Tree Diagram

A tree diagram is a visual representation of all possible future outcomes and... Read More

The time value of money (TVM) is a fundamental financial concept. It emphasizes that a sum of money is worth more in the present than in the future. There are three key reasons supporting this principle:

Time value of money calculations allow us to establish a given amount’s future value.

Let,

\(FV\) = Future value.

\(PV\) = Present value.

\(r\) = Stated discount rate per period.

\(N\) = Number of periods (Years).

Then the future value \((FV)\) of an investment is given by:

$$ FV_=PV(1+r)^N $$

If \(N\) is large such that \(N \rightarrow \infty\) the initial cashflow is compounded continuously:

$$ FV=PVe^{rN} $$

To find the present value of the investment, we rewrite the above formula so that:

$$ PV=FV(1+r)^{-N} $$

And for the continuous compounding, we have,

$$ PV=FV_t e^{-rN} $$

Example: Calculating the Present Value of continuously Compounded Cashflows

A fund continuously accumulates to $4,000 over ten years at a 10% annual interest rate. Calculate the closest present value of this fund.

Solution

From the question, \(FV\)=4,000, \(r_s\)=10%, \(N\)=10

So,

$$ PV=FV e^{-Nr_s}=\$4,000 \times e^{-10 \times 0.1}=\$1,471.5178 $$

When the frequency of compounding is more than once per year (quarterly, monthly, etc.), the formulas are analogously defined as:

$$ FV_N=PV \left(1+\frac {r_s}{m} \right)^{mN} $$

Where:

\(m\) = Number of compounding periods per year.

\(N\) = Number of years.

\(r_s\) = Annual stated rate of interest.

Intuitively, the formula for the \(PV\) is given by:

$$ PV=FV \left(1+ \frac {r_s}{m} \right)^{-mN} $$

In the following discussion, we shall let \(t=mN\) denote the number of compounding periods and \(\frac {r_s}{m}=r\) denote the stated discount rate per period.

For calculating \(FV\) and \(PV\) using the \(\text{BA II Plus}^{\text{TM}}\) Financial Calculator, use the following keys:

\(N\) = Number of compounding periods.

\(I/Y\) = Rate per period.

\(PV\) = Present value.

\(FV\) = Future value.

\(PMT\) = Payment.

\(CPT\) = Compute.

It is important to note that the sign of \(PV\) and \(FV\) will be opposite. For example, if \(PV\) is negative, then \(FV\) will be positive. Generally, an inflow is entered with a positive sign, while an outflow is entered as a negative sign in the calculator.

Fixed-income instruments are debt securities where an issuer borrows money from an investor (lender) in exchange for a promised future payment. Examples of fixed-income instruments are bonds, loans, and notes.

The market discount rate for fixed-income instruments, also known as yield-to-maturity (YTM), is the interest rate investors require to invest in a specific instrument.

