Alternative Investments vs. Traditiona ...

Traditional Investments Every possible investment choice is either an alternative or a traditional... Read More

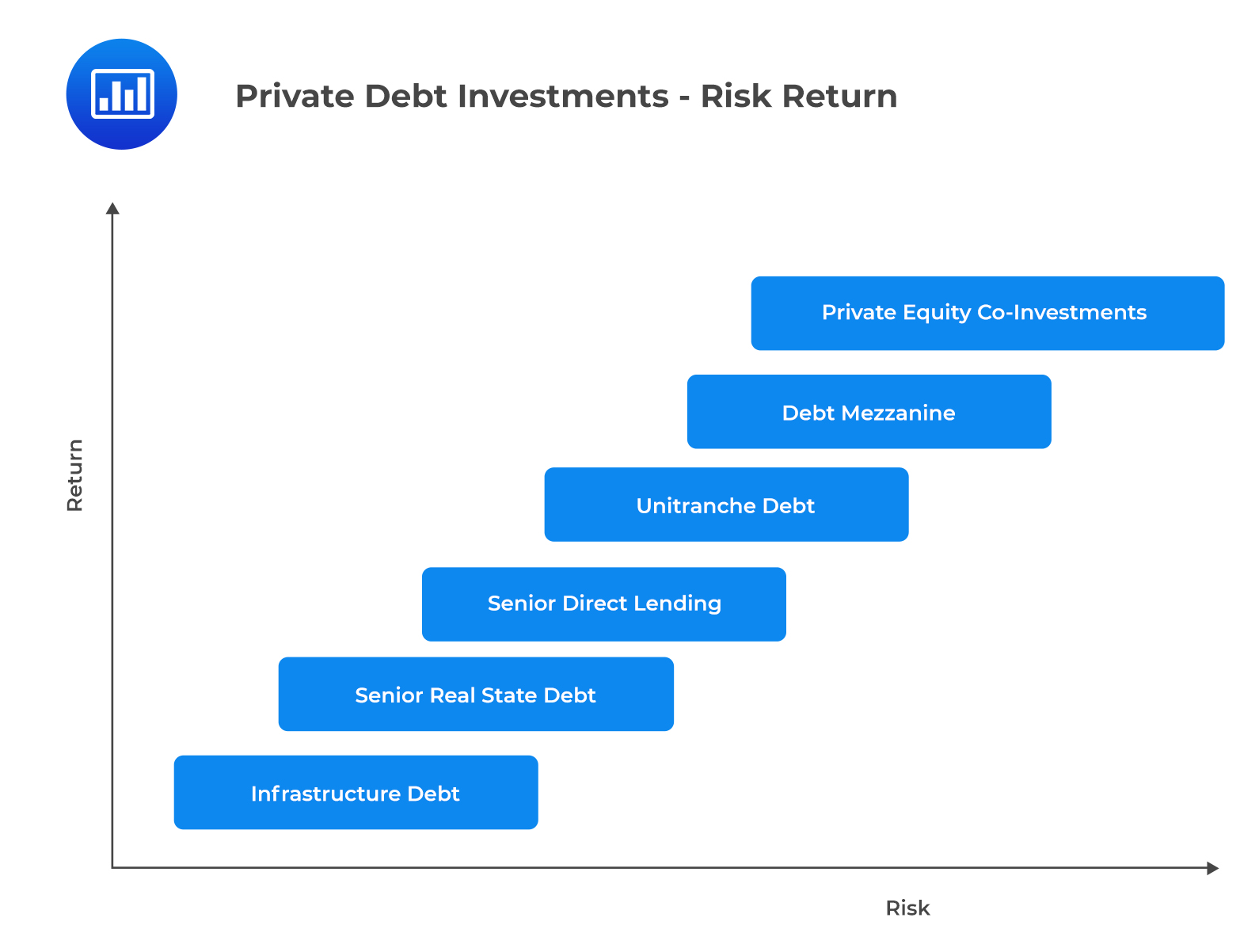

Private debt describes different forms of financing extended to private entity investors. Private debt is classified into direct lending, mezzanine loans, venture debt, and distressed debt.

