Pass SOA Exam IFM

with AnalystPrep

AnalystPrep's Study Materials for the SOA IFM Exam

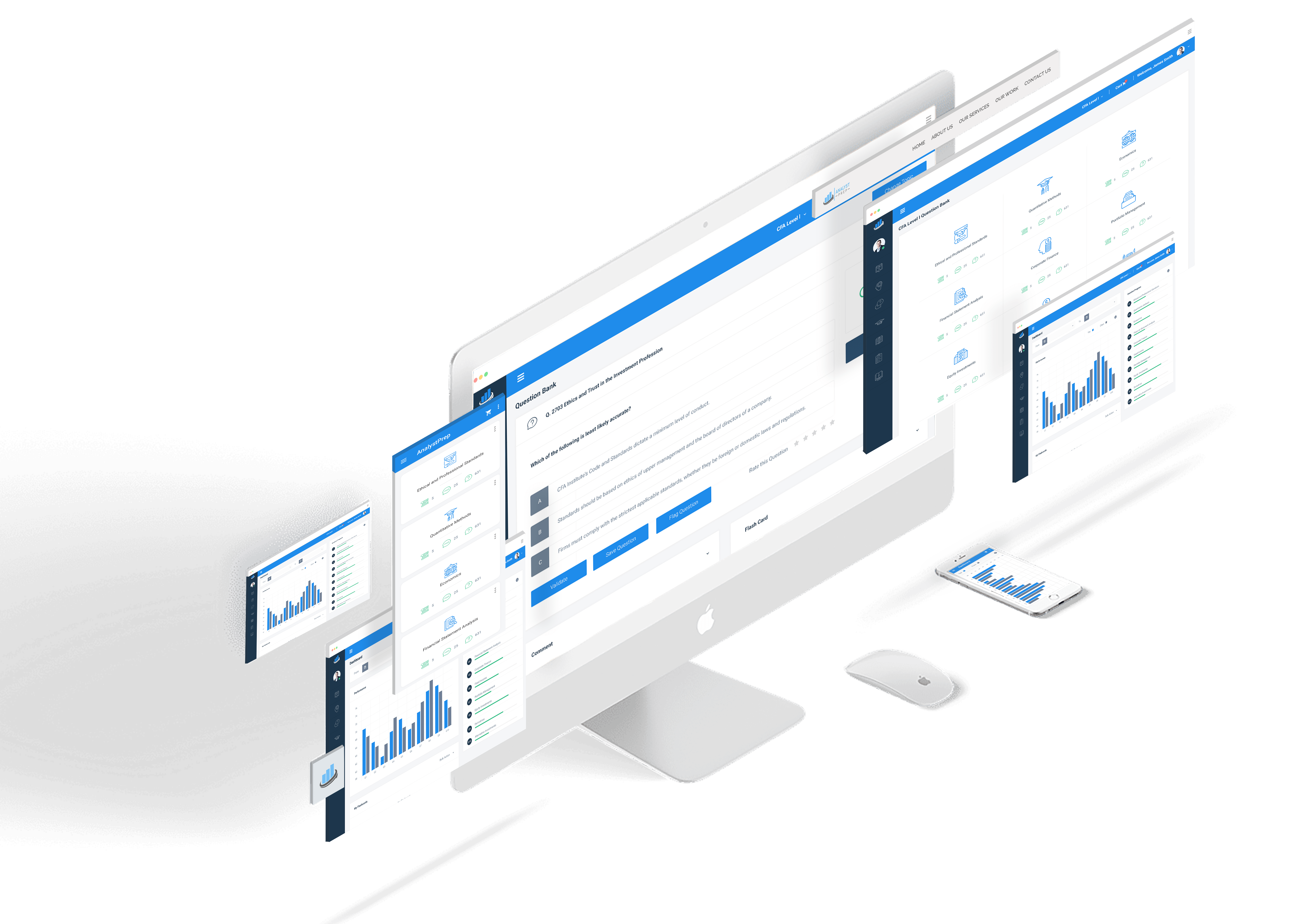

Our study notes have been made by academics and actuaries actually working in the field of investment. Our team, also known for building CFA and FRM exam prep packages, only produces high-quality financial markets study notes so that each learning objective is covered in detail.