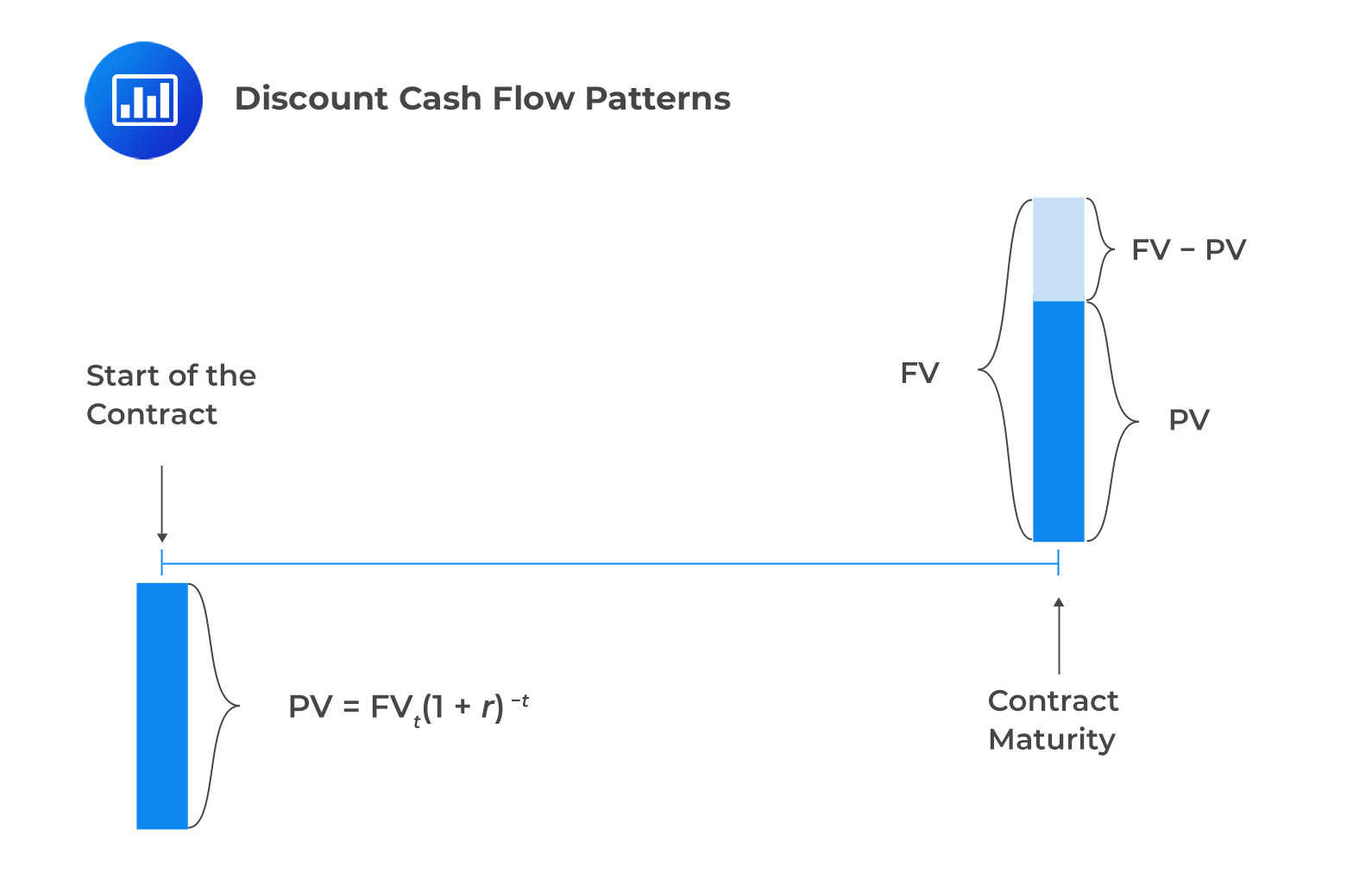

Cash flows in fixed-income instruments follow three general patterns: discount, periodic interest, and level payments.

For discount cashflow patterns, an investor pays an initial discounted price \((PV)\) for the instrument (such as a bond or a loan) and gets one payment \((FV)\) at the end maturity. The investor’s return is the interest earned, that is, the difference between the initial price and principle \((FV- PV)\).

Discount bonds are often called zero-coupon bonds since they do not have periodic interest payments (coupons).

The price of a discount bond can be calculated using the formula for the present value \((PV)\) of a single cash flow, which is as follows:

$$ PV =FV_t (1+r)^{-t} $$

Where:

\(FV\) = Future value.

\(PV\) = Present value.

\(r\) = Stated discount rate per period.

\(t\) = Number of compounding periods.

Example: Calculating the Future Value of a Zero-Coupon Bond

Assume Chad invests $8,000 in a zero-coupon bond that yields 8% annually and matures in four years. The maturity value of this bond is closest to:

Solution

Recall that:

$$ FV=PV(1+r)^t $$

In this case, we have \(PV\)=8,000, \(r\)=8%, \(t\)=4 so that:

$$ FV=8,000(1+8\%)^4=10,883.91 $$

Using the \(\text{BA II Plus}^{\text{TM}}\) Financial Calculator

$$ \begin{array}{l|c|c}

\textbf{Steps} & \textbf{Explanation} & \textbf{Display} \\ \hline

{[2nd] [\text{QUIT}] }& \text{Return to standard calc Mode} & 0 \\ \hline

{[2nd] [\text{CLR TVM}] } & \text{Clears TVM Worksheet} & 0 \\ \hline

4[N] & \text{Years/periods} & N = 4 \\ \hline

8[1/Y] & \text{Set interest rate} & PV = -8,000 \\ \hline

0[PMT] & \text{Set payment} & PMT = 0 \\ \hline

[CPT][FV] & \text{Compute future value} & FV = 10,883.91

\end{array} $$

Note that zero-coupon bonds can be issued at negative interest rates. In this case, the price (PV) of the bond is higher than the face value (FV).

