CFA Level 2 Exam Practice Questions Offered by AnalystPrep

Get AnalystPrep’s CFA Level 2 Sample Questions and Boost Your Chances of Success

When you talk to CFA charterholders, there’s one piece of advice they all agree on: practice is key to passing the CFA level 2 exam.

Practice like it’s exam day!

That’s where AnalystPrep stands out from other prep materials.

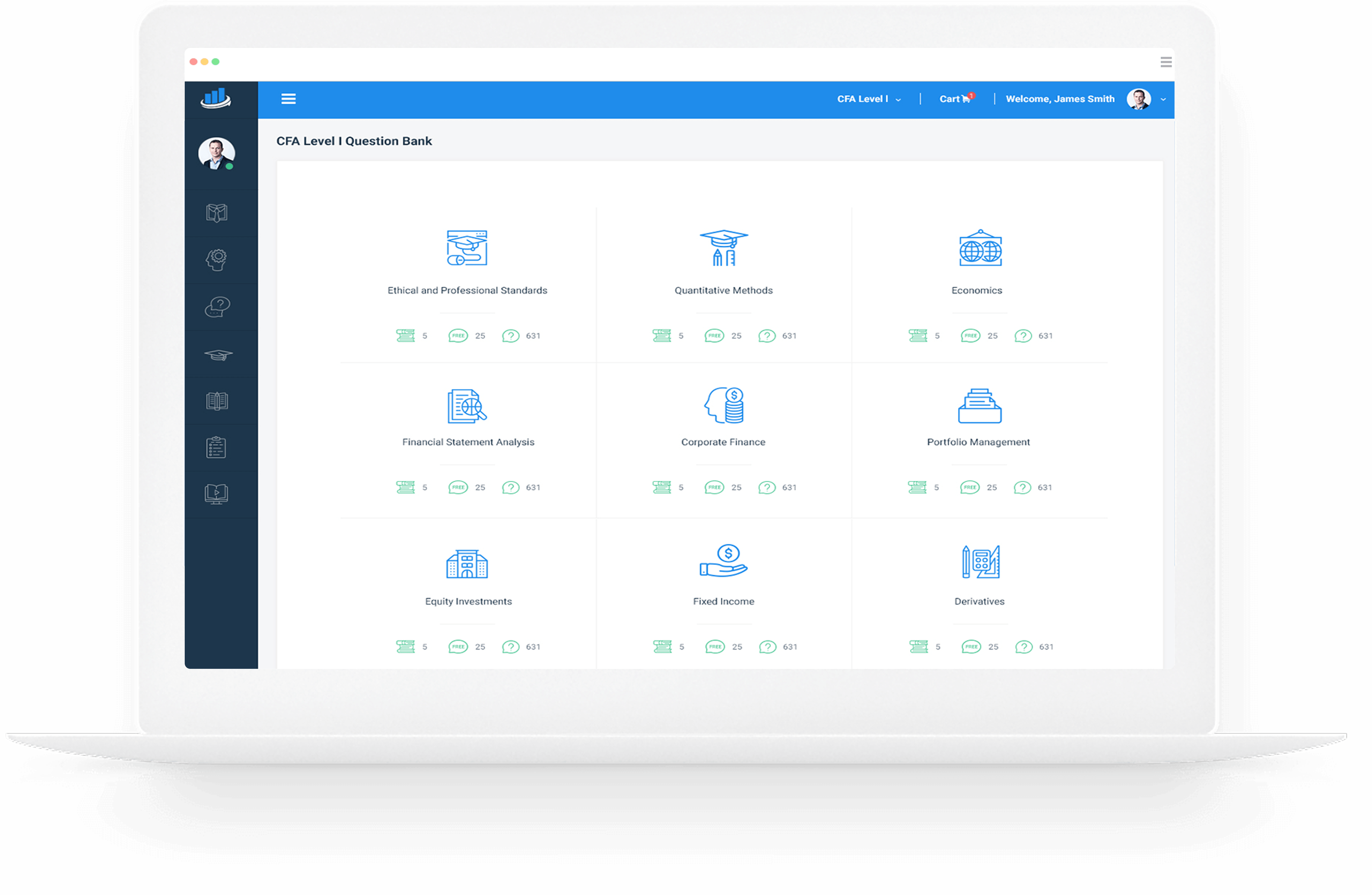

We provide CFA level 2 sample questions designed to mirror the actual exam format.

