AnalystPrep’s CFA® Level III Mock Exams

AnalystPrep’s CFA Level III mock exams are crafted to make sure you’re fully prepared for the actual exam, with the latest format and up-to-date content.

Here’s what makes our CFA Level 3 mock exams a must-have:

- Real-World Exam Replication: Each exam mirrors the CFA Level 3 structure with a mix of essay-type case studies and multiple-choice questions, just like what you’ll encounter on exam day. This helps you get comfortable with both question formats, making the actual test less intimidating.

- Practical Proficiency Focus: Level III emphasizes analytical skills and application. Our mock exams tackle this head-on, offering challenging, real-world scenarios so you can sharpen the skills that matter.

- Higher Pass Rates for Users: AnalystPrep candidates consistently perform better, thanks to the realistic practice environment that builds confidence, time management skills, and topic familiarity.

- Strategic Practice for Exam Day:

- Essay-Type Cases: Develops your ability to articulate and justify your answers clearly.

- Multiple-Choice Mastery: Enhances speed and accuracy, essential for tackling time-intensive questions.

Make your prep count!

Why Choose AnalystPrep’s CFA Level III Mock Exams?

When it comes to our CFA prep, we’ve thought of everything to make your experience both realistic and flexible:

- Exam-Like Format: Our two full-length, computer-based tests mirror the actual CFA exam format to get you familiar with the setup. Do you prefer pen and paper? No problem—you can easily print our PDFs!

- Up-to-date: The CFA Level 3 curriculum now consists of Core topics (65-70% exam weight) and a Specialized Pathway (30-35% exam weight). Our mock exams reflect this change, offering pathway-specific questions for Portfolio Management, Private Markets, and Private Wealth candidates.

- Access to Comprehensive Resources: Gain unlimited access to our CFA Qbank, quizzes, and mock exams; meaning you can drill down into any topic as much as you need.

- Annual Content Updates: Our team develops new mock exams yearly, keeping your study materials current and fresh so you’re never prepping with outdated content.