Example: Calculating the Price of a Discount Bond Issued at Negative Interest Rates

In January 2018, the Swiss government issued 15-year sovereign bonds at a negative yield of -0.08%. The present value (PV) of the bond per CHF100 of principal (FV) at the time of issuance is closet to:

Solution

Recall for a zero-coupon bond,

$$ \begin{align*}

PV & =FV_t (1+r)^{-t} \\

& =100(1-0.0008)^{-15}=101.21

\end{align*} $$

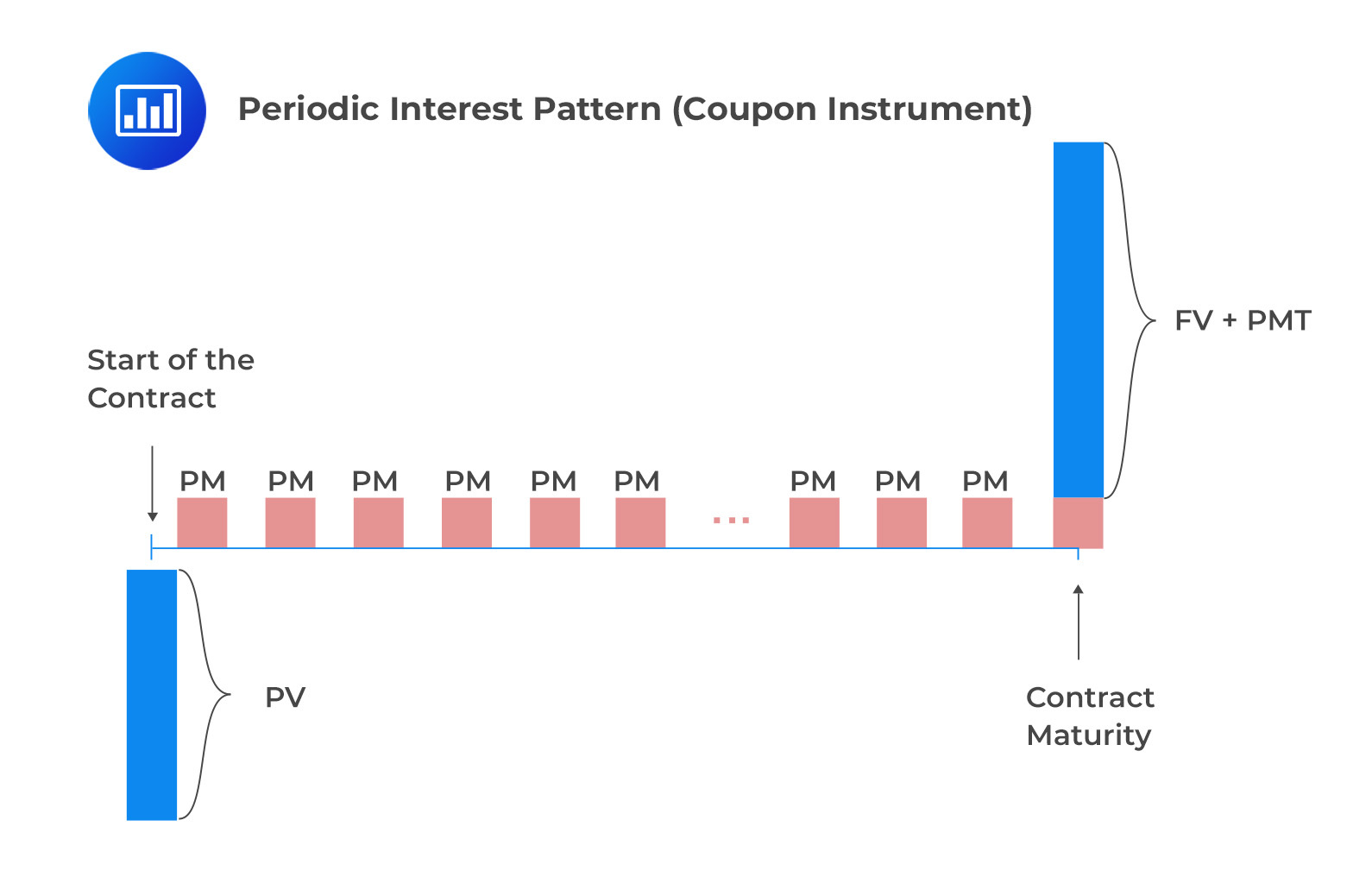

A coupon instrument is a fixed-income investment. It includes periodic cash flows called coupons and repays the principal at maturity. People often use these in coupon bond investments. These instruments have a set schedule with regular, equal payments.

The pricing of a coupon bond involves calculating its present value (PV) based on the market discount rate. The general formula for calculating the bond’s price is derived from the discounted cash flow model. It considers the coupon payments (PMTs) and the final principal payment (FV) at maturity. The bond’s price is determined by discounting each cash flow using the market discount rate (r).

