Describe Different Types of Bonds

Call Provisions A call provision gives the issuer the option to repurchase the... Read More

Duration – whether it’s Macaulay duration, effective duration, or any other kind of duration – is a measure of interest rate risk. Some factors affect duration and consequently affect interest rate risk.

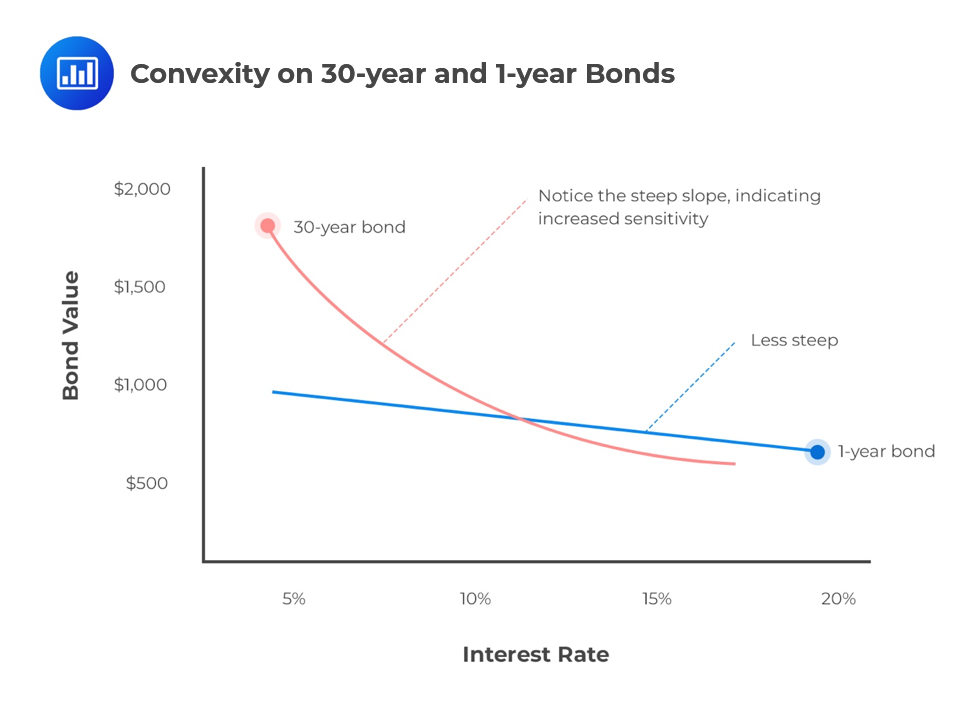

Longer maturity bond prices are more sensitive to changes in yields than shorter maturity bonds. As shown in the following graph, the price of the 30-year bond increases a lot more than that of the 1-year bond in response to a decrease in interest rates.

Bonds with higher coupon rates are less sensitive to changes in interest rates. This is because one can always reinvest the large coupon payments at the prevailing market interest rate. On the contrary, zero-coupon bonds are the most sensitive to interest rate swings since all the interest payments of zero-coupon bonds are accumulated and paid at maturity.

Putable bonds allow investors to sell the bond back to issuers before maturity at par value and protect them from higher benchmark yields. Therefore, the price of a putable bond is always higher than that of a comparable non-putable bond.

An embedded put option reduces the effective duration of a bond, especially when rates are rising. Thus, the inclusion of an embedded option reduces price sensitivity to changes in the benchmark yield curve.

Question

Which of the following bonds would have the highest interest rate risk?

- A 5% coupon bond.

- A 12% coupon bond.

- A zero coupon bond.

Solution

The correct answer is C.

Smaller coupon bonds are more sensitive to interest rate swings than bonds which pay bigger coupons. Since a zero coupon bond has the smallest of all coupons (being zero), it carries the highest interest rate risk.