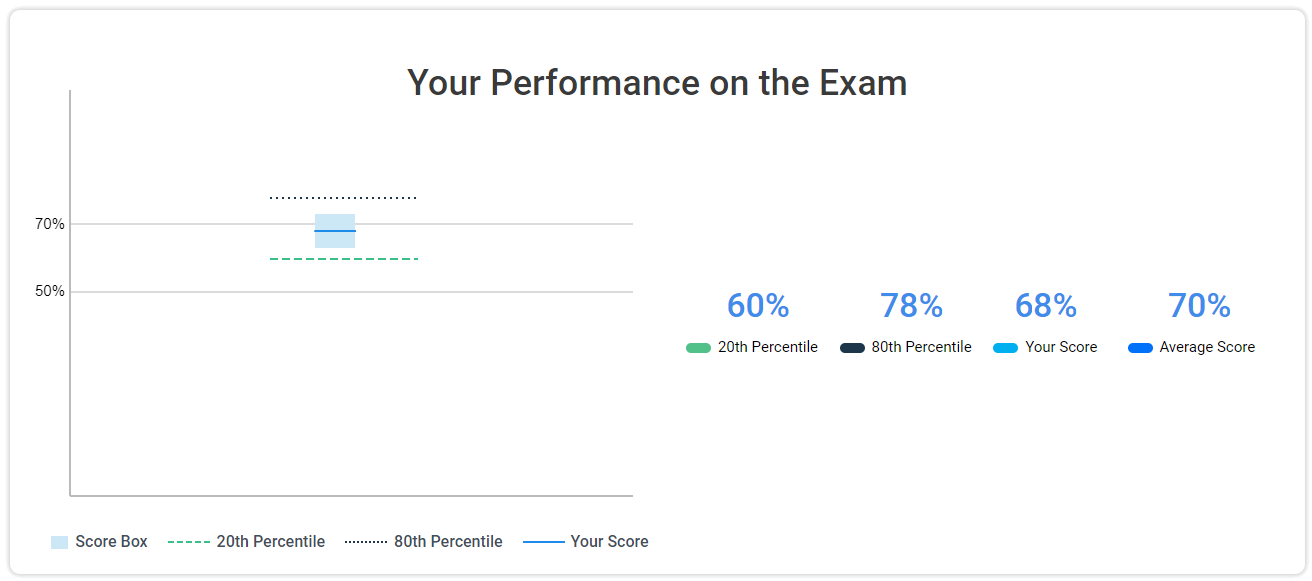

- Performance Insights: We present your results in a CFA-style report, complete with statistical comparisons against other candidates. See how you measure up and where to focus to achieve your best.

- Value That Lasts: You stay an AnalystPrep member until you pass Level III.

We’re with you every step of the way!

Questions Answered by our Users

Satisfied Customers

CFA PREPARATION PLATFORM BY REVIEW WEBSITES

Boost Your CFA Level 3 Mastery with AnalystPrep’s Expert Mock Exams

The CFA Level III exam requires a unique level of preparation, and that’s where AnalystPrep steps in.

- Simulate the Real Exam Intensity: By practicing under real conditions, you’ll master the art of staying calm and focused, even with the clock ticking.

- Pinpoint Your Weaknesses: Our mock exams aren’t just practice—they’re diagnostic tools. Spot the areas that need extra attention, refine your strategy, and build confidence.

- Achieve Exam-Day Confidence: Each practice session brings you closer to peak performance, so you’ll walk into the exam room ready to succeed!

AnalystPrep’s CFA Level III mock exams are designed to transform exam-day pressure into performance strength, so while others panic under the clock, you’ll confidently cruise through with ease.

Sample Questions from AnalystPrep's Level 3 CFA Mock Exams

The Whitakers

Kenn and Kelly Whitaker, a couple aged 35 and 38, meet Julian Sands, their new investment adviser. Throughout their careers, Kenn and Kelly have worked for Wallstreet Group, a multinational security company. The couple has two children who will begin high school soon.

Sands evaluates the Whitakers’ financial situation. Investments in their portfolio consist of ¥950,000 in stocks and ¥650,000 in fixed-income securities. WG shares account for 75% of their stock portfolio. Also, they own real estate worth ¥550,000, with a mortgage debt of ¥350,000. The Whitakers’ future expected consumption expenditures have a total present value of ¥850,000, and their pre-retirement earnings from WG are valued at ¥1,300,000.

The Whitakers aim to spend ¥350,000 on their children’s high school education. Furthermore, they plan to establish an endowment fund at their alma mater in 10 years, estimated to cost ¥400,000. In their communication with Sands, they expressed their desire to finance the endowment fund with high certainty. Based on this information, Sands creates a Whitaker economic balance sheet.

Question 1

Determine Whitaker’s economic net worth using the economic balance sheet method. Show your workings.

Solution 1

$$ \begin{array}{lrlr}

\textbf{Assets} & \bf {\text{Amount } (¥)} & \textbf{Liabilities} & \bf{\text{Amount } (¥)} \\ \hline

\textbf{Financial} & & \textbf{Financial} & \\

\textbf{Assets:} & & \textbf{Liabilities:} & \\ \hline

\text{Equity} & 950,000.00 & \text{Mortgage Debt} & 350,000.00 \\

\text{Fixed Income} & 650,000.00 & & \\

\text{Real Estate} & 550,000.00 & & \\

\textbf{Other Asset} & & \textbf{Other Liability} & \\

\textbf{Classifications:} & & \textbf{Classifications:} & \\ \hline

\text{Pre-retirement Earnings} & 1,300,000.00 & \text{Children’s High School Education} & 350,000.00 \\

& & \text{Endowment Fund} & 400,000.00 \\

& & \text{PV of consumption} & 850,000.00 \\

& & \text{Total Economic Liabilities} & 1,950,000.00 \\

& & \text{Economic Networth} & 1,500,000.00 \\

\textbf{Total Economic Assets} & \bf{3,450,000.00} & \textbf{Revised Total Economic} & \bf{3,450,000.00} \\

& & \textbf{Liabilities} &

\end{array} $$

Note:

$$ \text{Economic Networth} = \text{Total economic assets} – \text{Total economic liabilities} $$

Grading 1

A total of 5 points for the correct inputs and 2 points for the correct calculation of Economic Networth value.

