How Much Does the CFA® Program Really ...

Pricing Snapshot Here is a quick view of the basic registration costs. These... Read More

In this CFA study guide, we’ll make it easier to differentiate between the 3 major types of industries covered in the CFA Curriculum: perfect competition, monopoly, and oligopoly. Most of the formulas needed to crush the Economics portion of the CFA exam will be explained here.

In a perfectly competitive industry, all firms are price takers and this means they cannot control the market price of their product. Also, all firms have a relatively small market share and the consumer does not prefer one product to another. The formula for a perfect competition market is pretty simple:

$$\begin{align*}\text{Price}& = \text{Marginal revenue} = \text{Marginal cost} = \text{Average cost}\\

\text{P} &= \text{MR} = \text{MC} = \text{AC}\end{align*}$$

A firm should produce additional units as long as its marginal revenue is greater or equal to its marginal cost. In the short-run, the firm should shut down if its losses exceed its fixed costs.

In the long-run, all firms in a perfectly competitive market will make Economic profit = 0 (Economic profit = Total revenue – Total cost = 0). Long-run equilibrium will occur at the output where Marginal cost = Average total cost (MC = ATC), which is productive efficiency.

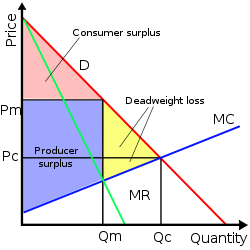

In a monopoly, there is only one producer. The sources of a monopoly power could be big sunk costs, patents, trade secrets (Coca-Cola), regulations, or simply a natural monopoly due to economies of scales (railways). A monopolistic firm’s marginal revenue is calculated as Marginal revenue = ΔTotal revenue / ΔQuantity.

But, a monopoly wants to maximize profits, not revenues. Therefore, a profit-maximizing monopoly chooses an output level where Marginal revenue = Marginal costs (MR = MC). We calculate the monopoly profit with the following formulas:

$$\begin{align*}\text{Monopoly profit} &= (\text{Price} – \text{Average total cost}) \times \text{Quantity}\\

\text{MP}& = (\text{Average revenue}\times \text{Quantity}) – (\text{Average total cost} \times \text{Quantity})\\

\text{MP}& = \text{Total revenue} – \text{Total cost}\end{align*}$$

A monopoly creates a deadweight loss, due to the fact that the monopoly restricts supply below the socially efficient quantity. Another way to see this inefficiency is that the monopoly always chooses a price that is above the marginal cost. The formula to find the deadweight loss is:

$$\begin{align*}\text{Deadweight loss}& = 0.5 \times (\text{Price} – \text{Marginal cost}) \times (\text{Quantity provided in a competitive market} – \text{Quantity produced by monopoly})\\

\text{DL} &= 0.5 \times (\text{P} – \text{C}) \times(\text{Qc} – \text{Qm})\end{align*}$$

If you would like to practice questions on this topic, consider our CFA Level 1 Question Bank.

An oligopoly is a state of limited competition, in which a market is shared by a small number of producers or sellers. If firms within an oligopolistic industry have cooperation and trust with each other, then they can theoretically maximize industry profits by setting a monopolistic price.

If oligopolies collude successfully, they will set price and output such that Marginal revenue = Marginal cost (MR = MC) for the industry overall.

You could also simply think of an oligopoly as a hybrid between a perfectly competitive market and a monopolistic market.

All 3 Levels of the CFA Exam – Complete Course offered by AnalystPrep

Photo by Kyle Glenn on Unsplash

Pricing Snapshot Here is a quick view of the basic registration costs. These... Read More

The CFA Level III August 2025 results were released on October 23, 2025... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.