Features and Investment Characteristic ...

Private debt refers to the various forms of debt provided by investors directly... Read More

Private capital refers to investment in assets that are not available in public markets. Private capital consists of private equity and private debt.

Private equity is an investment in privately-owned or public companies with an intention to privatize them. A private equity firm manages a private equity fund as a collection of investments. The company in which the firm invests is referred to as a portfolio company. Some of the primary types of private equity include:

Leveraged buyouts (LBOs) arise when private equity firms create buyout funds, also called LBO funds, to acquire developed private companies or public companies. In this arrangement, the largest portion of the target company’s price is financed through debt. The collateral for the debt consists of the acquired company’s assets whose cashflows are sufficient to repay the loan.

Upon conclusion of the buyout transaction, the acquired company transitions into private ownership. LBOs are two-fold: management buyouts (MBOs) and management buy-ins (MBIs).

In a management buyout (MBO), the existing management team is retained and incorporated in the acquisition. On the other hand, in management buy-ins (MBIs), the current management team is replaced with the management of the acquiring company. The acquiring company improves such outcomes as cashflow and revenue growth of the acquired company.

Venture capital (VC) involves the provision of financial support to or investment in private companies with high growth potential. Financed companies are usually start-up companies. Nevertheless, venture capital is also applicable to companies at any stage of growth provided the company in question qualifies for funding. It is, however, imperative to note that that the venture capital extended to a start-up comapny will demand higher returns due to high-risk potential. Equally noteworthy is the fact that venture capitalists are active investors.

Venture capitalists invest in companies and earn an equity interest. In other words, they provide funding in the form of debt. Given the foregoing clarifications, we have three stages of venture capital financing:

Such funding is extended to a company that is at the formation stage. The process of formative-stage financing includes:

Later-stage financing involves providing funds to companies after they have started commercial production and sales but before they have ventured into an initial public offering (IPO).

In mezzanine-stage financing, the financed company is prepared to go public. The company is thus financed until its IPO is completed or it is sold. Note that the term mezzanine implies that a company is financed as it transitions from a private company to a public company.

Another type of private equity is growth capital, also called growth equity or minority equity investing. Growth capital involves minority equity investments. It is a case where a firm owns a less-than-controlling interest in more mature companies seeking funds for expansion or restructuring, venturing into new markets, or funding major acquisitions.

Usually, growth capital is requested by the management of the receiving company. The aim of the requisitioning company is to earn a profit by selling a percentage of its shares before it goes public. Quite simply, the company aims to retain its existing management and consolidate its accomplishments.

The main objective of a private equity fund is to revive or improve an underperforming company and then make its exit when the valuations of the financed company are high, usually after an average of five years. Nevertheless, the exit timeline can run between less than six months to over ten years, based on the competitive environment of the portfolio company, general economic cycle, interest rates, and a company’s performance.

Some of the exit strategies include:

Trade sale involves selling a company to a strategic buyer, for instance, a competitor, through auction or private negotiation.

The initial public offering exit strategy involves selling shares (including all or part of those owned by private equity firms) to the public by a portfolio company.

These are actions taken by a private equity firm to enhance leverage in the portfolio company while paying itself a dividend from the new capital structure. Recapitalization is considered an untrue exit strategy. This is because private equity firms usually retain ownership and do not allow private equity investors to withdraw funds from their investments to pay investors. However, recapitalization can be considered as a sign of a future exit.

The downside of recapitalization is that GPs can use it to influence the internal rate of return of the funds.

Secondary sales involve the selling of a company to another private equity firm or another group of investors.

A write-off exit strategy happens when a private equity firm adjusts its investment value downward in the portfolio company. In the event that the transaction doesn’t work out, a write-off may lead to liquidation.

Private equity funds’ capacity to invest in private companies, their impact on portfolio companies’ management and operations, and their use of leverage contribute to their higher return potential than traditional investments. Investing in private equity, such as venture capital, carries a higher risk than investing in common equities. Investors, therefore, demand a higher return in exchange for taking on more risk, including illiquidity and leverage.

