Function and Definition of Money

Definitions of Money According to Growther, money refers to anything that is generally... Read More

Marginal revenue (MR) and marginal cost (MC) affect how a company makes its production decisions. Marginal cost (MC) refers to the increase in cost that is occasioned by the production of an extra unit. It is the additional cost of producing an additional unit.

Marginal revenue (MR) refers to the extra profit made by producing or selling an extra unit.

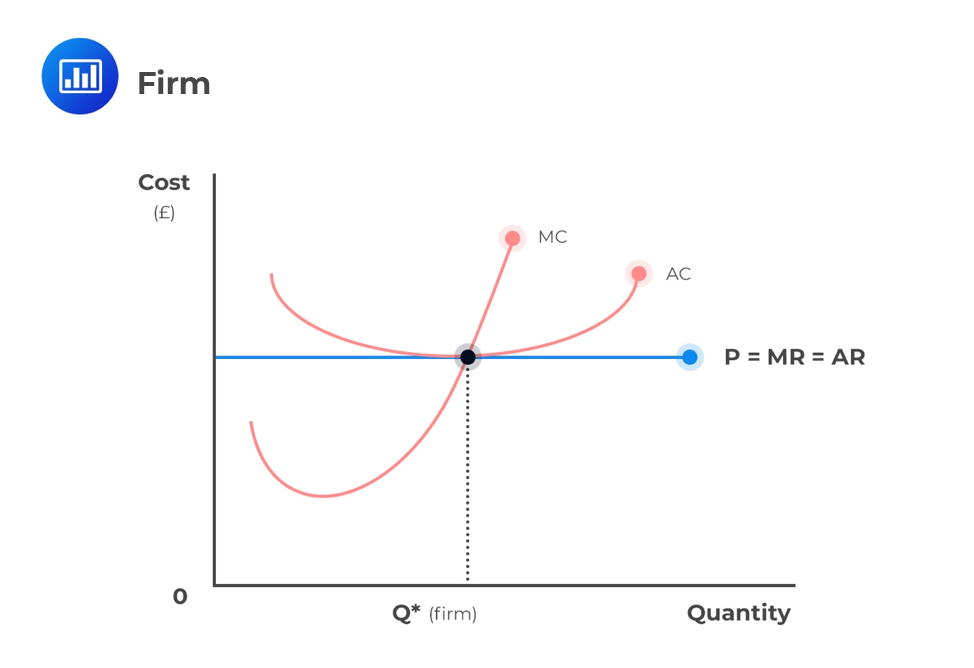

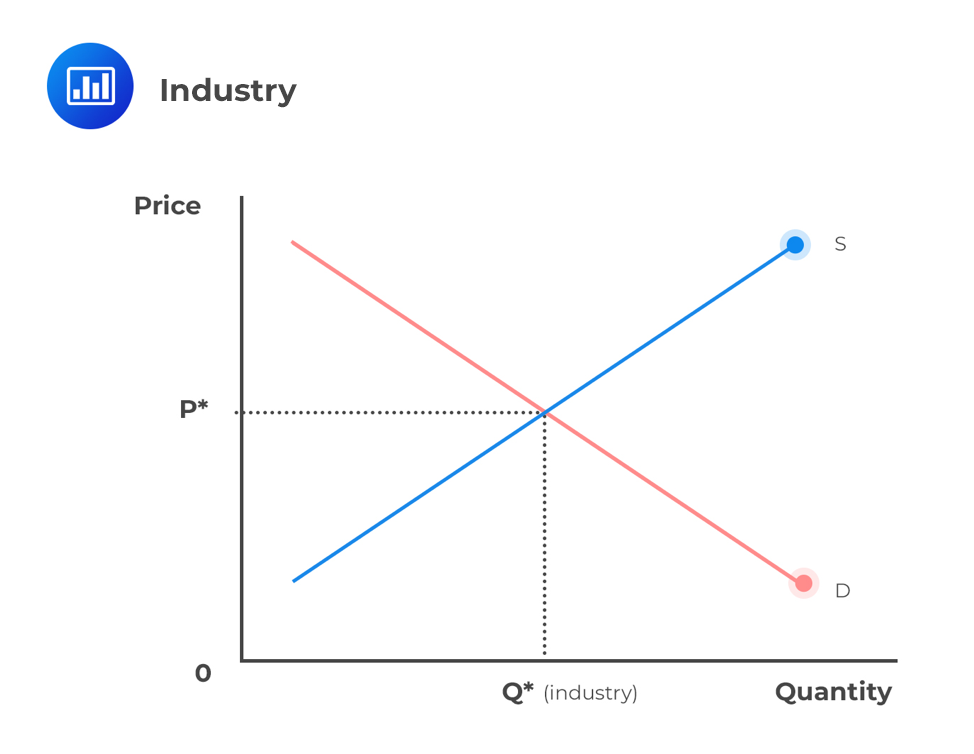

We’ll start with the perfect competition here because it is the easiest to understand. In perfect competition, each firm produces at a point where price (P) equals marginal revenue (MR) and average revenue (AR). As seen before, each firm does not make any economic profit in the long run. The quantity produced by each firm is also the point where the average cost (AC) equals marginal cost (MC).

