Effects of Combined Changes in Aggrega ...

[vsw id=”cRMasYNNsVA” source=”youtube” width=”611″ height=”344″ autoplay=”no”] Aggregate Demand Aggregate demand is the total... Read More

Like any other market, demand and supply of money will interact to produce an equilibrium price of money.

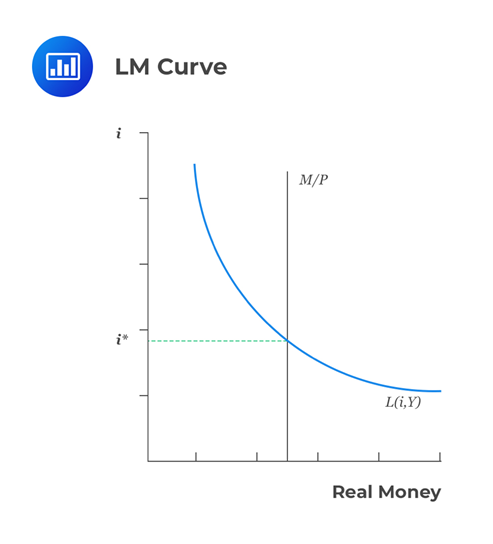

The graph below shows the supply and demand for money.

The money supply (MS – M/P) is vertical since it is assumed that there is a constant amount of money at any given time. On the other hand, the money demand (MD – L(i,Y)) curve is downward sloping since an increase in the interest rate makes the speculative demand for money to fall.

The demand for money is the amount of money individuals in an economy wish to hold at a particular time. Bonds, treasury bills, or treasury certificates are not included in the theory of the demand for money. The demand for money is motivated by three main reasons. These reasons are the pillars behind individuals’ desire to hold liquidity (money), and they include:

The quantity theory of money is the most discussed theory of money. The theory can be expressed using the equation of exchange:

$$M\times V = P\times Y$$

Where:

\(M\) is the quantity of money;

\(V\) is the velocity of circulation of money in the economy;

\(P\) is the price level; and

\(Y\) is the real output.

Thus, the amount of money used to purchase goods and services in an economy, M × V, is equal to the money value of this output, P × Y. However, if the velocity is constant, then the spending, P × Y, is relatively proportional to M. The quantity equation can also explain the consequence of money neutrality.

In most cases, if there is money neutrality, then the increase in money supply, M, will not affect the real output, Y, or the velocity of money, V. Since there is no effect of real output, there will be no need to exchange money rapidly. However, it causes the aggregate price to rise.

The quantity theory of money gave birth to the principle that price levels and inflation rates can be controlled by the growth rate of the money supply. As a result, the quantity of money in circulation depends on the level of economic activity.

Question

The transactions motive most likely refers to the desire to hold money:

A. as a buffer against unseen events.

B. to purchase goods and services.

C. based on the opportunity or risk available on other financial instruments.

Solution

The correct answer is B.

Money held for transactions motive is used to purchase goods and services.

A is incorrect. A buffer against unseen events, is a precautionary motive for holding money.

C is incorrect. The risk available on other financial instruments, refers to the speculative motive.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.