Step-by-Step Study Plan for FRM Part I ...

We’re not just handing you a random timetable or generic tips. We’re offering... Read More

Thinking about tackling the FRM exam this year? You’re not alone. One of the first things most candidates want to know is this: what are the chances of passing?

If you’re searching for the FRM pass rate, FRM passing percentage or just want the latest FRM exam results, you’ve come to the right place. We’ve got the latest data, insights from real candidates and practical study tips to help you improve your own FRM result.

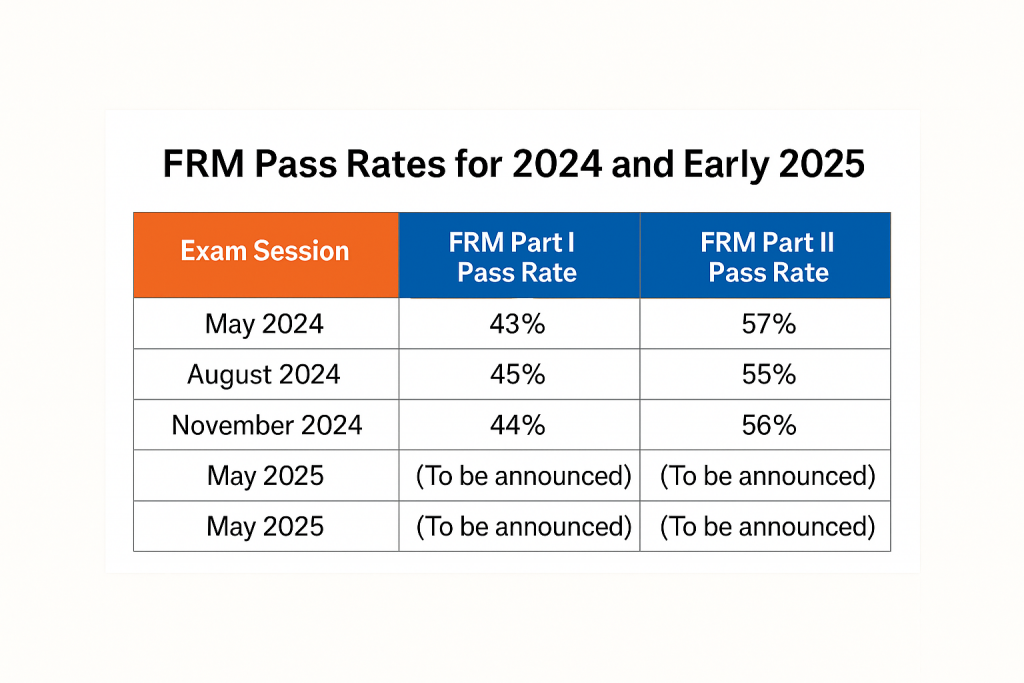

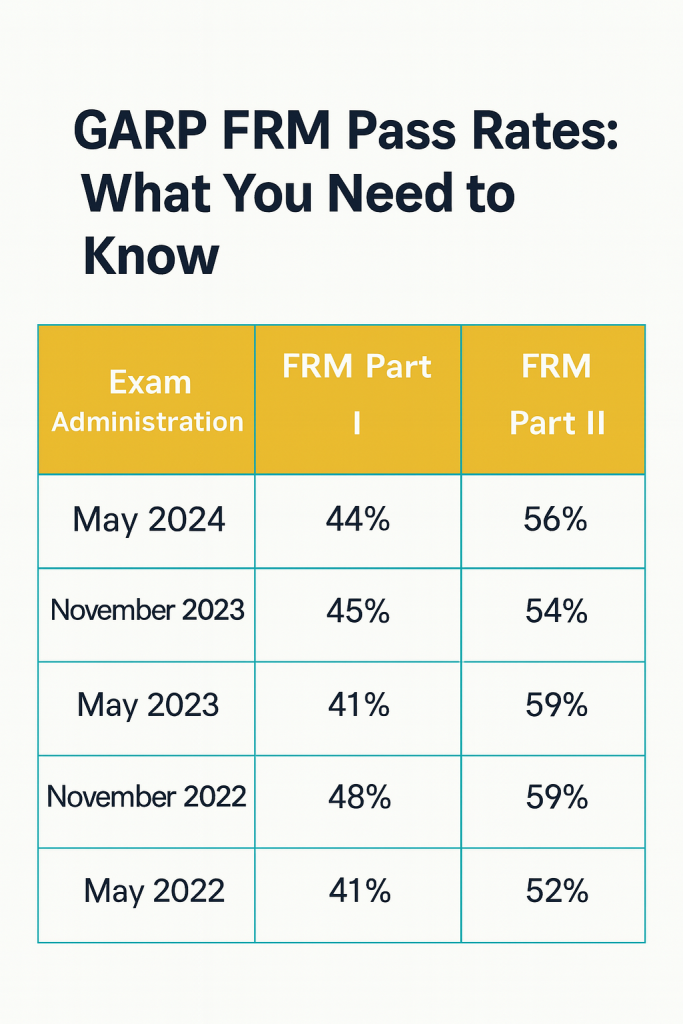

Here are the most recent FRM exam pass rates provided by GARP:

If we zoom out a bit, here’s what we find:

And remember, there’s no published FRM passing score. GARP uses a relative scoring system, meaning your performance is benchmarked against other candidates sitting the same exam. You don’t need to ace it; you just need to do better than the majority.

