FRM Part II Complete Course

- Video Lessons 53+ hours

- Practice Questions 2,500+ questions

- Students Enrolled 10,000+

Preparing for the FRM Part II exam can feel like solving a complex puzzle—but that’s where we come in. At AnalystPrep, we don’t just hand you study materials; we craft an immersive learning experience that helps you understand, apply, and master risk management concepts effortlessly.

Original price was: $599.00.$499.00Current price is: $499.00.

Course Features

- FRM Part II Video Lessons

- Online and Offline (Printable) FRM Part II Study Notes

- Online and Offline (Printable) FRM Part II Question Bank

- FRM Part II CBT Mock Exams

- Formula Sheet

- Performance Tracking Tools

- 5 Ask-A-Tutor Questions

- 12-Month Access

- 24/7 Technical Support

Course Overview

What Makes Our FRM Part II Course Stand Out?

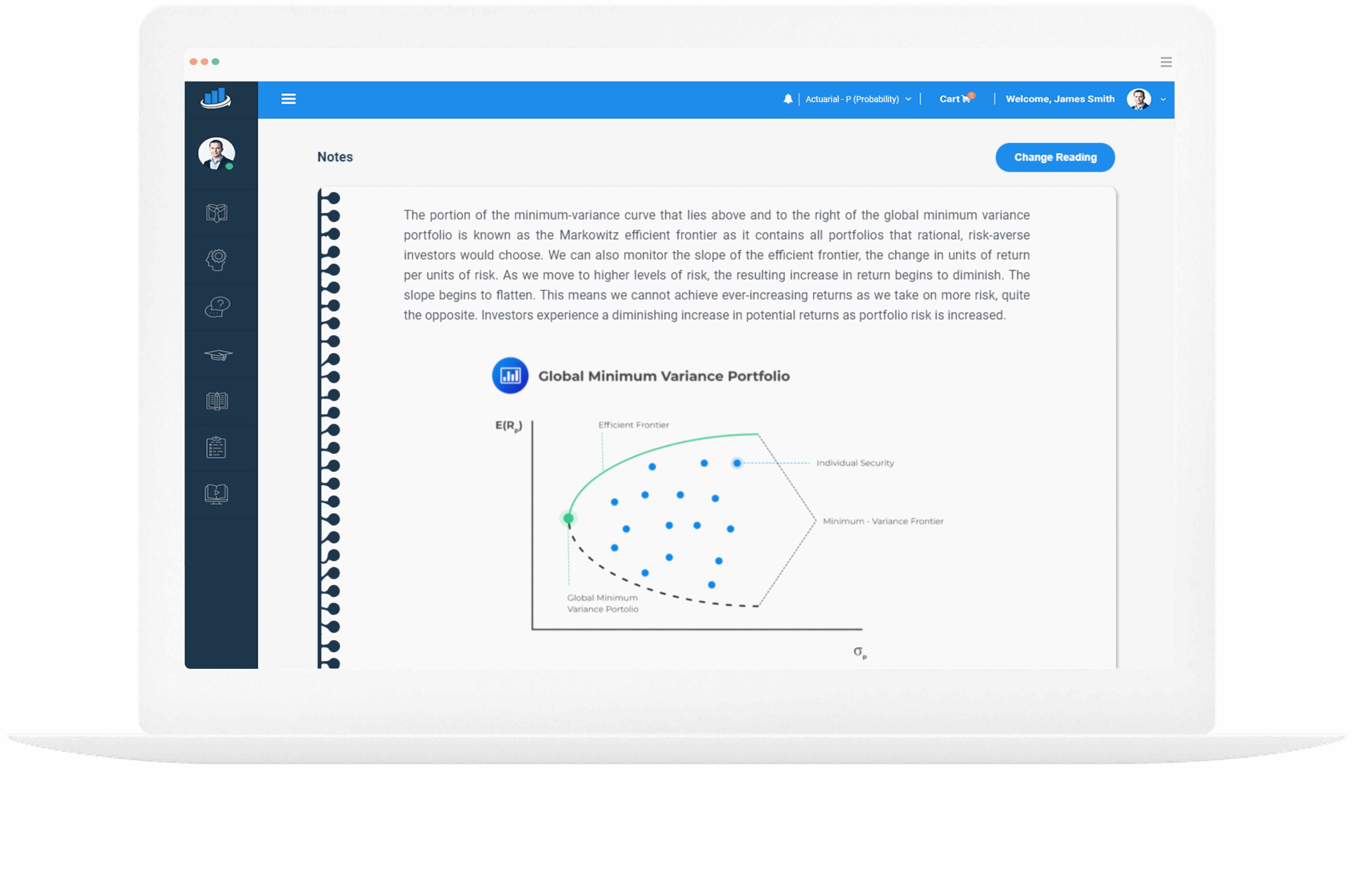

● Engaging Video Lectures & Study Notes

Visual learning is powerful. That’s why our expert instructors use real-world scenarios, practical analogies, and interactive visuals to break down the most challenging risk management concepts. Whether you’re tackling market risk measurement and management or operational risk and resilience, our 2024 FRM Exam Part II study materials make complex ideas feel intuitive.

● Exam-Centered Question Bank & Mock Exams

The best way to prepare for the FRM Part II exam is to practice like it’s the real thing. Our extensive question bank mirrors the difficulty and style of the actual exam, so you’re not just memorizing information—you’re mastering it.

○ 2,500+ exam-style questions

○ Fully aligned with GARP’s latest FRM Part II syllabus

○ Timed mock exams for real-exam simulation

● Up-to-Date Curriculum & Regular Updates

Risk management is an evolving field, and so is the FRM syllabus. We continuously update our study materials to reflect the latest changes in the 2024 FRM Exam Part II – Market Risk Measurement and Management Book, Liquidity and Treasury Risk Measurement and Management, and Risk Management and Investment Management sections.

Course Overview – What You Need to Know About FRM Part II