Question 2

Using an economic balance sheet approach, determine which of Whitakers’ current financial assets is the most concerning from an asset allocation perspective.

The most concerning asset allocation is equity.

Both Whitakers work at WG, and their equity portfolio is heavily concentrated in WG stock (75%). It is possible that both the Whitakers’ human capital and the investment value of WG stock may be adversely affected if WG faces difficult economic conditions.

It is, therefore, necessary to review their investment in WG and diversify their equity portfolio even further.

Grading 2

A total of 3 points for the answer justification mentioning key highlighted areas and 2 points for the correct choice of “equity” as the answer.

Question 3

According to Sands, the Whitakers’ previous adviser specified the following asset classes in their financial plan.

Equity: Japan’s equities

Debt: Real estate and corporate bonds of investment-grade around the world

Derivatives: Foreign equities primarily with large capitalizations

The former adviser’s report indicates that equity returns and derivatives are highly correlated. There is, however, a weak correlation between the returns on debt and those on equity and derivatives.

Among Whitakers’ asset classes, Sands believes the portfolio has overlapping risks due to the asset allocation strategy their previous financial adviser employed. To determine the portfolio’s optimal exposure to each risk factor, Sands intends to analyze its sensitivity to inflation, liquidity, and volatility.

Based on Sands’ belief that the previous adviser’s asset class specifications for equity and derivatives are inappropriate, the asset classes should be:

- Diversifying

- Mutually exclusive

- Relatively homogeneous

Mention the appropriate answer and justify your explanation.

Solution 3

$$ \textbf{Diversifying} $$

Ideally, an asset class should diversify and have low correlations with other classes for risk control purposes. Inclusion of both equity and derivatives asset classes will result in double exposure to risk since equity and derivatives returns are highly correlated. Incorporating both asset classes into the asset allocation will not diversify the portfolio.

Grading 3

A total of 3 points for the answer justification mentioning key highlighted areas and 2 points for the correct choice of “diversifying” as the answer.

Question 4

For moderately important objectives, Sands recommends mixing 80% global equities and 20% bonds for a 15-year period to balance expected return and risk. Exhibit 1 presents relevant data for three potential portfolios. Sands advises the Whitakers to consider one of the portfolios for their asset allocation strategy, according to their goals.

$$ \textbf{Exhibit 1: Whitaker Family Portfolio Allocations} \\

\begin{array}{c|c|c|c|c}

\textbf{Portfolios} & \textbf{Cash} & \textbf{Fixed} & \textbf{Global} & \textbf{Diversifying} \\

& & \textbf{Income} & \textbf{Equities} & \bf{\text{Strategies}^{\ast}} \\ \hline

A & 40\% & 60\% & 15\% & 0\% \\ \hline

B & 15\% & 20\% & 70\% & 15\% \\ \hline

C & 15\% & 35\% & 45\% & 25\% \\ \hline

\end{array} \\

\textbf{Note: } {{}^\ast} \text{ Investing in hedge funds is part of diversifying strategies} $$

Based on Exhibit 1, determine the portfolio that best meets the Whitakers’ education goal for their children. Explain your answer.

Solution 4

$$ \textbf{Portfolio A} $$

Portfolio A meets the Whitakers’ education goal for their children. It is estimated that the Whitakers’ expected education expenses will be ¥350,000. Since the Whitakers’ children will begin high school soon, Portfolio A, which emphasizes liquidity and stability, is the most appropriate portfolio for meeting the Whitakers’ short-term education goals.at present value.

