CFA® Exam Grading

The long wait for the release of CFA® exam scores by CFA Institute can be a period filled with a lot of uncertainty. Did you pass the exams? Did you not? Should you be saving up for the next level…

8 Ways to Improve your Writing Skills for the CFA® Level III Exam

Do you want to build an outstanding career in finance? To achieve this goal, you should not only become an expert in quantitative analysis and integrated risk management, but you should also improve your writing skills. Finance students tend to…

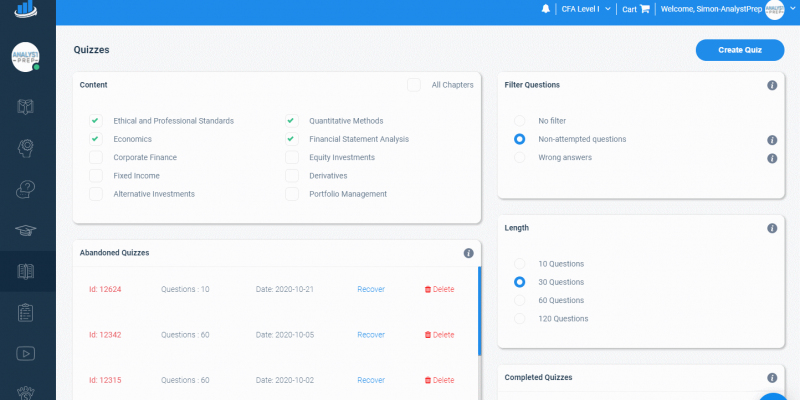

CFA® Level I Exam Study Plan offered by AnalystPrep

“If you fail to plan, you are planning to fail,” is one of the most famous quotes by Benjamin Franklin, and it illustrates the importance of planning not just for your CFA exams, but for every aspect of your life….

CFA® Program Course offered by AnalystPrep

The CFA Program encompasses three very challenging levels (levels I, II, and III). A charter issued by the CFA Institute® signifies that a candidate has successfully attempted and passed all three levels. To maintain their status as active charter holders,…

Level I CFA® Exam Preparation offered by AnalystPrep

Career as a CFA Charterholder Are you looking to be a financial analyst, an investment analyst, a portfolio manager, a research analyst, a credit analyst, an account manager? Those are but a few of the career opportunities that a CFA…

2021 CFA® Exams – New Exam Dates and Registration Fees

Whether affected or infected, it is indisputable that the COVID-19 brought with it more harm than good. Among the many adverse effects of the disease include deaths, loss of jobs, slow businesses, movement restrictions, and decline in countries’ economies. The…

Changes to CFA® Exams in 2021

Exam Postponements in 2020 In 2020, Coronavirus disrupted the normal functioning of the whole world. For this reason, CFA Institute decided to postpone the CFA exams, and in so doing, allowed candidates an extra 6 months to study. Postponing exam…

The Complete Study Guide and Outline to the Level I of the CFA® Exam

Getting your Chartered Financial Analyst® or CFA® designation is a great way to ensure a better career for yourself. In order to get there, however, there are a series of challenges that you must pass. The first one – and…

Best Tips and Tricks for Preparing and Successfully Passing FRM Exams

Passing your Financial Risk Management (FRM) exam on the first try isn’t impossible – it is however quite difficult. FRM exams are detailed and involve complex calculations and thinking from each exam candidate. A financial risk manager is expected to…

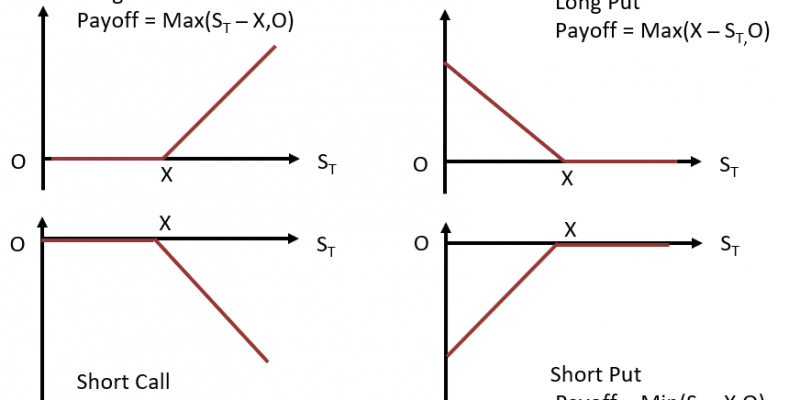

Options Payoffs and Profits (Calculations for CFA® and FRM® Exams)

Understanding call and put option payoffs is a must for mastering derivatives in the CFA® or FRM® exams—and for real-world trading strategies. This guide breaks down option payoff and profit formulas, shows you how to calculate each, and includes cha1rts…