The formula used to calculate the present value (PV) of a coupon bond is as follows:

$$ \text{PV(Coupon Bond)} =\frac {PMT}{(1+r)^1} + \frac {PMT}{(1+r)^2} +…+\frac {(PMT_N+FV_N)}{(1+r)^N} $$

Where:

\(PMT\) = Coupon payment.

\(FV\) = Future value.

\(r\) = Market discount rate (YTM).

\(N\) = Number of periods.

Example 1: Pricing a Coupon Bond on an Annual Basis

Suppose we have a 5-year bond with a face value of $1,000 and an annual coupon rate of 5%. The market discount rate is 6%. The bond’s price is closest to:

Solution

$$ \text{PV(Coupon Bond)}=\frac {PMT}{(1+r)^1} + \frac {PMT}{(1+r)^2} +\dots +\frac {(PMT_N+FV_N)}{(1+r)^N} $$

In this case, we have \(PMT\)=5% of $1,000=$50, \(r\)=6%, \(N\)=5 years, \(FV\)=$1,000 so that:

$$ \begin{align*}

PV & =\frac {\$50}{(1+0.06)^1} +\frac {\$50}{(1+0.06)^2} + \frac {\$50}{(1+0.06)^3} + \frac {\$50}{(1+0.06)^4} \\ & + \frac {(\$50+\$1,000)}{(1+0.06)^5} \\

PV & =\$47.17+\$44.50+\$41.98+\$39.60+\$784.62=\$957.88 \\

\end{align*} $$

Therefore, the price of the bond would be \(\bf{\$957.88}\)

You could use a BA II Plus Calculator to solve the above question:

$$ \begin{array}{l|c|c}

\textbf{Steps} & \textbf{Explanation} & \textbf{Display} \\ \hline

{[2nd] [\text{QUIT}]} & \text{Return to standard calc Mode} & 0 \\ \hline

{[2nd] [\text{CLR TVM}]} & \text{Clears TVM Worksheet} & 0 \\ \hline

{5[N]} & \text{Years/periods} & N = 5 \\ \hline

{6[1/Y]} & \text{Set interest rate} & I/Y = 6.00 \\ \hline

{50[PMT]} & \text{Set payment} & PMT = 50.00 \\ \hline

{1000[FV]} & \text{Set the face value} & FV=1000.00 \\ \hline

{[CPT][PV]} & \text{Compute the present value} & PV = -957.88

\end{array} $$

Example 2: Pricing a Coupon Bond With a Single Cash Flow on a semi-annual Basis

Assume an investor has a 2-year bond with a face value of $1000 and an annual coupon rate of 6%, paid semi-annually. The market discount rate is 5%. The price of the bond is closest to:

Solution

Recall that:

$$ \text{PV(Coupon Bond)}=\frac {PMT}{(1+r)^1} +\frac {PMT}{(1+r)^2} +…+\frac {(PMT_N+FV_N)}{(1+r)^N} $$

Where:

\(PMT\) = Coupon payments \(\left($1,000 \times \frac {6\%}{2} \right)=\$30\) in this case.

\(FV\) = Future value ($1,000 in this case).

\(r\) = Market discount rate (YTM), \(\left(\frac {(5\%)}{2}=2.5\%\right)\) per period in this case.

\(N\) = Number of periods (4 periods in this case).

Plugging these values into the formula, we get:

$$ \begin{align*}

PV & =\frac {\$30}{(1.025)^1} + \frac {\$30}{(1.025)^2} + \frac {\$30}{(1.025)^3} +\frac {(\$30+\$1,000)}{(1.025)^4} \\

PV & =\$29.27+ \$28.55+27.85+\$933.13=\$1,018.81

\end{align*} $$

Therefore, the bond’s price is \(\bf{\$1,018.81}\)

You can easily use the BA II Plus calculator (or any other allowed financial calculator) to solve the above question.

$$ \begin{array}{l|c|c}

\textbf{Steps} & \textbf{Explanation} & \textbf{Display} \\ \hline

{[2nd] [\text{QUIT}]} & \text{Return to standard calc Mode} & 0 \\ \hline

{[2nd] [\text{CLR TVM}]} & \text{Clears TVM Worksheet} & 0 \\ \hline

{4[N]} & \text{Years/periods} & N = 4 \\ \hline

{2.5[1/Y]} & \text{Set interest rate} & I/Y = 2.50 \\ \hline

{30[PMT]} & \text{Set payment} & PMT = 30.00 \\ \hline

{1000[FV]} & \text{Set the face value} & FV=1000.00 \\ \hline

{[CPT][PV]} & \text{Compute the present value} & PV = -1,018.81

\end{array} $$

Perpetual bonds are rare types of coupon bonds that do not have a stated date of maturity. They are generally issued by firms seeking equity-like financing and usually include redemption provisions.

