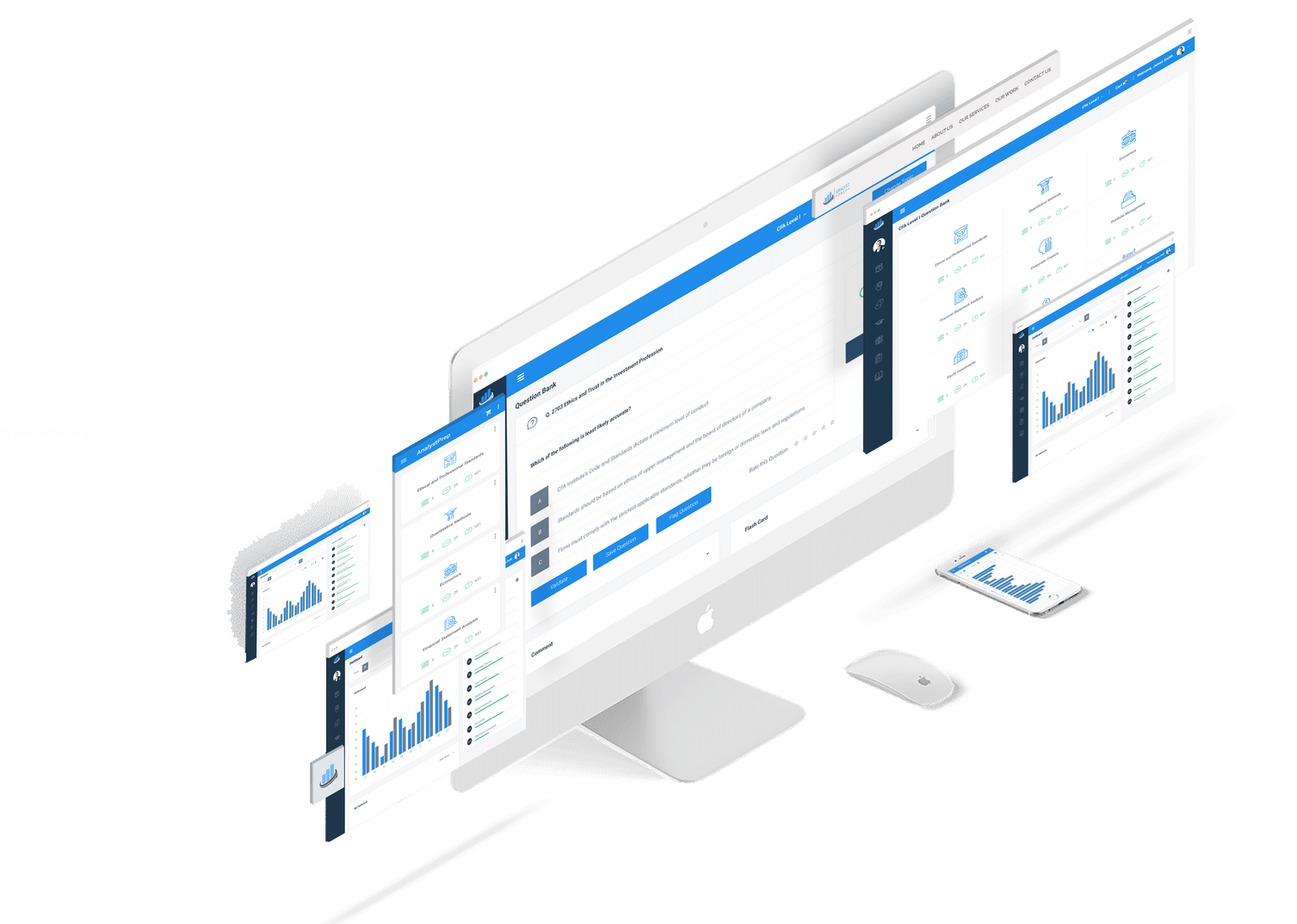

CFA Level 3 Complete Online Classes offered by AnalystPrep

- video lessons: 60+ hours

- study notes: 2,000+ pages

- essay-type cases: 50+

- MCQ vignettes: 100+

- mock exams: 1

- quizzes: unlimited

- students enrolled: 7,000+

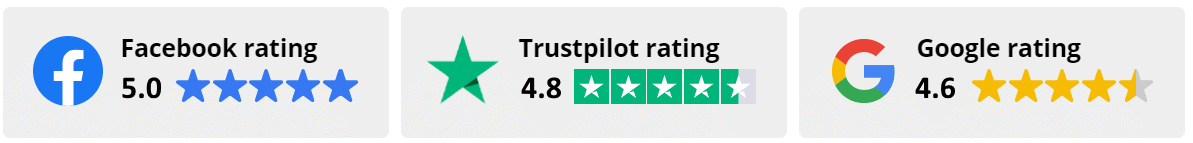

Congratulations on making it to the final level of the CFA® journey! AnalystPrep’s CFA Level 3 Online Class has been crafted by CFA charterholders who’ve been through the exam and know exactly what it takes to pass. Our experienced instructors ensure that each CFA Level 3 practice question is thoroughly validated, matching the most current curriculum and difficulty level. Join a community of over 20,000 CFA candidates each year who trust us to guide them to success. We are rated as the #1 prep platform for CFA exams.

