CFA Level 3 Practice Questions by AnalystPrep

Get AnalystPrep’s CFA Level 3 Sample Questions and Boost Your Chances of Success

Why is CFA Level 3 Unique?

While Levels 1 and 2 emphasize memorization and calculation, Level 3 takes a broader and more applied approach. You’ll need to weave descriptive knowledge with analysis, understanding the “why” behind investment strategies. This shift means candidates must go beyond rote learning to demonstrate critical thinking and analysis.

Understanding the CFA Level 3 Exam Structure

The CFA Level 3 exam is split into two distinct sections: item sets and constructed response (essay-style) questions. Knowing the format inside out can significantly boost your performance.

Note, starting in 2025, the CFA Level 3 exam consists of two parts: Core topics, which cover Asset Allocation, Portfolio Construction, Performance Measurement, Derivatives & Risk Management, and Ethics, and a Specialized Pathway of your choice. Candidates can select one of three pathways: Portfolio Management, Private Markets, or Private Wealth. Our CFA Level 3 practice questions ensure you are well-prepared for both the Core topics and your chosen pathway.

CFA Level 3 Item Set Breakdown

- What are item sets? Think of them as mini-case studies. Each item set presents a vignette, a short narrative on a financial scenario, followed by six multiple-choice questions.

- This format tests your ability to pull insights and make informed decisions based on the scenario.

Here’s a sample breakdown of topics often covered:

- Ethics and Professional Standards – Ethics aren’t going anywhere!

- Portfolio Management – The cornerstone of Level 3.

- Wealth Planning – Tailored for high-net-worth individuals.

Constructed Response Questions

- Essay section? Yes, but don’t worry, you’re not writing a novel! This part requires brief, clear, and to-the-point answers.

- Here are a few pointers to excel:

- Be direct: Each point you make should add value. Long-winded answers won’t earn extra marks.

- Use bullet points and clear language: The CFA examiners prefer answers that show logical thought, so structuring your response can really help.

How to Use the CFA Level 3 Practice Questions Effectively

Your study approach for CFA Level 3 should be as strategic as the portfolios you’ll one day manage. Here’s a straightforward guide to squeezing every drop of value from AnalystPrep’s practice questions:

- Familiarize Yourself with Real-World Scenarios: AnalystPrep’s item sets are crafted to mimic real-life financial dilemmas. For instance, you might analyze a retiree’s investment needs, balancing risks and returns.

- Focus on Weak Areas: Use practice questions to identify gaps. If alternative investments aren’t your strong suit, dedicate more time there.

- Practice Time Management: With only a few minutes per question, timing is crucial. Regularly practicing item sets will help you stay sharp and efficient.

- Review Every Explanation: Even if you answer correctly, read the explanation. This builds a deeper understanding and cements your learning.

Strategies for Answering CFA Level 3 Item Set Questions:

Mastering item sets requires more than knowledge—it’s about approach. Here are some strategies to keep you ahead of the curve:

- Scan First, Answer Later: Start by skimming the vignette to get a sense of the case. Then dive into the questions, revisiting relevant details in the vignette as you go.

- Look for Keywords: Words like “maximize return” or “minimize risk” tell you what the question is really asking.

- Make Educated Guesses: When you’re stuck, eliminate obviously incorrect choices to improve your odds.

- Don’t Overthink It: The exam isn’t trying to trick you. Stick to the information in the vignette and avoid unnecessary assumptions.

Time Management Tips

- Allocate roughly 10-12 minutes per item set. Pace yourself to ensure you have enough time to tackle every question with a calm mind.

- Use a watch or timer during your practice sessions to simulate exam day conditions.

Why Choose AnalystPrep’s CFA Level 3 Study Notes?

With so many resources available, why pick AnalystPrep?

Here’s why we stand out:

- In-Depth Explanations: Each practice question is paired with detailed answers to reinforce learning. You’ll not only know the correct answer but understand why it’s correct.

