Objectives of Financial Statements

The principles provided by financial reporting standards facilitate the preparation of financial reports... Read More

Return on Equity (ROE), i.e., net income divided by average shareholders’ equity, measures the return that a company generates on its equity capital.

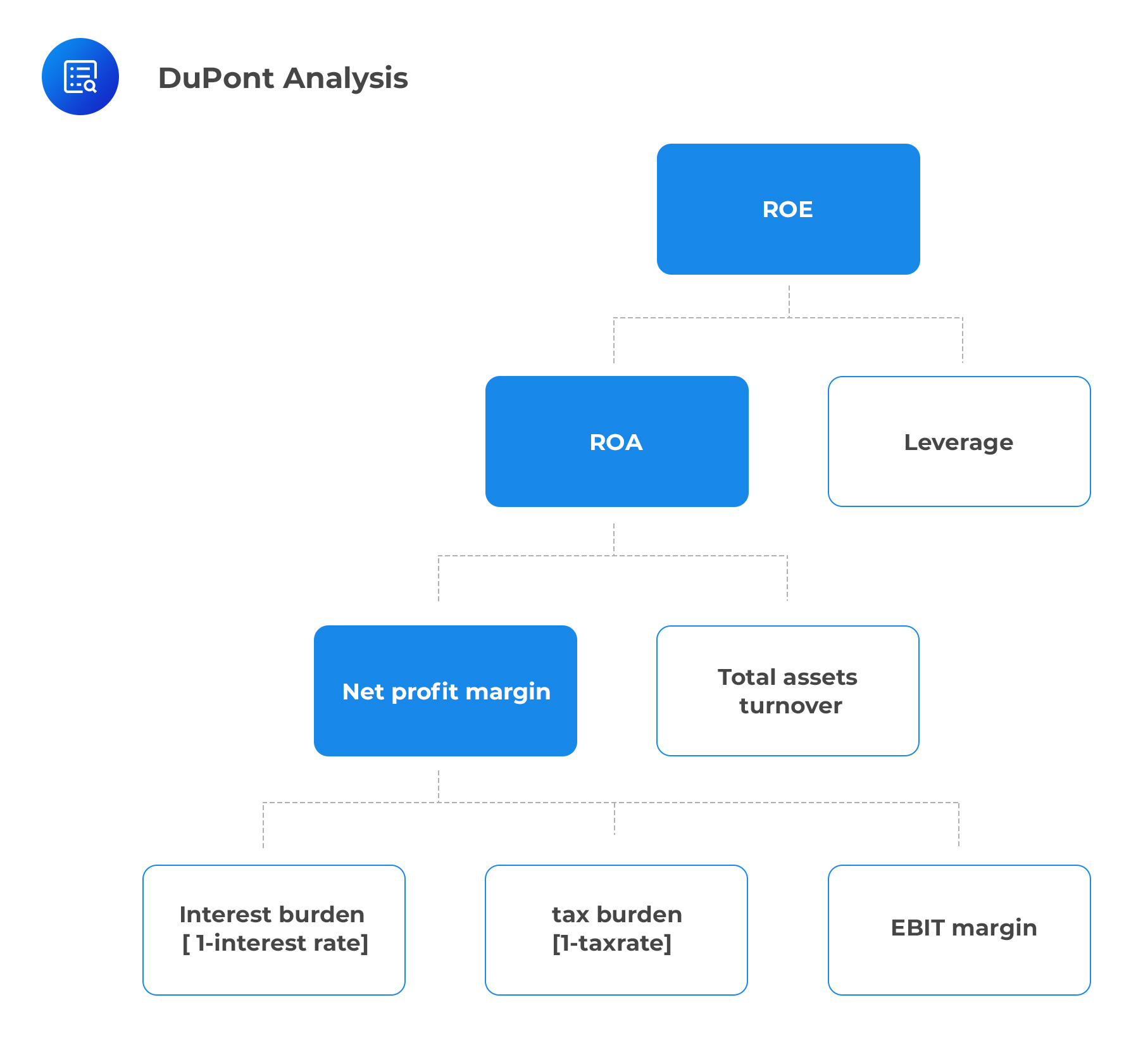

DuPont analysis is a technique that can be used to decompose ROE into its constituent parts. The process involves the expression of the basic ratio as the product of component ratios. This decomposition is useful in the determination of the reasons for changes in ROE over time for a given company. It also demystifies the differences in ROE for different companies in a given time period.

The figure below illustrates the idea behind DuPont’s analysis.

There are several methods for decomposing ROE using simple algebra.

$$\begin{align}\text{ROE} &= \frac{\text{Net income}}{ \text{Average shareholders’ equity}}\\ &= \left(\frac{\text{Net income}} {\text{Average total assets}}\right)\times \left(\frac{\text{Average total assets}}{\text{Average shareholders’ equity}}\right)\end{align}$$

Therefore

$$\text{ROE} = \text{Return on Assets (ROA)} \times \text{Leverage}$$

This implies that when a company uses leverage, a higher ROA will lead to a higher ROE.

$$\begin{align}\text{ROE} &= \frac{\text{Net income}}{\text{Average shareholders’ equity}}\\ &= \left(\frac{\text{Net income}}{ \text{Revenue}}\right) \times \left(\frac{\text{Revenue} }{\text{Average total assets}}\right)\times \left(\frac{\text{Average total assets}}{\text{Average shareholders’ equity}}\right)\end{align}$$

Which is interpreted as:

$$\text{ROE} = \text{Net profit margin} \times \text{Total asset turnover}\times \text{Leverage}$$

This tells us that when a company uses leverage, a higher asset turnover and net profit margin will lead to a higher return on equity.

To further separate the effects of taxes and interest, the net profit margin can further be decomposed leading to:

$$\begin{align}\text{ROE} = &\frac{\text{Net income}}{\text{Average shareholders’ equity}}\\= &\left(\frac{\text{Net income}}{ \text{EBT}}\right) \times \left(\frac{\text{EBT}}{\text{EBIT}}\right) \times \left(\frac{\text{EBIT}}{ \text{Revenue}}\right) \times\\ &\left(\frac{\text{Revenue}}{\text{Average total assets}}\right) \times \left(\frac{\text{Average total assets}}{\text{Average shareholders’ equity}}\right)\\ & = \text{Tax burden}\times \text{Interest burden} \times \text{EBIT margin}\times \text{Total asset turnover} \times \text{Leverage} \end{align}$$

This 5-way decomposition is the Dupont Analysis method that is found in financial databases such as Bloomberg.

Question 1

Given the following financial data on a company, what is the company’s ROE?

$$\begin{array} {ll}\\ \text{Net income}&50,000\\ \text{Revenue}&2,85,000\\ \text{Average total assets}&1,000,000\\ \text{Average shareholder’s equity}& 600,000\\ \end{array}$$

- 5.29%

- 8.33%

- 1.14%

Solution

The correct answer is B.

$$\begin{align}\text{ROE} &= \left(\frac{\text{Net income}}{\text{Revenue}}\right) × \left(\frac{\text{Revenue}}{\text{Average total assets}}\right) × \left(\frac{\text{Average total assets}}{\text{Average shareholders’ equity}}\right)\\&= \frac{50,000}{285,000} × \frac{285,000}{1,000,000} × \frac{1,000,000}{600,000} = 0.1754 × 0.285 × 1.667 = 8.33\%.\end{align}$$

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.