Private debt describes different forms of financing extended to private entities investors. Private debt is classified into direct lending, mezzanine loans, venture debt, and distressed debt.

Direct lending involves private debt investors offering capital to borrowers directly. In return, the private debt investors receive interest, the original principal, and other required repayments. Private debt is like a typical bank loan since it has a fixed structure of payments. It is a senior and unsecured loan and contains covenants as protection to the lender and the borrower.

In direct lending, a private equity firm collects funds from investors seeking higher-yielding debt. The fund managers then use the funds to grant loans to entities such as private equity funds. The interest rate in private equity is relatively higher since the entities seeking capital lack an alternative to bank loans—usually, banks may have denied them loans.

Direct lending may be done through a leveraged loan. A leveraged loan occurs when private debt firms borrow a loan to fund the private debt and then extend the loan to another borrower. Leverage loan has the potential of increasing private debt firm’s returns.

Mezzanine debt is a private debt that is subordinate to senior secured debt but senior to equity in the borrower’s capital structure. In other words, mezzanine debt is a pool of extra funds available to borrowers that are above senior secured debt. Mezzanine debt is usually common in financing leveraged buyouts (LBOs), recapitalization exit plans, acquisitions, and similar structures.

Mezzanine debts are riskier compared to senior secured debts since they are unsecured. As such, the interest rate charged by investors in mezzanine debt is higher and may involve options for equity participation. Other features of mezzanine loans are the warrants or conversion rights, which allow for equity participation—conversion of debt into equity or buying a borrower’s equity in particular conditions.

Venture debt is private debt funding given to start-ups or early-stage firms with venture capital that does not generate small or negative cashflow. Venture debt assumes a line of credit or term loan. If taken by investors, they run no risk of diluting shareholder ownership.

Like venture capital, venture debt may carry rights for equity participation.

Distressed debt buys the debt of mature companies that are battling financial challenges such as bankruptcy, defaulting on debt, or nearing default. Distressed debt is usually appropriate for companies experiencing temporary cashflow difficulties but that have good business plans, and therefore remain afloat and later succeed. As such, distressed debt investors purchase the debt and actively involve themselves in running the company in a bid to restructure and revive it.

Other types of private debts include collateralized loan obligations (CLO), unitranche debt, real estate debt, and specialty loans.

Investing in collateralized loan obligations (CLOs) involves extending numerous loans to businesses, pooling them together, and splitting them into several debt and equity tranches with varying levels of seniority and security. Each tranche is then sold to different investors according to their risk profiles, i.e., the least risky tranche is the most senior CLO.

Unitranche debt is made of a combined or hybrid loan structure. It is a blend of different tranches of unsecured and secured debts that collectively form a single loan with a single, blended interest rate that falls between the interest rates of secured and unsecured debts. As such, unitranche is ranked between the senior and subordinated debts.

Real estate debt describes loans and other forms of debt issued for real estate financing, where a particular real estate asset is used as collateral. On the other hand, infrastructure debt is a type of loan issued to finance a particular construction, operations, or infrastructure maintenance.

Specialty loans are the debts extended to niche borrowers in special situations, such as litigation.