The FRM Part II exam is where your risk management expertise is truly tested. If you’ve passed Part I, congratulations—you’re halfway to earning the prestigious Financial Risk Manager (FRM) certification. But Part II takes it up a notch, challenging you with deeper applications of risk management principles in real-world scenarios.

FRM Part II Exam Structure & Weightage

The exam is divided into six key themes, each carrying a different weight in your overall score:

📌 Market Risk Measurement and Management – 20%

📌 Credit Risk Measurement and Management – 20%

📌 Operational and Integrated Risk Management – 20%

📌 Liquidity and Treasury Risk Measurement and Management – 15%

📌 Risk Management in Investment Management – 15%

📌 Current Issues in Financial Markets – 10%

Each of these sections is critical to understanding how risk impacts financial institutions, and they align closely with top-tier resources such as the 2024 FRM Exam Part II – Market Risk Measurement and Management Book and the Liquidity and Treasury Risk Measurement and Management study guide.

FRM Part II Exam Format & Pass Rates

● 80 multiple-choice questions

● 4-hour exam session

● Offered twice a year (May & November)

● Pass rate: ~50% (Keep in mind that many candidates who fail Part II also struggled with Part I)

The FRM Part II exam isn’t just about memorization—it’s about applying risk concepts to real-world financial challenges. That’s why a structured FRM Part II study plan is essential. With the right materials, practice, and guidance, you can navigate these challenges confidently and maximize your chances of success.

Course Curriculum

We at AnalystPrep believe in transparency. Feel free to check out some of our free videos below. We are sure you will love them.

- Lesson 1 Estimating Market Risk Measures: An Introduction and Overview

- Lesson 2 Non-parametric Approaches

- Lesson 3 Parametric Approaches (II): Extreme Value

- Lesson 4 Backtesting VaR

- Lesson 5 VaR Mapping

- Lesson 6 Validating Bank Holding Companies’ Value-at-Risk Models for Market Risk

- Lesson 7 Beyond Exceedance-Based Backtesting of Value-at-Risk Models

- Lesson 8 Correlation Basics: Definitions, Applications, and Terminology

- Lesson 9 Empirical Properties of Correlation: How Do Correlations Behave in the Real World?

