Choosing the Best ESG Certification fo ...

Picture this: you’re sipping coffee, thinking about your career trajectory, and ESG certifications... Read More

When preparing for the CFA Level I exam, it’s easy to push CFA alternative investments to the back burner. After all, it’s one of the shortest topics in the curriculum, right? But here’s the truth — overlooking this section could be a costly mistake. Yes, its weight on the exam may be smaller, but the significance of mastering this area extends far beyond the exam hall. The insights you gain here can shape the way you approach complex investment decisions in the future, influencing your analytical skills and, ultimately, your career as a financial professional.

What is alternative investment? It isn’t just about memorizing facts; it’s about expanding your perspective. As the investment landscape evolves, traditional assets like stocks and bonds are no longer the only game in town. Alternative investments — from private equity alternative investments to real estate, hedge funds to natural resources — are becoming increasingly central to the portfolios of sophisticated investors. And that’s exactly why understanding the foundational concepts in this area will not only set you apart as a CFA candidate but also prepare you for the challenges and opportunities that lie ahead in your career.

At AnalystPrep, we understand that while this topic might seem like a minor piece of the puzzle, it’s actually a stepping stone toward mastering the more complex alternative investment strategies management material in CFA Level II. We’re here to guide you through this often-underestimated topic, breaking down every concept in a way that feels manageable and relevant to your broader journey. By the end of this guide, you’ll not only be well-prepared for the exam but also feel more confident about navigating the intricacies of alternative assets in the real world. So, let’s dive into this together, unlocking the potential that alternative investment products hold for your CFA exam success — and beyond.

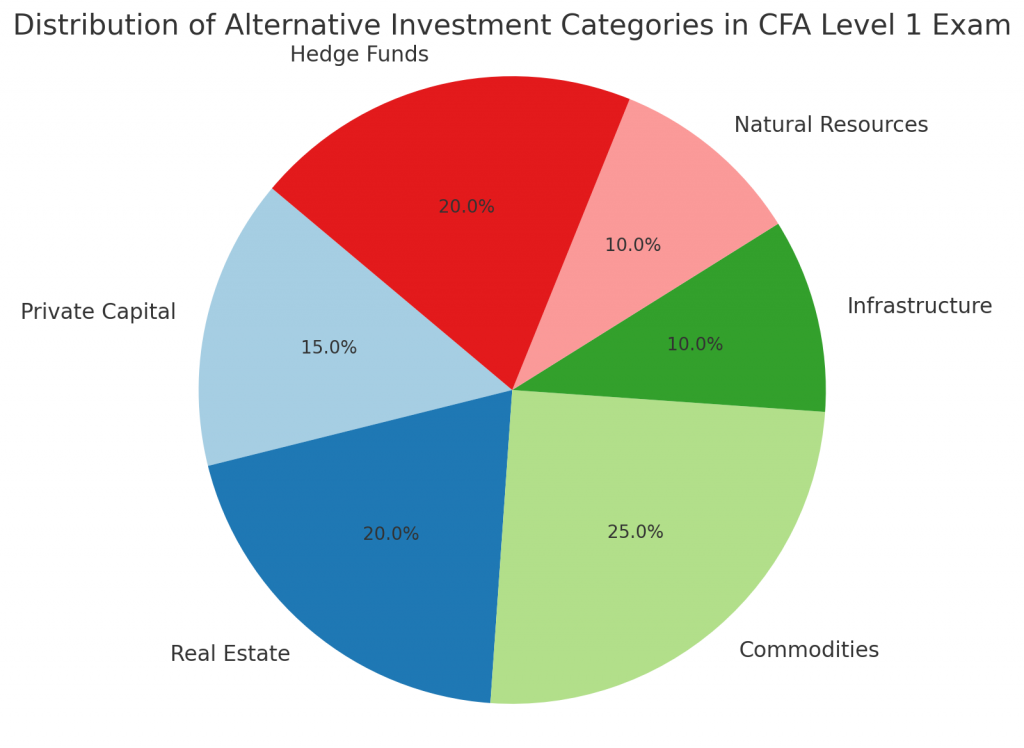

You’ve probably come across terms like private equity alternative investments or hedge fund alternative investment in passing, but what is alternative investment exactly? Simply put, they include investment vehicles that fall outside traditional categories like public stocks, bonds, or cash. The CFA Level I curriculum narrows it down to key types of alternative investments:

By understanding the role these alternative investment examples play, not just theoretically but in real-world finance, you’re adding another layer of depth to your alternative investment portfolio. And trust us, it’s worth taking the time to fully appreciate these instruments. They represent a diverse and increasingly important part of the financial landscape, making them essential for anyone serious about alternative asset management or investing in alternatives.

