Public vs. Private Equity Securities

Investment Characteristics: Public Equity: Offers easier market entry and exit, and is subject... Read More

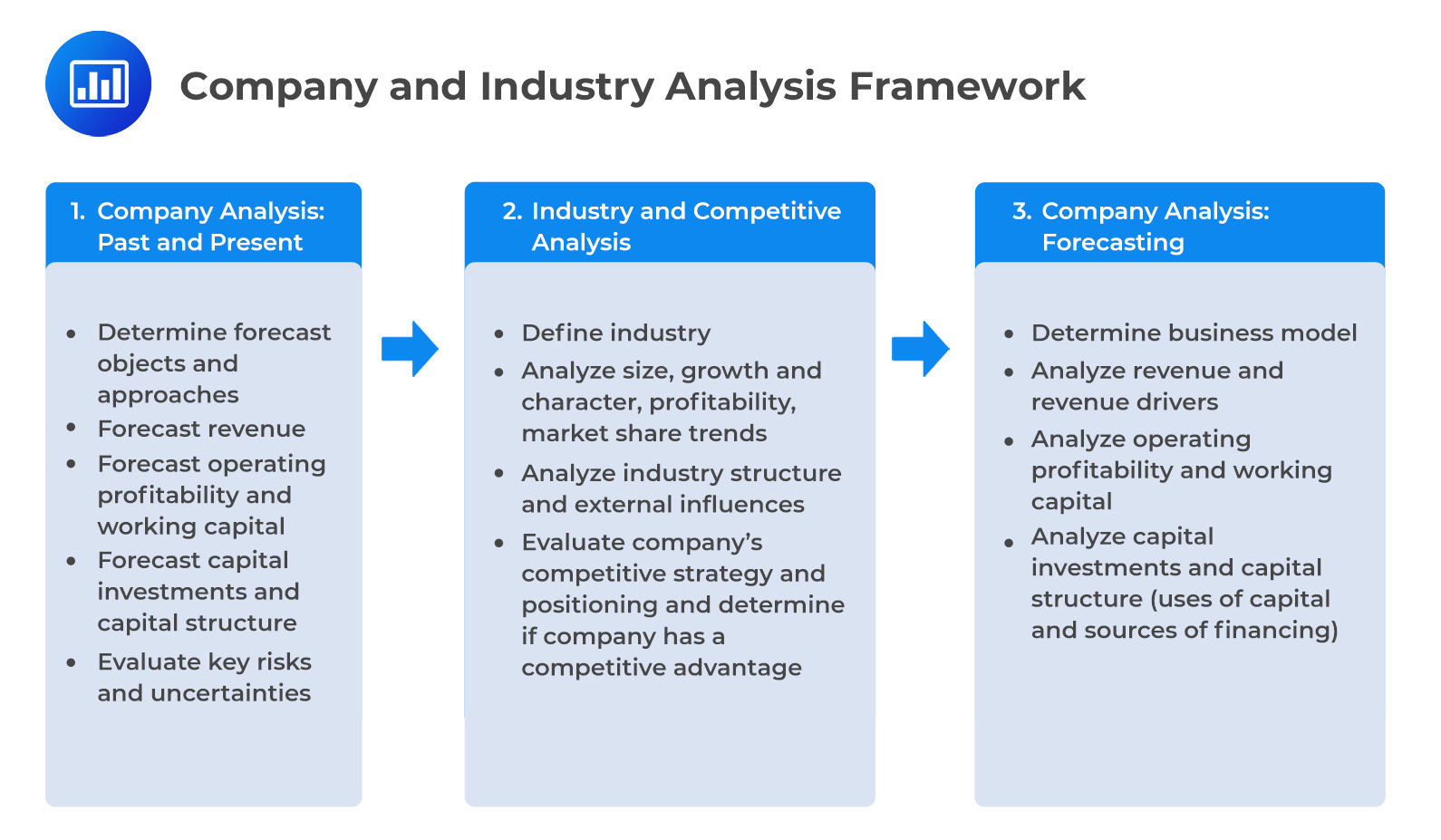

Recall that industry and competitive analysis is the second step in the company and industry analysis framework:

Industries are ecosystems of interrelated businesses, often sharing fundamental operational characteristics. Companies within an industry usually possess parallel business models and face analogous market challenges. They not only vie for market share in product sectors but also in sourcing raw materials, talent, and other essential factors. This shared competitive environment exposes them to common demand trends, supply chain complexities, and overarching risks.

