FRM Part 1 Study Notes

FRM Part I Foundations of Risk Management 1. The Building Blocks of Risk... Read More

After completing this reading, you should be able to:

Hedge funds are financial partnerships that use a pooled investment structure to earn excess returns for their investors. The sole objective of trading in hedge funds is to diversify funds and maximize profits.

Hedge funds are characterized by the following features:

Even though Hedge funds, hedge funds are sophisticated investment vehicles that promise high returns by employing diverse and complex strategies, the databases that track their performance and strategies harbor inherent biases that can significantly impact investors, analysts, and researchers’ understanding and decision-making processes. The following are some of the biases found in databases of hedge funds:

The historical performance of hedge funds had not been disclosed before the early 1990s. The reports of hedge fund managers first emerged in 1993. However, in 1994, the event was succeeded by huge losses from some managers in the industry due to sudden dynamics in the interest rate policy by the Federal Reserve.

Therefore, since the first reporting, the way hedge fund investors assess their portfolios was greatly affected. The 1994 event was the first recorded in the hedge fund industry, which encouraged diversification across the fund investors.

After that, the electronic databases came in. This enabled viability of research in hedge funds. Although hedge funds were not required to disclose their data, some hedge funds did. Between 1997 and 2010, approximately nine percent of the hedge funds were reporting to commercial databases.

Between 1997 and 2010, the number of hedge funds had increased more than four times as the assets under management rose by approximately ten times.

Therefore, the landmark events for the development of the industry are the 1993 reporting event, 1994 changes in interest rate policies by the Federal Reserve, and the introduction of electronic databases.

The dot com bubble collapse between 2000 and 2001 affected most investment industries. However, this did not affect the hedge fund industry. Surprisingly, the hedge funds industry had an increased net asset inflow, and the industry structure experienced a major shift.

Although institutional investors are characterized by a moderate expectation of return, lower tolerance to risk, and lower tolerance to high fees, they were still attracted to hedge funds, which required high costs. Therefore, on their first days of investing in hedge funds, the institutional investors constructed a diversified portfolio of hedge funds that met the goals of the institutions.

The institutional investors shift into the hedge fund industry was a result of the hedge funds’ best performance. Total assets under management of the fund increased from $197 billion at the closing of the year 1999 to $1,390 billion at the end of 2007, a rise more than the global GDP. Thus, the shift from less risky investments to hedge funds yielded positive returns.

Furthermore, institutional investors influenced changes in the prices of diverse financial instruments, thus creating a positive impact on the cumulative market conditions.

As earlier discussed, hedge funds are largely dominated by institutional investors in terms of assets under management. The governance structure of the institutional investors favored large hedge fund management companies as mirrored in the size of increased assets under management (AUM).

The substantial increase in the assets under management serviced by hedge funds and those reported to the commercial databases resulted from large hedge funds’ successful managers who chose to conceal their data.

The continuing positive change in the AUM of large funds affirms the existence of an equivalent positive perception of the value brought by large funds against their competitors. Therefore, the continued growth of the industry’s AUM is a result of the attractiveness of hedge funds despite their huge risk exposures.

Furthermore, the rapid growth of AUM in hedge funds is a result of their appealing performance compared to the competitors across markets, as well as their high turnover.