You might be thinking: “If this topic is so small, why should I dedicate precious study time to it?” That’s a fair question, especially when juggling larger topics like Fixed Income and equity investment CFA Level 1. Here’s the catch: though it makes up just 7%-10% of the CFA Level 1 exam, alternative investments can offer you relatively straightforward marks — if you’re prepared. Given its low technicality and manageable content, with the right focus, you can boost your score without getting bogged down in heavy calculations.

At AnalystPrep, we’re all about maximizing your study efficiency. Instead of sweating over hundreds of complex problems, mastering this section can give you an easy win on exam day. Plus, this is not just about passing the exam; having a solid understanding of alternative investment strategies, alternative investment risk, and the various alternative investment products will prove useful as you progress through your CFA journey and eventually work in fields like CFA private equity or alternative investment funds management.

Let’s talk study strategy. Like all areas of the CFA curriculum, CFA alternative investments requires a structured approach. But don’t worry — this isn’t rocket science. The CFA Institute lays out the readings in a way that makes it easy for you to build your knowledge incrementally:

Here’s a quick pro tip: when studying, don’t just focus on broad exam topics — zero in on the Learning Outcome Statements (LOS). These tell you exactly what you need to know, skill-wise. For instance, in CFA alternative investments, one LOS might ask you to “describe issues in performance appraisal of alternative investments.” That’s your clue to focus on performance metrics, alternative investment risk, and characteristics specific to this asset class.

At AnalystPrep, we believe that mastering the LOS is your secret weapon for exam success. Our study resources are designed to help you break down each LOS, so you’re not just passively reading but actively engaging with the material. Whether it’s alternative investment strategies, understanding the nuances of a hedge fund alternative investment, or distinguishing between types of alternative investments, when you can clearly articulate and apply each learning outcome, you’re already a step ahead.

Now, you might be asking: “But why do I really need to know this stuff? Will it ever come up in my day-to-day as an analyst?” The answer is yes — and more often than you might think. Over the past decade, alternative investments have grown dramatically. More institutional and private investors are turning to alternative investment products in search of higher returns, diversification, and protection against inflation. From hedge fund alternative investment to private equity alternative investments, understanding these assets is becoming increasingly crucial in modern finance.

By gaining a solid grasp of this material now, you’re preparing yourself not just for the exam but for the evolving demands of the financial industry. Knowing how to analyze and assess alternative assets and various alternative investment strategies could be the difference between making an average investment decision and delivering outstanding results for your clients or firm. This knowledge of alternative investment strategies management and the ability to manage an alternative investment portfolio could make you indispensable in the world of alternative asset management.

This is where many candidates trip up. Since alternative investments is a smaller topic, it’s easy to push it to the back burner, thinking you’ll get to it later. But here’s the problem with that approach — you might forget about it entirely until crunch time. And by then, you’ve missed out on scoring some easy points.

Our advice? Treat CFA alternative investments like any other topic. Schedule at least a week to focus on types of alternative investments, ideally in the middle of your study plan. This will allow you time to revisit key concepts, such as what is alternative investment, alternative investment risk, and how to invest in alternative investments, closer to the exam without letting the information slip away. We recommend using our AnalystPrep question bank to solidify your understanding, covering everything from alternative investment vehicle options to performance evaluation in alternative investment funds. The more you practice, the more confident you’ll feel about breezing through these questions on exam day.

The CFA Level 1 investments curriculum for alternative investments is divided into three key readings. Let’s walk through what you’ll be covering:

Categories, Characteristics, and Compensation Structures of Alternative Investments: This is where you get a full overview of the types of alternative investments. It’s like a crash course on everything from private equity alternative investments to commodities, and it’s essential to understand how these alternative investment products work. Additionally, you’ll learn about compensation structures like hard hurdle vs soft hurdle rates and high-water marks. You’ll encounter these again in your career, especially if you work in alternative asset management or investment banking.

Performance Calculation and Appraisal of Alternative Investments: Performance metrics for alternative investments are a little trickier than for traditional assets. This reading covers alternative investment risk and which performance measures can help you get an accurate picture of how these investments are doing. Yes, there are some calculations here, but don’t worry — we’ll walk you through those in our video lessons and study notes, breaking them down into manageable pieces, so you can confidently approach alternative investment portfolio management.