Porter’s Five Forces model is a fundamental framework for grasping industry dynamics. It asserts that variations in profitability among industries stem from structural elements like the power of suppliers, the risk of new competitors entering the market, competitive intensity, the influence of buyers, and the potential for substitute products or services. While the broader industry context establishes a basic profitability course, factors specific to individual companies, such as innovative strategies, operational intricacies, company size, and management effectiveness, can lead to deviations from the industry average.

The tug-of-war between industry and company-specific factors in shaping profitability has been the subject of extensive research. A seminal study by McGahan and Porter in 1997 highlighted this dynamic interplay. Their findings suggest that while the overarching industry environment is crucial in determining the sustainability of economic profits, the company-specific factors often wield a more potent influence, especially for companies that don’t rank at the top of their industry. Essentially, while industry dynamics can act as a cap on profitability, they don’t necessarily guarantee a minimum profitability threshold.

In any industry, competition serves as a constant force, striving to push companies toward an industry’s average profitability. The more intense the competition, the stronger this push. For analysts, understanding this dynamic is crucial. It allows them to gauge the industry’s median profitability rate, anticipate possible structural shifts in the market, and determine where a specific company stands in relation to this established baseline. However, it’s paramount to recognize the fluid nature of these dynamics. While the majority of businesses may hover around the industry average, outliers like disruptors or laggards can significantly deviate due to their strategies and market execution.

A comprehensive understanding of an industry necessitates a deep dive into the various competitive forces at play. This includes not only direct industry competitors but also potential threats from alternative products, the influence and bargaining power of suppliers, and the ever-evolving demands and preferences of consumers. By adopting a bird’s-eye view of the industry, analysts can demystify these dynamics. This typically involves meticulously documenting past competitive strategies, their implementation, subsequent market reactions, and the long-term outcomes of these strategic decisions.

An interesting revelation by Guan, Wong, and Zhang in 2014 showcased the nuanced layers of industry analysis. Their study found that analysts who broadened their horizons to include both companies and their suppliers in their evaluations showcased a markedly improved accuracy in predicting earnings.

Going beyond the obvious, conducting a thorough industry analysis can unveil hidden investment opportunities. Sometimes, an analyst may stumble upon a hidden gem – a company that industry giants previously overshadowed but, under closer scrutiny, demonstrates substantial strengths compared to its competitors. Additionally, for investors interested in the broader industry outlook rather than any particular company, the appeal might lie in the industry’s overall growth prospects. These investors, seeking diversification, could opt for a ‘basket approach,’ spreading their investments across a range of companies in the industry. They can adjust their stakes based on factors like company size, market liquidity, or perceived future potential.