The formula present value of perpetual bonds is obtained as follows: As \(N \rightarrow \infty\), the formula for calculating PV of coupon changes as follows:

$$ \begin{align*}

& \text{PV (perpetual bond)} \\ & =\begin{matrix} {lim}\\{(N \rightarrow \infty)}\end{matrix} \left[\frac {PMT}{(1+r)^1} +\frac {PMT}{(1+r)^2} +\dots +\frac {(PMT_N+FV_N)}{(1+r)^N} \right] \\ & =\frac {PMT}{r} \end{align*} $$

So, the present value of a perpetuity is given by:

$$ PV=\frac {PMT}{r} $$

Example: Perpetual Bond

In 2021, XYZ Financial (the holding company for XYZ Bank) issued $500 million in perpetual bonds with a 4.00 percent semi-annual coupon. Calculate the bond’s yield to maturity (YTM) if the market price was $98.50 (per $100).

Solution

Recall,

$$ PV=\frac {PMT}{r} $$

Hence,

$$r=\frac {PMT}{PV} $$

To solve this problem, we first need to calculate the semi-annual coupon payment, which is,

$$

\text{PMT(semi-annual coupon payment)}=\frac {\$100 \times 4\%}{2} = \$2,PV=\$98.50 $$

Therefore,

$$ r=\frac {\$2}{\$98.50}=0.0203=2.03\% $$

The annualized yield-to-maturity is:

