Tools of Fiscal Policy

[vsw id=”XDs9kjMPKTo” source=”youtube” width=”611″ height=”344″ autoplay=”no”]

Economists believe that business cycles and fluctuations in GDP levels result from a shift in the aggregate demand or supply curve.

The business cycle (economic expansions and contractions) is mainly caused by changes in the short-run value of GDP. During expansion periods, real GDP increases, resulting in a lower unemployment rate and higher capacity utilization (the extent to which an enterprise or a nation uses its installed productive capacity).

During contractions, the value of real GDP decreases, resulting in higher unemployment, hence reducing capacity utilization. Cyclical changes in real GDP and price levels are caused by fluctuations in the aggregate demand and supply in the ways discussed below.

A reduction in aggregate demand causes a leftward shift in the aggregate demand curve. This reduction lowers the GDP and price levels. This leads to economic contractions, making demand fall below the economy’s potential GDP, thereby causing a recession. Real GDP then falls, and so does the aggregate price level. Due to a reduction in demand and price levels, businesses cut their workforce, increasing the unemployment rate.

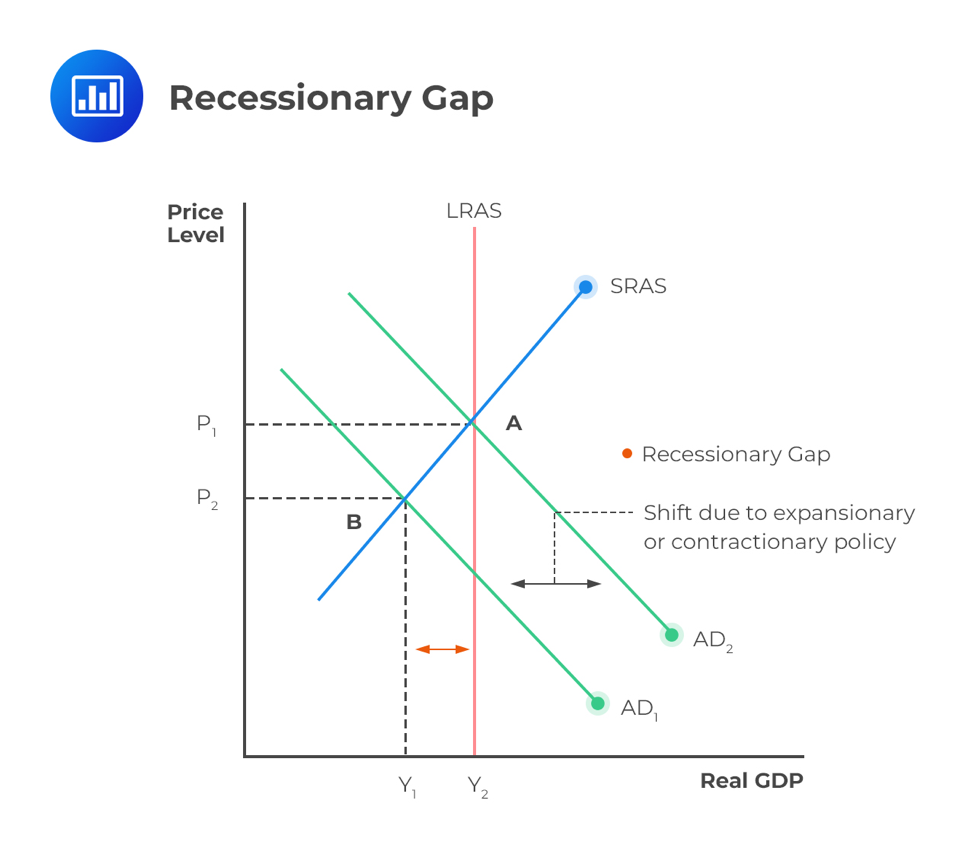

A recessionary gap occurs if the aggregate demand curve intersects the SRAS curve at a short-run equilibrium level below potential GDP. Due to a decrease in aggregate demand, the economy goes into recession and suffers decline of corporate profits, commodity prices, interest rates, and the demand for credit.

Look at the graph below. When the aggregate demand (AD) decreases, the equilibrium moves from point A to point B; the real GDP drops from Y2 to Y1 and prices from P1 to P2. The recession is measured between Y1 and Y2, which is the amount by which the real GDP is below GDP.

