Short-term Funding Alternatives Availa ...

[vsw id=”l7RAt_PtF9g” source=”youtube” width=”611″ height=”344″ autoplay=”no”] Funding markets are markets from which debt... Read More

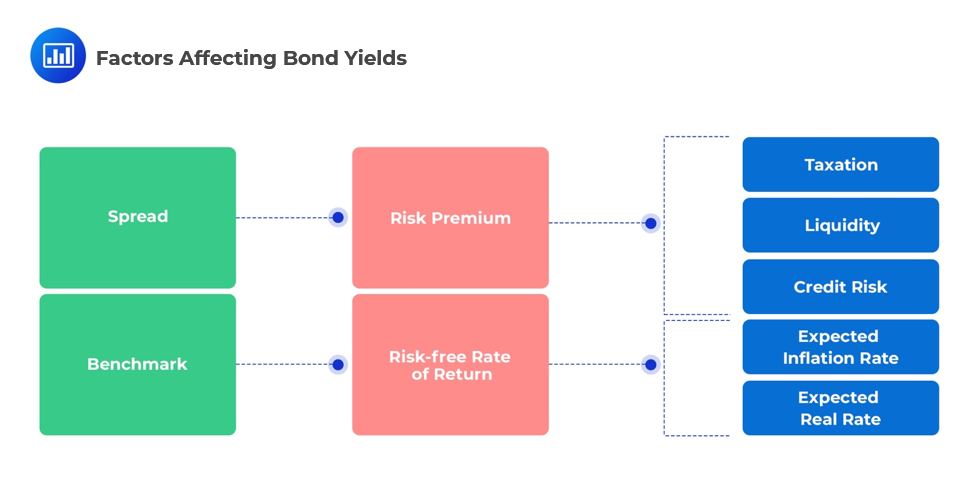

Yield spread (measured in basis points) is the difference between any two bond issues and is computed as follows:

Yield spread = Yield on Bond 1 – Yield on Bond 2

When the second bond is a benchmark (i.e. Treasury), the yield spread is referred to as the absolute yield spread.

Spread can be attributed to macroeconomic factors affecting the bond issuer as well as the bond itself. These include factors such as credit risk, liquidity, and taxation. The benchmark (risk-free rate) considers the expected rate of inflation, exchange rates, the impact of fiscal/monetary policies, and general economic growth.

G-spread (nominal spread) is the difference between the yield on Treasury Bonds and the yield on corporate bonds of the same maturity.

G-spread = Yc – Yg

Where:

Yc = yield on the non-treasury bond; and

Yg = yield on the government bond of the same maturity.

The I-spread stands for interpolated spread. It represents the difference between the yield on a bond and the swap rate (the interest rate applicable to the fixed leg in the floating-for-fixed interest rate swap, say, LIBOR). A higher I-spread means that a bond has a higher credit risk.

The zero-volatility spread (Z-spread) is the constant spread that makes the price of a security equal to the present value of its cash flows when added to the yield at each point on the spot rate Treasury curve. It is the spread that must be added to each spot interest rate to equate the present value of the bond cash flows to the bond’s price.

Z-spread can be calculated using the following equation:

$$P=\frac { { CF }{ 1 } }{ { \left( 1+{ s }{ 1 }+Z \right) }^{ 1 } }+\frac { { CF }_{ 2 } }{ { \left( 1+{ s }_{ 2 }+Z \right) }^{ 2 } } +…+\frac { { CF }_{ n } }{ { \left( 1+{ s }_{ n }+Z \right) }^{ n } } $$

Where:

P is the price of the bond;

CF1, CF2, and CFn are the first, second and nth cash flows;

Si is the ith spot interest rate; and

Z is the zero-volatility spread.

Option-adjusted spread equals zero-volatility spread minus the value of a call option, stated in basis points. It is appropriate when measuring the yield for callable bonds.

OAS = Z-spread – Option value

Question

A 10% annual coupon corporate bond maturing in two years is trading at a price of 100.750. The two-year, 8% annual payment government benchmark bond is trading at a price of 100.950. The one-year and two-year government spot rates are 2.4% and 3.5%, respectively, stated as effective annual rates.

The G-spread is closest to:

- 190 bps

- 200 bps

- 210 bps

Solution

The correct answer is C.

The yield-to-maturity for the corporate bond is 9.57%.

$$100.75=\frac { 10 }{ \left( 1+r \right) } +\frac { 110 }{ { \left( 1+r \right) }^{ 2 } } , \quad r=0.0957$$

The yield-to-maturity for the benchmark bond is 7.47%.

$$100.95=\frac { 8 }{ \left( 1+r \right) } +\frac { 108 }{ { \left( 1+r \right) }^{ 2 } } , \quad r=0.0747$$

The G-spread is 210 bps: 0.0957 – 0.0747 = 0.021

Practice bond‑spread & fixed‑income questions with full worked solutions.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.