CFA® ESG Practice Questions

offered by AnalystPrep

Get Access to 500 Exam-Style Questions

What Makes AnalystPrep’s Question Bank Unique?

Our ESG-focused question bank has been developed by professionals well-versed in sustainability and responsible investing. Our instructors understand the nuances of ESG standards and practices. Each question undergoes rigorous validation to ensure it is up-to-date with evolving ESG guidelines and offers you the best learning experience.

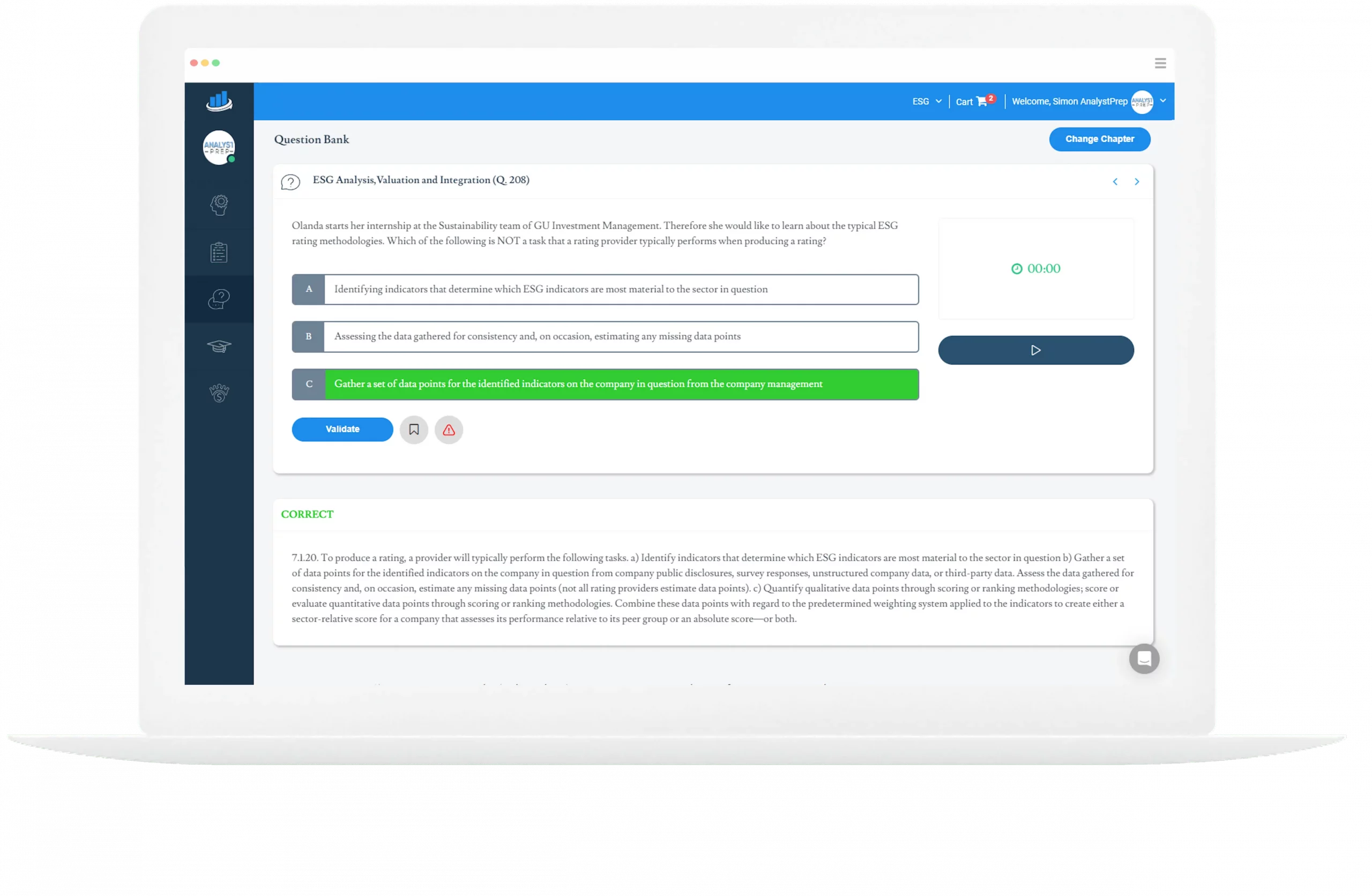

Preparing for an ESG evaluation or certification requires understanding the specific criteria and knowing what to anticipate in assessments. At AnalystPrep, our format mirrors real-world ESG assessment criteria. Each item comprises a main point (be it a question, statement, or table) and three options – A, B, and C. These options align contextually and grammatically with the main point. Additionally, each item corresponds to one or more ESG principles or guidelines.