$499.00

Course Features

- 60 Hours of Video Lessons

- 2,000 Pages of Study Notes

- 50+ Essay-type Cases

- 100+ MCQ Vignettes

- CBT Mock Exams

- Formula Sheet

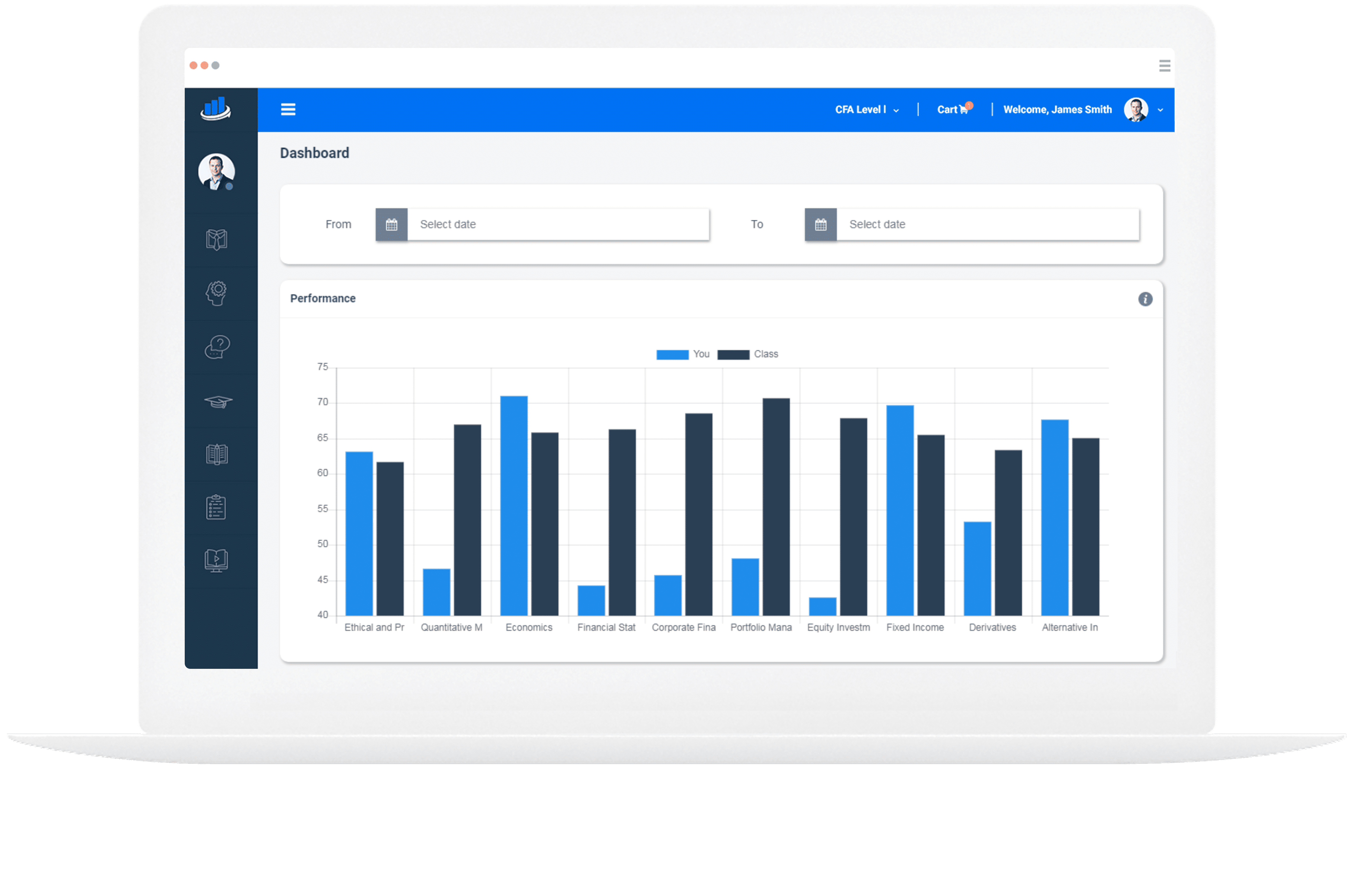

- Performance Tracking Tools

- 12-Month Access

- Ask-A-Tutor Questions

- 24/7 Tech Support

Course Overview

The CFA Level 3 exam represents the final step in the CFA journey and is offered twice a year. Unlike Levels 1 and 2, the focus at Level 3 shifts heavily towards Portfolio Management and Wealth Planning, which now comprise between 45% and 55% of the total exam weight. While familiar topics like Ethics, Alternative Investments, Derivatives, Equity Investments, and Fixed Income maintain their weightings, areas like Quantitative Methods, Corporate Finance, and Financial Statement Analysis have been removed to streamline your study focus.

Duration

The CFA Level 3 exam duration totals 4 hours and 24 minutes, split into two equally timed sessions with a break in between. You’ll have access to proctors if needed, ensuring a smooth and focused test-taking experience.

Exam Structure

The CFA Level III exam employs a dual-format structure, combining item sets and constructed response (essay) sets. Each set begins with a vignette—a detailed case scenario—followed by either multiple-choice questions (for item sets) or essay questions (for constructed response sets). Unlike Level I’s standalone questions, Level III requires candidates to analyze and apply the vignette information to answer all questions within each set.

The exam’s balanced structure consists of 22 total sets, with each session containing a mix of formats. A session may include either 6 item sets and 5 essay sets or 5 item sets and 6 essay sets. Each set carries 12 points, with 20 sets scored and 2 sets (one item set and one essay set) serving as unscored trial questions.

Topic areas from the CFA Program curriculum are randomly distributed throughout the exam, meaning any topic could appear in either or both sessions. Each set begins with a clear identifier stating both the topic area and the point value, ensuring candidates can effectively manage their time and effort across the exam.

Example:

Topic: Derivatives and Risk Management

Total Value Point Value for this Set is 12 Points

Constructed Response (Essay) Format

Unlike multiple choice questions, constructed response questions require candidates to generate and articulate their own answers, similar to how investment professionals write client recommendations or portfolio reviews.

Here are a few issues of note:

– Command Words: Questions use specific directives highlighted in bold, such as “Justify,” “Calculate,” “Formulate,” or “Determine” to clearly direct your approach. You’ll have a dedicated text box for your response, with flexibility to use either paragraph format or bullet points. The exam platform accepts both narrative explanations and numerical answers.

