SOA Exam IFM Practice Questions

Get access to over 500 exam-style Investment and Financial Markets Practice Problems

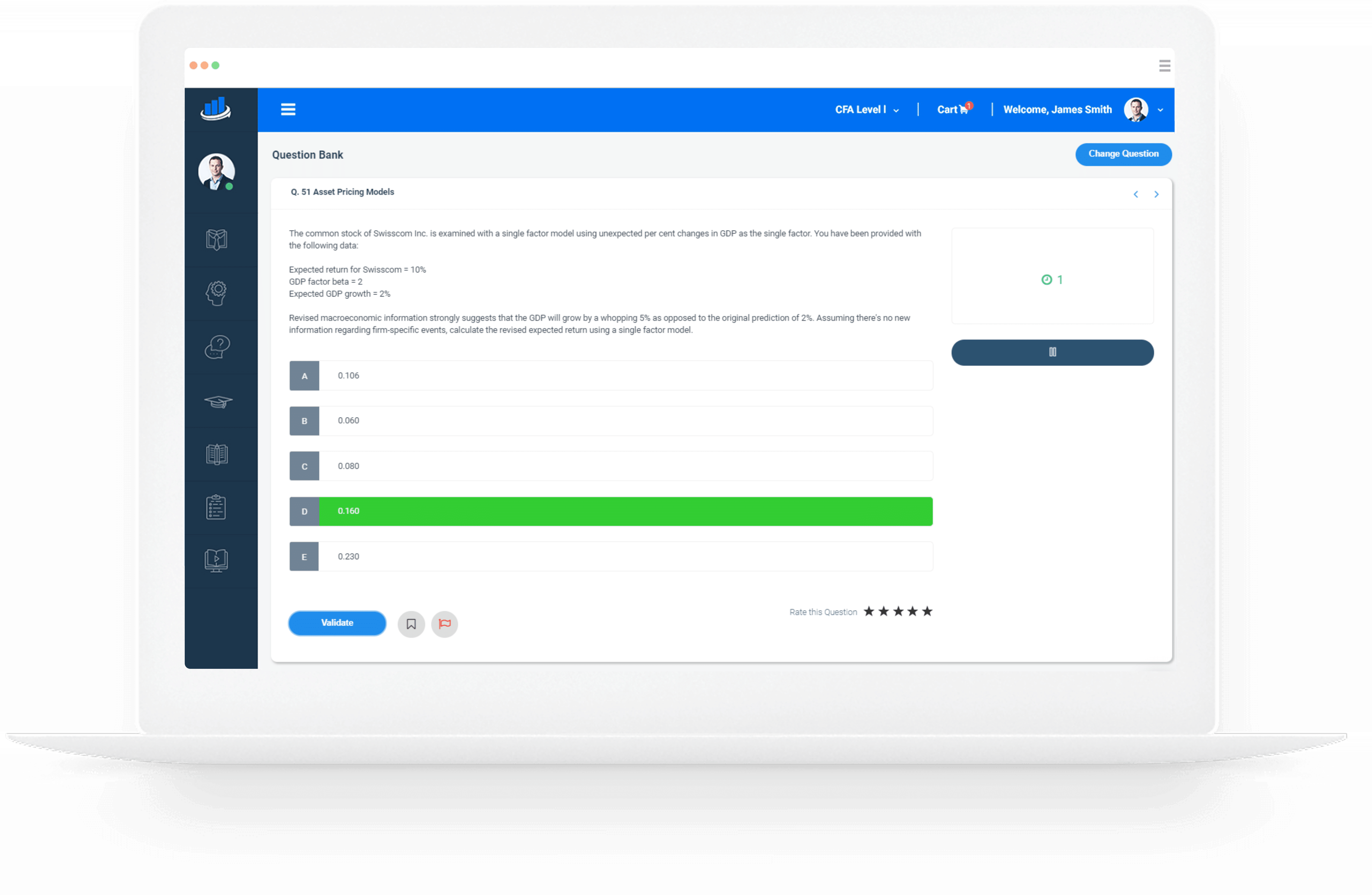

Investment and Financial Markets Question Bank

To increases your chances of passing Exam IFM by the Society of Actuaries, repetition is the key to success. AnalystPrep’s financial markets practice problems (multiple-choice questions from A to E – just like the actual exam) reflect the difficulty and style of the Exam IFM from the Society of Actuaries. More so, our team of highly-skilled academics and actuaries includes regular reviews to match each new bit of content that is posted in the IFM exam syllabus.

Aside from getting up-to-date study materials, you also get access to our customizable quizzes and performance metrics tailored to help you improve your weakest topics. Also, our team of tutors, that you can contact 24/7 via our live chat, is guaranteed to help you get ready for actuarial Exam IFM.

How is the IFM Question Bank Subdivided?