In a competitive market, individual buyers and sellers represent a very small share of total transactions made in the market. Therefore, they do not influence the prices of their products. Any individual firm is a price taker, and it is the market forces of demand and supply that determine the price.

In perfect competition, total revenue (TR) is equal to price times quantity for any given demand function. Mathematically it is represented as TR = P×Q.

The relationship between change in prices and change in quantities demanded is referred to as price elasticity. Total revenue is maximized when marginal revenue is zero; hence total revenue will only decrease when marginal revenue becomes zero. Therefore, the elasticity of demand in this regard shows that the percentage decrease in price is greater than the percentage increase in quantity demanded.

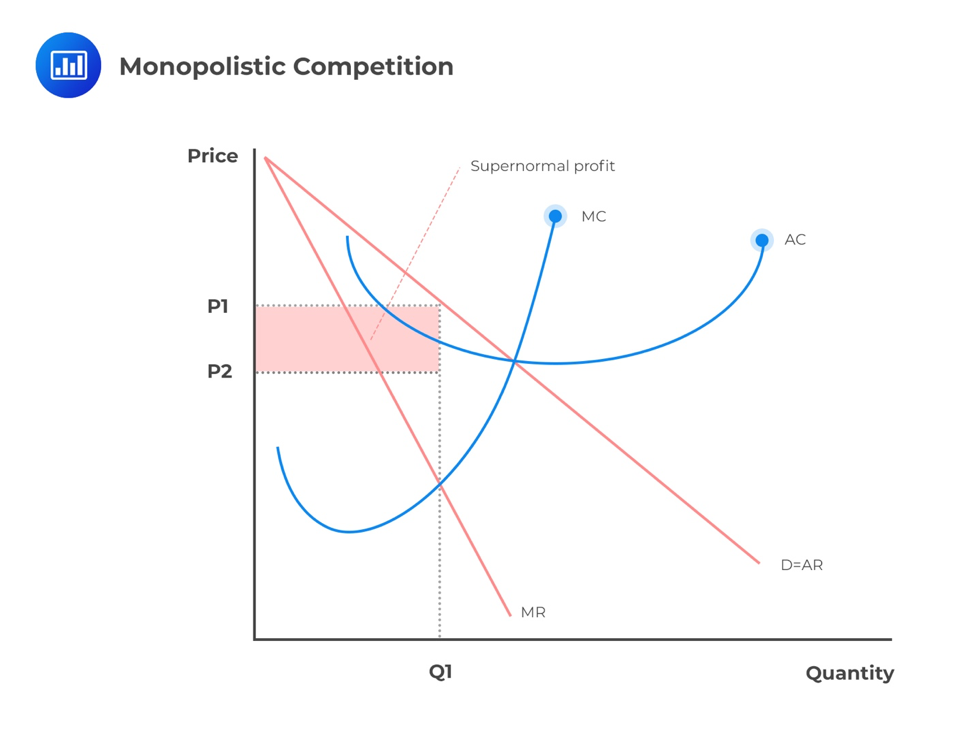

Goods produced under monopolistic competition are differentiated from one another by branding. This means that these firms have some control over their prices. However, raising these prices may cause some of the customers to shift to other products. As a result, demand for these products will fall.

