FRM Part I Complete Online Course

- Video Lessons: 40+ hours

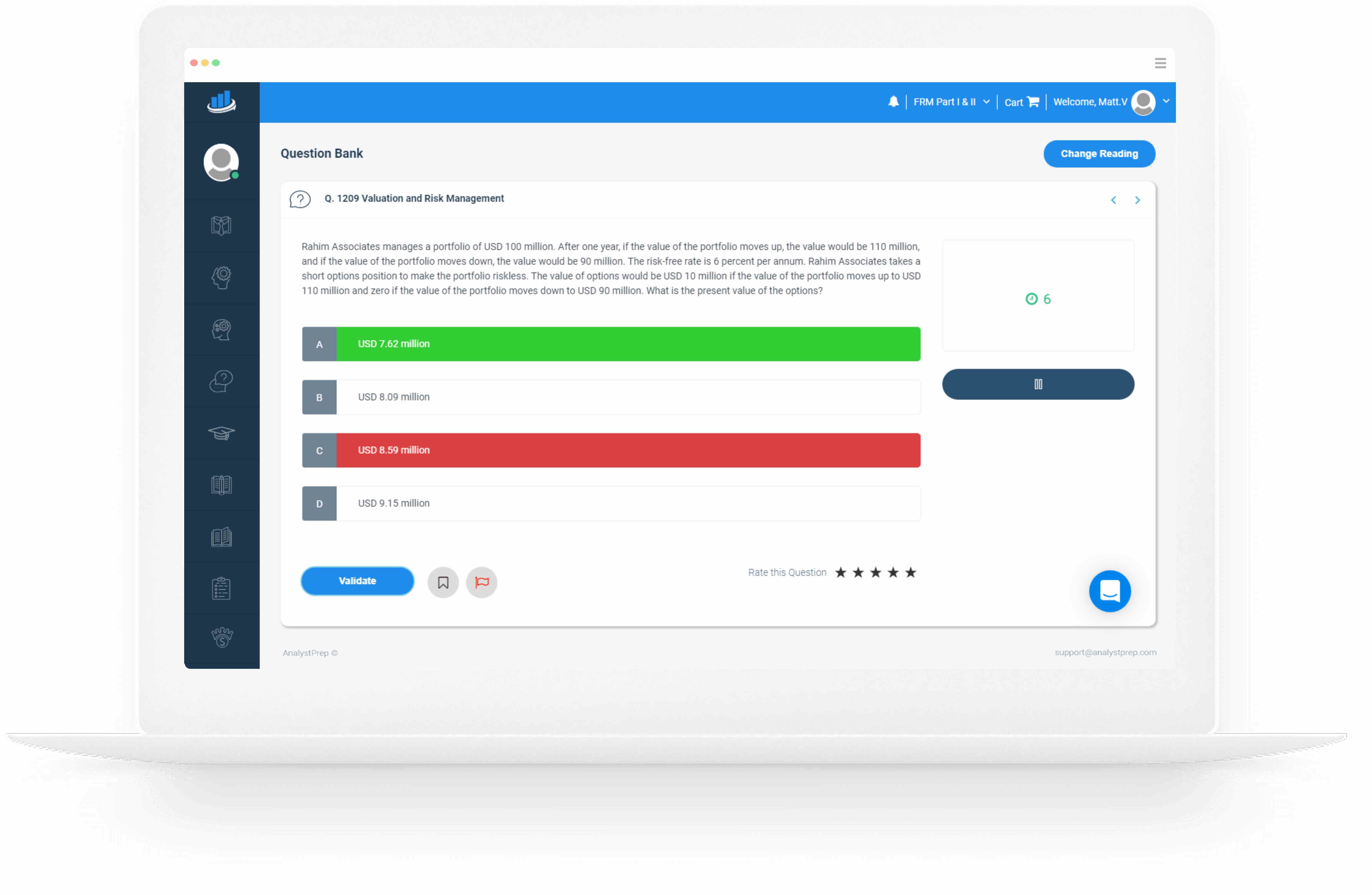

- Question Bank: 1,500+ questions

- Students Enrolled: 30,000+

Preparing for the FRM Part I exam requires more than just reading textbooks—it demands practical application, real-world examples, and exam-style practice. At AnalystPrep, we provide a comprehensive study package designed to help you grasp complex financial risk management concepts with ease.

Original price was: $599.00.$499.00Current price is: $499.00.

