Natural Resources

Commodities and raw land are the two main categories of natural resources for... Read More

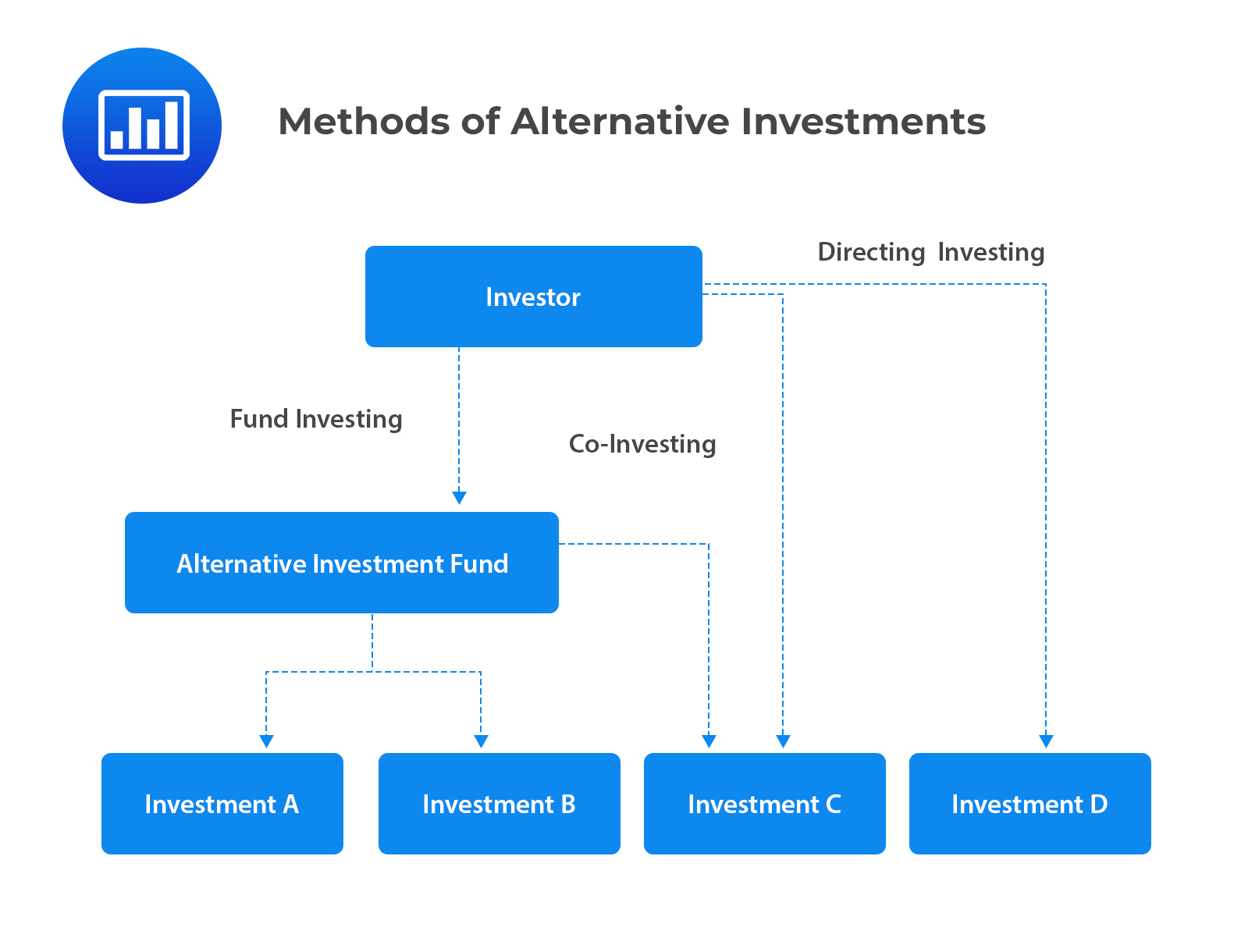

Investors have three primary methods of accessing alternative investments. These methods are:

Typically, investors start their journey in alternative investments via funds. As they gain more experience and knowledge, they may start to explore co-investing and direct investing.

Investors, especially those with limited resources or experience, often choose fund investing as a means to participate in alternative investments. In fund investing, investors contribute capital to a fund, and the fund’s management takes care of the investments on their behalf.

The investor is then charged a management fee and, if the fund manager delivers superior results compared to a benchmark or hurdle rate, a performance fee. The investment decisions of fund investors are limited to either investing in the fund or not. Fund investing is available for all major alternative investment types, including hedge funds, private capital, real estate, infrastructure, and natural resources.

