Pass SOA Exam FM

with AnalystPrep

AnalystPrep's Study Materials for the SOA FM Exam

SOA Exam FM is usually the second exam most actuarials students sit for. It consists of a vast amount of material contained made up of 8 different topics. Since the amount of information to memorize and understand can be overwhelming, we’ve produced comprehensive Financial Mathematics study notes in an easy-to-read format to help you learn efficiently and effectively. These study notes cover each learning objective given by the Society of Actuaries one-by-one.

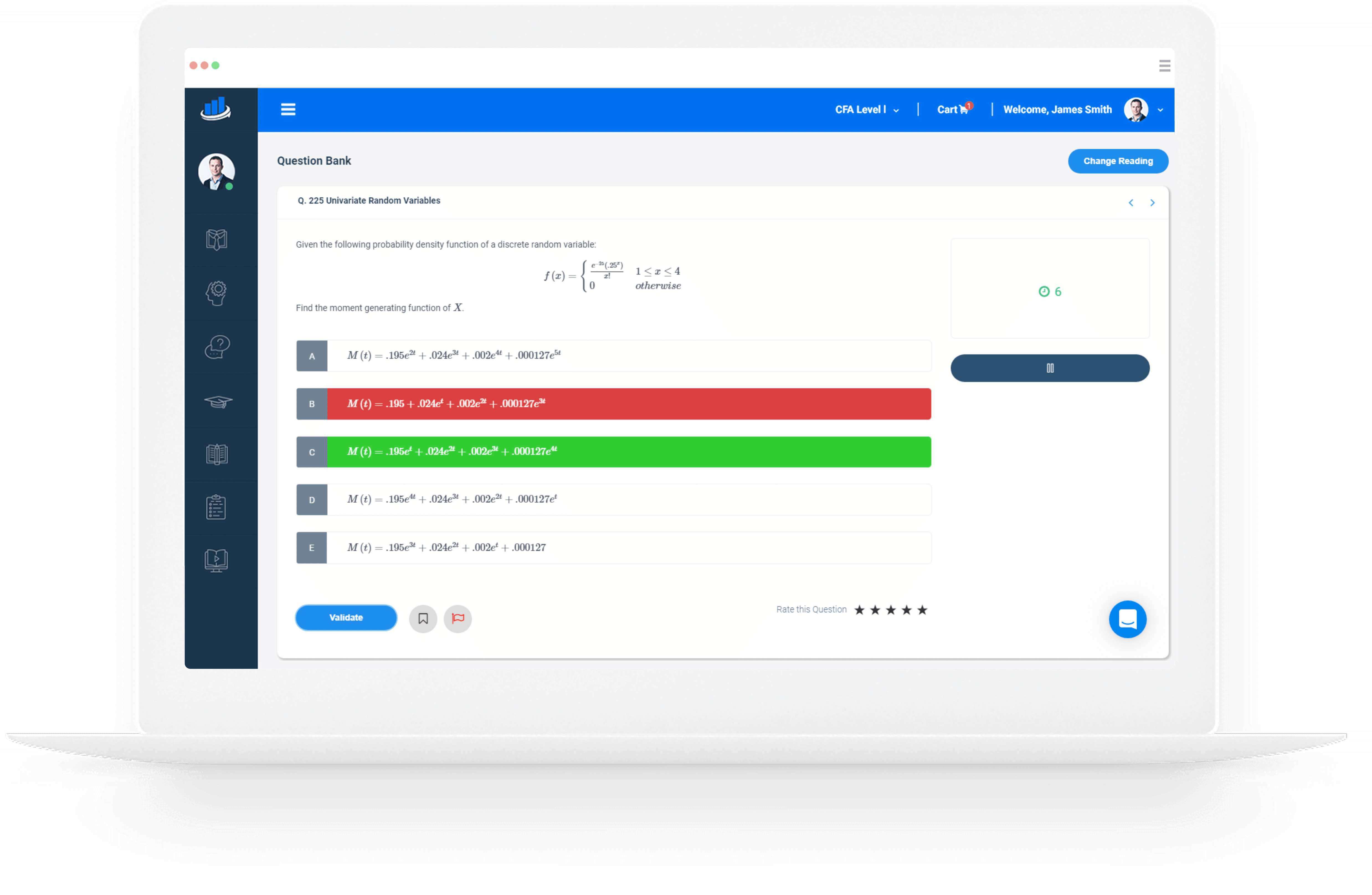

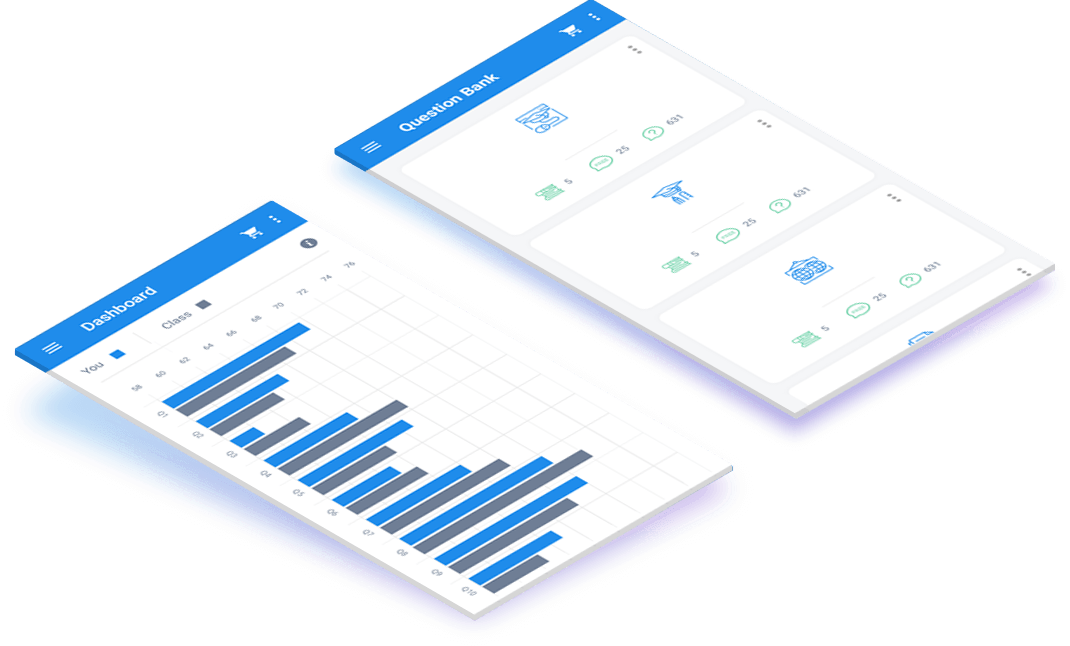

Our Exam FM question bank has been developed by academics in the field of actuarial sicences with first-hand experience of the exam. Our instructors know what it takes to pass. Our question bank is divided into specific topics to help you attain an all-round understanding of the curriculum. Every question is accompanied by a detailed solution.

Some harder concepts such as Macaulay duration, immunization, and interest rate swaps are well covered in our extensive study notes and question bank. In the event that you’d like some clarification on a specific concept, our instructors are reachable round the clock. Plus, you can create an unlimited number of customizable quizzes to focus on certain topics that need specific attention.

Syllabi Updates

Professional Advices

Community

Questions Answered by our Users

Satisfied Customers

Preparation Platform By Review Websites

What Should You Expect about Exam FM from the Society of Actuaries?

Exam FM is a 3-hour long exam that consists of 30 multiple-choice questions. Just like the P exam, it is a computer-based exam.