Our question bank is segmented into distinct ESG topics, ensuring a comprehensive grasp of both the environmental, social, and governance facets. Every question comes with a thorough explanation. And if you ever find yourself needing further insights into a specific ESG topic, our instructors are available at all times.

Our ESG practice questions are routinely updated to remain aligned with the latest sustainability standards and complexity. Join the ever-growing community who turn to our platform for the valuable, free ESG resources we offer exclusively.

Performance Tracking Lets you Find your Strengths and Weaknesses

The ESG certification comprises 9 chapters encompassing a comprehensive understanding of environmental, social, and governance factors. Testing your knowledge in each specific chapter using our practice questions lets you pinpoint both your areas of expertise and areas for improvement. Stay ahead and evaluate your progression with our FREE performance tracking tool.

Performance tracking is just one feature within our comprehensive analytics suite that offers invaluable insights into your proficiency. Notably, you have the opportunity to juxtapose your results with those of thousands of users globally. Based on these analytics, tailor your study strategy and concentrate on chapters that demand further mastery. Efficient preparation starts with discerning where to channel your efforts to optimize your likelihood of certification success.

Questions Answered by our Users

Satisfied Customers

Cfa Preparation Platform By Review Websites

Some Free Exam-style CFA ESG Practice Questions offered by AnalystPrep

Question 1

Introduction to ESG Investing

By standardizing sustainability disclosures, the EU’s Sustainable Finance Action Plan has introduced new standards that enable institutional asset owners and retail clients to more easily assess the sustainability features of investment funds. Which EU regulation best fits the above?

A) Sustainable Disclosure Regulation (SDR)

B) European Sustainability Disclosure Regulation (ESDR)

C) Sustainable Finance Disclosure Regulation (SFDR)

In March 2021, the European Union (EU)’s Sustainable Finance Disclosure Regulation (SFDR) came into force. The SFDR is designed to support institutional asset owners and retail clients to compare, select and monitor the sustainability characteristics of investment funds’ by standardizing sustainability disclosures.

Question 2

Introduction to ESG Investing

Giovannah manages a thematic fund that seeks exposure to sustainable food. As a result, her portfolio likely has an overweight in consumer staples, consumer discretionary, and materials. As she seeks to evolve her ESG approach, she is considering implementing an additional negative screening method that excludes companies that violate planetary boundaries. As she refines her process, she notes that the materials sector is most likely to be affected. Which companies within the materials sector might be most likely to be affected by the “nitrogen and phosphorus pollution” planetary boundary?

A) Iron Ore Producers

B) Fertilizer Producers

C) Food Producers

The correct answer is: B).

Phosphorus is typically used in modern agriculture. As a results, the fertilizer producers are most likely to be impacted. Food producers may also be exposed as they likely use fertilizers in their production, however food producers are in the staples sector, not materials. Iron ore producers are not exposed.

Question 3

The ESG Market

Greenwashing is the practice of falsely claiming a financial product to be more sustainable than it really is, and hence misleading clients. For instance, an asset management firm may call a fund “Renewable Climate Fund”, but then allocate assets to heavy carbon-emitting oil production companies. What could happen to the investment management industry if cases of greenwashing increase?

A) Since asset managers will have good explanations for why they hold those stocks, the AUM of ESG funds is likely going to increase

B) The investment management industry will take a hit on its credibility and unfairly punish pure ESG funds which may be painted with a broad brush

C) Regulators will likely deem the rules and regulations around the marketing of ESG products as too strict and reduce the number of regulations around marketing practices

The correct answer is: B).

Asset owners, but also individual retail investors, have questioned why certain stocks, either involved in significant controversies or with controversial activities, are part of the top holdings of ESG funds, which has at times impacted the credibility of efforts in responsible investment.

Question 4

Environmental Factors

Both the Kyoto Protocol (2005) and the Paris Agreement (2015) were key milestones in global action to combat climate change. What is the major difference between the two?