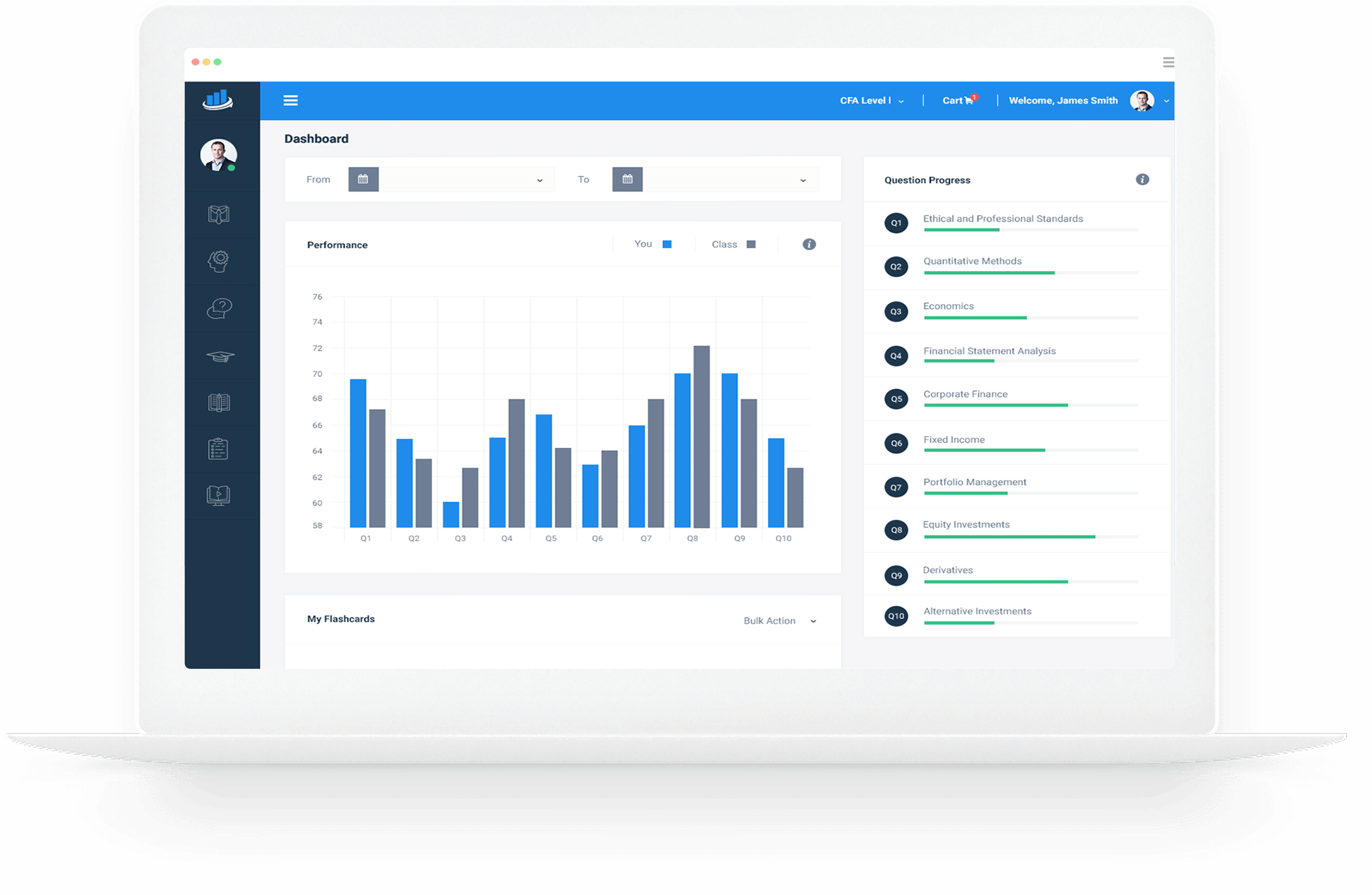

- Performance Tracking: Identify your strengths and weaknesses with our personalized analytics, focusing your study time where it counts.

- User-Friendly Platform: Access questions, quizzes, and study resources on any device, anytime. Whether you’re at home or commuting, you can keep learning.

- Proven Success: Thousands of candidates have used AnalystPrep to pass the CFA exams. Join them and get a head start on your CFA journey!

Ready to test your skills?

Get Started Right Away

All item sets from AnalystPrep’s CFA Level 3 Question Bank are well organized by chapter and cover most of the important concepts that have been tested in past CFA Level III exams.

Register a free account to test out 10 item sets (60 free questions) and see why AnalystPrep has helped thousands of candidates pass CFA exams!

