Fluctuations in Aggregate Demand and S ...

Economists focus on the nature of competition and the pricing model in a particular market when describing a market structure. Since firms price their products based on the market structure, pricing, therefore, depends on competition. A market structure is often seen as the number of firms that produce identical goods or services in a market.

The structure of a market has a big influence on the behavior of individual firms. This influence mainly revolves around pricing.

The market structure also affects how different goods are supplied, as well as market entry barriers. Remember that market entry barriers are high for monopolies but non-existent in perfect competition.

Efficiency also has some influence on the behavior of different market structures. Firms under perfect competition exhibit the highest efficiency level, whereas monopolies are the least efficient from an economic standpoint.

In a monopoly, there is only one producer in an entire market. An oligopoly will exist in a market where several firms produce the same goods. Besides, a duopoly is made up of only two firms in a market. And lastly, for a monopsony, there exists only one buyer. Most monopsonies tend to be government-based. A good example is the military.

The concentration ratio lies between zero (for perfect competition) and 100 (for monopolies).

This feature covers the economies of scale and sunk costs (costs incurred and which the firms cannot recover) if any.

Vertical integration refers to how different production and distribution stages are combined and put under the management of one enterprise. This is often seen in a monopoly – the manufacturing firm is also the distributor, the retailer, and the one responsible for after-sales services.

The existence of relatively large firms selling differentiated products is referred to as monopolistic competition. On the other hand, only a few sellers selling basically the same product, such as in the oil industry, are in oligopolistic competition.

