All You Need to Know About the CFA Ins ...

Sustainability isn’t just a corporate talking point anymore. It’s the financial world’s new... Read More

Ever asked yourself, “Is CFA ESG easy or hard?”

If so, you are already thinking like a serious candidate.

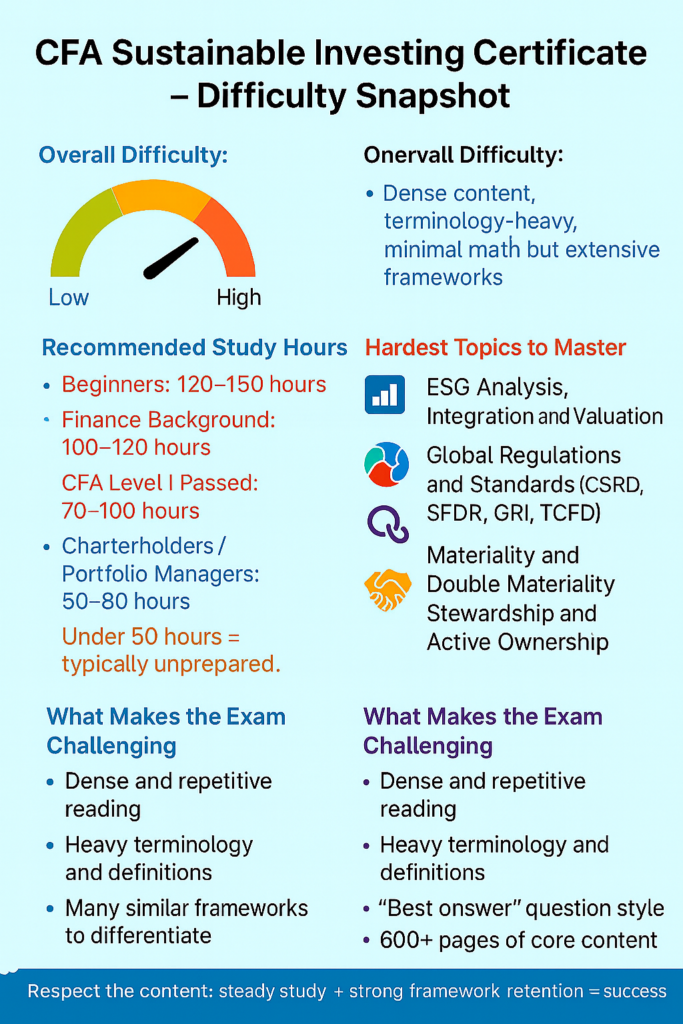

The CFA Sustainable Investing Certificate often gets labeled as “lighter” than other CFA programs, which can be misleading. The exam does not contain any math, formulas or calculations. That might make it seem easy but the real challenge is different. It comes from the sheer amount of material, the unfamiliar terminology and the variety of global frameworks that appear similar yet have subtle differences.

In this guide, we will break down the CFA sustainable investing difficulty, discuss how your background affects performance, reveal realistic CFA ESG study hours, explain what the unofficial CFA ESG pass rate implies, rank the hardest topics and outline a study strategy that sets candidates up for success. This is a candid, comprehensive look at the exam from the perspective of real candidates.

The Short Answer: It’s Not Hard but It Is Dense and Unfamiliar

The exam is not mathematically challenging because there is no quant involved. What makes it difficult is the breadth of content, the unfamiliarity of the concepts and the need to retain detailed frameworks. Many candidates describe the material as dense, repetitive or even dry. The tricky part is staying focused while processing a lot of conceptual information.

One of the main reasons candidates fail is underestimating the exam.

Many assume that because it is an introductory certificate, it will be easy. In reality, even professionals with finance or sustainability experience find the reading heavy and the frameworks require careful study.

1. Candidates with Finance or CFA Level I Background

Difficulty: ★★☆☆☆ (Moderate)

Strengths:

You understand investment analysis, portfolio construction and risk frameworks. This background helps in integrating ESG into financial contexts.