Direct lending involves private debt investors offering capital to borrowers directly. In return, the private debt investors receive interest, the original principal, and other required repayments. Private debt is like a typical bank loan since it has a fixed structure of payments. It is a senior and unsecured loan containing covenants to protect the lender and the borrower.

In direct lending, a private equity firm collects funds from investors seeking higher-yielding debt. The fund managers then use the funds to grant loans to entities such as private equity funds. The interest rate in private equity is relatively higher since the entities seeking capital lack an alternative to bank loans-usually, banks may have denied them loans.

Direct lending may be done through a leveraged loan. In the case of a leveraged loan, private debt firms borrow to fund a private debt and then extend a loan to another borrower. A leveraged loan has the potential to increase private debt firms’ returns.

Mezzanine debt is a private debt subordinate to senior secured debt but senior to equity in the borrower’s capital structure. In other words, mezzanine debt is a pool of extra funds available to borrowers above senior secured debt. Mezzanine debt is usually common in financing leveraged buyouts (LBOs), recapitalization exit plans, acquisitions, and similar structures.

Mezzanine debts are riskier than senior secured debts since they are unsecured. As such, the interest rate investors charge in mezzanine debt is higher and may involve options for equity participation. Other features of mezzanine loans are the warrants or conversion rights, which allow for equity participation – converting debt into equity or buying a borrower’s equity in particular conditions.

Venture debt is private funding given to start-ups or early-stage firms with venture capital that does not generate small or negative cash flow. Venture debt assumes a line of credit or term loan. As such, if a company takes venture debts, it runs no risk of diluting shareholder ownership.

Like venture capital, venture debt may carry rights for equity participation.

Distressed debt investors buy the debt of mature companies battling financial challenges such as bankruptcy, defaulting on debt, or nearing default. Distressed debt is usually appropriate for companies experiencing temporary cash flow difficulties but that have good business plans, remain afloat, and later succeed. As such, distressed debt investors purchase the debt and actively involve themselves in running the company in a bid to restructure and revive it.

Other private debts include collateralized loan obligations (CLO), unitranche debt, real estate debt, and specialty loans.

Investing in collateralized loan obligations (CLOs) involves extending numerous loans to businesses, pooling them together, and splitting them into several debt and equity tranches with varying levels of seniority and security. Each tranche is then sold to different investors according to their risk profiles, i.e., the most senior CLO is the least risky tranche.

Unitranche debt is made of a combined or hybrid loan structure. It is a blend of different tranches of unsecured and secured debts that collectively form a single loan with a single, blended interest rate that falls between the interest rates of secured and unsecured debts. As such, unitranche is ranked between senior and subordinated debts.

Real estate debt describes loans and other forms of debt issued for real estate financing, where a particular real estate asset is used as collateral. On the other hand, infrastructure debt is a loan issued to finance construction, operation, or infrastructure maintenance.

Specialty loans are debts extended to niche borrowers in special situations, such as litigation.

Compared to traditional bonds, private debt investments may give higher-yielding opportunities to fixed-income investors after increased returns. Larger levels of risk are linked to the possibility of higher rewards, as seen in the graph below:

Question

Which of the following exit strategies will most likely yield the highest value to a private equity firm?

- IPO.

- Trade sale.

- Liquidation.

Solution

The correct answer is A.

The highest price can be achieved through an IPO.

B is incorrect. A trade sale involves selling a company to a strategic buyer, for instance, a competitor, through auction or private negotiation. An IPO is a more attractive option.

C is incorrect. Liquidation has the potential for attracting the lowest price compared to the other exit strategies that include secondary sales, recapitalization, and trade sales.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.