The exam focuses on mastering the rudimentary aspects of financial mathematics used in valuing financial instruments such as bonds and interest rate swaps. Knowledge of calculus and an introductory knowledge of probability is assumed. There are 8 board topics listed below. Each topic has several learning objectives around which the exam is concentrated. An examples of a learning objective would be: “Given sufficient information, calculate the market value, notional amount, spot rates or swap rate of an interest rate swap, deferred or otherwise, with either constant or varying notional amount”.

Each question is accompanied by 5 unique choices: A, B, C, D, and E. Given your right/wrong answer in each of the questions, you will be given easier or harder questions going forward. As such, each candidate will have a different set of 30 questions.

Here are the 8 main topics and their weighting in the exam:

| Topic | Weighting (%) | |

| 1 | Time Value of Money | 10-15% |

| 2 | Annuities/cash flows with non-contingent payments | 15-20% |

| 3 | Loans | 10-20% |

| 4 | Bonds | 10-20% |

| 5 | General Cash Flows and Portfolios | 15-20% |

| 6 | Immunization | 10-15% |

| 7 | Interest Rate Swaps | 0-10% |

| 8 | Determinants of Interest Rates | 0-10% |

Actuarial Exams Study Packages

Exam P (Learn + Practice Package)

$

349

/ 6-month access

- Video Lessons

- Study Notes

- Question Bank and Quizzes

- Performance Tracking Tools

- 6-Month Access

Exam FM (Learn + Practice Package)

$

349

/ 6-month access

- Video Lessons

- Study Notes

- Question Bank and Quizzes

- Performance Tools

- 6-Month Access

Unlimited Actuarial Exams Study Package

Unlimited Actuarial Exams Access

$

549

/ lifetime access

- Exams P & FM Video Lessons

- Exams P & FM Study Notes

- Question Banks and Quizzes

- Performance Tracking Tools

- Lifetime Access

- Unlimited Ask-a-Tutor Questions