Example

Justify three reasons why a liability-driven investment strategy would be appropriate for this pension fund.

– Multi-Part Responses: When questions request multiple components (e.g., “Explain three advantages…”), responses must be clearly separated into distinct bullets or paragraphs.

– Calculations: For numerical questions, the exam platform accommodates both numbers and explanatory text. Importantly, correct numerical answers alone earn full credit without requiring supporting calculations or formulas. However, showing your work—either through the math editor or typed equations—can help earn partial credit if your final answer is incorrect.

– Alternative Question Formats: Within the essay portion, some questions may appear in a multiple-choice format. Unlike traditional multiple-choice questions, these may contain varying numbers of answer options, deviating from the standard three-choice format.

Example

Determine which regulatory framework would be most appropriate for the family office structure described. Justify your choice.”

(Single-family office registration, Multi-family office registration)

– Points Disclosure Each essay set contains a varying number of items, with each item carrying different point values. While the total points for each set (12 points) are known, the specific point allocation per item within the set is not disclosed to candidates.

– Scoring: Sequential grading means in a question asking to “Identify three risk factors,” only your first three responses are evaluated, even if you list five. This rewards precise, well-thought-out answers over quantity.

Item Set Format

Each item set starts with a vignette followed by four multiple-choice questions, each valued at 3 points. The exam contains 11 item sets (44 multiple-choice questions in total), with each question worth 3 points. Unlike constructed response questions, these multiple-choice questions maintain a consistent three-option format throughout the exam.

Course Curriculum

At AnalystPrep, our CFA Level 3 study materials are designed by CFA charterholders who know firsthand what it takes to succeed. Each practice question, study note, and video lesson is meticulously validated and regularly updated to align with the latest CFA Level 3 curriculum and exam difficulty.

Our curriculum aligns seamlessly with the CFA Institute’s new structure, focusing on the common core topics (65%-70%) while providing in-depth coverage of the private wealth, private markets, and portfolio management pathways (30%-35%). Whether you’re aiming to master foundational concepts or delve into specialized areas, our platform caters to your unique learning needs.

With study notes, video lessons, and a vast question bank, each topic is broken down into easily digestible modules. Every practice question is accompanied by detailed solutions, and our instructors are always available to clarify concepts and provide guidance. Regular updates ensure that our resources reflect the latest curriculum and exam difficulty levels, keeping you ahead of the curve.

Join the 20,000+ CFA candidates who choose AnalystPrep each year and get to know why we are rated as the #1 CFA prep platform

CFA Level III Common Core Topics

The Level III common core represents the foundational expertise required across all investment management roles, creating a robust framework that transcends specialized pathways. This essential knowledge base encompasses:

- Asset Allocation: The curriculum delves deep into developing capital market expectations and macro forecasting methodologies, while teaching candidates how to navigate and optimize portfolio decisions within real-world constraints. These skills form the cornerstone of strategic investment decision-making.

- Portfolio Construction: This segment covers comprehensive approaches to building portfolios across equity, fixed income, and alternative investments, examining the nuanced differences between institutional and private wealth mandates. Special attention is given to trading costs and their impact on portfolio implementation.

- Performance Measurement: Candidates master the intricacies of performance attribution and manager selection processes, while gaining thorough understanding of Global Investment Performance Standards. This ensures the ability to evaluate investment success and maintain standardized reporting practices.

- Derivatives & Risk Management: The focus here is on practical applications of options, swaps, forwards, and futures strategies, along with currency hedging techniques. This knowledge enables candidates to implement sophisticated risk management and portfolio optimization solutions.

- Ethics: Professional integrity is emphasized through detailed study of the Code of Ethics, Standards of Professional Conduct, and Asset Manager Code. This foundation ensures candidates understand their fiduciary responsibilities and professional obligations.