Obviously, if a firm lowers the prices of its products, buyers will shift from buying other products and start buying its products. Consequently, the demand for the products will rise.

Generally, a firm under monopolistic competition can best be described by its elasticity (responsiveness) to demand. When demand is high, it increases the price of goods to maximize profit. This creates some supernormal profit, as can be seen in the graph below. The firm will choose to price its good at P2 instead of P1 because the demand (D=AR) is higher.

On the other hand, when demand is low, the firm will lower its prices to win more customers. In the long run, other firms can also enter the market and compete to eliminate the supernormal profits. As a result, the profits of the monopolistic competitive firm will be normalized.

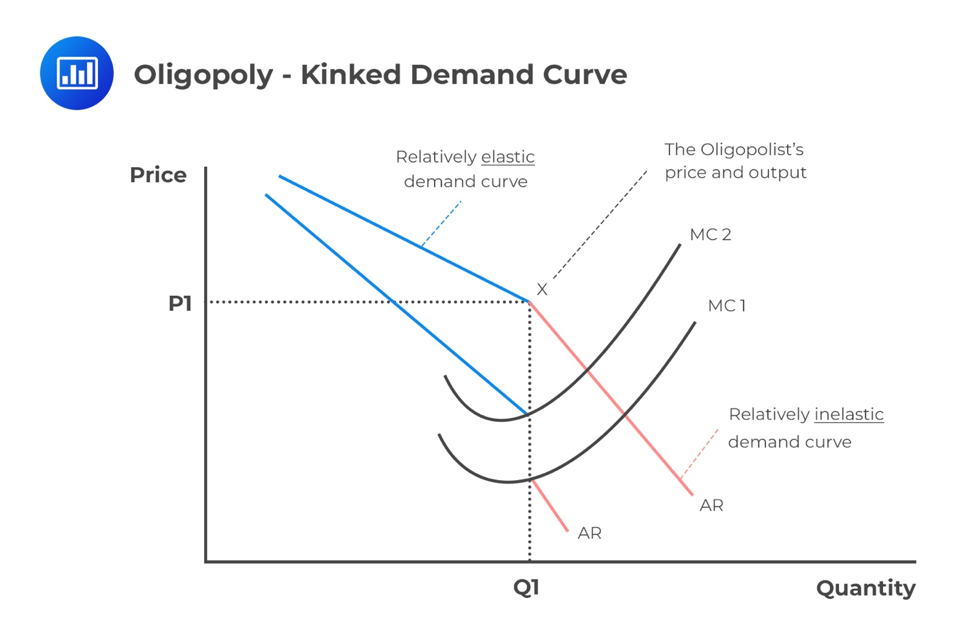

Firms under this market structure are assumed to generally work towards the protection and maintenance of their share of the market. In other words, all firms may match one another’s prices. If one of the businesses raises its price, then a large substitution effect takes place. As a result, demand becomes relatively elastic.

On the other hand, a firm reducing its price will experience a relatively smaller change in price. Its demand becomes inelastic. This leads to a kinked demand curve, as shown by the graph below.

The marginal revenue associated with each demand structure also differs in the oligopoly, and each is synonymous with a different part of the kinked demand curve. The level of output that maximizes profit occurs where marginal revenue (MR) is equal to marginal cost (MC), that is, MR=MC.

