AnalystPrep

FRM® Part II

FRM® Part II Study Materials and Question Bank

FRM Study Platform Trusted by Thousands of Candidates Each Year

Our online FRM Part 2 study notes are designed to make complex concepts easier to digest. Whether you’re brushing up on current issues in financial markets or tackling credit risk, our concise summaries and real-world examples will help reinforce key concepts faster.

👉 Ideal for visual learners and time-strapped professionals

👉 Focused, topic-by-topic breakdowns aligned with the latest FRM Part 2 curriculum

👉 Paired perfectly with our FRM Part 2 question bank PDF and video lessons

Our FRM Part 2 question bank is packed with high-quality, exam-style questions that closely reflect the actual difficulty level of the GARP FRM Part 2 exam. Each question is crafted to test your understanding of core concepts—just like what you’ll face on exam day.

✔️ Covers all key topics from the latest curriculum

✔️ Detailed explanations for every answer

✔️ Designed to sharpen problem-solving skills under time pressure

Get exam-ready with our full-length FRM Part 2 mock exams, built to mirror the structure, difficulty, and time pressure of the actual GARP FRM Part 2 exam. It’s the perfect way to simulate test day and benchmark your readiness.

✔️ Reflects real exam format and question complexity

✔️ Includes detailed answer explanations for every question

✔️ Helps you identify knowledge gaps and fine-tune your strategy

Treat the mock exams as the final rehearsal before the big day. Combine them with our FRM Part 2 question bank and study notes for a complete, confidence-building experience.