- Lesson 10 Financial Correlation Modeling—Bottom-Up Approaches

- Lesson 11 Regression Hedging and Principal Component Analysis

- Lesson 12 Arbitrage Pricing with Term Structure Models

- Lesson 13 Expectations, Risk Premium, Convexity, and the Shape of the Term Structure

- Lesson 14 The Art of Term Structure Models: Drift

- Lesson 15 The Art of Term Structure Models: Volatility and Distribution

- Lesson 16 The Vasicek and Gauss+ Models

- Lesson 17 Volatility Smiles

- Lesson 18 Fundamental Review of the Trading Book

- Lesson 1 Fundamentals of Credit Risk

- Lesson 2 Governance

- Lesson 3 Credit Risk Management

- Lesson 4 Capital Structure in Banks

- Lesson 5 Introduction to Credit Risk Modeling and Assessment

- Lesson 6 Credit Scoring and Rating

- Lesson 7 Credit Scoring and Retail Credit Risk Management

- Lesson 8 Country Risk: Determinants, Measures, and Implications

- Lesson 9 Estimating Default Probabilities

- Lesson 10 Credit Value at Risk

- Lesson 11 Portfolio Credit Risk

- Lesson 12 Credit Risk

- Lesson 13 Credit Derivatives

- Lesson 14 Derivatives

- Lesson 15 Counterparty Risk and Beyond

- Lesson 16 Netting, Close-out, and Related Aspects

- Lesson 17 Margin (Collateral) and Settlement

- Lesson 18 Central Clearing

- Lesson 19 Future Value and Exposure

- Lesson 20 CVA (Part A)

- Lesson 21 CVA (Part B – Wrong-way Risk)

- Lesson 22 The Evolution of Stress Testing Counterparty Exposures

- Lesson 23 Structured Credit Risk

- Lesson 24 An Introduction to Securitization

- Lesson 1 Introduction to Operational Risk and Resilience

- Lesson 2 Risk Governance

- Lesson 3 Risk Identification

- Lesson 4 Risk Measurement and Assessment

- Lesson 5 Risk Mitigation

- Lesson 6 Risk Reporting

- Lesson 7 Integrated Risk Management

- Lesson 8 Cyber-resilience: Range of Practices

- Lesson 9 Case Study: Cyberthreats and Information Security Risks

- Lesson 10 Sound Management of Risks related to Money Laundering and Financing of Terrorism

- Lesson 11 Case Study: Financial Crime and Fraud

- Lesson 12 Guidance on Managing Outsourcing Risk

- Lesson 13 Case Study: Third-Party Risk Management

- Lesson 14 Case Study: Investor Protection and Compliance Risks in Investment Activities

- Lesson 15 Supervisory Guidance on Model Risk Management

- Lesson 16 Case Study: Model Risk and Model Validation

- Lesson 17 Stress Testing Banks

- Lesson 18 Risk Capital Attribution and Risk-Adjusted Performance Measurement

- Lesson 19 Range of Practices and Issues in Economic Capital Frameworks

- Lesson 20 Capital Planning at Large Bank Holding Companies: Supervisory Expectations and Range of Current Practice

- Lesson 21 Capital Regulation Before the Global Financial Crisis

- Lesson 22 Solvency, Liquidity and Other Regulation After the Global Financial Crisis

- Lesson 23 High-level Summary of Basel III Reforms

- Lesson 24 Basel III: Finalizing Post-Crisis Reforms

- Lesson 1 Liquidity Risk

- Lesson 2 Liquidity and Leverage

- Lesson 3 Early Warning Indicators

- Lesson 4 The Investment Function in Financial Services Management

- Lesson 5 Liquidity and Reserves Management: Strategies and Policies

- Lesson 6 Intraday Liquidity Risk Management

- Lesson 7 Monitoring Liquidity

- Lesson 8 The Failure Mechanics of Dealer Banks

- Lesson 9 Liquidity Stress Testing

- Lesson 10 Liquidity Risk Reporting and Stress Testing

- Lesson 11 Contingency Funding Planning

- Lesson 12 Managing and Pricing Deposit Services

- Lesson 13 Managing Nondeposit Liabilities

- Lesson 14 Repurchase Agreements and Financing

- Lesson 15 Liquidity Transfer Pricing: A Guide to Better Practice

- Lesson 16 The US Dollar Shortage in Global Banking and the International Policy Response

- Lesson 17 Covered Interest Rate Parity Lost: Understanding the Cross-Currency Basis

- Lesson 18 Risk Management for Changing Interest Rates: Asset-Liability Management and Duration Techniques

- Lesson 19 Illiquid Assets

- Lesson 1 Factor Theory

- Lesson 2 Factors

- Lesson 3 Alpha (and the Low-Risk Anomaly)

