Interaction between Monetary and Fisca ...

The three main tools central banks use to implement monetary policies are open market operations, the central bank’s policy rate, and reserve requirements. These tools affect aggregate demand through the supply of money, cost of money, and credit availability, respectively.

Open market operations refer to cases where a central bank buys and sells government bonds from and to commercial banks or designated market markers. For instance, when the central bank sells government bonds, to commercial banks, the commercial bank’s reserves are decreased, reducing their ability to lend, leading to a decline in briad money growth through the money multiplier effect.

On the other hand, when the central bank purchases government bonds from commercial banks, the commercial banks’ reserves increase, increasing their ability to lend more to households and corporations, who, in turn, invest more. In this way, broad money growth expands through the money multiplier mechanism.

The policy rate, often referred to by various names depending on the central bank, is a primary tool that central banks use to convey their monetary policy intentions. Its main purpose is to influence both short-term and long-term interest rates, and ultimately real economic activity.

Generally, the policy rate is the interest rate at which the central bank lends money to commercial banks, and is achieved using repo rates in a repurchase agreement transaction, i.e., the central bank buys from commercial banks with an agreement to sell them back to the commercial banks at some time in the future. As the lender, the central bank earns a repo rate from this transaction (whose maturity ranges from overnight to two weeks.

When a central bank raises its policy rate, (meaning that commercial banks will obtain loans at a higher rate), commercial banks will typically raise their base rates in response. The base rate of a commercial bank is a benchmark for its lending rates to various customers. Banks adjust their rates based on the central bank’s rate to avoid lending at rates lower than what the central bank charges them. Since it is costlier for commercial banks to borrow, they will decrease their lending activities and subsequently reduce the money supply in the economy.

On the other hand, a reduction in the policy rate makes borrowing cheaper for commercial banks encounraging them to increase their lending activities, consequently boosting the money supply in the economy.

In essence, by adjusting the policy rate, central banks can control the amount of money circulating in the market. A higher policy rate makes borrowing from the central bank costlier, potentially leading to reduced lending and slowed money growth in the broader economy and vice versa.

The law requires commercial banks to keep a certain percentage of their total deposits in the central bank as a reserve. To reduce money supply in the economy, the central bank raises reserve requirements for commercial banks, leaving them with less money to lend. To increase the money supply in the economy, the central bank lowers reserve requirements for commercial banks, leaving them with more money to lend.

Setting reserve requirements as a monetary policy is not commonly used in developed market economies. Varying reserve requirements are disruptive to the banks because a sudden increase can halt a bank’s lending if it lacks sufficient reserves.

However, central banks in emerging economies still use reserve requirements to manage lending.