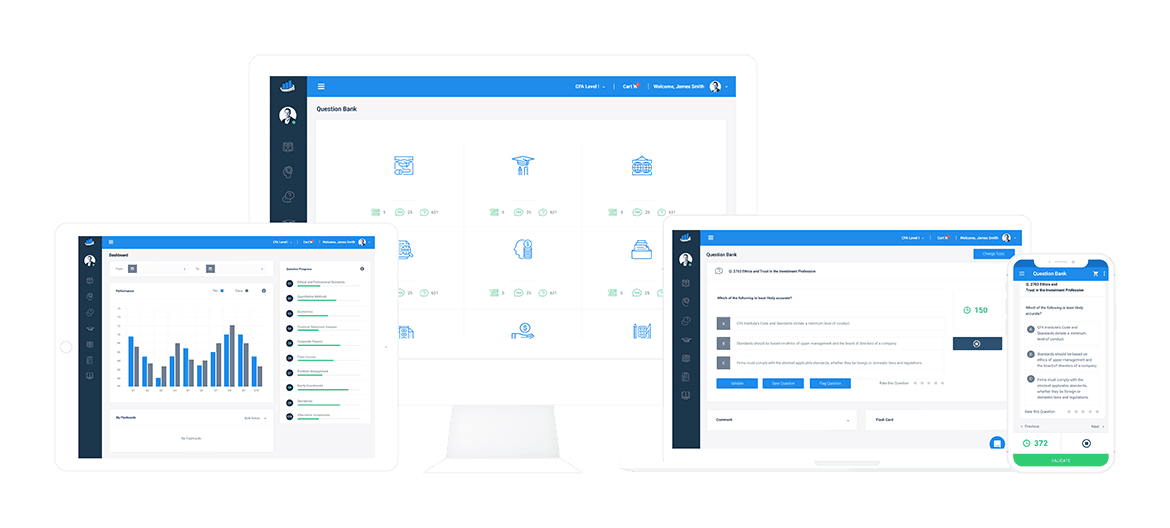

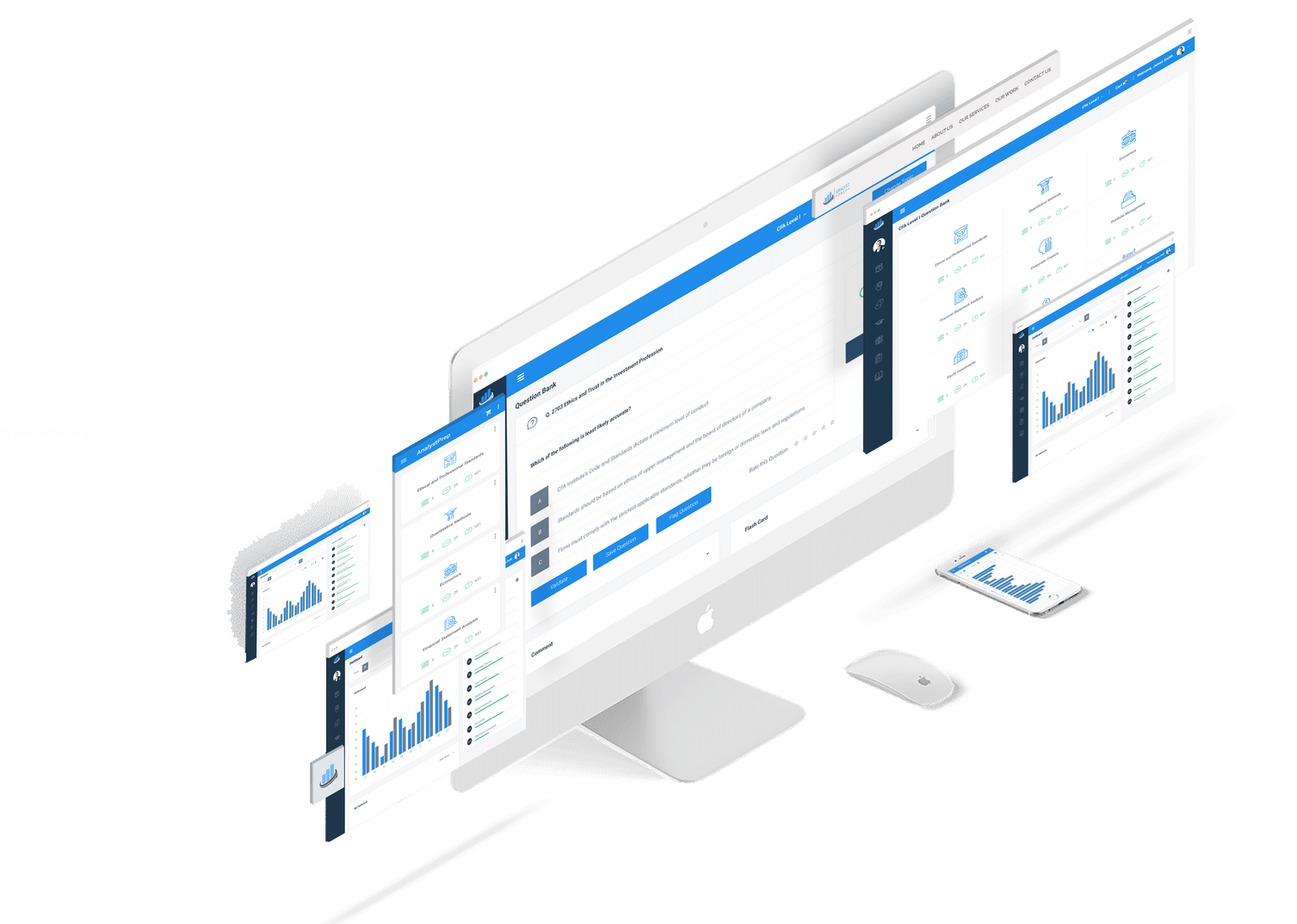

Our Platform

Study Materials for the FRM Part II Exam

Each AnalystPrep FRM Part 2 package includes 1,500+ exam-style practice questions designed to simplify even the most complex areas of risk management—market risk, credit risk, operational risk, and more.

✔️ Build unlimited quizzes to sharpen specific topic areas

✔️ Practice with full-length FRM Part 2 mock exams approved by GARP

✔️ Includes questions on current issues in financial markets—just like the real exam

Whether you’re revising formulas or testing your recall under pressure, our platform is built for efficient, targeted FRM Part 2 preparation.

What Should You Expect from the FRM Part 2 Exam?

The GARP FRM exam focuses on applying advanced risk management techniques across five core topics—plus current issues affecting global markets. Each topic carries a different weight in your final score:

- Market Risk Measurement and Management – 20%

- Credit Risk Measurement and Management – 20%

- Operational and Integrated Risk Management – 20%

- Liquidity and Treasury Risk Management – 15%

- Risk Management in Investment Management – 15%

- Current Issues in Financial Markets – 10%

You’ll face 80 multiple-choice questions in total, all designed to test not just your knowledge—but your ability to apply it. The exam is offered twice a year, in April and November.

The Pass rate for FRM Part 2 is around 50%. But don’t forget—most test-takers already cleared FRM Part 1, so the competition is fierce.

Key Topics to Prioritize in Your FRM Part 2 Preparation:

- Value at Risk (VaR) Mapping

- Volatility Smiles

- Spread Risk & Default Intensity Models

- Stress Testing Banks

- Basel II.5, Basel III & Post-Crisis Reforms

- Fund Manager Due Diligence

- Alpha and the Low-Risk Anomaly

- Current Issues in Financial Markets

- Termination Features: Netting, Compression, Resets

Expect longer, more complex problems than in Part 1. Many require multi-step calculations and a deep understanding of financial models. If there’s one rule to succeed:

Practice, practice, and practice some more.

Use our extensive FRM Part 2 question bank, mock exams, and quizzes to get hands-on with every topic. That’s how you turn theory into confidence.

Questions Answered by our Users

Satisfied Customers

FRM preparation platform by review websites

FRM® Part 2 Packages

Our Learn + Practice packages include study notes and video lessons for $499.

Combine FRM Part I and FRM Part II Learn + Practice for $799. This package includes unlimited ask-a-tutor questions and lifetime access with curriculum updates.

FRM Part 2 Practice Package

$

349

/ 12-month access

- Question Bank (Part 2)

- Printable Mock Exams (Part 2)

- Formula Sheet (Part 2)

- Performance Tracking Tools

FRM Part 2 Learn + Practice Package

$

499

/ 12-month access

- Question Bank (Part 2)

- Printable Mock Exams (Part 2)

- Formula Sheet (Part 2)

- Performance Tracking Tools (Part 2)

- Video Lessons (Part 2)

- Study Notes (Part 2)

FRM Unlimited Package (Part 1 and Part 2)

$

799

/ lifetime access

- Question Bank (Parts 1 & 2)

- Printable Mock Exams (Parts 1 & 2)

- Formula Sheet (Parts 1 & 2)

- Performance Tracking Tools

- Video Lessons (Parts 1 & 2)

- Study Notes (Parts 1 & 2)