Positions an Investor Can Take in an A ...

[vsw id=”LFJYcV5EL-w” source=”youtube” width=”611″ height=”344″ autoplay=”no”] A position in an asset describes how... Read More

Financial analysts utilize specialized models when examining financial statements. The objective is to assess and offer investment guidance on issuers’ equity securities. These aren’t just any models; they’re quantitative blueprints that echo an analyst’s anticipations for the future – encompassing future earnings scenarios, cash flows, and the financial stance of the company in question.

It’s crucial to understand that these models don’t equate to mathematical problems with a singular correct answer. They’re reflections of the analyst’s viewpoints. And like any professional viewpoint, they should be anchored in evidence and fortified by thorough scrutiny.

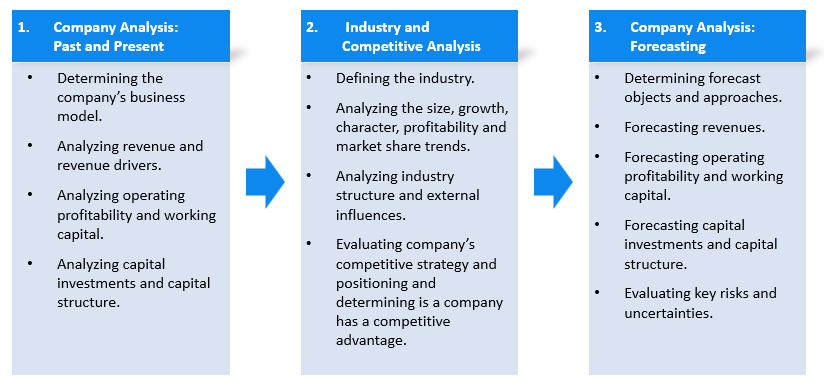

Company and industry analysis is the process of forming and justifying a view of an issuer’s future financial results and position. This involves studying past and present financial statements to form a view of future financial results.

The above figure summarizes company and industry analysis. Starting from the left:

In essence, the framework provides a structured approach, ensuring that analysts consider all critical factors before making investment recommendations.

The company research reports contain analysts’ company and industry analysis, as well as their valuation and investment recommendations. The structure, content, and tone of a company research report are dependent on the analyst’s setting.

In the case of public issuer equity securities, reports created for external clients, known as “sell-side reports,” typically include a comprehensive initial report when the analyst starts covering the security. This is often called an “initiating coverage” report or “initiation.”

The structure of the initial company research report is given in the following table:

$$\begin{array}{l|l} \hline

\textbf{Section} & \textbf{Details} \\

\hline

\textbf{Front Matter} & \text{Issuer, security, analysts} \\

& \text{recommendation, target prices,} \\

& \text{disclosures, disclaimers, legal} \\

\hline

\textbf{Recommendation} & \text{Analysts’ summary reasons.} \\

\hline

\textbf{Company Description} & \text{Issuer’s business model, strategy,} \\

& \text{key charts and figures.} \\

\hline

\textbf{Industry Overview and} & \text{Analysis of industry metrics,} \\

\textbf{Competitive Positioning} & \text{competitive landscape, external} \\

& \text{influences, industry position,} \\

& \text{strategy.} \\

\hline

\textbf{Financial Analysis and Model} & \text{Evaluation, forecasting of revenue,} \\

& \text{costs, profitability, cash flows,} \\

& \text{financial statements.} \\

\hline

\textbf{Valuation} & \text{Estimation of company, security} \\

& \text{values, target prices, discussion} \\

& \text{on key inputs, analyses.} \\

\hline

\textbf{ESG Considerations} & \text{Assessment of ESG indicators,} \\

& \text{risks, ownership structure,} \\

& \text{management composition,} \\

& \text{executive compensation.} \\

\hline

\textbf{Risks} & \text{Evaluation of potential risks} \\

& \text{impact on financial analysis} \\

& \text{and valuation.} \\

\end{array}

$$

Follow-up reports are more concise compared to the initial ones. These reports are designed for readers already acquainted with the issuer or security, seeking updates related to new data, analyses, or shifts in the analyst’s recommendations.

The structure of a subsequent report depends on the analyst’s setting and the nature of the report. For example, an analyst might deliver a short verbal report or a few presentation slides to update the internal team on the latest financial results of Microsoft Corp.

The typical elements of subsequent elements are given in the table below:

$$

\begin{array}{l|l}

\hline

\textbf{Section} & \textbf{Details} \\

\hline

\textbf{Front Matter} &

\begin{array}{l}

\text{- Analysts’ names} \\

\text{- Issuer name} \\

\text{- Security and exchange identifiers (e.g., symbol, CUSIP)} \\

\text{- Analysts’ recommendation: buy, hold, sell} \\

\text{- Current security price and analysts’ target price} \\

\text{- Disclosures, disclaimers, and other legal requirements}

\end{array} \\

\hline

\textbf{Recommendation} &

\begin{array}{l}

\text{- Analysts’ updated recommendation} \\

\text{- Summary of changes from the prior recommendation} \\

\text{- Supporting explanations for any changes}

\end{array} \\

\hline

\textbf{Analysis of New Information} &

\begin{array}{l}

\text{- Comparison of quarterly results to projections} \\

\text{- Interpretation of new data} \\

\text{- Adjustments to prior forecasts based on new data}

\end{array} \\

\hline

\textbf{Valuation} &

\begin{array}{l}

\text{- Review of prior financial statement forecasts} \\

\text{- Updated forecasts based on new data} \\

\text{- Updated company and security value estimates} \\

\text{- Discussion of any changes from the prior report’s valuation}

\end{array} \\

\hline

\textbf{Risks} &

\begin{array}{l}

\text{- Updated risk factors} \\

\text{- Detailed discussion of any changes from prior risk assessments}

\end{array} \\

\end{array}

$$

Question

Which of the following is the most likely primary factor that determines the structure of a subsequent report after the initiating coverage report?

- The analyst’s setting and the nature of the report.

- The financial models used in the report.

- The future earnings and cash flows of the issuer.

The correct answer is A.

The primary factor that determines the structure of a subsequent report after the initiating coverage report is the analyst’s setting and the nature of the report. The analyst’s setting refers to the context in which the analyst is working, including the type of firm, the analyst’s role, and the audience for the report. The nature of the report refers to the purpose of the report, such as whether it is an update on a company’s financial performance, a response to a significant event affecting the company, or a change in the analyst’s recommendation.

The report’s structure is customized to fit specific circumstances. For instance, a report about a company’s quarterly earnings may emphasize comparing actual results with the analyst’s past forecasts and consensus estimates. In contrast, a report addressing a major event might center on analyzing how the event affects the company’s future outlook.

B is incorrect. While the financial models used in the report are an important part of the analysis, they do not determine the structure of the report. The models are tools that the analyst uses to support his or her analysis and recommendations. It’s noteworthy that the structure of the report is determined by the analyst’s setting and the nature of the report.

C is incorrect. The future earnings and cash flows of the issuer are important factors that the analyst will consider in their analysis, but they do not determine the structure of the report. The analyst will use financial models to forecast the issuer’s future earnings and cash flows and to value the issuer’s securities, but the structure of the report is determined by the analyst’s setting and the nature of the report.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.