CFA Level III Specialized Pathways

Private Wealth Pathway (30-35% of Curriculum)

The Private Wealth pathway equips candidates with sophisticated knowledge for serving High Net Worth individuals (US$5M+), focusing on comprehensive wealth management across the client lifecycle. This specialized curriculum addresses:

- Private Wealth Management Industry: The curriculum examines diverse business models within wealth management, intricate fee and compensation structures, and the crucial role of coordinating various professional advisors. Special emphasis is placed on navigating the complex regulatory landscape unique to private wealth management.

- Working with the Wealthy: Candidates learn to understand the psychology of wealth, family dynamics, and governance structures across different wealth tiers. This section develops essential skills for engaging with ultra-high-net-worth clients and facilitating effective family decision-making frameworks.

- Wealth Planning: This segment focuses on creating goals-based financial plans, implementing asset protection strategies, and developing tax-efficient solutions. Particular attention is given to liquidity management strategies that align with clients’ complex needs.

- Investment Planning: The focus here is on crafting tailored portfolio allocations, implementing tax-efficient investment strategies, and developing comprehensive retirement solutions. Students master performance measurement techniques specifically adapted for private wealth contexts.

- Preserving Wealth: This section addresses strategies for protecting human capital through insurance products and other risk mitigation tools. Candidates learn to develop robust plans for managing inflation risk and currency volatility in private wealth contexts.

- Advising the Wealthy: The curriculum covers advanced topics including cross-border wealth management, strategies for entrepreneurs and business owners, and specialized approaches for managing concentrated wealth positions. Particular attention is given to optimizing outcomes for high-earning professionals and athletes.

- Transferring Wealth Candidates master strategies for both lifetime wealth transfer through gifting and posthumous transfer through inheritance planning.

Private Markets Pathway (30-35% of Curriculum)

The Private Markets pathway approaches investing primarily from the General Partner (GP) perspective, providing advanced knowledge of private investment strategies across multiple asset classes. This specialized curriculum addresses:

- Private Investments and Structures: The curriculum examines fundamental differences between private and public markets, exploring various investment methods and structures across equity, debt, real estate, and infrastructure. Candidates learn to evaluate performance metrics and assess private markets’ role in strategic asset allocation.

- GP and LP Perspective and Investment Process: This section details the intricate relationships between General Partners and Limited Partners, covering fee structures, performance measurement, and alignment of interests. Special focus is placed on due diligence, value creation, and exit strategies in private investments.

- Private Equity: Candidates master private equity strategies across company lifecycles, from venture capital through buyouts. The section covers valuation methodologies specific to different investment stages and analyzes risk-return profiles within strategic portfolio contexts.

- Private Debt: This segment explores debt financing across the investment lifecycle, including leveraged loans, high-yield bonds, and mezzanine financing. Emphasis is placed on credit analysis, valuation techniques, and the strategic role of private debt in investment portfolios.

- Private Special Situations: The curriculum addresses event-driven opportunities involving financial distress, including distressed debt investments and capital structure arbitrage. Candidates learn specialized due diligence and valuation processes for complex investment situations.

- Private Real Estate: This section covers private real estate investment strategies, focusing on value-add and opportunistic approaches. Students master due diligence processes and valuation techniques, including specialized knowledge of alternative real estate investments like timberland and farmland.

- Infrastructure: Candidates learn to evaluate infrastructure investments across project lifecycles, understanding financing structures and investment vehicles. Particular attention is given to risk-return characteristics and the role of infrastructure in portfolio allocation.

Portfolio Management Pathway (30-35% of Curriculum)

The Portfolio Management pathway builds on traditional CFA Program strengths, focusing on advanced public markets investment strategies. This specialized curriculum addresses:

- Index-based Equity Strategies The curriculum examines sophisticated approaches to passive management, comparing market-cap-weighted and factor-based methodologies. Candidates master various replication techniques, including full replication, stratified sampling, and optimization, while learning to analyze tracking error and risk sources.