Private Capital, Real Estate, Infrastructure, Natural Resources, and Hedge Funds: Finally, this reading gets into the specifics of each alternative asset type. You’ll learn about the potential returns, the risks, and why these assets appeal to certain types of investors. This is where concepts like CFA real estate, hedge fund alternative investment, and private equity alternative investments come into play. Pay extra attention here. These are the kinds of questions that will pop up on exam day, and being able to differentiate between these asset classes is key to scoring those points.

Dismissing alternative investments as a minor section in the CFA Level 1 investments exam could be a costly mistake. While this topic may seem small, its significance stretches far beyond exam day. The foundational knowledge you gain in alternative investments can make a substantial impact, not only on your exam score but also on your future as a financial analyst. Whether your career takes you into alternative asset management, private equity alternative investments, real estate, or any specialized area of finance, a strong understanding of these alternative investment products will set you apart as a versatile professional.

At AnalystPrep, we know that mastering every aspect of the CFA curriculum — no matter how minor it may appear — is crucial to your success. Our comprehensive study tools, including mock exams, video lessons, and an extensive question bank, are designed to ensure you don’t just memorize material, but truly understand the nuances of topics like alternative investment portfolios. This knowledge will not only serve you well on exam day but also prepare you for the complex challenges of navigating diverse alternative asset opportunities in the real world.

The road to CFA success is built on thorough preparation, and with AnalystPrep as your study partner, you’ll have the skills, confidence, and insight to excel. Trust us to help you turn even the smallest sections of the CFA syllabus into opportunities for growth, mastery, and long-term career success.

Yes, Alternative Investments is a vital and strategic topic within the CFA Level 1 exam, and here’s why. While it only accounts for a small percentage (around 7%-10%) of the overall exam, the content is relatively manageable and less technically demanding compared to other sections such as Fixed Income or Derivatives. This makes it an excellent opportunity for candidates to earn some relatively straightforward marks, as long as they understand the core concepts.

Moreover, beyond the exam, Alternative Investments plays an increasingly critical role in the real-world finance landscape. With the rising demand for alternative asset management and private capital investments, gaining a firm grasp of this topic not only helps you on exam day but also gives you practical knowledge that will be highly relevant in your future career. For professionals working in private equity, real estate, hedge funds, or infrastructure investing, understanding these assets can differentiate you from your peers and improve your ability to manage diverse portfolios effectively.

In the CFA Level 1 curriculum, Alternative Investments refers to investment vehicles that do not fall under the traditional asset classes of publicly traded stocks, bonds, or cash equivalents. These assets are typically characterized by being less liquid, more complex, and having different risk and return profiles compared to traditional investments. The main categories covered in Level 1 include:

In essence, Alternative Investments offer diversification benefits, inflation protection, and the potential for higher returns, making them an important part of a well-rounded investment portfolio.

The Alternative Investments section in CFA Level 1 accounts for approximately 7%-10% of the total exam weight. While it might seem small compared to major sections like Equity Investments or Financial Reporting and Analysis, the proportion of the exam it represents is still significant enough that mastering this topic can impact your overall score.

Given that the exam is structured with around 240 questions (split between two sessions of 120 questions each), this weighting means that around 17 to 24 questions will cover Alternative Investments. For many candidates, these are some of the more accessible questions in the exam due to their conceptual nature and less complex calculations.

On the CFA Level 1 exam, you can expect around 17 to 24 questions on Alternative Investments, depending on the exam cycle and question distribution. These questions will focus on areas such as:

The relatively low number of questions shouldn’t lead to complacency. Because the content is less technically challenging, it provides a great opportunity for scoring high marks if you prepare thoroughly. Make sure to practice with questions from reliable sources like AnalystPrep to ensure you fully understand the topic and can apply your knowledge efficiently on exam day.

Looking for more insights to aid your CFA preparation? Explore these useful resources from AnalystPrep:

Practice CFA Level I alternative investments questions covering hedge funds, private equity, real assets, and structured products with exam-style scenarios and step-by-step solutions.

Picture this: you’re sipping coffee, thinking about your career trajectory, and ESG certifications... Read More

Quick Reference: CAPM Beta Formula Formula: $$ \beta = \frac{\text{Cov}\left(\text{R}_{\text{i}}, \text{R}_{\text{m}}\right)}{\text{Var}\left(\text{R}_{\text{m}}\right)} $$ $$\begin{array}{c|l}... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.