Each practice session is built around item sets: just like what you’ll face in the real test. These item sets include a detailed case statement (typically 800-1,000 words) followed by 4 multiple-choice questions. And, every question comes with a thorough explanation, so you can learn from each answer.

CFA Level 2 Exam Item Sets

The CFA Level 2 exam is often considered the toughest of all three CFA exams. At AnalystPrep, we know that practicing non-item set questions just won’t cut it. You need to focus on what you’ll actually face on exam day. That’s why we’ve created 200 vignette-style item sets, giving you access to over 1,000 CFA Level 2 sample questions, all designed to reflect the real test. Our team of CFA charterholders has carefully crafted each item set to ensure you’re practicing exactly what you need to know for the CFA level 2 exam.

How to Get Started?

Register for a free account and get access to 10 item sets (that’s 40 free CFA level 2 questions), completely free!

It’s a no-risk (no-brainer) way to see how AnalystPrep can help you pass the CFA level 2 exam with confidence.

CFA® Level II Study Packages by AnalystPrep

Add video lessons and study notes for only $150 extra.

Combine all three levels, with lifetime access and unlimited ask-a-tutor questions for only $799.

Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

Learn + Practice Package

$

499

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

Unlimited Package (All 3 Levels)

$

799

/ lifetime access

- Question Banks for all three Levels of the CFA Exam

- Mock Exams for all three Levels of the CFA Exam

- Performance Tracking Tools

- Video Lessons for all three Levels of the CFA Exam

- Study Notes for all three Levels of the CFA Exam

Example Item Set from AnalystPrep's Question Bank

Smart Coffee Growers, SCG, is a U.S.-based society specializing in coffee processing and value addition. In line with its recently approved policy that prioritizes diversification, the society is contemplating an investment in 2 local companies: A chocolate manufacturer – Yummy Bars, and a small scale groundnut company – Natural Nuts Ltd. SCG’s management would like to finalize investment decisions regarding the two entities by January 1, 2017.

SCG wants a 30% stake in Yummy Bars, and the management feels the level of control acquired will be sufficient to allow SCG to be represented on the board. That means society will be able to participate in decision-making and policy-making processes. As such, the society is willing to offer $180 million in cash. Now, the book values of Yummy Bar’s assets and liabilities equal their values, with the exception of a manufacturing plant. Just before the acquisition, the plant has a book value of $24 million, a fair value of $45 million, and useful life of 10 years. The exhibit below provides pre-investment balance sheets and income statements of the two entities.

SCG and Yummy Bars Pre-Acquisition Balance Sheets and Income Statements

| SCG ($ 000) |

Yummy Bars ($ 000) |

|

| Income Statement | ||

| Sales | 1,200,000 | 750,000 |

| Cost of Sales | (675,000) | (300,000) |

| Other Expenses | (135,000) | (60,0000) |

| Net Income | 390,000 | 390,000 |

| Balance Sheet | ||

| Cash | 105,000 | 45,000 |

| Inventory | 330,000 | 255,000 |

| Accounts Receivable | 165,000 | 120,000 |

| Other assets | 45,000 | 30,000 |

| Total Assets | 645,000 | 450,000 |

| Accounts Payable | 225,000 | 180,000 |

| Long-Term Debt | 15,000 | 6,000 |

| Shareholders’ Equity | 240,000 | 180,000 |

| Retained Earnings | 165,000 | 84,000 |

| Total Liabilities and Shareholder’s Equity | 645,000 | 450,000 |

SCG plans to acquire 100% of the outstanding shares of Natural Nuts Ltd. The society will achieve this by issuing 6 million equity, which has a $1 par value and $30 million current market value. Exhibit 2 below provides pre-acquisition balance sheet information for Natural Nuts Ltd using book values and fair values. The shareholders’ equity figure included in SCG’s pre-acquisition balance sheet (exhibit 1) includes $90 million additional paid in capital, with the remainder attributable to $1 par value common stock.