Challenges:

Sustainability frameworks like SASB, GRI, CSRD and TCFD can be confusing. Regulatory details and the terminology may require extra attention.

Candidate insight:

Finance knowledge is helpful but consistent study and discipline still determine success.

2. ESG or Sustainability Professionals (Non-Finance)

Difficulty: ★★★☆☆ (Moderate to High)

Strengths:

Comfortable with environmental and social themes, climate risk, impact investing and sustainability terminology.

Challenges:

Finance concepts such as risk factors, valuation methods, discounting and portfolio integration can feel like a new language.

Candidate insight:

Many sustainability professionals find the finance sections more challenging than expected, particularly integration and valuation discussions.

3. Complete Beginners (No Finance or ESG Background)

Difficulty: ★★★★☆ (High)

Challenges:

Study Hours:

Typically 120 to 150 hours are required to gain confidence.

4. CFA Level I/II/III Candidates and Charterholders

Difficulty: ★☆☆☆☆ (Low)

For charterholders and experienced candidates, the exam feels easier conceptually. Still, ESG frameworks are new for many and candidates often report needing 60 to 80 hours of study to grasp them fully. The biggest risk is underestimating the content and not allocating enough dedicated time.

While the CFA Institute does not provide official guidance, patterns from candidate communities give a clear picture:

Recommended CFA ESG Study Hours:

Most candidates who study less than 50 hours find themselves unprepared. Treating it as a light certificate is a common reason for underperformance.

1. Dense, Dry and Repetitive Material

Many candidates find that staying engaged with the reading is harder than understanding it. The content is critical but not inherently exciting.

2. Terminology Overload

The exam includes hundreds of ESG-related terms, including:

Candidates must differentiate similar concepts accurately.

3. Heavy Focus on Frameworks and Regulations

Frameworks and regulations tested include:

This section tests precision in understanding nuanced differences.

4. Best Answer Question Format

Many questions have multiple technically correct options. You must select the answer most aligned with sustainable investing principles.

5. Large Reading Volume

Core content exceeds 600 pages depending on the version. While less than CFA Level I, it still demands consistent attention.

The CFA Institute does not publish pass rates. Candidate communities consistently estimate a CFA ESG pass rate of roughly 70 to 80 percent, with some providers estimating 75 to 85 percent.

High pass rates do not imply the exam is easy. They reflect that motivated candidates self-select into the program. Candidates emphasize:

The exam uses a minimum passing score that varies by session. Most candidates estimate a passing threshold of 60 to 70 percent. The exam is single-sitting and does not award partial credit. Focus on consistent performance across topics rather than chasing a specific score.

Easier Conceptually:

Harder in Retention and Reading Volume:

Step 1 — Master Foundational ESG Concepts (20–30 hours)

Start with core principles, definitions and sustainability basics.

Step 2 — Tackle the Hardest Chapters Early (30–40 hours)

Prioritize integration, regulation and portfolio construction.

Step 3 — Memorize Frameworks and Regulations (15–20 hours)

Review SASB, TCFD, GRI, CSRD and SFDR consistently.

Step 4 — Practice 300–500 Questions (20–30 hours)

Pattern recognition and question familiarity are key.

Internal link: AnalystPrep ESG Question Bank + Mocks

Step 5 — Take 2–3 Mock Exams (10–20 hours)

Build timing, stamina and confidence.

For Most Candidates: Moderately Difficult

The exam is not math-heavy but is conceptually dense and terminology-intensive.

You Will Pass if You Respect the Exam

Study 80 to 120 hours, practice CFA-style questions and focus on integration, regulation and portfolio application.

You Will Struggle if You Underestimate It

The biggest trap is assuming it is light or easy.

Sustainability isn’t just a corporate talking point anymore. It’s the financial world’s new... Read More

Hey there, and welcome! If you’re reading this, chances are you’re either considering... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.