- Lesson 4 Portfolio Construction

- Lesson 5 Portfolio Risk: Analytical Methods

- Lesson 6 VaR and Risk Budgeting in Investment Management

- Lesson 7 Risk Monitoring and Performance Measurement

- Lesson 8 Portfolio Performance Evaluation

- Lesson 9 Hedge Funds

- Lesson 10 Performing Due Diligence on Specific Managers and Funds

- Lesson 11 Finding Bernie Madoff: Preventing Fraud by Investment Managers

- Lesson 1 2023 Bank Failures, Preliminary lessons learnt for resolution

- Lesson 2 Generative Artificial Intelligence in Finance: Risk Considerations

- Lesson 3 Artificial intelligence and the economy: implications for central banks

- Lesson 4 Interest Rate Risk Management by EME Banks

- Lesson 5 Laying a robust macro-financial foundation for the future

- Lesson 6 The Rise and Risks of Private Credit

- Lesson 7 Monetary and fiscal policy: safeguarding stability and trust

- Lesson 8 Regulating the Crypto Ecosystem: The Case of Unbacked Crypto Assets

- Lesson 9 Digital Resilience and Financial Stability. The Quest for Policy Tools in The Financial Sector

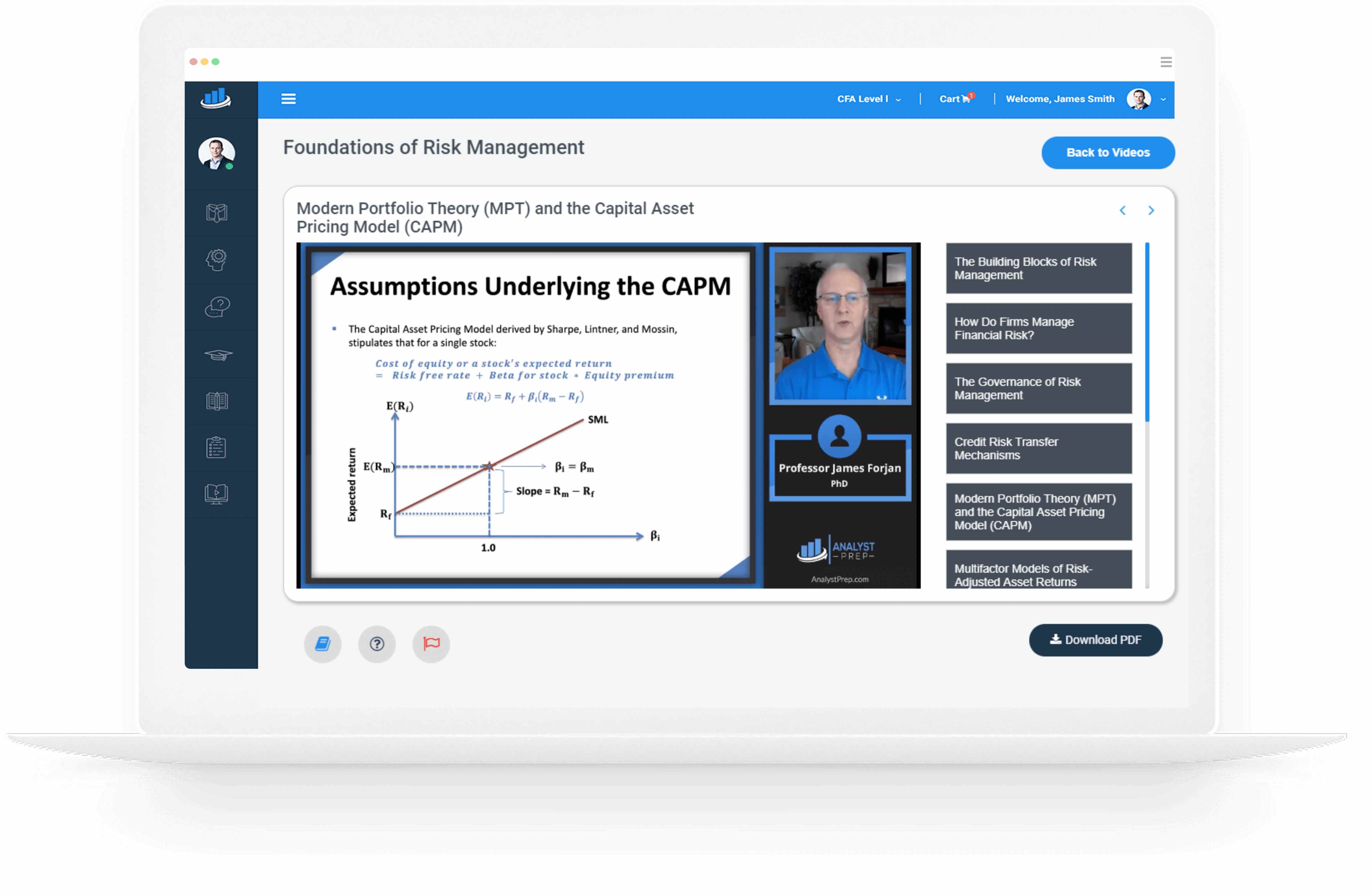

James Forjan, PhD

Professor James Forjan has taught college-level finance classes for over 25 years. With a clear passion for teaching, Prof. Forjan has worked in the CFA exam preparation industry for decades after earning his charter in 2004. His resume includes:

☑ BS in accounting

☑ MSc in Finance

☑ Ph.D. in Finance (minor in Economics and two PhD level classes in Econometrics)

☑ Has taught at different 6 universities (undergraduate and graduate-level Finance classes)

☑ Co-author of investment books

☑ Has crafted, edited, updated, and upgraded a multitude of CFA exam type questions at all levels

☑ And much more…

Reviews 12

Pratham K.2024-07-11 13:43:13

Loved the video series. I love the video series because the explanation is provided in the simplest manner. It is helping me in clearing my concepts.

Mary F.2023-08-18 14:22:01

BIG THANK YOU! I'd like to special thank you for Prof Forjan and the team. [...] I'm more than grateful to have access to these amazing tutorials here which greatly ease my study pressure and gain confidence. [...] Once again, a big THANK YOU!

Roz M.2022-06-03 15:19:57

Just wanted to say thank you to everyone at Analystprep for helping me pass the CFA level 1 examination. Professor James Forjan is a very charismatic lecturer who can make these topics interesting and explains the key points well. The question bank is large and a valuable resource for exam preparation. [ ... ]

