CFA® Level 1 Mock Exams

Exams That Mirror the Real Test

Practice under real exam conditions with printable PDFs and CBT simulations. Get instant access to free and premium mock exams aligned with the 2026 CFA® curriculum, complete with answer keys.

Why Practice with AnalystPrep?

Package Value

- 5 full-length CFA-style mock exams

- Both PDF (printable) and CBT (online simulation) formats

- Timed exams + scoring analytics

- Detailed explanations + answer keys

- Based on CFA® 2026 learning outcomes

Choose Your CFA Level 1 Course Product

Practice Package

Learn + Practice

Unlimited Package

What’s Inside Our CFA® Level 1 Mock Exams

CFA-style multiple-choice questions based on the 2026 curriculum

Topic weightings that match the official exam blueprint

Timed and untimed modes (online CBT)

Printable PDFs for offline practice and review

Success Stories: Hear from our CFA Candidates

Trusted by 70,000+ Candidates: Here’s How We Compare

| Feature | AnalystPrep | CFA Institute | Schweser | 300Hours |

|---|---|---|---|---|

| Number of Mock Exams | 5 full-length exams | 1 free exam | 2–4 (varies by plan) | 1 free exam |

| CBT (Computer-Based Testing) Format | ||||

| Printable PDF Version | ||||

| Detailed Answer Explanations | ||||

| 2026 Curriculum Aligned | ||||

| Score Analytics / Review Mode | ||||

| Free Trial Access | Yes (1 exam) |

Not Ready to Buy? Try Our Free Trial For Access To Mock Exams

Try It Risk-Free

Easy Upgrades

No Progress Lost

Start Your Free Trial

What’s Included in Your Free Trial

Frequently Asked Questions

How many mock exams should I take?

Most top candidates complete at least 4–5 full-length mock exams before exam day, enough to simulate test conditions and diagnose weaknesses without burning out. AnalystPrep includes 5 full-length mock exams, matching the optimal study strategy.

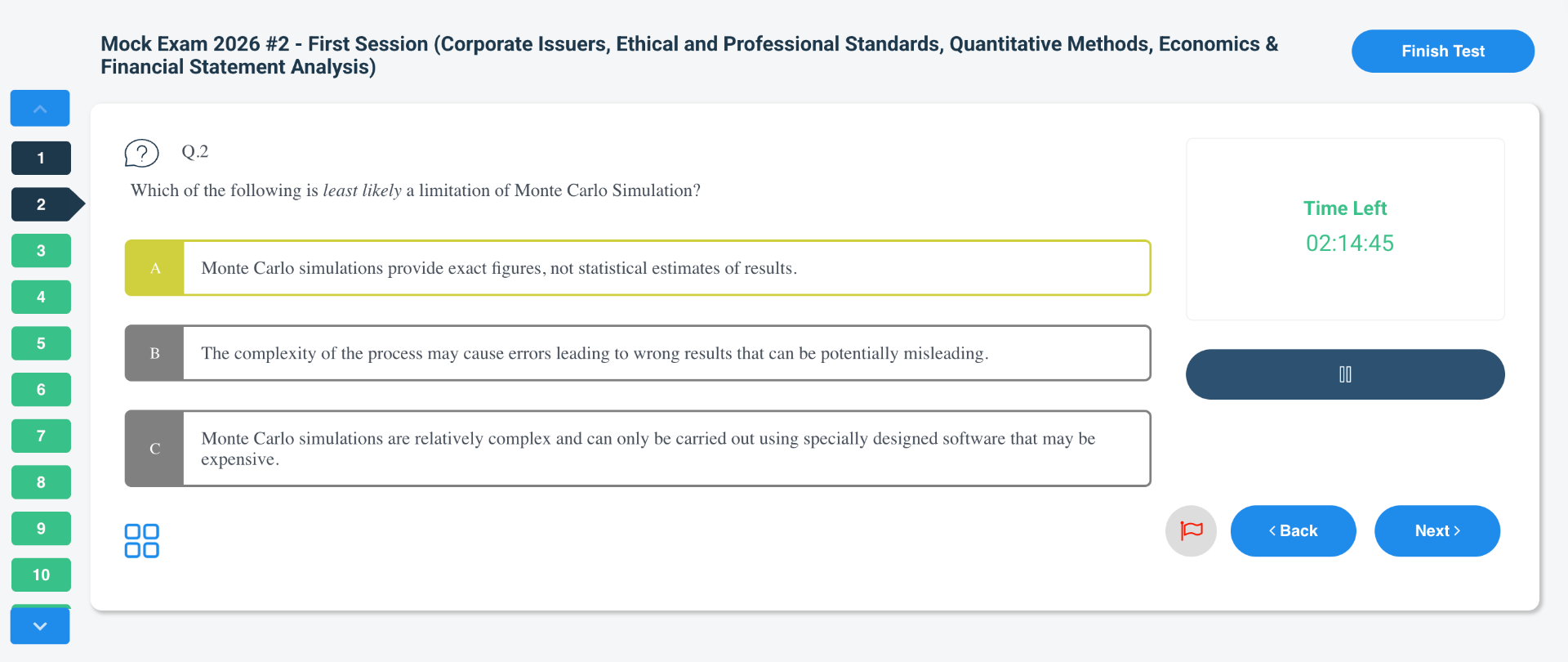

Are these mock exams timed like the real CFA® test?

Yes! Each mock exam simulates the official exam format: two 2h 15m sessions, with options for untimed review or strict timed CBT mode, matching CFA Institute’s computer-based testing structure.

Can I download and print the mock exams?

Absolutely. Every mock exam is available in printable PDF format with full answer keys and explanations, so you can study on the go or offline.

Are answer explanations provided?

Yes, each mock includes detailed video explanations tied to Learning Outcome Statements (LOS), helping you understand the why behind every correct answer.

Is there a free version I can try?

Yes, you can try one full mock exam for free with no time limit. This includes both CBT and PDF formats so you can test the interface, difficulty, and explanations before upgrading.

How closely do these mock exams match actual CFA Level 1 difficulty?

Quite closely. Created by CFA charterholders, our mocks are built to mirror real exam tone, question style, and topic weighting, so you’re not surprised on test day, just ready.

Do I get score reports or analytics?

Yes, you’ll receive score breakdowns by topic, CBT analytics showing strengths/weaknesses, and guidance to focus your review effectively, so every mock takes you closer to passing your exam.

Can I take an in-person mock exam?

Currently, all mocks are online (CBT and PDFs). While we don’t offer in-person proctored sessions like Schweser’s Prometric center exams, our fully simulated platform delivers the same exam-day feeling without leaving home.