$$ r=0.0203 \times 2 \approx 4.06\% $$

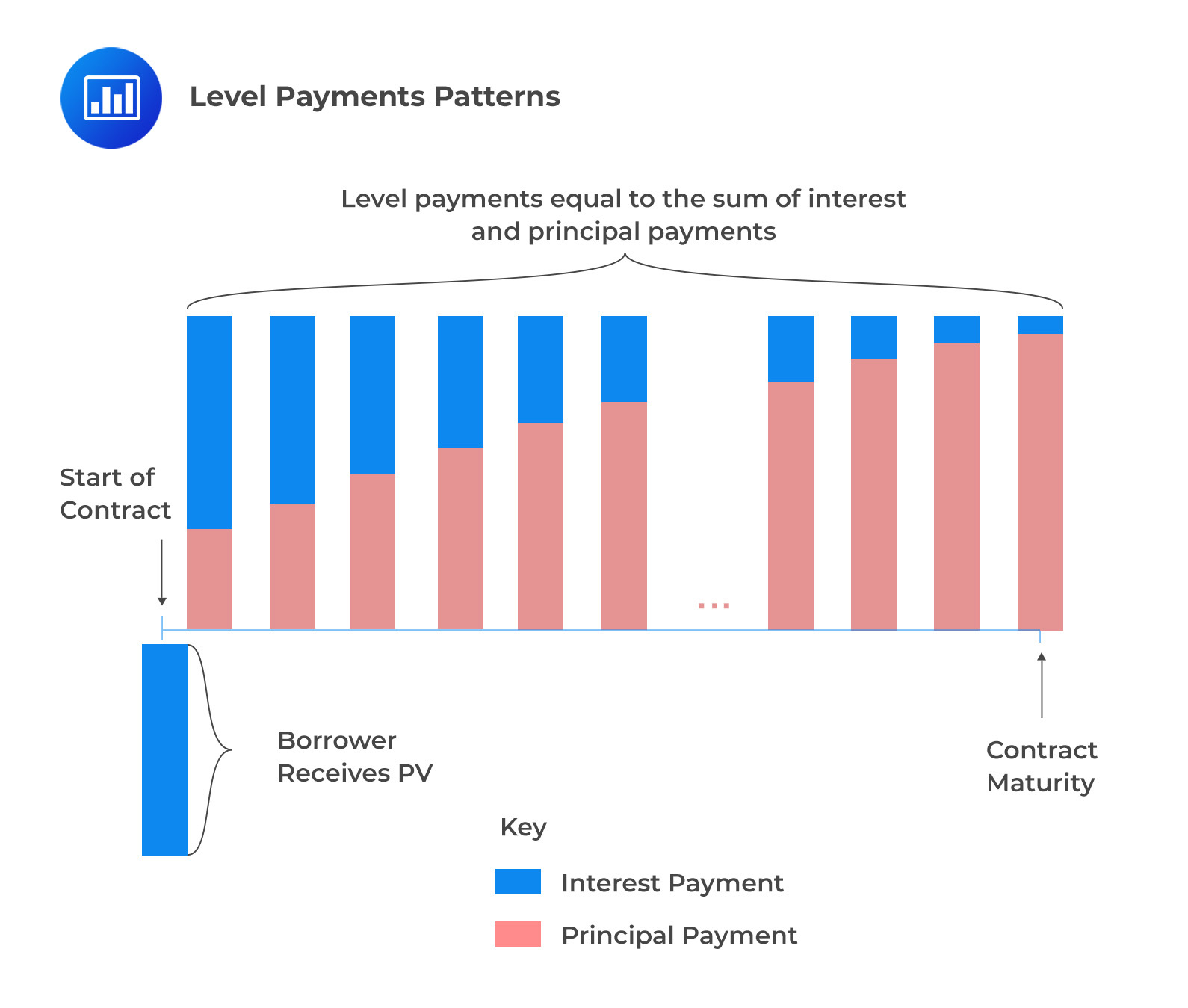

An annuity is a finite series of cash flows, all with the same value. A fixed-income instrument with annuity payments provides a stream of periodic equal cash inflows over a finite period.

Level payments consist of interest and principal. Fixed income instruments with level payments include fully amortizing loans such as mortgages.

There are two types of annuities: ordinary annuities and annuities due. Annuity due is a type of annuity where payments start immediately at the beginning of time, at time \(t = 0\). In other words, payments are made at the beginning of each period.

On the other hand, an ordinary annuity is an annuity where the cashflows occur at the end of each period. Such payments are said to be made in arrears (beginning at time t = 1). We shall consider ordinary annuity in this section.

Ordinary Annuity

Remember that in an ordinary annuity, the series of payments does not begin immediately. Instead, payments are made at the end of each period. It is further worth noting that the present value of an annuity is equal to the sum of the current value of each annuity payment:

$$\begin{align*} PV&=A(1+r)^{-1}+A(1+r)^{-2}+…+A(1+r)^{-N-1}+A(1+r)^{-N} \\& =A (1+r)^{-1}+(1+r)^{-2}+…+(1+r)^{-(N-1)}+(1+r)^{-N} \\PV & =A \frac {1-(1+r)^N}{r} \end{align*} $$

Where:

\(A\) = Periodic cash flow.

\(r\) = Market interest rate per.

\(PV\) = Present value/ Principal Amount of the loan or bond.

\(N\) = Number of payment periods.

The periodic annuity is calculated as follows:

$$ A=\frac {r(PV)}{(1-(1+r)^{-N} } $$

Consider a fully amortizing mortgage loan. In this case, the borrower receives the mortgage loan now and promises to make periodic payments equal to the sum of interest and principal payments.

Note that the periodic mortgage payment is constant, but the proportion of the interest payment decreases while the principal payment increases.

The cash flow pattern of a fully amortizing mortgage follows the pattern of an ordinary annuity with a series of equal cash flows. As such, the periodic annuity (periodic payment) of a fully amortizing mortgage is given by:

$$ A=\frac {r(PV)}{1-(1+r)^{-t} } $$

Where:

\(A\) = Periodic cash flow.

\(r\) = Market interest rate per period.

\(PV\) = Present value or principal amount of loan or bond.

\(t\) = Number of payment periods.

Example: Calculating the Periodic Payment of a Mortgage

Jake is looking to secure a fixed-rate 25-year mortgage to finance 75% of the value of an $800,000 residential property. If the annual interest rate on the mortgage is 4.5%, Jake’s monthly mortgage payment is close to:

Solution

Remember,

$$ A=\frac {r(PV)}{1-(1+r)^{-t} } $$

Where:

\(A\) = Periodic cash flow.

\(r\) = Market interest rate per period.

\(PV\) = Present value/ Principal Amount of the loan or bond.

\(t\) = Number of payment periods.