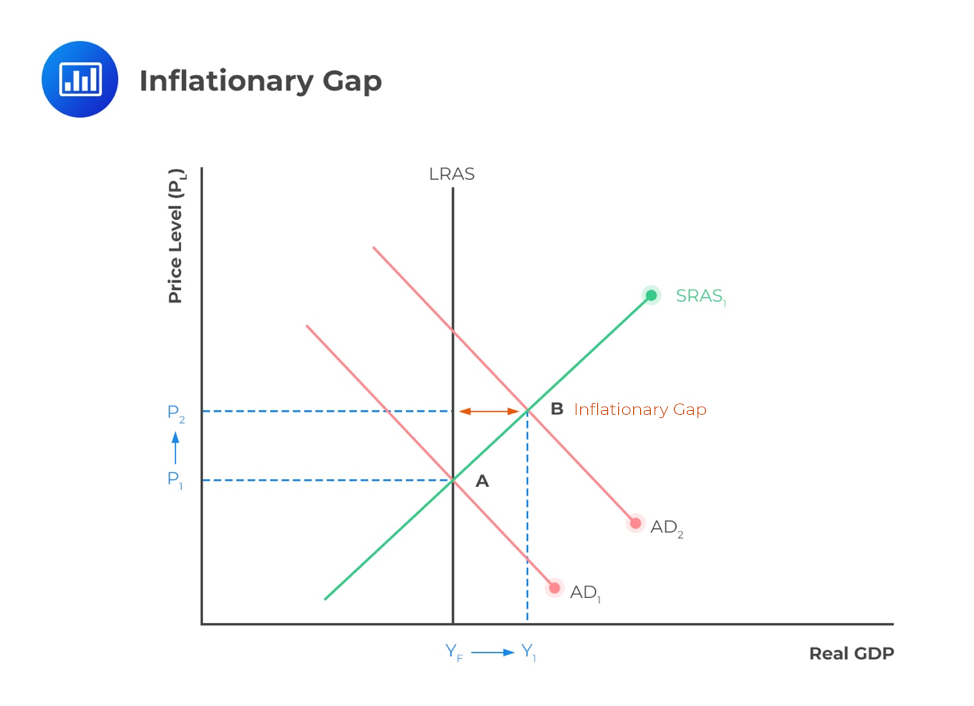

Increase of aggregate demand leads to higher employment and the economic expansion of real GDP. If the economic expansion takes the economy ahead of its production capacity, it will lead to inflation. Increased government spending, a decline in taxes, and an increase in money supply will shift the aggregate demand curve to the right. When the aggregate supply does not adjust to the increase in aggregate demand, there will be an increase in price levels and a rise in real output.

Study the graph below. When AD increases, the equilibrium shifts from A to B, real output increases from YF to Y1, and the prices rise from P1 to P2. The increase in price increases demand, thereby increasing workforce and production. The unemployment rate, therefore, declines. Upon attainment of the potential GDP, firms are required to pay higher wages and other input costs to further widen production power. Therefore, the economy faces the inflationary gap that emanates from the difference between YF and Y1. Thus, the inflationary gap occurs when the short-run level of the economy is above the potential GDP, which results in upward pressure on prices.

Due to the increase in aggregate demand, corporate profits, commodity prices, interest rates, and inflationary pressures rise.

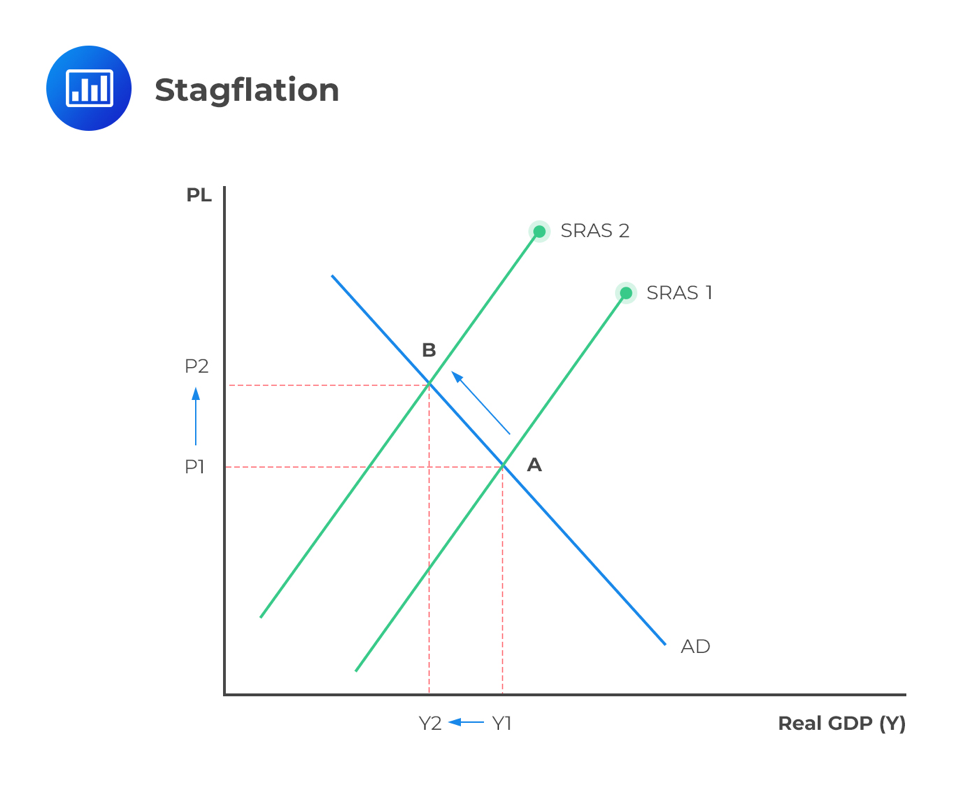

A steady decline in aggregate supply results in stagflation. In economic theory, stagflation is a situation in which the inflation rate is high, the economic growth rate is slow, and unemployment remains steadily high. This, in fact, is what constitutes the “perfect storm” of economic bad news.

Study the graph below. When the aggregate supply declines, the equilibrium level of the GDP shifts from A to B. The GDP falls from Y1 to Y2, and prices rise from P1 to P2. Over time, the reduced output and employment exert downward pressure on wages and input prices, resulting in a shift of the SRAS curve to the right and back to full employment at point A.

Stagflation leads to slow economic growth and is very expensive and difficult to address.

Question

Among the following phenomena, which one is least likely caused by a shift in aggregate demand?

A. Stagflation.

B. A recession gap.

C. An inflationary gap.

Solution

The correct answer is A.

Stagflation happens during a decline in output and an increase in price. This is mainly due to a decline in aggregate supply, not aggregate demand.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.