- Active Equity Investing – Strategies: This section covers comprehensive approaches to active management, from fundamental to quantitative methodologies. Candidates learn to develop and implement bottom-up, top-down, factor-based, activist, and arbitrage strategies while understanding various investment style classifications.

- Active Equity Investing – Portfolio Construction: Students master the practical aspects of portfolio construction, exploring the relationships between Active Share and Active Risk. Special attention is given to risk budgeting, position sizing, liquidity management, and portfolio efficiency optimization within specific mandates.

- Liability Driven and Index Based Fixed Income Strategies: The curriculum addresses sophisticated fixed income portfolio management, focusing on liability-matching strategies and passive implementation approaches. Candidates learn to select and justify appropriate benchmarks while managing various interest rate scenarios.

- Fixed-income Active Management: Yield Curve Strategies This segment explores advanced fixed-income techniques for generating excess returns through yield curve positioning. Emphasis is placed on duration management, cross-currency strategies, and interest rate volatility analysis.

- Fixed-income Active Management – Credit Strategies: Candidates master spread-based portfolio management, including sophisticated approaches to credit analysis, CDS strategies, and structured products. Special focus is placed on tail risk management and international credit market dynamics.

- Case Study in Portfolio Management – Institutional: Through detailed case analysis of institutional portfolio management, candidates learn to develop and implement strategic asset allocations. The section covers liquidity management, derivative implementation, and ESG integration within an institutional context.

- Trade Strategy and Execution: The curriculum concludes with advanced trading strategies across multiple asset classes, including algorithmic trading and machine learning applications. Candidates learn to evaluate execution quality, measure costs, and ensure regulatory compliance.

- Lesson 1 Framework and Macro Considerations

- Lesson 2 Forecasting Asset Class Returns

- Lesson 3 Overview of Asset Allocation

- Lesson 4 Principles of Asset Allocation

- Lesson 5 Asset Allocation with Real World Constraints

- Lesson 1 Overview of Equity Portfolio Management

- Lesson 2 Overview of Fixed-Income Portfolio Management

- Lesson 3 Asset Allocation to Alternative Investments – Part I

- Lesson 4 Asset Allocation to Alternative Investments – Part II

- Lesson 5 Overview of Private Wealth Management – Part I

- Lesson 6 Overview of Private Wealth Management – Part II

- Lesson 7 Portfolio Management for Institutional Investors – Part I

- Lesson 8 Portfolio Management for Institutional Investors – Part II

- Lesson 9 Passive Equity Investing

- Lesson 10 Trading Costs and Electronic Markets

- Lesson 1 Standard I – Professionalism

- Lesson 2 Standard II – Integrity

- Lesson 3 Standard III – Duties to Clients

- Lesson 4 Standard IV – Duties to Employers

- Lesson 5 Standard V – Investment Analysis

- Lesson 6 Standard VI – Conflicts of Interest

- Lesson 7 Standard VII – Responsibilities as a CFA Institute Member or CFA Candidate

