One-tailed vs. Two-tailed Hypothesis T ...

A one-tailed test (one-sided test) is a statistical test that considers a change... Read More

A chart pattern is a distinct trading formation appearing repeatedly and which can be used to predict future price movements of a given stock. The formations appear on price charts and create unique, recognizable shapes. Analysts study these formations when trying to predict the future course of prices. The patterns reveal the collective psychological relationships within the market at a given time. There are two major types of chart patterns:

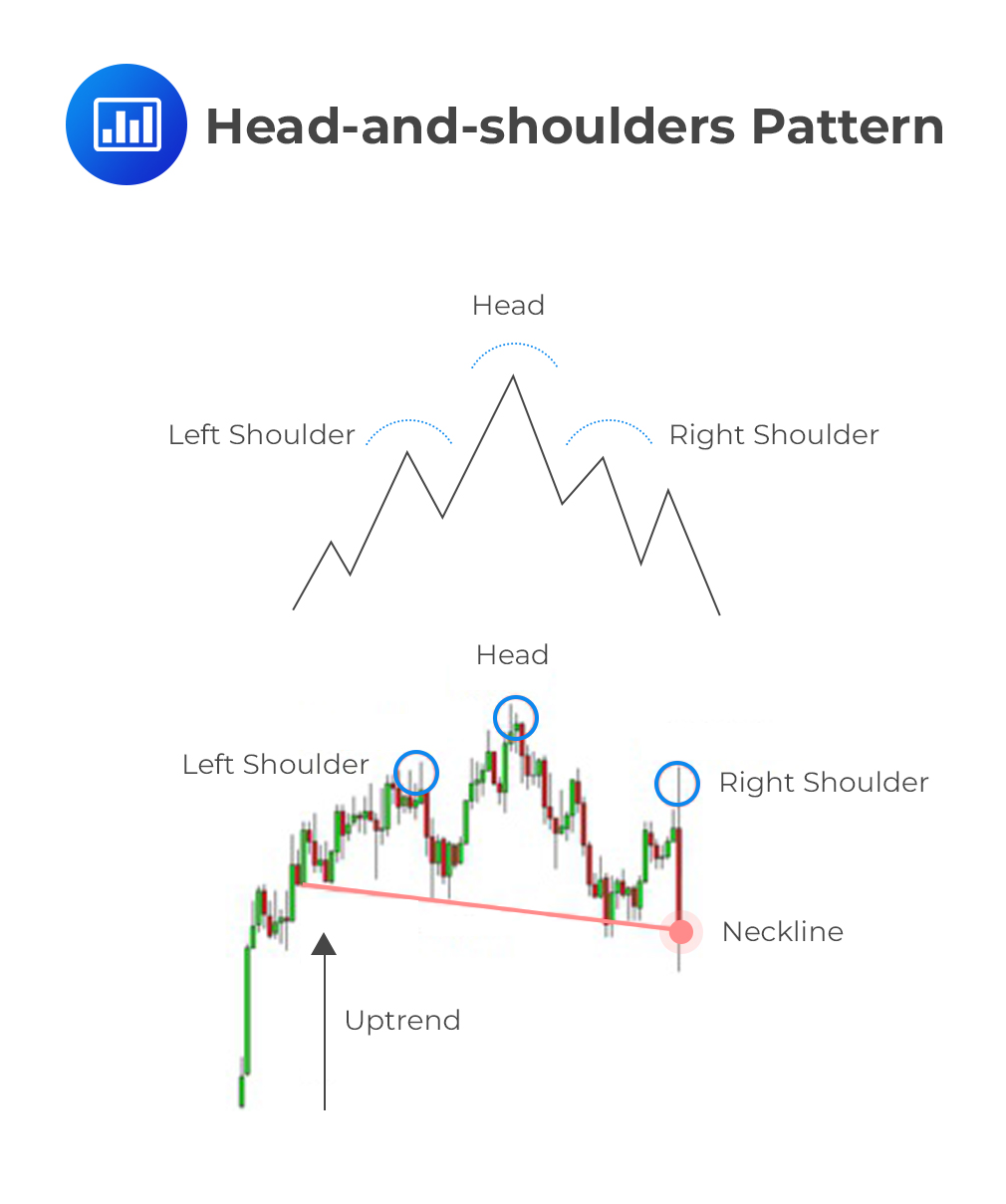

A reversal pattern indicates that an earlier trend is likely to reverse once it is complete. The term ‘reversal’ actually refers to the trend of the stock prior to the development of the pattern. In fact, for a pattern to have some predictive value, the pattern must be preceded by a clear, distinguishable trend. Caution is necessary when trying to identify patterns for the purpose of price prediction. Perhaps the most useful and widely recognized reversal pattern is the head-and-shoulders-pattern.

As the name suggests, the head-and-shoulders-pattern has 3 distinctive parts. It appears in form of a peak (left shoulder), followed by a higher peak (head), and then a lower head (right shoulder). When the lowest points of the two troughs are connected, they form what analysts call a “neckline.” This type of pattern is preceded by an uptrend.

The head doubles up as the second peak and the highest point in the pattern. Neither the left shoulder nor the right one exceeds the head. In an attempt to profit from a security that exhibits a head-and-shoulders pattern, technicians set a price target equal to:

$$ \text{Price target} = \text{Neckline} – (\text{Head} – \text{Neckline}) $$

Investors should anticipate the price target and close the investment at that point. Eying even higher returns beyond the price target almost always results in lesser returns because the price starts to tumble.