Natural Nut Ltd.’s Pre-Acquisition Balance Sheet using Book Values and Fair Values

| Book Value ($ 000) |

Fair Value ($ 000) |

|

| Cash | 12,000 | 12,000 |

| Inventory | 7,500 | 10,500 |

| Accounts Receivable | 1,500 | 1,500 |

| Other Assets | 24,000 | 31,500 |

| Total Assets | 45,000 | 55,500 |

| Accounts Payable | 6,000 | 6,000 |

| Long-Term Debt | 15,000 | 21,000 |

| 21,000 | 27,000 | |

| 66,000 | 82,500 | |

| Shareholder’s Equity | ||

| Common Stock ($1 par) | 40,500 | |

| Additional Paid-in Capital | 18,000 | |

| Retained Earnings | 13,500 |

One year following the investment in Natural Nuts Ltd., the carrying value of its steel conversion unit is $4,500,000, while the fair value is $3,750,000. An in-house analyst estimates the fair value of its identifiable net assets to be worth $3,540,000. The steel conversion unit is an independent reporting unit.

Practice Questions

Question 1/4

What’s the amount of goodwill reported on Fisher SCG’s balance sheet immediately following the purchase of Yummy Bars?

A. $0.

B. $45 million.

C. $94 million.

The correct answer is A.

Since the investment in Yummy Bars will provide SCG with board representation in addition to the ability to participate in policy decision-making matters, SCG will have significant influence over the target. Thus, the investment in Yummy Bars should be accounted for via the equity method of accounting.

Under the equity method of accounting, goodwill is not reported separately in the acquirer’s balance sheet. Rather, it’s incorporated as part of the cost of investment. As such, the amount of goodwill to be reported in the balance sheet is $0.

Study Session 5, Reading 16, LOS 16(C): analyze how different methods used to account for intercorporate investments affect financial statements and ratios

Question 2/4

Suppose SCG offered $50 million for the acquisition of Yummy Bars. SCG would most likely:

A. Subject itself to post-acquisition legal suits from Yummy Bars.

B. Recognize the difference between the fair value of Yummy Bars’ assets and the purchase price as a gain in profit and loss.

C. Recognize the difference between the fair value of Yummy Bars’ assets and the purchase price as a loss in profit and loss

The correct answer is B.

$50 million would be considerably less than the fair value of Yummy Bars’ net assets. As such, that would effectively make the acquisition a bargain acquisition. Under both IFRS and US GAAP, SCG would be required to recognize the difference between the fair value of Yummy Bars’ assets and the purchase price as a gain in profit and loss.

Study session 5, Reading 16, LOS 16(b): distinguish between IFRS and US GAAP in the classification, measurement, and disclosure of investments in financial assets, investments in associates, joint ventures, business combinations, and special purpose and variable interest entities

Question 3/4

Suppose SCG acquired just 18% of Yummy Bars. Would the society have significant influence over the associate?

A. No, significant influence can only be exercised with a minimum of 30% of voting rights

B. Yes, provided SCG holds at least 50% of board positions

C. Yes, provided SCG is represented in the board

The correct answer is C.

Influence can be exercised with a 20%-50% of voting power. If an investor holds less than 20% of the voting rights, they cannot exert influence unless the such influence can be demonstrated. With 18% of voting power, SCG would be able to exert influence if and only if:

- It has representatives in the board of directors

- It can participate in policy formulation

- It is capable of pulling of material transactions between itself and Yummy Bars

- There’s interchange of managerial personnel

- There’s technological dependency

Study session 5, Reading 16, LOS 16(a): describe the classification, measurement, and disclosure under International Financial Reporting Standards (IFRS) for 1) investments in financial assets, 2) investments in associates, 3) joint ventures, 4) business combinations, and 5) special purpose and variable interest entities

Question 4/4

A year into SCG’s investment in Yummy bars, SCG sold $7.5m of inventory to Yummy Bars for $12m. Yummy resold $8m of this inventory during the year. What was SCG’s share of the unrealized profit?

A. $4.5m

B. $1.4985m

C. $0.44955m

The correct answer is C.

SCG’s profit from the sale = $12 – $7.5 = $4.5m

Yummy Bars sells 8/12 = 66.7% of the goods purchased from SCG.

That means 33.3% remains unsold.

Total unrealized profit = 33.3% × $4.5m = $1.4985m

SCG’s share of the unrealized profit = 30% × $1.4985 = $0.44955m

Study session 5, Reading 16, LOS 16(b): distinguish between IFRS and US GAAP in the classification, measurement, and disclosure of investments in financial assets, investments in associates, joint ventures, business combinations, and special purpose and variable interest entities