Is FRM tough? The short answer is: yes, and that hasn’t changed.

Here’s why the FRM passing rate remains low:

1. Candidates Still Underestimate the Exam

Many assume it’ll be similar to academic tests or other finance designations. But the FRM goes deep into real-world applications of risk frameworks, quantitative analysis, market risk modeling and regulatory changes.

2. Study Discipline Remains a Challenge

With GARP still recommending 275–300 hours of prep time per part, the importance of consistent, long-term study can’t be overstated. Too many candidates burn out or start too late.

3. Life Keeps Getting in the Way

Remote work, side gigs, family demands; life in 2025 is busier than ever. If you’re juggling responsibilities, a clear study plan is your lifeline.

4. Mock Exams Are Still Underused

Despite abundant access to study materials, many candidates avoid full-length practice exams. Don’t fall into this trap; mocks train your brain to handle the unique style of FRM exam questions.

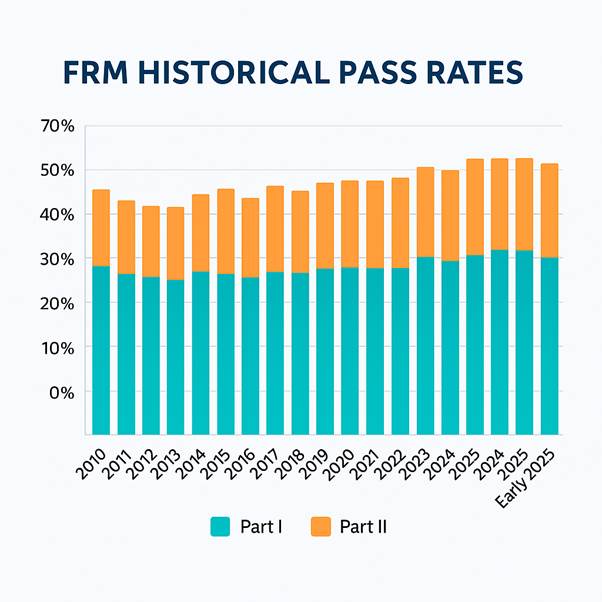

Let’s take a moment to appreciate the bigger picture:

FRM Part I Results (Past 5 Years):

FRM Part II Results:

One thing to note: Unlike exams like the CFA that saw major fluctuations due to COVID-19, FRM exam pass rates have remained relatively steady. That’s good news; it makes it easier to benchmark your own progress.

For an easy-to-understand breakdown, refer to the table below:

We combed through forums, survey feedback and user testimonials. Here’s what current test-takers are saying:

Here’s a quote from Nina, who sat the November 2024 exam: “Mock exams saved me. I went from 40% accuracy to 75% just by practicing full sets. Don’t skip them.”

Do you want to be part of the group that gets their FRM results and sees “Pass” at the top? Here’s how:

Tip #1: Start Early

Begin studying 5 to 6 months ahead of your exam. Space out learning, do frequent reviews, and leave the final month for practice tests.

Tip #2: Focus on High-Weight Areas

For Part I:

For Part II:

Tip #3: Use Reputable Study Resources

Tip #4: Take Mocks (and Review Them Deeply)

Mocks aren’t optional; they’re vital. Aim for three to five full mocks. After each one, go through every question you got wrong. You’ll be amazed at how much you improve.

Tip #5: Stick to a Study Plan

Your time is your biggest resource. Use a calendar. Track progress. Set micro-goals each week. Reward yourself after each milestone.

FRM result dates tend to followFRM result dates tend to follow a predictable rhythm, roughly six weeks after the exam window closes. In 2025, that pattern has held steady across the board.

Here is how things have unfolded this year:

Although GARP has not yet published the official pass rates for 2025, early candidate feedback and third-party estimates suggest that the FRM Part I pass rate may hover around 58% and Part II around 52%. These figures align with the exam’s historical averages and reflect GARP’s continued emphasis on depth, applied knowledge and exam-day precision rather than memorisation.

So, if you have been typing “FRM result date 2025” or “FRM Part 1 results” into your browser, that is where things stand at the moment. Two cycles are already out and the final one should arrive just after the holidays.

Absolutely. The GARP FRM certification is a valuable asset in 2025, opening up roles in enterprise risk, treasury, banking regulation, fintech, and beyond. Sure, the FRM exam pass rate isn’t high. But the test isn’t designed to be impossible—it’s designed to certify those truly prepared.

Let your prep match the challenge.

Start early. Study smart. Take mocks. Trust yourself.

Explore more:

Practice FRM‑style questions, structured notes & mock exams — maximize your pass chances.

We’re not just handing you a random timetable or generic tips. We’re offering... Read More

It is essential to have a final preparation study plan for the last... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.