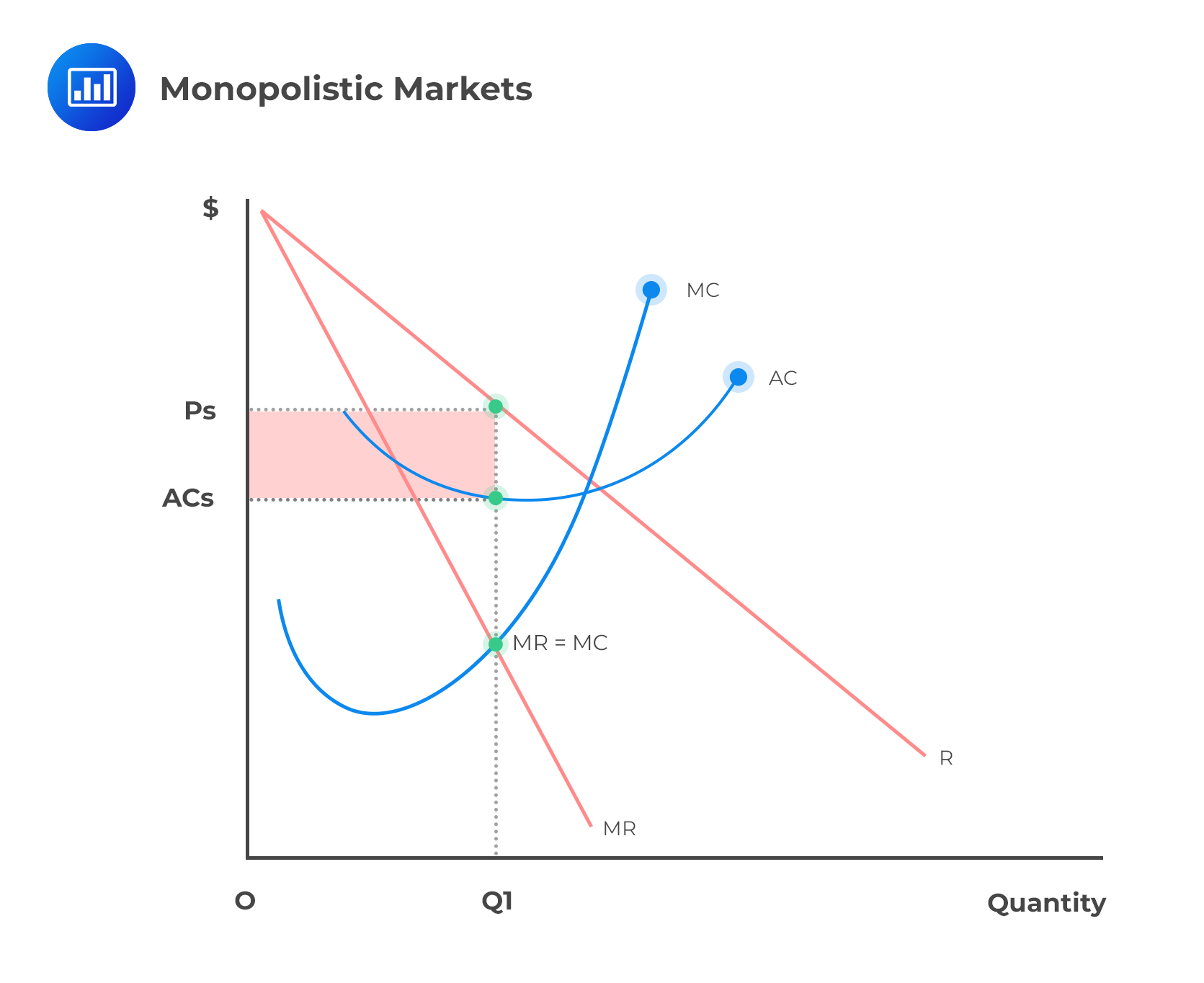

Since only one firm controls the whole market for a monopoly, the demand curve will be the average revenue curve (AR=D). The quantity that the monopolist will produce is at the point where marginal revenue equals marginal cost (MR=MC), just like in perfect competition. However, since the marginal revenue and the average revenue curves are separate, the monopolist will charge the price \(Ps\) at the top.

Since the monopolist produces Q1 but charges the price P2, this creates a “box” of supernormal profit all the way from P1 to P2 and from Q=0 to Q1.

In this form of market, the demand is relatively inelastic. This means that consumers buy about the same amount whether the price drops or rises. To produce more, the monopolist needs to lower their prices by offering bundles or discounts.

Question

Over time, the market share of a dominant oligopoly firm:

A. increases;

B. decreases; or

C. remains constant.

Solution

The correct answer is B.

Over time, the profits made by the dominant oligopoly firm will attract more investors or companies to the industry. Therefore, the market share of the dominant firm will decrease.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.