In this case, we have:

Plugging these values into the formula, we get:

$$ A=\frac {0.00375 \times \$600,000}{1-(1+0.00375)^{-300} }=\$3,334.995 \approx \$3,335 $$

Using a BA II Plus financial calculator:

$$ \begin{array}{l|c|c}

\textbf{Steps} & \textbf{Explanation} & \textbf{Display} \\ \hline

{[2nd] [\text{QUIT}]} & \text{Return to standard calc Mode} & 0 \\ \hline

{[2nd] [\text{CLR TVM}]} & \text{Clears TVM Worksheet} & 0 \\ \hline

{300[N]} & \text{Years/periods} & N = 300 \\ \hline

{0.375[1/Y]} & \text{Set interest rate} & I/Y = 0.375 \\ \hline

-600,000[PV] & {\text{Set the present value} } & PV = -600,000.00 \\

& {\text{of the mortgage}} & \\ \hline

{0[FV]} & \text{Set the face value} & FV=0.00 \\ \hline

{[CPT][PMT]} & \text{Compute the periodic payment} & PMT= 3,334.99

\end{array} $$

Equity investments, such as stocks, enable an investor to acquire a fractional share/ownership by the issuing company. This gives investors the right to receive a share of the company’s available cash flows as dividends.

In the context of equity instruments, the time value of money (TVM) is used to discount expected future cash flows to determine their present value. This allows investors to value the company shares.

The present value of expected future cash flows is calculated using a discount rate, r, which represents the expected rate of return on the investment.

Valuing equity investments depends on dividend cashflows, which can take one of three forms: constant dividends, constant dividend growth rate, or changing dividend growth rate.

1. Valuing Equity Instruments based on Constant Dividend: The Constant Dividends model values stocks based on the assumption that dividends will remain constant over time. The preferred or common share dividend cash flows are in the form of an infinite series that is valued like perpetuity. The formula for the constant dividends model is as follows:

$$ PV_t=\sum_{i=1}^\infty {\frac{D_t}{(1+r)^i}} =\frac {D_t}{r} $$

Where:\(PV_t\) = Present value at time \(t\)

\(D_t\) = Dividend payment at time \(t\)

\(r\) = Discount rate.

Assuming we have a preferred stock with a dividend payment of $5 per year. The discount rate is 8%. The present value of the stock is closest to:

Solution

Recall,

$$ PV_t=\frac {D_t}{r} $$

In this case, \(D\)=$5, \(r\)=8%, \(PV\)=?

So,

$$ PV=\frac {5}{0.08}=\$62.5 $$

This means that the present value of the stock is $62.5.

2. Valuing Equity Instruments Based on Constant Dividend Growth Rate: The constant dividend growth model is a method used to estimate the value of a stock based on its future dividends. This model assumes that dividends will grow at a constant rate (g) forever. To derive the formula for this model, we start by considering that the present value of a stock is equal to the sum of its future dividends, discounted by the required rate of return \(r\). If dividends are assumed to grow at a constant rate, then each future dividend can be calculated by multiplying the previous dividend by \((1 + g)\).

Let \(D_t\) represent the expected dividend in the next period. The present value of the stock can then be expressed as:

$$ \begin{align*}

PV_t & =\frac {D_t}{(1+r) }+ \frac {D_t (1+g)}{(1+r)^2} + \frac {D_t (1+g)^2}{(1+r)^3} +\dots \\

& =\sum_{i=1}^\infty \frac {D_t(1+g)^i}{(1+r)^i}

\end{align*} $$

This is an infinite geometric series with a common ratio of \(\frac {(1+r)}{(1+g)}\). Using the formula for the sum of an infinite geometric series, we can simplify this equation to:

$$ PV_t=\frac {D_t (1+g)}{r-g}= \frac {D_{t+1}}{r-g} $$

Where:

\(PV_t\) = Present value at time \(t\).

\(D_{t+1}\) = Expected Dividend in the next period.

\(r\) = Required rate of return.

\(g\) = Constant growth rate.

\( r-g \gt 0\)

Therefore, this is the formula for calculating the present value of a stock using the constant dividend growth rate. This model can help estimate the value of a stock when its future dividends are expected to grow steadily.

Example: Valuing Equity Instruments based on Constant Dividend Growth Rate

Suppose a stock currently pays an annual dividend of $2.00 per share. The required rate of return for this stock is 10%, and the dividends are expected to grow at a constant rate of 5% per year indefinitely. Using the constant dividend growth model, the present value of this stock is closest to:

Solution

Recall that,

$$ PV_t=\frac {D_t (1+g)}{r-g}=\frac {D_{t+1}}{r-g} $$

In this case, we know that \(D_t\)=$2.00, \(r\)=10%, \(g\)=5%

So,

$$ PV=\frac {2 \times 1.05}{r-g}=\frac {2.10}{0.10-0.05}=\$42 $$

Therefore, the present value of the stock is $42

3. Valuing Equity Instruments with Changing Dividend Growth Rates is a dynamic process. It begins with the investor buying a stock at an initial price and getting an initial dividend. The unique aspect is that the dividend is expected to grow at a rate that evolves as the company matures and shifts from high growth to slower growth. This valuation doesn’t have a single formula because it relies on assumptions about future dividend growth. However, a common method is to use a multi-stage dividend discount model. This model assumes that dividends will grow at different rates during various stages of the company’s growth. To find the stock’s present value, you sum up the present values of dividends at each stage.