AnalystPrep’s question bank for Exam IFM has been specifically crafted around the syllabus given by the Society of Actuaries. As such, it is subdivided into ten main topics:

- Mean-Variance Portfolio Theory (10-15%)

- Asset Pricing Models (5-10%)

- Market Efficiency and Behavioral Finance (5-10%)

- Investment Risk and Project Analysis (10-15%)

- Capital Structure (10%)

- Introductory Derivatives – Forwards and Futures (5-10%)

- General Properties of Options (10-15%)

- Binomial Pricing Models (10%)

- Black-Scholes Option Pricing Model (10-15%)

- Option Greeks and Risk Management (5-10%)

Having also built study materials for CFA and FRM exam, AnalystPrep’s team of highly-skilled academics and investment professionals knows exactly what it takes to teach you the theory behind financial markets.

Questions Answered by our Users

Satisfied Customers

preparation platform according to review websites

Free Investment and Financial Markets Practice Problems with Answers

Question 24

Mean-Variance Portfolio Theory

You are given the following information about the annual returns of two stocks, A and B:

.The expected returns of A and B are \(E[R_A] = 10\%\) and

\(E[R_B] = 15%.\)

The volatilities of the returns are \(V_A =18\%\) and \(V_B = 20\%\).

The correlation coefficient of the returns for these two stocks is 0.25.

The expected return for a certain portfolio, consisting only of stocks A and B, is 12%.

Calculate the volatility of the portfolio return.

A) 13.00%

B) 13.96%

C) 14.96%

D) 15.70%

E) 12.45%

The correct answer is: C)

Let \(w_A\) be the weight of stock A and so \(1 – w_A\) is the weight of stock B

Then, the expected return of the portfolio is:

$$

E_p=w_A E_A+w_B E_B $$

Where \(w_B=1-w_A\)

So,

$$ \begin{align*}

0.12 & =w_A E_A+(1-w_A)E_B \\

0.12 & =w_A (0.10)+(1-w_A )(0.15)=0.15-0.05W_A \\

\Rightarrow w_A & =0.6 \\ \end{align*} $$

We need :

$$ \begin{align*}

Var[0.6 R_A+0.4R_B]

& =0.6^2 Var[R_A ]+0.4^2 Var[R_B ]2(0.6)(0.4)Cov(R_A,R_B ) \\

& =0.6^2 \times 0.18^2,+0.4^2 \times 0.20^2+2(0.6)(0.4)(0.25)(0.18)(0.20) \\

& =0.022384 \\ \end{align*} $$

The volatility is equivalent to the standard deviation. So, the volatility is :

\(

=\sqrt {0.022384}=0.1496=14.96\% \)

Question 74

Asset Pricing Models

A portfolio has a return of 15% and its beta and the standard deviation are 0.8 and 25% respectively. The return on the market is 8% with a standard deviation of 0.5 and the risk-free rate is 5%.

Calculate the ratio between Sharp and Treynor measures.

A) 2:1

B) 3:4

C) 4:6

D) 5:1

E) 3:1

The correct answer is: A)

The Sharpe ratio is given by:

$$ \begin{align*}

Sharpe \quad Measure & =\cfrac {R_p-R_f}{\sigma} \\

& = \cfrac {0.15-0.05}{0.25}=0.4 \\

Treynor \quad Measure & =\cfrac {R_p-R_f}{ \beta} \\

\end{align*} $$

But,

$$ \begin{align*}

\beta & =\cfrac {\sigma_p}{\sigma_m} =\cfrac {0.25}{0.5}=0.5 \\

∴ Treynor \quad Measure & =\cfrac {0.15-0.05}{0.5}=0.20 \\

\end{align*} $$

So, the ratio is:

$$ 0.4:0.2=2:1 $$

Question 112

Market Efficiency and Behavioral Finance

Behavioral finance examines investor behavior to understand how people make decisions, individually and collectively. Some of the behavior patterns include the following:

- Familiarity bias

- Information cascades

- Overconfidence bias

- Herding bias

Determine which of these behavioral biases LESS likely to cause stock prices to deviate from their fundamental values.

A) Familiarity bias and information cascades

B) Familiarity bias and overconfidence bias

C) Overconfidence bias and herding bias

D) Information cascades and overconfidence bias

E) Overconfidence bias and herding bias

The correct answer is: B)

We have to determine which of these are NOT systematic trading biases and are, therefore, LESS likely to cause stock prices to deviate from their fundamental values.

Familiarity bias is where the investors buy the stocks which are quite familiar to them. For instance, buying the stocks on their country or from the companies that they are accustomed to. This will not cause many effects on the price of the securities.

Over confidence bias results from uninformed individuals over estimating the accuracy of their knowledge.

Question 169

Investment Risk and Project Analysis

The expected returns of One Dollar shops are assumed to be distributed uniformly over the range [10%,20%].

Calculate the expected shortfall below 12%.

A) 0.1

B) 0.2

C) 0.3

D) 0.4

E) 0.5

The correct answer is: B)

The expected shortfall for continuously distributed returns is given by:

$$ \int _{ -\infty }^{ B }{ \left( B-x \right) } f\left( x \right) dx=\int _{ 0.1 }^{ 0.12 }{ \left( 0.12-x \right) } 10dx=0.002=0.2\% $$

Question 216

Capital Structure

A company will pay a dividend of $8 next year. The payout ratio is 40%, the ROE is 12%, and the stock price is $80.

