AnalystPrep's CFA® Certificate in ESG Mock Exams

Attaining proficiency in the CFA ESG (Environmental, Social, and Governance) exam transcends the bounds of extensive study hours. It necessitates the adept application of knowledge with an emphasis on practical skill sets.

AnalystPrep’s ESG mock exams for the CFA Program are intricately crafted to align with the latest exam blueprint, encompassing a mix of case studies and multiple-choice questions. This blend is reflective of the style and complexity of the ESG exams conducted by the CFA Institute®. Participation in these detailed simulations is crucial for aspirants, as they emulate the diverse question formats expected in the actual ESG exam. It is consistently noted that candidates engaging with these mock exams tend to exhibit enhanced performance in the actual ESG exam, in contrast to those who depend solely on conventional study techniques. We advocate these practice exams as an essential strategy for acclimatizing to the subtleties of the real ESG exam environment, aiding in effective time management and mastery over the topics in both case-based and multiple-choice question formats.

Reasons to Choose AnalystPrep Mock Exams?

Our preparation packages for the CFA ESG (Environmental, Social, and Governance) exams include two full-length practice tests in a computer-based testing (CBT) format, meticulously designed to mirror the actual CFA ESG exam experience. For those who prefer conventional study methods, we also offer these exams in PDF format, suitable for printing and facilitating pen-and-paper study habits.

AnalystPrep’s packages, known for their exceptional value, provide access to our Qbank, unlimited quizzes, and ESG-specific mock tests. This commitment ensures that you retain your premium status until you successfully navigate the CFA ESG exam. We continuously refresh our materials, creating new mock exams each year with our dedicated team, assuring that our premium members always have access to the most recent and unique ESG practice content.

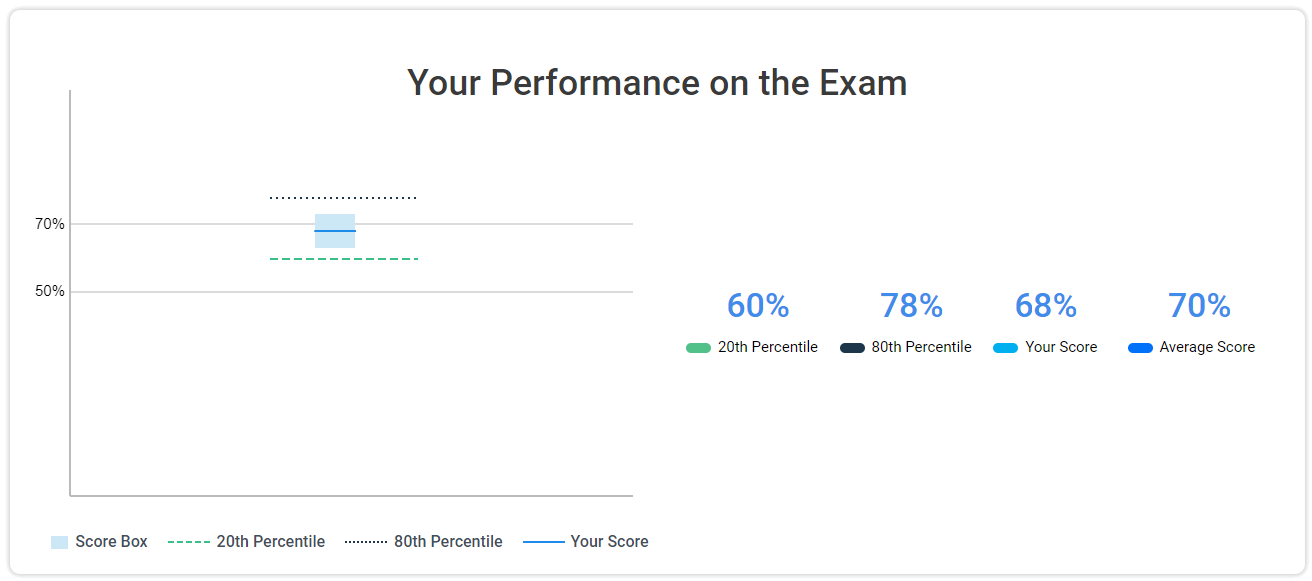

Moreover, we present results in a format akin to that of the CFA Institute, offering candidates a clear insight into their potential performance. Additionally, we provide statistical comparisons with fellow AnalystPrep users, giving you a thorough overview of your standing in your ESG exam preparation journey.