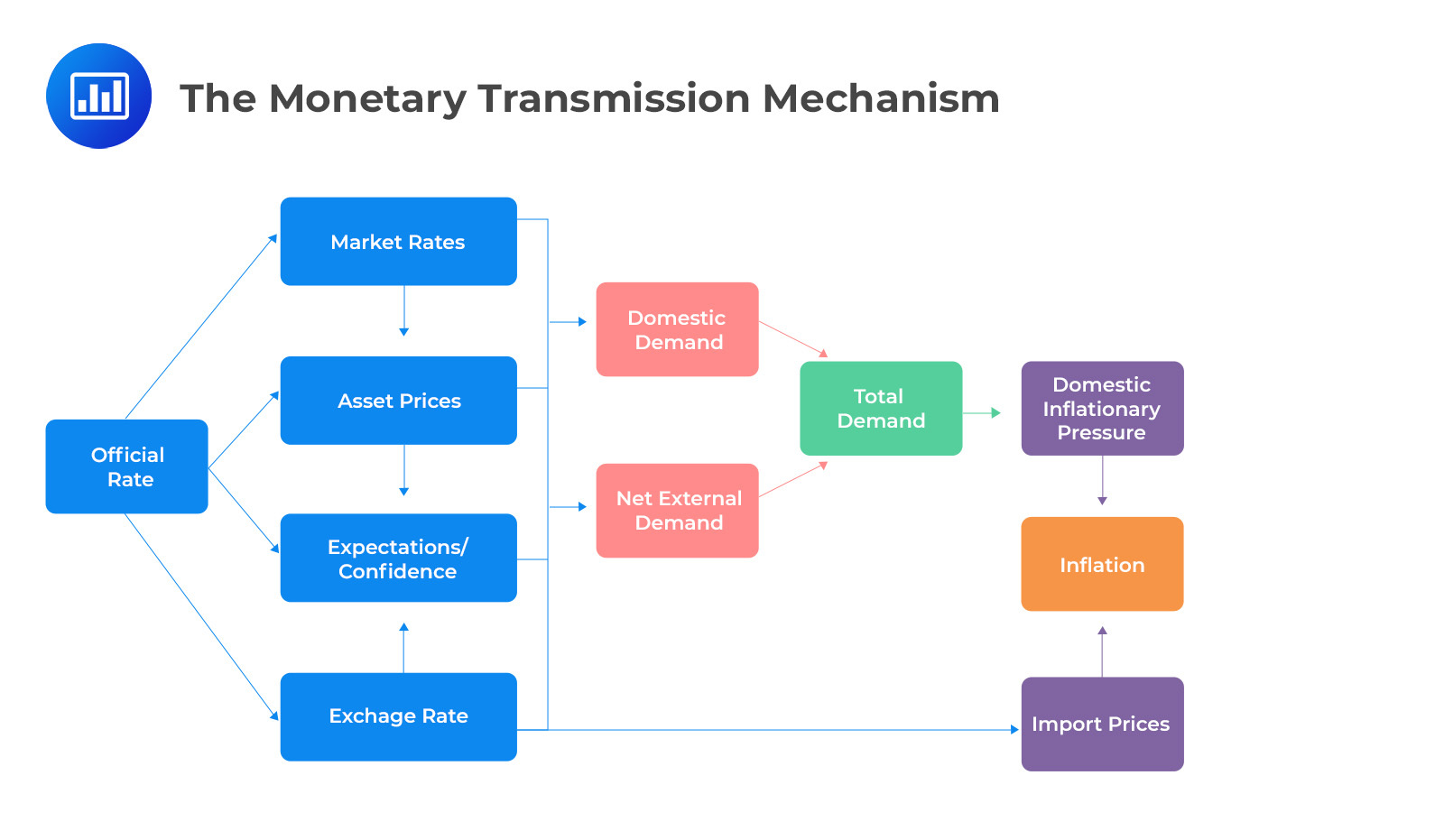

The monetary transmission mechanism is the process that explains how a central bank’s interest rate is transmitted through the economy, ultimately affecting the rate of increase of prices (inflation).

When a central bank increases or reduces its interest rates, the effect is felt in the economy through four different interconnected channels: bank lending rates, asset prices, agents’ expectations or confidence and exchange rates.

When the central bank increases its official rate, commercial banks usually respond by increasing their base and interbank rates. This, in turn, amplifies the borrowing costs for both individuals and corporations across various time horizons. With heightened interest rates, there is a general trend among businesses and consumers to limit their borrowing activities.

Higher short-term interest rates can lead to an increased discount rate for estimating future cash flows. Consequently, the prices of assets like bonds or the value of capital projects may fall.

Market players might interpret increased interest rates as a precursor to slower economic growth, diminished profits, and a reduction in borrowings to finance the purchasing of assets. The anticipation and interpretation of future interest rate trends can have a significant influence on investment and purchasing decisions. If the market perceives the central bank’s move as the beginning of a series of other interest rate increases, there may be reduced consumption, borrowing, and a decline in asset prices.

Increase in interest rates might make a country’s exchange rate to appreciate. This appreciation can make domestically produced goods expensive for international buyers, potentially reducing exporters’ earnings. This could further dampen the demand for local exports.

Overally, an increase in the central bank’s policy rate may lead to a decrease in both domestic demand and net external demand (export consumption less import consumption).

A weaker total demand would tend to push domestic inflation rates downward, as would a stronger currency, which would drive down the cost of imports. When these elements are considered collectively, the overall measure of inflation may start to experience negative pressure.

The monetary transmission mechanism is summarized in the diagram below:

Question

Which of the following elements is least likely to be a component of the monetary transmission mechanism?

- Setting an inflation rate target.

- Implementing a transfer payment program.

- Adjusting the central bank’s official interest rate.

Solution

The correct choice is B.

Transfer payments are related to fiscal policy, not monetary policy.

A is not correct. Establishing an inflation rate target is an aspect of the monetary transmission mechanism, typically occurring later in the process.

C is not correct. Modifying the central bank’s official interest rate is usually the initial step in the monetary transmission mechanism.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.