Calculate the cost of equity capital for that company.

A) 0.15

B) 0.16

C) 0.17

D) 0.2

E) 0.21

The correct answer is: B)

To calculate the cost of equity, we need to first calculate the growth rate:

$$ g=\left( 1-Dividend\quad payout\quad ratio \right) \times ROE $$

Now, we can calculate the return on equity:

$$ \begin{align*}

g & =\left( 1-0.40 \right) \times 0.10=0.06 \\

{ r }_{ e } & =\frac { { D }_{ 1 } }{ { P }_{ 0 } } +g=\frac { 8.0 }{ 80 } +0.06=0.16\quad or\quad 16\% \\

\end{align*} $$

Question 271

Introductory Derivatives – Forwards and Futures

An investor enters into a 5-month contract on 1 Jan 2020 to by 100 shares at the end of the contract’s term. The price of each share at that time is $100. The dividends are received at a dividend yield of 6% per year and the risk-free rate of interest is 4% per year effective. Assume that there is no arbitrage opportunity.

The investor decided to sell his contract on 1 April 2020 when the price per share was $50. Compute the value of the forward contract at this time.

A) -$4323.89

B) $4,264.90

C) -$4,898.95

D) $4,532.50

E) $3,253.78

The correct answer is: C)

The forward price of the contract on 1 April is:

$$ 50{ e }^{ -0.06\times \frac { 2 }{ 12 } }\times { 1.04 }^{ \frac { 5 }{ 12 } }\times 100=4982.71 $$

So, the value of the contract on 1 June is:

$$ 4982.71-9913.79=-4931.08 $$

So, the value on 1 April is:

$$ -4931.08\times { 1.04 }^{ -\frac { 2 }{ 12 } }=-4898.95 $$

Question 397

Black Scholes Option Pricing Model

A European put option is written on non-dividend paying stock currently priced at $70 with a strike price of $90. The risk-free rate of interest is 5% per year, the volatility is 35% per year and time to maturity is 6 months. Calculate the price of the option.

A) 3.00

B) 2.38

C) 3.45

D) 2.56

E) 2.90

The correct answer is: B)

From the information given,

\(S_0=70,K=90,r=0.05,\sigma=0.35\) and \(T=0.5 \)

So,

$$ \begin{align*}

d_1 & =\cfrac {\text {ln} \frac {S_0}{K}+\left[r-q+ \left(\frac {s^2}{2}\right) \right]T}{\sigma \sqrt {T}}=\cfrac {ln \frac {70}{75}+\left[0.05-0+ \left(\frac {0.35^2}{2} \right) \right]0.5}{0.35 \sqrt {0.5}}=-0.05401 \\

d_2 &=-0.05401-0.35 \sqrt {0.5}=-0.30150 \\

p_0 & =Ke^{-rT} \times N(-d_2 )-S_0 e^{-qT} \times N(-d_1) \\

& =75e^{-0.05 \times 0.5} \times N(0.05)-70 \times N(0.30)=90e^{-0.05 \times 0.5} \times 0.5199-70 \times 0.617 \\

& =2.3827 \\

\end{align*} $$

Question 441

Option Greeks and Risk Management

The share price of Slatten company suddenly began to trade at $1500 per share, after previously trading at $X per share during which a call option on the stock priced at $200 was traded too. The call option has a delta of 0.60 and a gamma of 0.004 and the current price of the option is 250.

Calculate X.

A) 1345.23

B) 1432.06

C) 1546.89

D) 1234.56

E) 1969.9

The correct answer is: B)

This question is a bit treacherous. We need to use delta-gamma approximation. We know that:

$$ \left( { S }_{ t+h } \right) =C\left( { S }_{ t } \right) +\epsilon \Delta \left( { S }_{ t } \right) +\frac { 1 }{ 2 } { \epsilon }^{ 2 }\Gamma \left( { S }_{ t } \right) $$

We need to find \(\epsilon \). Using the information given, we have:

$$ \begin{align*}

250&=200+\epsilon 0.60+\frac { 1 }{ 2 } { \epsilon }^{ 2 }\times 0.004\\ &=0.002{ \epsilon }^{ 2 }+0.60\epsilon -50=0\\

\end{align*}$$

Using the quadratic formula:

$$ \epsilon =\frac { -b\pm \sqrt { { b }^{ 2 }-4ac } }{ 2a } $$

Where \(a=0.002,b=0.60,c=-50\)

$$ \epsilon =\frac { -0.60\pm \sqrt { { 0.60 }^{ 2 }-4\times 0.002\times -50 } }{ 2\times 0.002 } =-367.95,67.94 $$

The positive answer is relevant, so we go with 67.94.

So,

$$ X=1500-67.94=1432.06 $$