James B.2019-03-14 14:04:41

"Thanks to your program I passed the first level of the CFA exam, as I got my results today. You guys are the best. I actually finished the exam with 45 minutes left in [the morning session] and 15 minutes left in [the afternoon session]... I couldn't even finish with more than 10 minutes left in the AnalystPrep mock exams so your exams had the requisite difficulty level for the actual CFA exam."

Jose Gary2019-03-04 16:52:14

"I loved the up-to-date study materials and Question bank. If you wish to increase your chances of CFA exam success on your first attempt, I strongly recommend AnalystPrep."

Brian Masibo2019-03-04 16:50:55

"Before I came across this website, I thought I could not manage to take the CFA exam alongside my busy schedule at work. But with the up-to-date study material, there is little to worry about. The Premium package is cheaper and the questions are well answered and explained. The question bank has a wide range of examinable questions extracted from across the whole syllabus. Thank you so much for helping me pass my first CFA exam."

Aadhya Patel2018-10-16 18:21:06

"Good Day! I cleared FRM Part I (May-2018) with 1.1.1.1. Thanks a lot to AnalystPrep and your support. Regards,"

Justin T.2017-09-28 07:55:56

“@AnalystPrep provided me with the necessary volume of questions to insure I went into test day having in-depth knowledge of every topic I would see on the exams.”

Joshua Brown2017-09-28 07:54:27

“Great study materials and exam-standard questions. In addition, their customer service is excellent. I couldn’t have found a better CFA exam study partner.”

Zubair Jatoi2017-09-28 02:47:09

“I bought their FRM Part 1 package and passed the exam. Their customer support answered all of my questions when I had problems with what was written in the curriculum. I'm planning to use them also for the FRM Part 2 exam and Level I of the CFA exam.”

Jordan Davis2017-09-27 08:52:35

“I bought the FRM exam premium subscription about 2 weeks ago. Very good learning tool. I contacted support a few times for technical questions and Michael was very helpful.”

Abdulgadir M.2024-08-11 17:55:47

James Forjan is just Brilliant. I'm totally new to these exams and James Forjan's videos have been really helpful, I'm looking to take my exam this February. I'm from London, highly recommend.