Example Item Set from AnalystPrep's Level III CFA Exam Question Bank

High-Rise Investment Management (HRIM) is a Canadian asset management firm with a reputable standing in the financial community. Bill Coss is the head of the trading division at the firm and supervises more than twenty financial experts in his department. Due to an expansion in the firm’s business, Coss has recently hired a few portfolio managers to support the trading activities of the firm. One of the new employees is Bruce Block, an equity portfolio manager who worked for a small Canadian equity firm for two years. During his job interview, Coss mentioned the various types of orders traders use, which portfolio managers need to understand. Block made the following comments:

Statement 1: “A variation of the market order designed to give the agent of the trader greater discretion than a simple market order is the market-not-held order.

An order type that gives the trader’s agent even more discretion is the ‘best efforts order.’”

Statement 2: “Sometimes traders with a buying motive post bids, hoping others would sell to them, yielding negative implicit trading costs. However, if the bid-ask spread is small, they may buy at the ask. Such trading is termed a pegging strategy which typically utilizes iceberg orders.”

On his first day at work, Block was instructed by Coss to work with the firm’s most senior trader, Mike Gentile, to purchase 1,650 shares of Altec Corporation. The trade was executed in a single day and was split into three parts of different trade sizes. Exhibit 1 displays information about the dealers who make a market in Altec Corp’s stock and their quoted bid-ask prices. Exhibit 2 displays information about the three trades executed by Block.

Exhibit 1 Bid-Ask Prices of Dealers

| Dealer | Bid Price (C$) | Bid Size | Ask Price (C$) | Ask Size |

| Dealer A | 45.74 | 750 | 47.88 | 800 |

| Dealer B | 45.76 | 500 | 47.56 | 450 |

| Dealer C | 45.68 | 200 | 48.90 | 350 |

Exhibit 2 Trading transactions in Altec stock

| Trade | Shares Bought | Execution Price (C$) |

| Trade 1 | 750 | 47.70 |

| Trade 2 | 500 | 47.56 |

| Trade 3 | 400 | 49.10 |

Dealer A’s quote was in effect at the time of trade 1, Dealer B’s quote was in effect at the time of trade 2, and Dealer C’s quote was in effect at the time of trade 3.

Coss came over to analyze the costs of the trade. After his analysis, he made the following comments:

Statement 3: “The inside bid-ask spread is lower than any individual dealer’s spread.”

Statement 4: “The average effective spread of Altec Corp’s stock transactions is C$2.4.”

Gentile works with many of the firm’s portfolio managers toward selecting the appropriate execution strategy for portfolio decisions. As a part of this process, Gentile assesses the execution of orders in three stocks. Exhibit 3 displays information in the order management system, including trade sizes, market attributes, and the urgency levels of the portfolio managers, for the three stocks.

| Stock | Size (shares) | Avg. Daily Vol. | Price | Spread (%) | Urgency |

| A | 15,000 | 45,000 | 65.78 | 0.45 | Low |

| B | 89,000 | 1,500,000 | 102.34 | 0.03 | Low |

| C | 47,000 | 1,000,000 | 39.02 | 0.02 | Low |

Gentile sold 500 shares of Star Energy Inc. for a pension fund at $50.00 per share. All the trades that occurred during the day in Star Energy Inc. are shown in Exhibit 4.

| Trade Price ($) | Shares Traded |

| 53.45 | 300 |

| 49.77 | 400 |

| 50.00 | 500 |

| 50.10 | 650 |

Coss is working with Gentile to rebalance his portfolio in order to keep the asset class weights within their specified corridors. Coss has specified a corridor for each asset class as a common multiple of the standard deviation of the asset class’s returns.

Gentile is determining the appropriate execution strategy for the stock of Pyramid Enterprise, a thinly traded stock with irregular volume patterns. He has decided to use a simple logical participation strategy but is unsure which one to use.

Practice Questions

Question 1/6

Block is least accurate with respect to:

A. Statement 1 only.

B. Statement 2 only.

C. neither Statement 1 nor Statement 2.

The correct answer is C.

Statement 1 is correct. A market-not-held order gives the agent of a trader greater discretion than a simple market order since the broker is not required to trade at any specific price or time interval, as would be required with a simple market order. A ‘best efforts order’ gives the agent even more discretion to work the order only when the agent judges market conditions to be favorable.