Grading 4

A total of 3 points for the answer justification mentioning key highlighted areas and 2 points for the correct choice of “Portfolio A” as the answer.

CFA® Level 3

Study Packages by AnalystPrep

Add video lessons and study notes for only $150 extra.

Combine all three levels, with lifetime access and unlimited ask-a-tutor questions for only $799.

Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

Learn + Practice Package

$

499

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

- Essential Review Summaries

Unlimited Package (All 3 Levels)

$

799

/ lifetime access

- Question Banks for all three Levels of the CFA Exam

- Mock Exams for all three Levels of the CFA Exam

- Performance Tracking Tools

- Video Lessons for all three Levels of the CFA Exam

- Study Notes for all three Levels of the CFA Exam

- Essential Review Summaries

Frequently Asked Questions

1. What’s included in AnalystPrep’s CFA Level 3 Mock Exam Package?

Each package includes full-length mock exams, detailed explanations, and real-time analytics, along with access to a Qbank, quizzes, and performance tracking.

2. Do AnalystPrep’s CFA Level 3 mock exams cover the new Specialized Pathways?

Yes! Our updated mock exams include questions tailored to the three CFA Level 3 pathways: Portfolio Management, Private Markets, and Private Wealth. Candidates can practice pathway-specific case studies to ensure they’re fully prepared for the 2025 exam format.

3. How do AnalystPrep’s mock exams compare to the actual CFA Level 3 exam?

Our mock exams replicate the format and difficulty level of the real exam, covering both essay-type and multiple-choice questions.

4. How can I use my performance analytics to improve?

Instant feedback highlights your strengths and areas needing improvement, allowing targeted revision for optimal performance.

5. Are downloadable PDFs available for offline study?

Yes, mock exams are available in PDF format, perfect for those who prefer print options.

6. What happens if I don’t pass Level III?

Your membership and access continue until you pass, ensuring unlimited support.

7. Do AnalystPrep’s mock exams get updated to match CFA Institute® changes?

Yes, mock exams are updated annually to reflect the latest curriculum changes.

8. How should I schedule my mock exams before the CFA Level 3 exam?

We recommend starting mock exams early, aiming to complete at least two practice tests in the weeks leading up to your exam.

Strategies to Boost Your CFA Level III Exam Performance

Here’s how to make the most of your study time and optimize each CFA mock exam questions:

🏴 Master Key Formulas: AnalystPrep’s comprehensive formula sheet covers the essentials. Start here to reinforce fundamental concepts.

🏴 Early Practice is Key: Complete at least one or two CFA Level 3 practice exams ahead of time to identify focus areas.

🏴 Simulate Real Exam Conditions: Each mock exam aligns with CFA’s time constraints, helping you develop time management skills.

🏴 Smart Question Strategy: Begin with easier questions, and tackle challenging ones afterward if time permits.

🏴 Thorough Post-Exam Analysis: After each mock exam, review your answers using detailed explanations to pinpoint weaknesses and deepen your understanding.

So, if you’ve been wondering how to pass CFA Level 3, this is it. These strategic steps build your confidence and competence, bringing you closer to exam success.

Building Confidence with Real-Time Analytics

Imagine finishing a mock exam and knowing exactly where you stand within seconds!

With AnalystPrep’s CFA Level III mock exams, you get real-time analytics on every attempt, helping you instantly spot strengths and pinpoint areas needing improvement. This immediate feedback loop allows you to track progress over time, adjust strategies, and keep building confidence every step of the way.

Addressing Areas for Improvement

Each question in our CFA Level III mock exams includes a thorough explanation to help you recognize and improve on areas needing extra focus. Whether you’re working on mastering Portfolio Management, Ethical and Professional Standards, Fixed Income, Derivatives, or Performance Evaluation, our tailored Video Lessons, Study Notes, Question Bank, and Mock Exams are designed to support your progress.

Start preparing today with AnalystPrep’s CFA Level 3 practice questions and give yourself the advantage of refining your skills, building knowledge, and boosting your overall performance.