- Lesson 8 Asset Manager Code of Professional Conduct

- Lesson 1 Private Investments and Structures

- Lesson 2 General Partner and Investor Perspectives and the Investment Process

- Lesson 3 Private Equity

- Lesson 4 Private Debt

- Lesson 1 Private Special Situations

- Lesson 2 Private Real Estate Investments

- Lesson 3 Infrastructure

- Lesson 1 The Private Wealth Management Industry

- Lesson 2 Working With the Wealthy

- Lesson 3 Wealth Planning

- Lesson 4 Investment Planning

- Lesson 1 Preserving the Wealth – Part I – Human Capital

- Lesson 2 Preserving the Wealth – Part II – Purchasing Power

- Lesson 3 Advising the Wealthy

- Lesson 4 Transferring the Wealth

- Lesson 1 Index-Based Equity Strategies

- Lesson 2 Active Equity Investing: Strategies – Part I

- Lesson 3 Active Equity Investing: Strategies – Part II

- Lesson 4 Active Equity Investing: Portfolio Construction – Part I

- Lesson 5 Active Equity Investing: Portfolio Construction – Part II

- Lesson 6 Liability-Driven and Index-Based Strategies – Part I

- Lesson 7 Liability-Driven and Index-Based Strategies – Part II

- Lesson 1 Yield Curve Strategies

- Lesson 2 Fixed-Income Active Management: Credit Strategies

- Lesson 3 Trade Strategy and Execution – Part I

- Lesson 4 Trade Strategy and Execution – Part II

- Lesson 5 Case Study in Portfolio Management: Institutional

Professor James Forjan, PhD, CFA

Professor James Forjan has taught college-level finance classes for over 25 years. With a clear passion for teaching, Prof. Forjan has worked in the CFA exam preparation industry for decades after earning his charter in 2004. His resume includes:

☑ BS in accounting

☑ MSc in Finance

☑ Ph.D. in Finance (minor in Economics and two PhD level classes in Econometrics)

☑ Has taught at different 6 universities (undergraduate and graduate-level Finance classes)

☑ Co-author of investment books

☑ Has crafted, edited, updated, and upgraded a multitude of CFA exam type questions at all levels

☑ And much more…

Reviews 11

Pratham K.2024-07-11 13:43:13

Loved the video series. I love the video series because the explanation is provided in the simplest manner. It is helping me in clearing my concepts.

Mary F.2023-08-18 14:22:01

BIG THANK YOU! I'd like to special thank you for Prof Forjan and the team. [...] I'm more than grateful to have access to these amazing tutorials here which greatly ease my study pressure and gain confidence. [...] Once again, a big THANK YOU!

James B.2019-03-14 14:04:41

"Thanks to your program I passed the first level of the CFA exam, as I got my results today. You guys are the best. I actually finished the exam with 45 minutes left in [the morning session] and 15 minutes left in [the afternoon session]... I couldn't even finish with more than 10 minutes left in the AnalystPrep mock exams so your exams had the requisite difficulty level for the actual CFA exam."

Jose Gary2019-03-04 16:52:14

"I loved the up-to-date study materials and Question bank. If you wish to increase your chances of CFA exam success on your first attempt, I strongly recommend AnalystPrep."

Brian Masibo2019-03-04 16:50:55

"Before I came across this website, I thought I could not manage to take the CFA exam alongside my busy schedule at work. But with the up-to-date study material, there is little to worry about. The Premium package is cheaper and the questions are well answered and explained. The question bank has a wide range of examinable questions extracted from across the whole syllabus. Thank you so much for helping me pass my first CFA exam."

Aadhya Patel2018-10-16 18:21:06

"Good Day! I cleared FRM Part I (May-2018) with 1.1.1.1. Thanks a lot to AnalystPrep and your support. Regards,"

Justin T.2017-09-28 07:55:56

“@AnalystPrep provided me with the necessary volume of questions to insure I went into test day having in-depth knowledge of every topic I would see on the exams.”

Joshua Brown2017-09-28 07:54:27

“Great study materials and exam-standard questions. In addition, their customer service is excellent. I couldn’t have found a better CFA exam study partner.”

Zubair Jatoi2017-09-28 02:47:09

“I bought their FRM Part 1 package and passed the exam. Their customer support answered all of my questions when I had problems with what was written in the curriculum. I'm planning to use them also for the FRM Part 2 exam and Level I of the CFA exam.”

Jordan Davis2017-09-27 08:52:35

“I bought the FRM exam premium subscription about 2 weeks ago. Very good learning tool. I contacted support a few times for technical questions and Michael was very helpful.”

Abdulgadir M.2024-08-11 17:55:47

James Forjan is just Brilliant. I'm totally new to these exams and James Forjan's videos have been really helpful, I'm looking to take my exam this February. I'm from London, highly recommend.