In addition, there are head-and-shoulders patterns preceded by downtrends called inverse head-and-shoulders which can be analyzed the same way as the reversal ones.

Other reversal patterns include double bottom and triple bottom patterns.

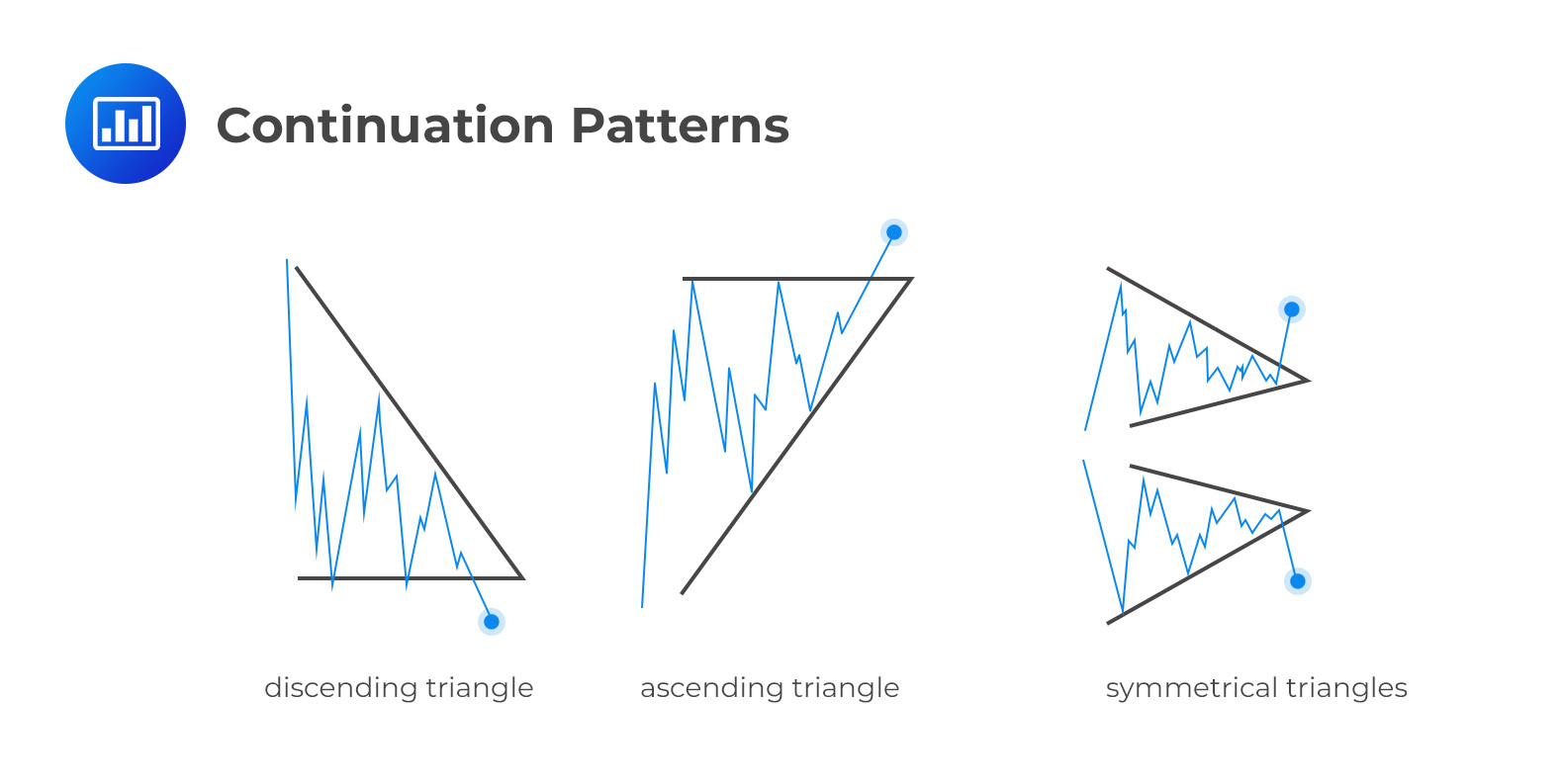

Unlike reversal patterns, continuation patterns suggest a pause in a trend. Some of the most well-known patterns under this category are triangles. Market veterans further subdivide these into symmetrical triangles, ascending triangles, and descending triangles. A triangle forms as the range between the high and low prices narrows. As a result, all the 3 types form after the convergence of two trend lines.

On an ascending triangle, two or more equal highs form a horizontal line representing overhead supply. This line serves as a price ceiling, effectively preventing further movement of price. Another two or more troughs form an ascending line that converges on the upper horizontal line. Although the price remains below the upper ceiling, the higher lows are a sign of increased buying pressure, hence the “bullish” formation.

The descending triangle forms during a downtrend. Remember that there are two or more equal lows form a horizontal line at the bottom, representing overhead demand. This line serves as a price floor, effectively preventing further decline in price. Another two or more declining peaks form a descending line that converges on the horizontal line. Although the price remains above this level, the lower highs signal increased selling pressure, hence the “bearish” formation.

Lastly, the symmetrical triangles containing at least two higher lows and two lower highs form during a trend. Connecting these points yields convergence.

Other continuation patterns include rectangles, flags and pennants.

Reading 56 LOS 56d:

Describe common chart patterns.

Access AnalystPrep’s free trial to solve CFA-style technical analysis questions, master common chart patterns, and strengthen your exam performance with detailed explanations.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.