Statement 2 is correct. A pegging strategy is an opportunistic strategy in which the trader who wishes to buy posts a bid, hoping others will sell to him or her, yielding negative implicit trading costs. If the bid-offer spread is small, the trader might buy at the ask. This strategy involves using iceberg orders, also called reserve or hidden orders, and crossing to provide additional sources of liquidity at a low cost.

Question 2/6

Coss is most accurate with respect to:

A. Statement 3 only.

B. Statement 4 only.

C. both statements 3 and 4.

The correct answer is B.

Statement 3 is incorrect. Inside bid-ask spread is the lowest ask less the highest bid = 47.56-45.76 = $1.8, which is equal to Dealer B’s spread.

Statement 4 is correct. For trade 1, the midpoint of the market at the time the order is entered (which are the quotes of Dealer A) is equal to 45.74+47.88/2 = 46.81

The effective spread = 2×(47.70-46.81) = $1.78

For trade 2 the effective spread is 2×(47.56-46.66)=$1.8

For trade 3, the effective spread is 2×(49.10-47.29) = $3.62

The average effective spread is 1.78+1.8+3.62/3 = $2.4

Question 3/6

Which of the following is most accurate about the orders in the Order Management System?

A. The order in Stock A is most suited for a VWAP algorithm, and the order in Stock B should be traded using an implementation shortfall algorithm.

B. The orders in Stock B and C are most suited for a logical participation strategy, whereas the order in Stock A should be traded on a crossing system.

C. The order in Stock B should be traded on a crossing system, whereas the order in Stock C is most suitable for trading through a broker.

The correct answer is B.

Orders as a percentage of average daily volume:

A: 15,000/45,000 = 0.33

B: 89,000/1,500,000 = 0.0593

C: 47,000/1,000,000 = 0.047

The order in Stock A is large relative to the average daily volume, has a large spread and a low urgency, so it should most likely be traded using a broker or a crossing system.

The orders in Stocks B and C are small relative to their average daily volumes, have low spreads, and have low urgencies. Hence, they are suited for algorithmic execution, probably with a VWAP algorithm or other simple logical participation strategies.

Question 4/6

The implicit transaction cost of the trade in Star Energy Inc., using the VWAP as the price benchmark, is closest to:

A. $212.39

B. $230.95

C. $272.43

The correct answer is C.

VWAP = dollar volume/trade volume

Dollar volume = (300×53.45) + (400×49.77) + (500×50) + (650×50.10) = 93,508

Trade volume = 300+400+500+650 = 1,850

VWAP = 93,508/1,850 = 50.545

Implicit costs = 500 × ($50.545-$50) = $272.43

Question 5/6

Which of the following is most accurate about the rebalancing strategy that Coss is using for his own portfolio?

A. Each asset class will have a different probability of triggering rebalancing if the normal distribution describes the asset class returns.

B. The rebalancing strategy does not account for differences in transaction costs or asset correlations.

C. Such a strategy requires less frequent rebalancing when the market is trending and more frequent rebalancing when the market is characterized by reversals.

The correct answer is B.

The rebalancing strategy used by Coss is an equal probability rebalancing strategy. In this discipline, each asset class is equally likely to trigger rebalancing if the normal distribution describes asset class returns. Also, equal probability rebalancing does not account for differences in transaction costs or asset correlations. Option C describes tactical rebalancing, a variation of calendar rebalancing that specifies less frequent rebalancing when markets appear to be trending and more frequent rebalancing when they are characterized by reversals.

Question 6/6

Which of the following simple logical participation strategy will be most appropriate for trading in Pyramid Enterprise’s stock?

A. TWAP.

B. VWAP.

C. Percentage of volume strategy

The correct answer is A.

The TWAP strategy breaks up the order over the day in proportion to the time and hence, is useful in thinly traded assets whose volume patterns might be erratic. Since the above traits characterize the stock of Pyramid Enterprise, the TWAP (time-weighted average price) strategy would be most appropriate.

Level III of the CFA® Exam

AnalystPrep’s practice packages for Level III of the CFA exam start as low as $349 with a 12-month access.

Level III of the CFA Exam - Practice Package by AnalystPrep

$

349

/ 12-month access

- Question Bank (Item Sets)

- Essay-Type Questions

- Performance Tracking Tools

- 5 Ask-A-Tutor Questions