Dilutive Securities and Anti-dilutive ...

Dilutive securities and anti-dilutive securities can impact the calculation of earnings per share... Read More

An accounting system allows a company to translate its business activities into usable financial records. The company uses these financial records to assess its profitability, evaluate its financial position, and identify any business activity which requires further action.

The accounting system is usually presented in the form of a spreadsheet. In recording an activity in this spreadsheet, its financial impact is assessed before it is expressed as an accounting transaction. The following steps are involved:

In accordance with the accounting equation i.e. Assets = Liabilities + Owners’ equity (in its basic form), every recorded transaction should affect at least two accounts. This will ensure that the equation remains balanced, which is a fundamental accounting concept. ‘Double-entry accounting’ is a term which describes this accounting process. For example, if a company uses cash to purchase inventory, one account, cash, decreases, while another account, inventory, increases. All through, the accounting equation remains in balance.

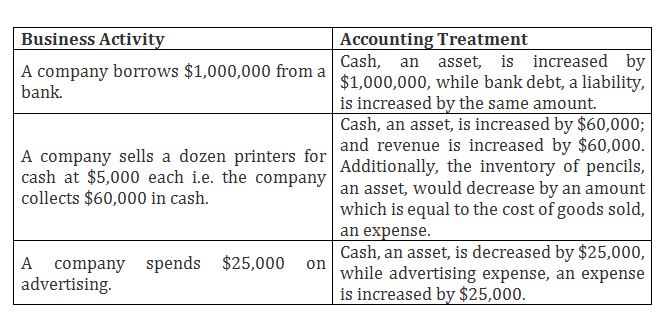

The following sample will help to demonstrate this concept better.

Financial statements allow financial data that is reported in the accounting system to be presented in a more useful and meaningful manner.

Question

Company XYZ purchases new equipment for $55,000 in cash. Which of the following statements describes the correct accounting treatment to reflect this?

A. Cash increases by $55,000, while equipment decreases by $55,000

B. Cash decreases by $55,000, while equipment increases by $55,000

C. Cash decreases by $55,000, while accounts payable increases by $55,000

Solution

The correct answer is B.

Since cash is used, cash decreases, and since the equipment is acquired, equipment increases. Accounts payable does not change as a result of this transaction.

Reading 22 LOS 22d:

Describe the process of recording business transactions using an accounting system based on the accounting equation

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.