Course Features

- FRM Part I Video Lessons

- Online and Offline (Printable) FRM Part I Study Notes

- Online and Offline (Printable) FRM Part I Question Bank

- FRM Part I CBT Mock Exams

- Formula Sheet

- Performance Tracking Tools

- 5 Ask-A-Tutor Questions

- 12-Month Access

- 24/7 Technical Support

Course Overview

Why Choose AnalystPrep’s FRM Part I Course?

● Visual Learning – Our FRM study notes and video lectures break down tricky concepts using visual analogies and real-world examples, making them easier to grasp and retain.

● Real-World Application – We don’t just teach theory. We connect concepts to real financial markets, risk scenarios, and case studies so you can see exactly how they apply in the real world.

● Exam-Style Practice Questions – Our FRM Part I question bank mirrors the difficulty, style, and structure of the actual GARP FRM Part I exam, ensuring you’re fully prepared for test day.

● Up-to-Date Mock Exams – Tackle full-length mock exams that are regularly updated to reflect the latest curriculum changes and test formats.

● Focused & Exam-Centered Approach – Our tailored question bank ensures you focus on the most tested and high-yield areas of the FRM curriculum, helping you maximize your study time.

With thousands of exam-style questions, expert-led video explanations, and a curriculum updated regularly to match GARP’s latest syllabus, you’re getting the best frm prep materials available.

What This Means for You

✔ No more second-guessing what to study – We prioritize what matters most.

✔ No information overload – Everything is structured for efficient learning.

✔ Higher chances of passing – Our students consistently outperform the global average pass rate.

Start your FRM Part I journey with AnalystPrep today and turn complex risk management concepts into second nature!

FRM Course Overview

The Financial Risk Manager (FRM) Part I exam is designed to test your understanding of risk management concepts through a structured curriculum that focuses on four key areas:

FRM Part I Exam Topics & Weighting:

● Foundations of Risk Management – 20%

● Quantitative Analysis – 20%

● Financial Markets and Products – 30%

● Valuation and Risk Models – 30%

This section-weighting ensures you develop a well-rounded understanding of risk assessment, market dynamics, and valuation techniques, all crucial for financial risk professionals.

Exam Format & Pass Rates:

● 100 multiple-choice questions designed to assess your practical knowledge and analytical skills.

● Conducted in a computer-based testing format, available three times a year at designated testing centers worldwide.

● Pass rates typically range from 45-50%, making proper preparation essential for success.

At AnalystPrep, we bridge the gap between theory and application by providing expert-guided study materials, question banks, and realistic mock exams—ensuring you are fully prepared to pass on your first attempt.