Questions Answered by our Users

Satisfied Customers

CFA PREPARATION PLATFORM BY REVIEW WEBSITES

Enhance Your Mastery for the CFA ESG Certificate Exam with AnalystPrep's Expertly Designed Mock Exams

The CFA ESG (Environmental, Social, and Governance) exam poses distinct challenges, requiring a level of preparation surpassing that of many other professional tests. To be fully equipped for what the exam entails, experiencing its intensity in advance is key.

In the high-stakes environment of the real ESG exam, even thoroughly prepared candidates might struggle, leading to anxiety, mistakes, and less than optimal performance. The secret to success on exam day lies in mastering composure under pressure, which is why practicing in conditions that mimic the actual exam is invaluable.

AnalystPrep’s ESG mock exams are carefully designed to emulate the structure and difficulty level of the actual CFA ESG exam. These practice exams act as critical diagnostic tools, highlighting areas that require further attention, adjustments in revision strategies, or enhanced skills to handle the pressures of the exam. They play a pivotal role in boosting your confidence and ensuring you are thoroughly prepared for the exam.

Strategies to Boost Your Exam Performance

- Begin your preparation by reviewing common concepts with our ESG study notes.

- Start early and aim to complete at least one or two practice exams well in advance of your test date.

- Each mock exam is designed to match the time constraints of the actual exam, with a recommended average time equal to the number of marks each question has.

- Focus on answering easier questions first, then circle back to tackle the more challenging ones if time permits.

- Attempt all questions before reviewing the answers to simulate actual exam conditions.

- After completing the mock exam, take the time to thoroughly analyze your answers using the detailed explanations provided. This step is crucial for identifying weak areas and improving your understanding of the material.

Addressing Areas for Improvement

Every question in our CFA ESG mock exams is accompanied by a detailed explanation, helping you pinpoint and improve your areas of weakness. Whether you face challenges in Environmental Factors, Social Factors, Governance Factors, Engagement and Stewardship, or Investment Mandates,Portfolio Analytics and Client Reporting, or any other related topic, our comprehensive Study Notes, Question Bank, and Mock Exams are designed to support your educational journey.

Begin your preparation for the CFA ESG exam with AnalystPrep’s specialized mock exams today, providing yourself with ample opportunity to hone your skills, enhance your knowledge, and boost your exam performance.

Question Example from AnalystPrep's Level I CFA Mock Exams

Question 1

Of the 6 United Nations Principles for Responsible Investment (PRI), which one expects signatories to incorporate ESG into their investment approach?

Solution 1

1.1.9. The PRI developed six principles, which are voluntary, but provide overarching guidance on actions members can take to incorporate ESG issues into investment practice. The six principles are: 1. We will incorporate ESG issues into investment analysis and decision-making processes. 2. We will be active owners and incorporate ESG issues into our ownership policies and practices. 3. We will seek appropriate disclosure on ESG issues by the entities in which we invest. 4. We will promote acceptance and implementation of the principles within the investment industry. 5. We will work together to enhance our effectiveness in implementing the principles. We will each report on our activities and progress toward implementing the principles

Question 2

Maria works for an ESG consulting firm. Her client, a Norwegian pension fund, is interested in implementing ESG investing. At the kick-off meeting, Maria presents different ESG investment styles and believes that ethical investing might be the most appropriate style to achieve the client’s goals. However, her counterpart Niklas believes that ethical investing is not an accepted ESG investment style. He believes that thematic investing is probably the most appropriate ESG investment style. In your opinion, which form of ESG investing is least likely to be considered an appropriate ESG investment style?

1.1.3. There are different approaches to ESG investing: responsible investment; socially responsible investment (SRI); sustainable investment; best-in class investment; ethical/values-driven investment; thematic investment; impact investment; green investment; social investment; shareholder engagement.

Question 3

John Elkington created the term “triple bottom line” about 25 years ago. To this day, it continues to grow in popularity and has become part of everyday language in business. Which of the following is least likely to be one of the three P’s of the triple bottom line concept?

A. Planet

B. Profits

C. Principle

Solution 3

1.1.2. The TBL accounting theory expands the traditional accounting framework focused only on profit to include two other performance areas: the social and environmental impacts of a company. These three bottom lines are often referred to as the three Ps: 1. people; 2. planet; and 3. profit.

CFA® ESG

Study Packages by offered by AnalystPrep

Learn + Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Study Notes

- 5 Ask-A-Tutor Questions

- 12-Month Access