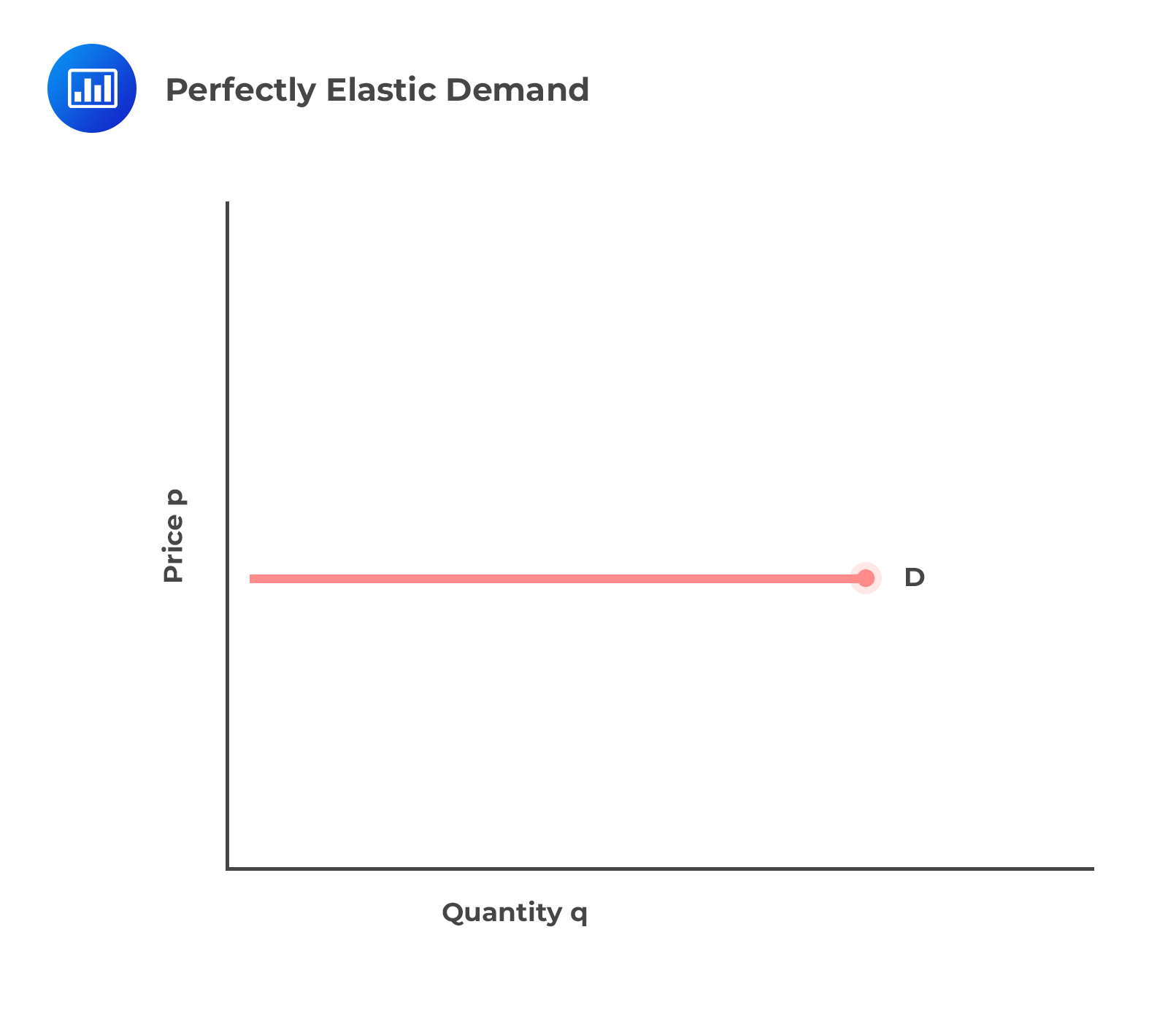

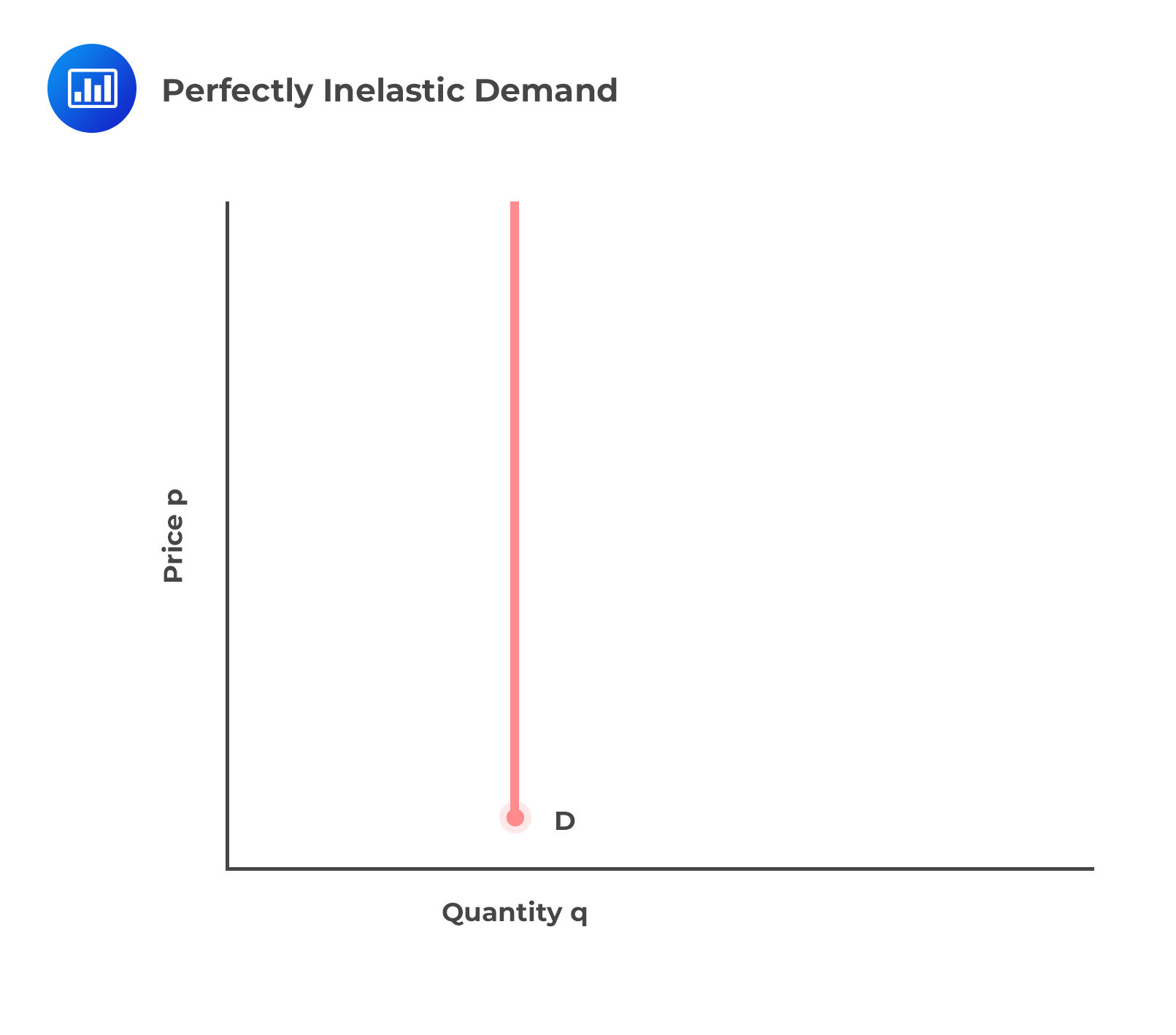

A market exhibiting inelasticity in demand entails firms in a monopoly market. On the other hand, when there is a perfectly elastic demand curve, firms operating in such a market are in perfect competition with each other.

Question

Which of the following best describes a market structure with only one buyer?

- Monopoly.

- Monopsony.

- Monopolistic competitive market.

Solution

The correct answer is B.

A monopsony has only one buyer.

A is incorrect. A monopoly has one seller but many buyers.

C is incorrect. A monopolistic competitive market has many buyers and fairly many sellers.