Course Curriculum

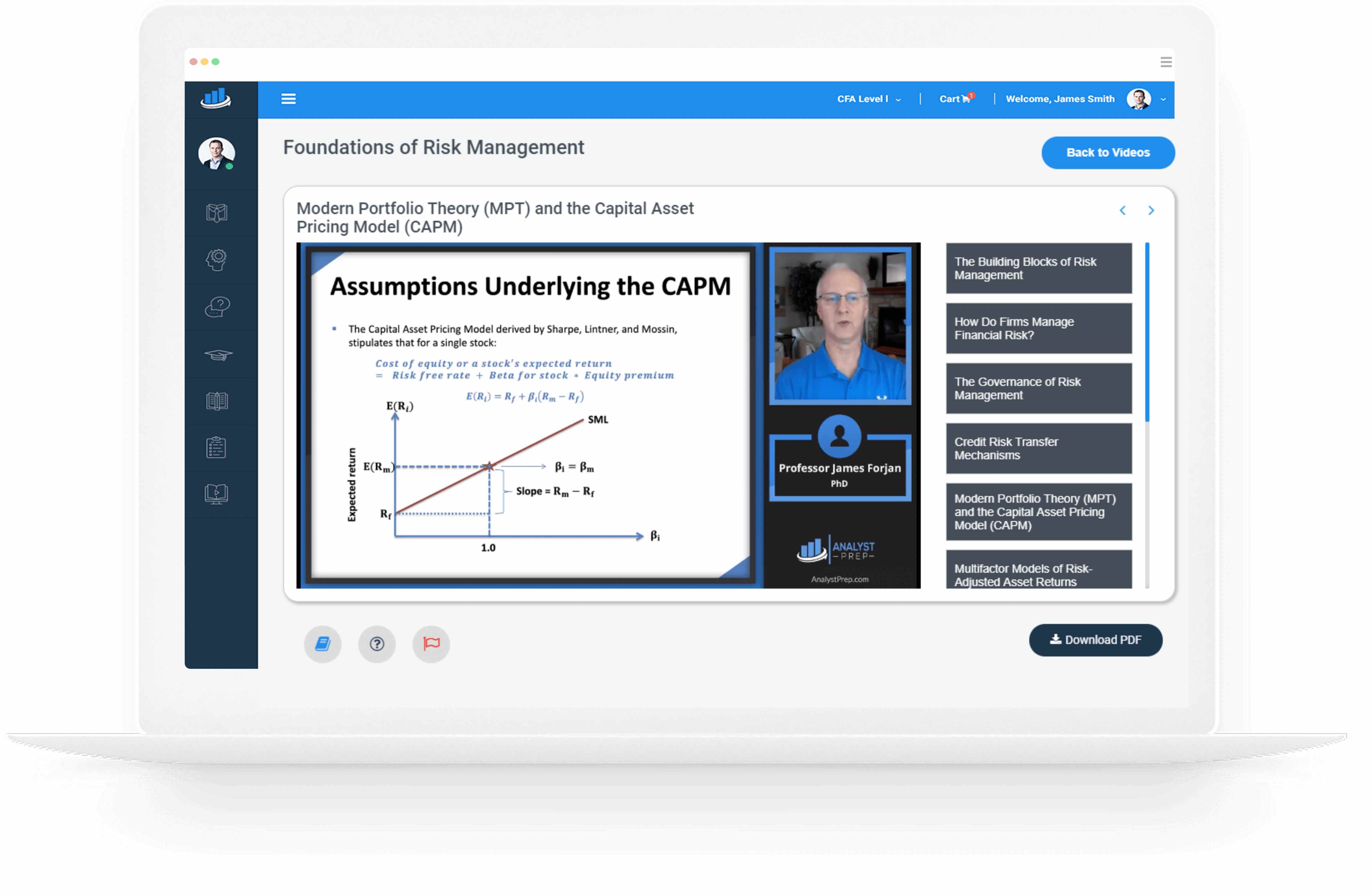

We at AnalystPrep believe in transparency. Feel free to browse some of our videos below. We are sure you will love them.

- Lesson 1 The Building Blocks of Risk Management

- Lesson 2 How Do Firms Manage Financial Risk?

- Lesson 3 The Governance of Risk Management

- Lesson 4 Credit Risk Transfer Mechanisms

- Lesson 5 Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM)

- Lesson 6 The Arbitrage Pricing Theory and Multifactor Models of Risk and Return