The Multi-Stage Dividend Discount Model builds on the Constant Dividend Growth Model. It accommodates a company’s transition from high initial growth to lower, more stable growth.

Let’s say a company has a high short-term growth rate \(g_s\) followed by a perpetual lower growth rate \(g_l\). To find the present value (PV) of the stock at time \(t\) using this model, we compute it in two stages:

Example: Valuing Equity Instruments based on Changing Dividend Growth Rate

Assuming we have a stock with an expected dividend payment of $2 in one period, and the discount rate is 10%. The stock is expected to have a high dividend growth rate of 20% for the first three years, followed by a slower growth rate of 5% thereafter. Calculate the present value of the stock.

Solution

First, we calculate the present value of the dividends during the high growth period:

Recall that,

$$ PV_t=\sum_{i=1}^n {\frac {D_t (1+g_s )^i}{(1+r)^i}} $$

In this case, \(D_t\)=$2, \(g_s\)=0.20, \(r\)=0.10, \(n\)=3

So,

$$ \begin{align*}

PV_{\text{Dividends}} & = \frac {2 \times (1+0.20)}{1+0.10)^1} + \frac {2 \times (1+0.20)^2}{1+0.10)^2} +\frac {2 \times (1+0.20)^3}{1+0.10)^3} \\

& =2.182+2.380+2.596=7.158 \\

& = \$7.158

\end{align*} $$

Next, we calculate the present value of the dividends during the slower growth period, assuming that dividends will grow at a constant rate of 5% thereafter:

Recall that,

$$ E(S_t+n)= \frac {D_{t+n+1}}{(r-g_l ) } $$

So,

$$ E(S_t+n)=\frac { 2(1+0.20)^3 \times (1+0.05)}{ 0.10-0.05 }==\$72.576 $$

Finally, we calculate the present value of \(P_3\)

$$ P_3=\frac {\$72.576 }{(1+0.10)^3} =\$54.50 $$

The total present value of the stock is the sum of \(PV_{\text{Dividends}}\) and \(P_8\)

$$ \begin{align*}

PV_{\text{total}} & =PV_{\text{Dividends}}+P_8\\

&=\$7.158+\$54.50 \\

& =\$61.66

\end{align*} $$

Question

Five years ago, Milton Inc. issued corporate bonds with a 15-year maturity. The bonds have a semi-annual coupon rate of 7.8% per annum, and the current yield to maturity is 8.5% per annum. The current price of Milton Inc’s bonds (per CAD100 of par value) is closest to:

- CAD91.23.

- CAD95.35.

- CAD96.15.

The correct answer is B.

Solution

Recall the formula for calculating the price of a bond:

$$ \text{PV(Coupon Bond)}=\frac {PMT}{(1+r)^1} +\frac {PMT}{(1+r)^2} +…+\frac {(PMT_N+FV_N)}{(1+r)^N} $$

First, let’s get the semi-annual equivalent rates:

- The semi-annual coupon rate is \(\frac{7.8\%}{2} = 3.9\%\).

- The semi-annual yield to maturity is \(\frac{8.5\%}{2} = 4.25\%\).

Next, we find the number of periods remaining until the bond matures:

Since the bonds were issued 5 years ago and have a 15-year maturity, \(10 (=15 – 5)\) years remain to maturity. Since interest is paid semi-annually, this equates to \(10\times 2 = 20\) periods.

You can plug the above values into the general formula, consuming valuable time. Therefore, using BA II plus a financial calculator,

$$ \begin{array}{l|c|c}

\textbf{Steps} & \textbf{Explanation} & \textbf{Display} \\ \hline

{[2nd] [\text{QUIT}]} & \text{Return to standard calc Mode} & 0 \\ \hline

{[2nd] [\text{CLR TVM}]} & \text{Clears TVM Worksheet} & 0 \\ \hline

{20[N]} & \text{Years/periods} & N = 20 \\ \hline

{4.25[1/Y]} & \text{Set interest rate} & I/Y = 4.25 \\ \hline

3.9[PMT] & {\text{Set the periodic} } & PMT = 3.90 \\

& {\text{coupon payment}} & \\ \hline

{100[PV]} & \text{Set the face} & FV= 100.00 \\

& \text{value of the bond} & \\ \hline

{[CPT][PV]} & \text{Compute the present value} & PV = -95.35

\end{array} $$