Natural Resources (Level II 2022)

Natural resources are assets comprising commodities and raw land utilized for farming and... Read More

Real estate returns primarily stem from two key avenues: generating rental income and the possibility of property value appreciation.

For example, consider a real estate investor who acquires a commercial property and leases out its units to businesses. The rental income received from these businesses offers a consistent and often dependable revenue stream. This stability is particularly evident in commercial real estate, where multi-year leases with fixed rent terms are commonly employed. This dependable income generation is a defining feature of real estate investments.

Additionally, the value of the property can increase over time from various factors, including changes in market conditions, economic growth, and demand for the property.

Real estate investments can yield either lower-risk, resembling bond-like income from leases, or higher-risk, akin to equity, speculative returns from realizing value in development projects or property appreciation.

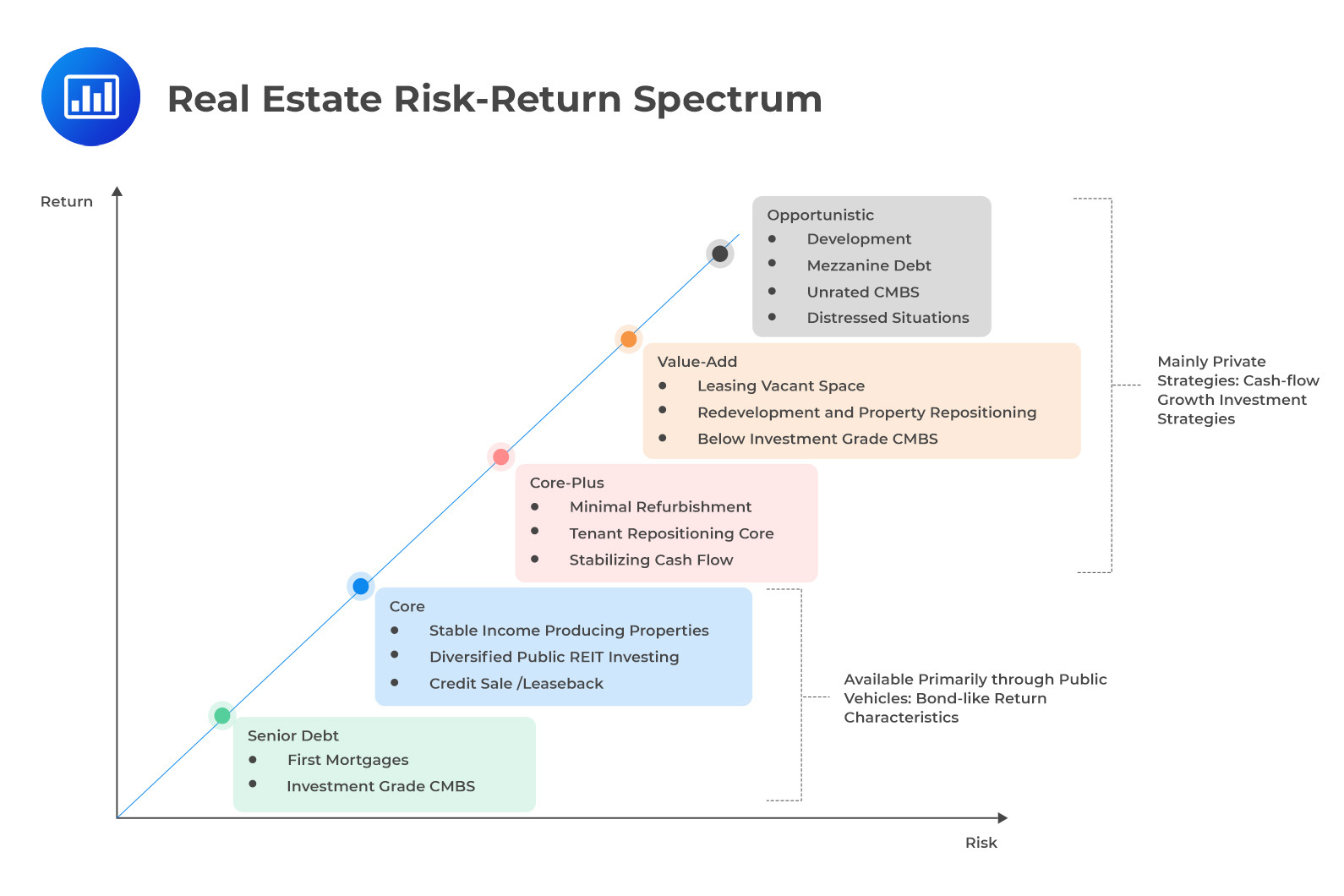

The risk-return spectrum for real estate investments is shown below with the corresponding strategies, encompassing both debt and equity investments:

The first part of the spectrum, characterized by low risk and low returns, which begins in the lower left corner of the diagram above, consists primarily of relatively low-risk financial instruments. These include senior debt instruments like first mortgages and investment-grade commercial mortgage-backed securities (CMBS). Given that these assets are primarily in the form of bonds, the associated risks and returns closely resemble those of bonds.

The second part of the spectrum encompasses core, reliable Real Estate Investment Trusts (REITs) that focus on generating stable income. These REITs invest in properties that consistently produce cash flows, typically originating from long-term leases with multiple tenants, often in residential real estate, or through sale-leaseback transactions. Shareholders of these REITs receive a dependable return on their investment through the distribution of this income.