- Lesson 7 Risk Data Aggregation and Reporting Principles

- Lesson 8 Enterprise Risk Management and Future Trends

- Lesson 9 Learning From Financial Disasters

- Lesson 10 Anatomy of the Great Financial Crisis of 2007-2009

- Lesson 11 GARP Code of Conduct

- Lesson 1 Fundamentals of Probability

- Lesson 2 Random Variables

- Lesson 3 Common Univariate Random Variables

- Lesson 4 Multivariate Random Variables

- Lesson 5 Sample Moments

- Lesson 6 Hypothesis Testing

- Lesson 7 Linear Regression

- Lesson 8 Regression with Multiple Explanatory Variables

- Lesson 9 Regression Diagnostics

- Lesson 10 Stationary Time Series

- Lesson 11 Nonstationary Time Series

- Lesson 12 Measuring Return, Volatility, and Correlation

- Lesson 13 Simulation and Bootstrapping

- Lesson 14 Machine-Learning Methods

- Lesson 15 Machine Learning and Prediction

- Lesson 1 Banks

- Lesson 2 Insurance Companies and Pension Plans

- Lesson 3 Fund Management

- Lesson 4 Introduction to Derivatives

- Lesson 5 Exchanges and OTC Markets

- Lesson 6 Central Clearing

- Lesson 7 Futures Markets

- Lesson 8 Using Futures for Hedging

- Lesson 9 Foreign Exchange Markets

- Lesson 10 Pricing Financial Forwards and Futures

- Lesson 11 Commodity Forwards and Futures

- Lesson 12 Options Markets

- Lesson 13 Properties of Options

- Lesson 14 Trading Strategies

- Lesson 15 Exotic Options

- Lesson 16 Properties of Interest Rates

- Lesson 17 Corporate Bonds

- Lesson 18 Mortgages and Mortgage-Backed Securities

- Lesson 19 Interest Rate Futures

- Lesson 20 Swaps

- Lesson 1 Measures of Financial Risk

- Lesson 2 Calculating and Applying VaR

- Lesson 3 Measuring and Monitoring Volatility

- Lesson 4 External and Internal Credit Ratings

- Lesson 5 Country Risk

- Lesson 6 Measuring Credit Risk

- Lesson 7 Operational Risk

- Lesson 8 Stress Testing

- Lesson 9 Pricing Conventions, Discounting, and Arbitrage

- Lesson 10 Interest Rates

- Lesson 11 Bond Yields and Return Calculations

- Lesson 12 Applying Duration, Convexity, and DV01

- Lesson 13 Modeling and Hedging Non-Parallel Term Structure Shifts

- Lesson 14 Binomial Trees

- Lesson 15 The Black-Scholes-Merton Model

- Lesson 16 Option Sensitivity Measures: The “Greeks”

James Forjan, PhD

Professor James Forjan has taught college-level finance classes for over 25 years. With a clear passion for teaching, Prof. Forjan has worked in the CFA exam preparation industry for decades after earning his charter in 2004. His resume includes:

☑ BS in accounting

☑ MSc in Finance

☑ Ph.D. in Finance (minor in Economics and two PhD level classes in Econometrics)

☑ Has taught at different 6 universities (undergraduate and graduate-level Finance classes)

☑ Co-author of investment books

☑ Has crafted, edited, updated, and upgraded a multitude of CFA exam type questions at all levels

☑ And much more…

Reviews 12

Pratham K.2024-07-11 13:43:13

Loved the video series. I love the video series because the explanation is provided in the simplest manner. It is helping me in clearing my concepts.

Mary F.2023-08-18 14:22:01

BIG THANK YOU! I'd like to special thank you for Prof Forjan and the team. [...] I'm more than grateful to have access to these amazing tutorials here which greatly ease my study pressure and gain confidence. [...] Once again, a big THANK YOU!

Roz M.2022-06-03 15:19:57

Just wanted to say thank you to everyone at Analystprep for helping me pass the CFA level 1 examination. Professor James Forjan is a very charismatic lecturer who can make these topics interesting and explains the key points well. The question bank is large and a valuable resource for exam preparation. [ ... ]

James B.2019-03-14 14:04:41

"Thanks to your program I passed the first level of the CFA exam, as I got my results today. You guys are the best. I actually finished the exam with 45 minutes left in [the morning session] and 15 minutes left in [the afternoon session]... I couldn't even finish with more than 10 minutes left in the AnalystPrep mock exams so your exams had the requisite difficulty level for the actual CFA exam."

Jose Gary2019-03-04 16:52:14

"I loved the up-to-date study materials and Question bank. If you wish to increase your chances of CFA exam success on your first attempt, I strongly recommend AnalystPrep."

Brian Masibo2019-03-04 16:50:55

"Before I came across this website, I thought I could not manage to take the CFA exam alongside my busy schedule at work. But with the up-to-date study material, there is little to worry about. The Premium package is cheaper and the questions are well answered and explained. The question bank has a wide range of examinable questions extracted from across the whole syllabus. Thank you so much for helping me pass my first CFA exam."

Aadhya Patel2018-10-16 18:21:06

"Good Day! I cleared FRM Part I (May-2018) with 1.1.1.1. Thanks a lot to AnalystPrep and your support. Regards,"

Justin T.2017-09-28 07:55:56

“@AnalystPrep provided me with the necessary volume of questions to insure I went into test day having in-depth knowledge of every topic I would see on the exams.”

Joshua Brown2017-09-28 07:54:27

“Great study materials and exam-standard questions. In addition, their customer service is excellent. I couldn’t have found a better CFA exam study partner.”

Zubair Jatoi2017-09-28 02:47:09

“I bought their FRM Part 1 package and passed the exam. Their customer support answered all of my questions when I had problems with what was written in the curriculum. I'm planning to use them also for the FRM Part 2 exam and Level I of the CFA exam.”

Jordan Davis2017-09-27 08:52:35

“I bought the FRM exam premium subscription about 2 weeks ago. Very good learning tool. I contacted support a few times for technical questions and Michael was very helpful.”

Abdulgadir M.2024-08-11 17:55:47

James Forjan is just Brilliant. I'm totally new to these exams and James Forjan's videos have been really helpful, I'm looking to take my exam this February. I'm from London, highly recommend.