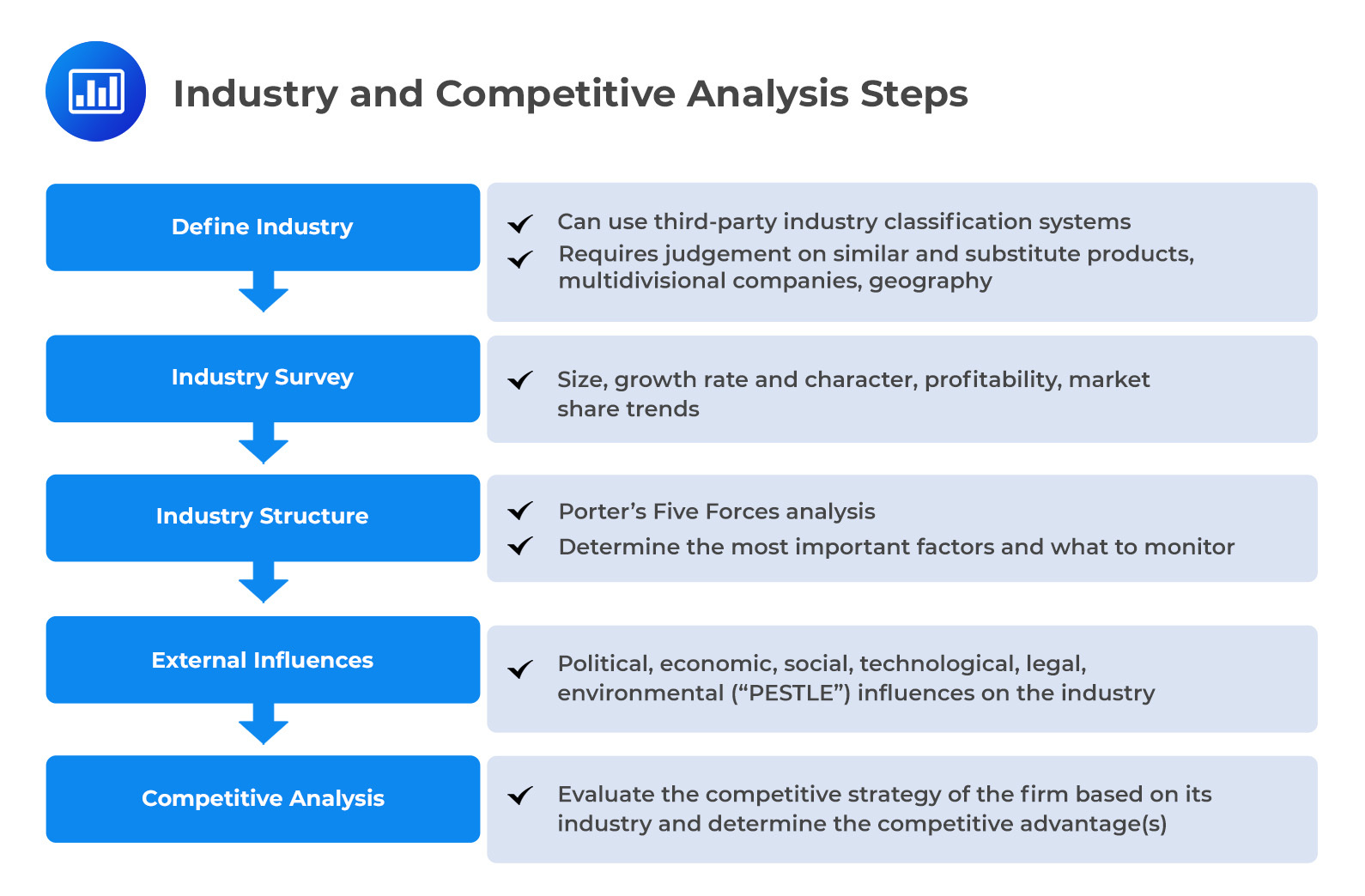

Industry and competitive analysis are vital tools for businesses and investors, offering a deeper understanding of a company’s position within its industry and the competitive landscape. This analysis is generally approached in a structured manner, breaking down into specific steps to ensure a holistic understanding. Here are the key steps involved:

Question

Which of the following is most likely a primary implication of industry participants having parallel business models and competing in the same or similar product markets?

- It results in identical profitability for all industry participants.

- It ensures that all industry participants have the same competitive strategy.

- It leads to the same demand and supply opportunities and risk factors for all industry participants.

The correct answer is C.

The key takeaway from the resemblance among industry players is that it results in identical demand and supply scenarios, along with shared risk factors for all participants in that industry. Typically, companies within an industry operate under comparable business models and vie for market share in the same or closely related product markets. Consequently, they encounter comparable structural elements that are prevalent in the industry, including the extent of competition, the negotiating strength of suppliers and customers, the possibility of new entrants into the market, and the potential for substitute products to emerge. These factors wield substantial influence over the opportunities and risks involving the demand and supply dynamics for all companies within that industry.

For example, if an industry is characterized by high competition, all companies in the industry may face pressure on prices and margins. Similarly, if an industry is dependent on a few large suppliers, all companies in the industry may face the risk of supply disruptions or price increases. Therefore, understanding the industry structure is crucial for assessing the opportunities and risks faced by companies in the industry.

A is incorrect. While industry participants may have similar business models and face similar industry structural factors, it does not necessarily result in identical profitability for all industry participants. Companies can differentiate themselves through various strategies, such as cost leadership, differentiation, or focus, which can lead to different levels of profitability. Furthermore, the profitability of a company also depends on its operational efficiency, financial management, and other company-specific factors.

B is incorrect. The similarity among industry participants does not ensure that all industry participants have the same competitive strategy. Even within the same industry, companies can adopt different competitive strategies based on their unique capabilities, resources, and market positioning. For example, some companies may choose to compete on price, while others may choose to compete on quality, innovation, or customer service. Therefore, the competitive strategy of a company is not solely determined by the industry structure but also by the company’s own strategic choices.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.