In a sale-leaseback transaction, the property owner sells the property to an investor and then leases it back for continued use. This arrangement significantly reduces the risk of default, offering investors a secure and relatively stable return. Real estate investors frequently utilize sale-leaseback structures to secure cost-effective financing or to reduce their leverage.

Overall, the returns from these investments tend to be relatively higher in comparison to low-risk senior debt. The nature of these returns is generally bond-like because the primary source of income stems from long-term lease payments. The stability of these payments, especially when the tenant is a trustworthy entity, ensures that the return from these REITs is relatively secure and foreseeable.

The third and fourth segments of the spectrum present higher levels of risk and offer potentially less predictable returns. In these segments, the primary source of return shifts away from the reliable, bond-like cash flows that come from contracts. Instead, it becomes more reliant on speculative sources, particularly potential price appreciation.

In the case of core-plus holdings, the main source of return is derived from leases. However, the cost of acquiring these leases and maintaining and updating the underlying properties can become significant. This is particularly true when the property requires refurbishment, renovation, and redevelopment. For instance, if you own a commercial building and lease it out to various businesses, your primary source of income would be the rent you collect.

For value-add real estate, the returns become increasingly equity-like. The price appreciation component becomes progressively more meaningful in this part of the spectrum. This means that the returns from value-add real estate investments are more dependent on the increase in the property’s value over time, similar to how returns from equity investments depend on the increase in the stock’s price.

Opportunistic real estate investment is the final and fifth phase of the investment spectrum. It offers the highest potential returns but also carries the highest levels of risk. This type of investment typically involves distressed properties and property development.

For instance, a real estate investor might buy a dilapidated building in a prime location with the intention of renovating it and selling it at a higher price. However, these are inherently riskier than investments in financially stable properties or those with stable operations, such as core real estate.

The above issues can lead to a reduction in the Internal Rate of Return (IRR) versus the initial expectations. This means that the investor may not be adequately compensated for the higher risk and illiquidity associated with opportunistic real estate investment.

Historically, real estate has demonstrated minimal correlations with other asset categories like stocks and bonds. This implies that the inclusion of real estate in an investment portfolio can offer advantages in terms of diversification. Diversification is an approach employed by investors to mitigate risk by distributing investments across a range of financial instruments, sectors, and various asset classes.

For example, if the stock market experiences a downturn, the real estate market may remain robust, potentially helping to offset potential losses.

An important feature of real estate investments is their capacity to serve as a hedge against inflation. This is made possible by the regular adjustment of lease payments, which enables a transparent valuation and pricing structure for the property. For instance, a lease contract may incorporate a provision for annual rent escalations tied to the inflation rate. This characteristic of real estate investments renders them a valuable instrument for investors seeking protection against the erosive effects of inflation.

However, research indicates that the ability of real estate to hedge against inflation can vary significantly based on geographic location, market segment, and time period. Specifically, the inflation-hedging potential of real estate may be harder to identify if the high-inflation period of the late 1970s and early 1980s is not included in the period of study.

Real estate investments offer a wide array of opportunities, each with its unique risk and return profile. The risk and return associated with each investment can be significantly influenced by the degree of leverage used. For instance, consider a real estate investor who purchases a property worth $1 million with $200,000 of their own money and $800,000 borrowed from a bank. If the property appreciates to $1.2 million, the investor’s equity has doubled from $200,000 to $400,000, demonstrating how leverage can amplify gains.

Conversely, if the property value drops to $800,000, the investor’s equity is wiped out, illustrating how leverage can also magnify losses. This is particularly relevant for speculative real estate investors who may face an increased risk of default, especially in the face of unforeseen changes in interest rates, access to financing, or government land-use regulations.

The performance of real estate investments can greatly differ based on the measurement period being considered. For example, a property purchased in a booming market may yield high returns in the short term but may underperform in the long term if the market cools down. The returns for both debt and equity investors in real estate are largely dependent on the ability of the owners or their agents to effectively manage the underlying properties.

For instance, a well-managed rental property can generate steady income, while a poorly managed one can lead to vacancies and reduced returns. The value of properties can fluctuate based on global, national, and local conditions. For example, a global economic downturn, a national housing market crash, or a local job market slump can all negatively impact property values.

Question

Which of the following statements best describes the potential benefits of adding real estate to his investment portfolio?

- Increase the overall risk because it is a different asset class.

- Provides no diversification benefits because it is not correlated with stocks and bonds.

- Provides diversification benefits and potentially lowers the overall risk due to its low correlation with other asset classes.

The correct answer is C.

Adding real estate to the investment portfolio can provide diversification benefits and potentially lower the overall risk due to its low correlation with other asset classes. Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale behind this technique is that a portfolio constructed of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Real estate investments have historically shown low correlations with other asset classes such as stocks and bonds. This means that the returns from real estate investments do not move in tandem with the returns from stocks and bonds. Therefore, adding real estate to an investment portfolio can help to spread the risk and potentially enhance the portfolio’s risk-adjusted returns. This is the essence of diversification.

A is incorrect. Adding real estate to the portfolio will not necessarily increase the overall risk just because it is a different asset class. In fact, the addition of a different asset class that is not highly correlated with the existing investments in the portfolio can help to reduce the overall risk through diversification.

B is incorrect. The statement that adding real estate to the portfolio will provide no diversification benefits because it is not correlated with stocks and bonds is incorrect. The low correlation of real estate with stocks and bonds is precisely what provides the diversification benefits. When assets are not correlated, they do not move in the same direction at the same time, which can help to reduce the overall risk of the portfolio.