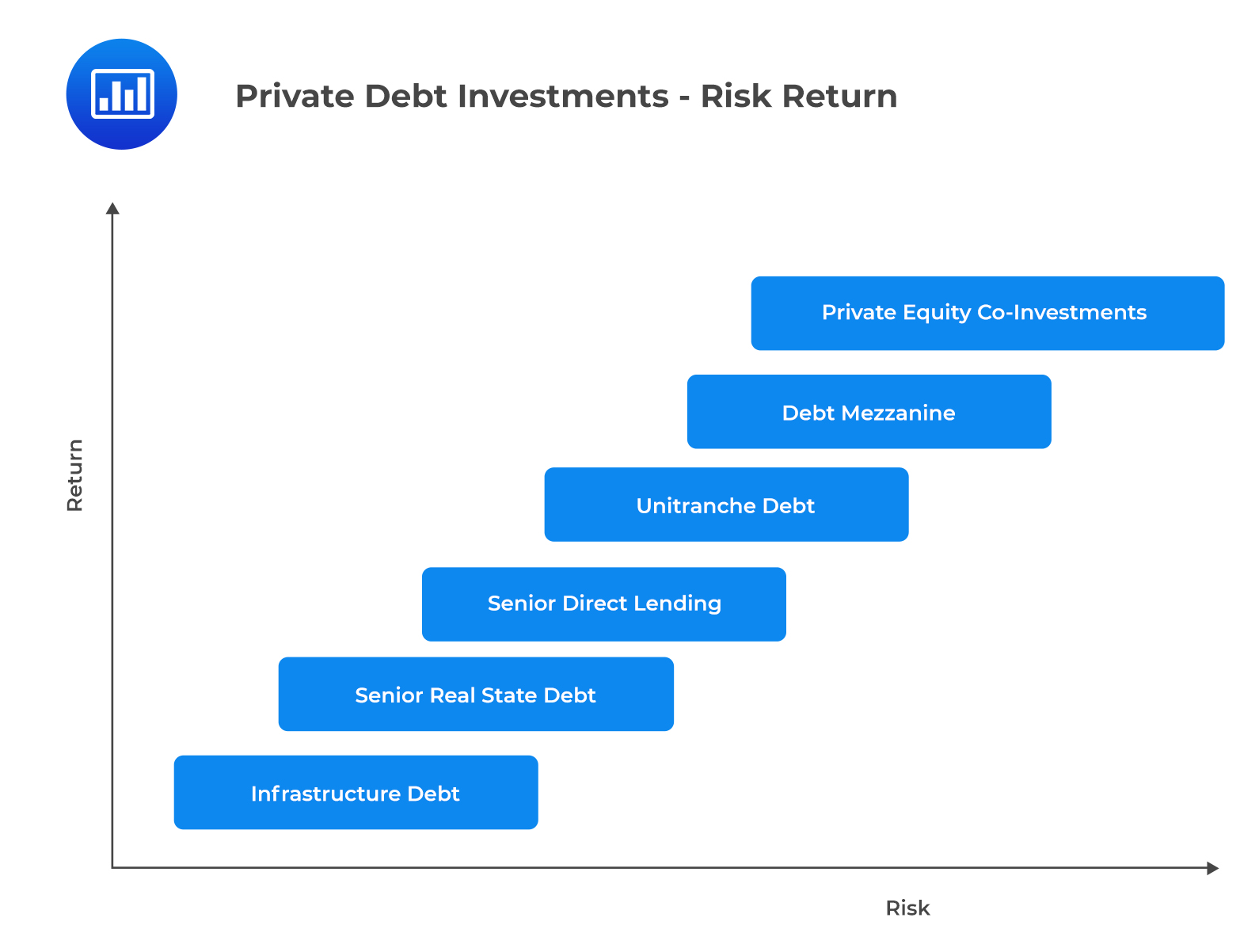

Private debt investments have become an appealing alternative for fixed-income investors seeking higher yields compared to traditional bonds such as government or corporate bonds. Larger levels of risk are linked to the possibility of higher rewards, as seen in the graph below:

The allure of private debt largely comes from the illiquidity premium, which compensates investors for the lack of liquidity associated with these investments as opposed to public bonds.

Additionally, private debt can enhance portfolio diversification as its returns may not correlate with those from other asset classes.

The interest rates on private debt are often benchmarked to reference rates like the Secured Overnight Financing Rate (SOFR), with a specified number of basis points added on. For instance, if SOFR is 2% and the private debt offers SOFR + 200 basis points, the interest rate on the private debt would be 4%.

This mechanism ensures that the coupon rate of the debt fluctuates with changes in the broader interest rate environment.

Private debt entails distinct entry and exit points with lenders, providing borrowers with more flexibility in financing arrangements. Specialized knowledge is necessary to navigate private debt financing, with investors needing to understand the borrower’s industry, financial health, and loan agreement terms.

The phase of a company’s life cycle significantly impacts the risk and return profile of debt financing. Early-stage debt financing usually carries higher risks but also offers higher returns.

The spectrum of private debt offers varying levels of risk and return. Senior private debt, for instance, provides a steadier yield with moderate risk, while mezzanine private debt presents higher growth potential, equity upside, and increased risk.

Investing in private debt is generally riskier than traditional bonds. It’s imperative that investors are cognizant of the associated risks, including illiquidity and heightened default risk, especially when loans are extended to riskier entities or in precarious situations.

The modeling of private equity or debt returns is complex due to the scarcity of high-quality data and the tendency for returns to be artificially smoothed. This is partly because private debt returns are often based on appraisals rather than market prices, and these investments usually lack a set maturity date.

Private debt investment, much like private equity investment, provides a range of choices for investors based on the direct versus indirect investment approach.

In direct private debt investment, the investor lends directly to a specific operating company. In the indirect approach, the investor purchases an interest in a fund that pools contributions to buy into the debt from a set of operating companies. This could be likened to an investor buying into a mutual fund that invests in the debt of companies.

Question

Which of the following is most likely the primary factor that led to the expansion of the private debt market after the 2008 financial crisis?

- The rise in the number of private lending funds.

- The increased demand for borrowing from private entities.

- The reduced lending supply from traditional lenders due to stricter regulations.

The correct answer is C.

After the financial crisis, banks and other traditional lenders faced stricter regulations and higher capital requirements, which made them more cautious in their lending practices. This created a gap in the market, as the demand for borrowing remained high, particularly from small and medium-sized enterprises that were unable to access traditional sources of finance.

This gap was filled by private lending funds, which were able to provide the necessary capital to these borrowers. The growth of the private debt market was therefore driven primarily by the reduced supply of lending from traditional lenders rather than by an increase in demand or the rise in the number of private lending funds.

A is incorrect. The rise in the number of private lending funds was a response to the gap in the market created by the reduced lending supply from traditional lenders rather than a primary driver of the expansion of the private debt market. These funds were able to step in and provide the necessary capital to borrowers who were unable to access traditional sources of finance, thereby contributing to the growth of the private debt market.

B is incorrect. While the demand for borrowing from private entities may have increased after the financial crisis, this was not the primary factor driving the expansion of the private debt market. The key driver was the reduced supply of lending from traditional lenders, which created a gap in the market that was filled by private lending funds.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.