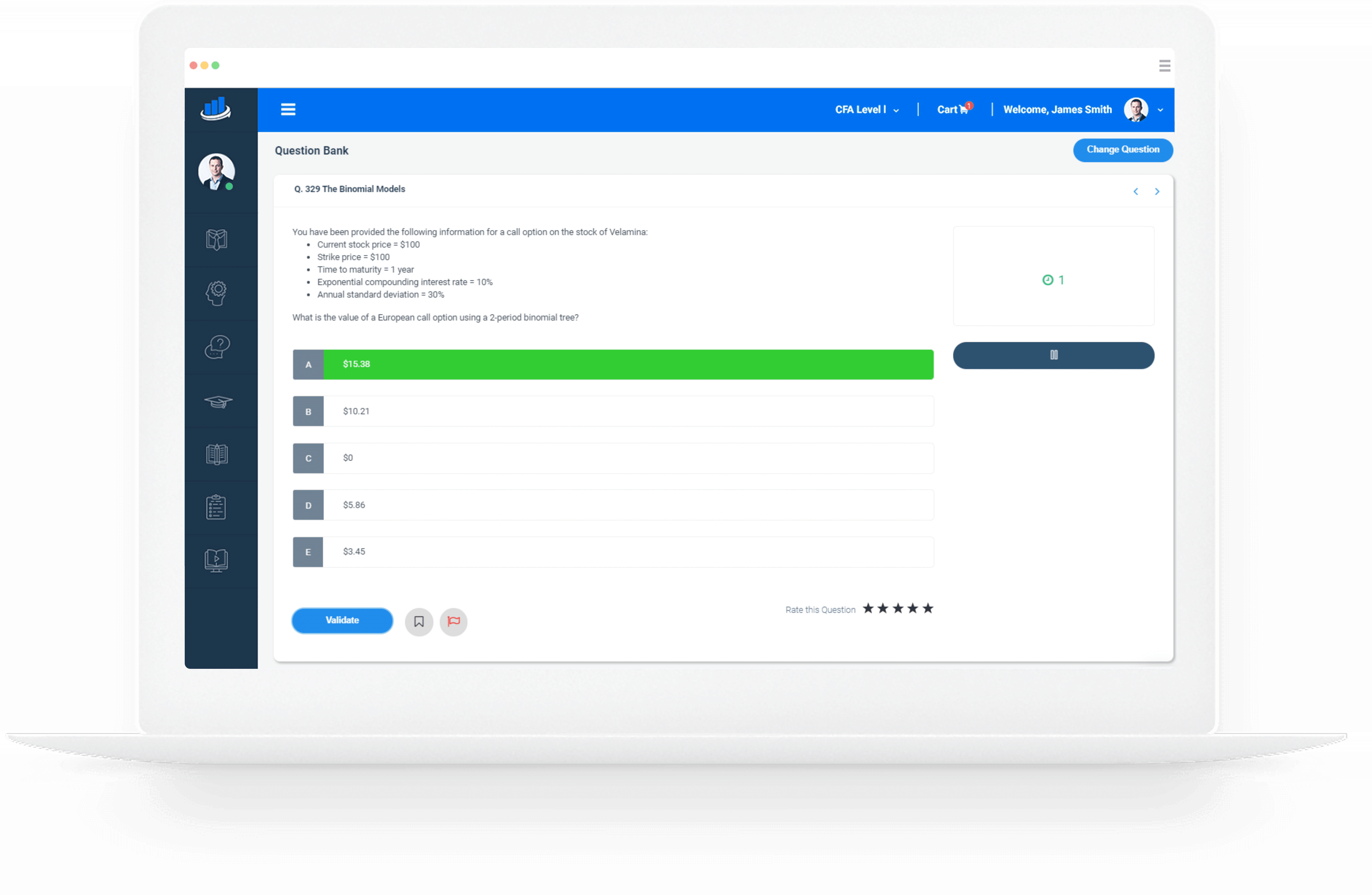

After reading a particular topic, jump into the question bank tab and solve hundreds of practice questions tailored to teach you all of the rudimentary aspects of financial markets. To succeed in exam IFM, you will need to solve numerous hard, mathematical practice questions on a number of different topics such as the Capital Asset Pricing Model (CAPM), market efficiency, derivative pricing, the BSM model, and much more.

You can also create an unlimited number of quizzes to test your understanding of one or more topics at the same time. Once you have covered all of the content, you can also simulate the actual exam using our Quiz function.

Exam IFM Study Materials

Syllabi Updates

Professional Advices

Community

Questions Answered by our Users

Satisfied Customers

preparation platform according to review websites

What Should You Expect from Exam IFM?

Exam IFM is a 3-hour long exam that consists of 30 multiple-choice questions. It is a computer-based exam and each question has five answer choices.

This exam builds up your knowledge of the theoretical elements of corporate finance and financial models. Additionally, you become conversant with how the financial models are utilized not only in insurance but also other financial risks.

Each question is accompanied by 5 unique choices: A, B, C, D, and E. Given your right/wrong answer in each of the questions, you will be given easier or harder questions going forward. As such, each candidate will have a different set of 30 questions.

Here are the ten main topics and their weighting in the exam:

| Topic | Weighting | |

| 1 | Mean-Variance Portfolio Theory | 10-15% |

| 2 | Asset Pricing Models | 5-10% |

| 3 | Market Efficiency and Behavioral Finance | 5-10% |

| 4 | Investment Risk and Project Analysis | 10-15% |

| 5 | Capital Structure | 10% |

| 6 | Introductory Derivatives – Forwards and Futures | 5-10% |

| 7 | General Properties of Options | 10-15% |

| 8 | Binomial Pricing Models | 10% |

| 9 | Black-Scholes Option Pricing Model | 10-15% |

| 10 | Option Greeks and Risk Management | 5-10% |

Actuarial Exams Study Packages

Exam P (Learn + Practice Package)

$

249

/ 6-month access

- Online Study Notes

- Online Question Bank and Quizzes

- Performance Tracking Tools

- 6-Month Access

Exam FM (Learn + Practice Package)

$

249

/ 6-month access

- Online Study Notes

- Online Question Bank and Quizzes

- Exam FM Video Lessons

- Performance Tools

- 6-Month Access

Exam IFM (Learn + Practice Package)

$

249

/ 6-month access

- Online Study Notes

- Online Question Bank and Quizzes

- Performance Tools

- 6-Month Access

Unlimited Actuarial Exams Study Package

Unlimited Actuarial Exams Access

$

399

/ lifetime access

- Online and Offline Exams Study Notes

- Online and Offline QBank and Quizzes

- Exam FM Video Lessons

- Performance Tracking Tools

- Lifetime Access

- Unlimited Ask-a-Tutor Questions

Testimonials