Investing in alternative assets requires specialized skills that many investors do not have. For instance, investing in real estate requires knowledge about property valuation, legal issues, and market trends, which a typical investor may not have. Such investors can gain exposure to these assets through fund investing. In this method, one or more investors contribute capital to an investment management company that identifies, selects, manages, and monitors investments on behalf of the investors.

Comparing Fund Investment with Traditional Public Equity and Fixed Income

Fund investment structures for alternative investments differ significantly from traditional public equity and fixed-income fund or ETF investments:

Co-investing is a strategic method of investment where an investor diversifies their investment approach by investing in assets both indirectly through a fund and directly in the same assets. This is achieved by obtaining co-investment rights. For instance, if a private equity fund is investing in a startup, an investor with co-investment rights could also directly invest in that startup alongside the fund.

Co-investing allows an investor to participate in a deal identified by a fund, not just by investing in the fund itself. This method of investment provides an opportunity for investors to expand their investment knowledge, skills, and experience beyond what they would gain from a fund-only investment approach.

Managers also benefit from choosing one or more co-investors. The benefits include:

Direct investing is a method employed by large, sophisticated investors who possess the necessary skills and knowledge to manage individual alternative investments. This approach eliminates the need for an intermediary, providing the investor with maximum flexibility and control over their investment choices, financing methods, and timing. For instance, a billionaire investor like Warren Buffet might directly invest in a company like Apple, buying shares directly from the market instead of going through a mutual fund or an ETF.

In the context of private equity, direct investing involves the acquisition of a direct stake in a private company. This is done without the use of a fund managed by an external asset manager or general partner.

The direct investor must have the resources to provide the specialized knowledge, skills, and oversight capabilities that direct investment requires. For example, a venture capitalist might directly invest in a startup, taking a significant stake in the company and actively participating in its management and decision-making process.

While the direct investment approach is commonly applied to private capital and real estate, it is also used by some very large investors, such as pensions and sovereign wealth funds, for direct investment in infrastructure and natural resources.

Question #1

Which of the following is least likely a potential benefit for the manager in choosing to co-invest?

- Reducing the need for active management of the investment.

- Expanding the scope of available new investments by pooling resources.

- Accelerating the timing of the investment when available funds are insufficient.

The correct answer is A.

Reducing the need for active management of the investment is not a potential benefit for the hedge fund manager in choosing to co-invest. Co-investment does not necessarily reduce the need for active management. In fact, it may increase the need for active management due to the complexity of managing multiple investors and their expectations.

Co-investment can bring additional resources and capital, but it also brings additional responsibilities and potential conflicts of interest. The manager will still need to actively manage the investment to ensure that it is performing as expected and to manage the relationships with the co-investors. Therefore, reducing the need for active management is not a benefit of co-investment for the hedge fund manager.

B is incorrect. Expanding the scope of available new investments by pooling resources is also a potential benefit of co-investment. By pooling resources with co-investors, a hedge fund manager can potentially access larger or more diverse investment opportunities that would be out of reach if the manager were investing alone. This can help to diversify the investment portfolio and potentially increase returns.

C is incorrect. Accelerating the timing of the investment when available funds are insufficient is indeed a potential benefit of co-investment. If a hedge fund manager has identified a lucrative investment opportunity but does not have sufficient funds to take full advantage of it, bringing in co-investors can provide the additional capital needed to make the investment sooner rather than later.

Question #2

An investor with co-investment rights is considering directly investing in a startup alongside a private equity fund. Which of the following is most likely a potential drawback that the investor should consider?

- Co-investing does not provide any learning opportunities.

- Co-investing requires more active management, which can increase costs.

- Co-investing does not allow the investor to participate in a deal identified by a fund.

The correct answer is B.

Co-investing requires more active management, which can increase costs. When an investor co-invests alongside a private equity fund, they are taking on a more active role in the investment. This means that they will need to dedicate more time and resources to managing the investment, which can increase costs. This is in contrast to investing in a private equity fund, where the fund manager takes on the responsibility of managing the investments.

The investor will need to conduct their own due diligence, negotiate terms, monitor the investment, and potentially take on a role in the management of the startup. All of these activities require time and expertise, which can increase the cost of the investment. Therefore, while co-investing can provide potential benefits such as increased control and potentially higher returns, it also comes with increased costs and responsibilities.

A is incorrect. Co-investing can provide significant learning opportunities. By taking on a more active role in the investment, the investor can gain a deeper understanding of the business and the industry. This can be a valuable experience that can be applied to future investments. Therefore, the statement that co-investing does not provide any learning opportunities is incorrect.

C is incorrect. Co-investing does allow the investor to participate in a deal identified by a fund. In fact, this is one of the main benefits of co-investing. The investor can leverage the expertise and deal-sourcing capabilities of the private equity fund while also having the opportunity to invest directly in the startup. Therefore, the statement that co-investing does not allow the investor to participate in a deal identified by a fund is incorrect.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.