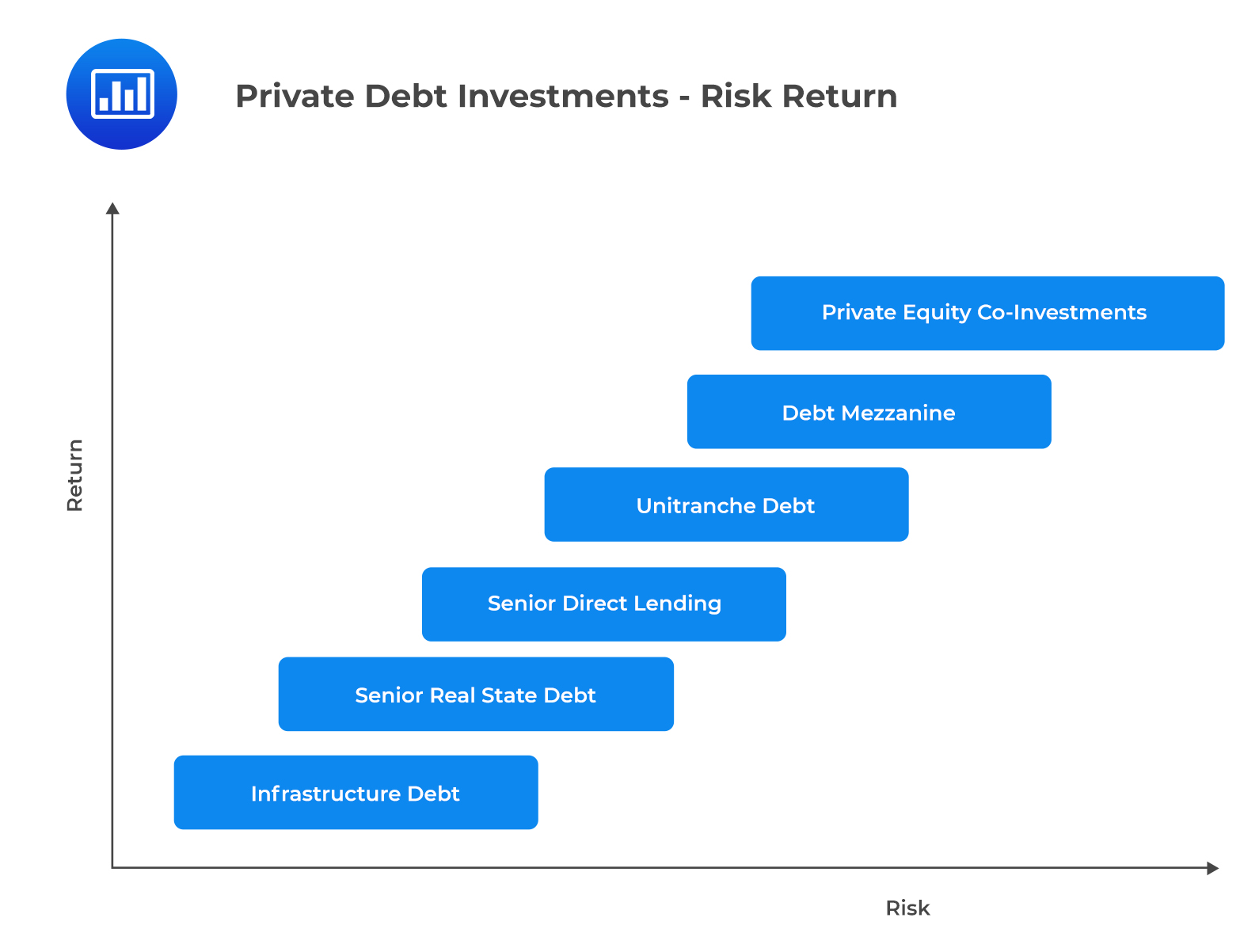

Compared to traditional bonds, private debt investments may give higher-yielding opportunities to fixed-income investors who are after increased returns. Larger levels of risk are linked to the possibility of higher rewards, as seen in the graph below:

Private capital funds can provide a small diversification advantage to a portfolio of publicly-traded equities and bonds, whose correlation with the market is significantly positive. Particular to private equity, periodic diversification can be achieved since the capital is invested over many years.

Question

Which of the following exit strategies will most likely yield the highest value to a private equity firm?

- Liquidation.

- Trade sale.

- IPO.

Solution

The correct answer is C.

The highest price can be achieved through an IPO.

Options A is incorrect. Liquidation has the potential for attracting the lowest price compared to the other exit strategies that include secondary sales, recapitalization, and trade sales.

Option B is incorrect. A trade sale involves selling a company to a strategic buyer, for instance, a competitor, through auction or private negotiation. An IPO is a more attractive option.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.