A) Kyoto included emerging markets only, while Paris also included developed nations.

B) Kyoto aimed to set targets, but no formal commitments were achieved. In Paris, a global standard was set.

C) Kyoto included developed nations only, while Paris was a global response.

The correct answer is: C).

The Kyoto Protocol was adopted in 1997 and became effective in 2005. It was the first international convention to set targets for emissions of the main GHGs. It established top-down, binding targets, but only for developed nations, while in Paris a landmark agreement was reached to mobilize a global response to the threat of climate change in the form of the Paris Agreement. Although the Paris Agreement is not legally binding under international law, it serves as a significant landmark in tackling climate change on a global scale.

Question 5

Social Factors

A) A transition that is aligned with the Kyoto Agreement

B) A transition that shares the financial and social burden fairly

C) A transition that respects labor and human rights

Climate change and the neighboring effect of transition risk has social implications. A widespread call is that the transition should be a ‘just’ transition. In the process of adjusting to an economy that does not adversely affect the climate, sectors that employ millions of workers (such as energy, coal, manufacturing, agriculture, and forestry) must restructure. It is feared that the period of economic structural change will result in ordinary workers bearing the costs of the transition, leading to unemployment, poverty, and exclusion for the working class.

Question 6

Governance Factors

A) Ahold and Parmalat

B) Vivendi Universal and BCCI

C) Wirecard and Ahold

The correct answer is: A)

The 2003 failures at Ahold and Parmalat, in the Netherlands and Italy respectively, led to pressure for heightened standards of corporate governance and both board and auditor independence across Europe.

Question 7

Engagement and Stewardship

Giando works as a junior portfolio manager at Belroy Family Office. The family office manages approximately $1.5 billion in assets. In preparation for the annual performance review, the senior PM Roy asks Giando to prepare the firm’s approach to stewardship and engagement. While presenting his work to Roy, Giando and Roy note that their views differ on what active ownership entails. Giando believes that Belroy, as a signatory to the PRI, is required to act as an active owner and thus engage with companies. This includes voting and engagement. Roy, on the other hand, believes that voting is sufficient, as this already counts as active ownership. Who is most likely correct?

A) Roy is correct

B) Giando is correct

C) The PRI princinples do not require engagement in any form

The correct answer is: B)

Engagement is the way in which investors put into effect their stewardship responsibilities in line with the Principles for Responsible Investment (PRI) principle 2 (“We will be active owners and incorporate environmental, social and governance (ESG) issues into our ownership policies and practices”). It is often described as purposeful dialogue with a specific objective in mind; that purpose will vary from engagement to engagement but often relates to improving companies’ business practices, especially in relation to the management of ESG issues.

Question 8

ESG Analysis,Valuation and Integration

Kwela has heard that Morningstar’s ESG rating is a widely recognized measure of a company’s ESG performance, and she is interested in using it as a benchmark for the company’s own ESG efforts. What methodology does the Morningstar ESG rating employ?

A) Holding-based approach

B) Sector-based approach

C) Relative value approach

The correct answer is: A)

Case study: Morningstar takes a ‘holdings-based approach’–a weighted average of portfolio companies’ ESG scores.

Question 9

ESG Int. Portfolio Construction and Mgmt

Attribution models serve to quantify and demonstrate the effects of asset allocation and selection decisions on investment returns. Which of the following is most likely a correct attribution model?

A) Brinson attribution

B) ESG attribution

C) Sector attribution

The correct answer is: A)

Generally speaking, institutional investors apply two popular approaches towards decomposing performance attribution: Brinson attribution and risk factor attribution. Attribution models serve to quantify and demonstrate the effects of asset allocation and selection decisions on investment returns. Brinson attribution decomposes performance returns based on a portfolio’s active weights. For a given time series, this generally represents performance returns attributed to the regional, sector, and stock-specific exposure. There are efforts to embed ESG within risk factor analysis, combining fundamental risk factors – value, yield, growth, quality, size, volatility, and momentum – alongside an approximation of ESG risk in both composites and disaggregated (E/S/G) formats. Leveraging external data sources, Style Analytics produces this factor by inferring ESG qualities from the top and bottom, ESG-ranked companies within a given index.

CFA® ESG

Study Packages by offered by AnalystPrep

Learn + Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Study Notes

- 5 Ask-A-Tutor Questions

- 12-Month Access