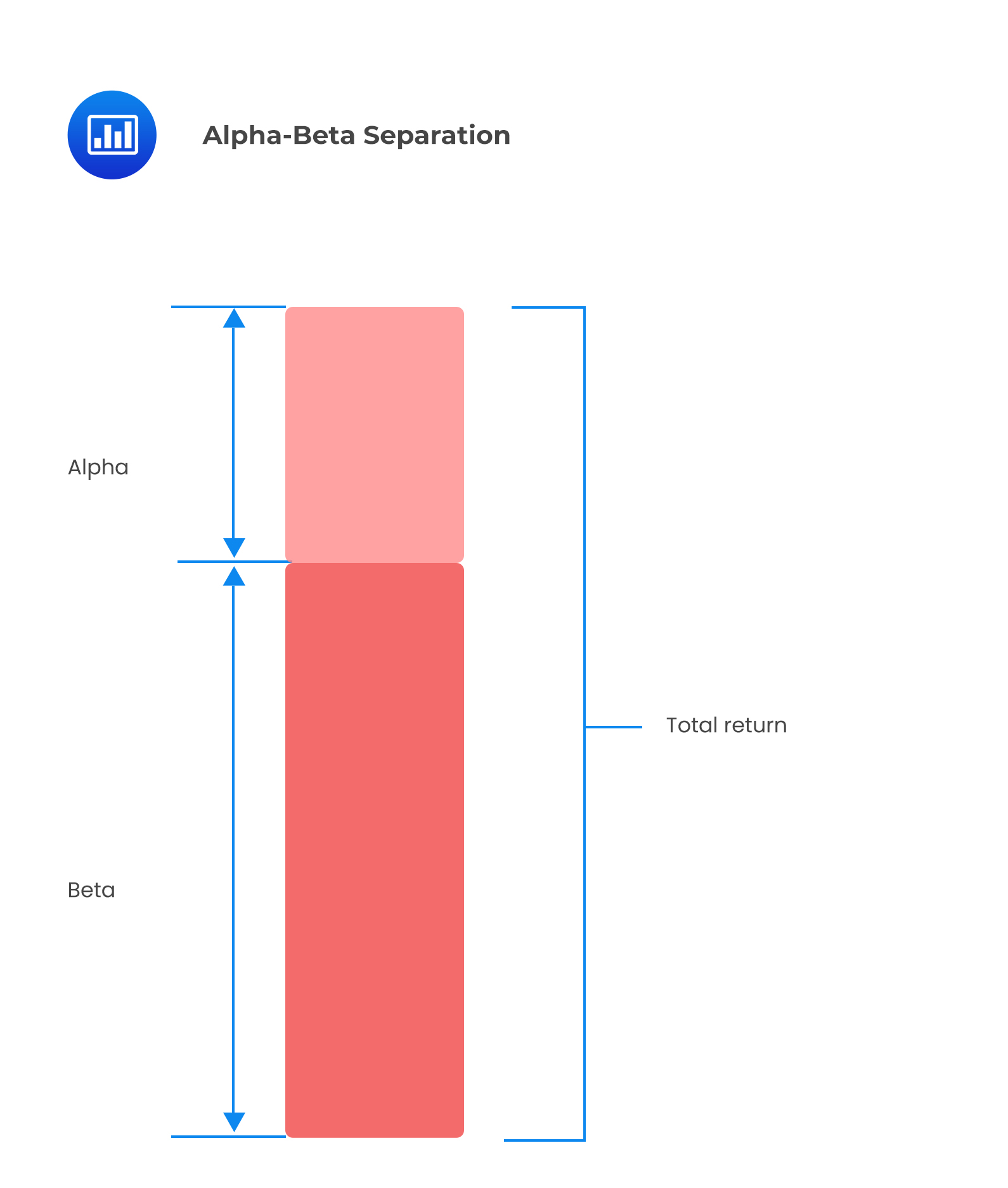

Alpha and risk provide investors with what they are searching for – returns. Alpha is the amount by which the returns from a particular asset exceed the gains from the entire market. In other words, it is the part of the return unrelated to any risk premium. Alpha is estimated by regressing the asset’s returns against the market returns. The difficult part is to separate alpha from risk.

A manager can use quantitative tools, statistical techniques such as VaR, or benchmarking to differentiate between returns generated from the superior performance of an active manager and those generated by high levels of market risk (undiversifiable risk).

The primary lever of risk management in hedge funds is the construction of a diversified portfolio. In so doing, it is important to have a clear understanding of the underlying risks from the various hedge fund strategies. Different hedge fund investors have different goals. For example, some invest for safety away from equity markets, others look for absolute returns, and others perceive hedge funds as an alternative source of profit.

Therefore, individually selecting the hedge fund exposures to risk factors (alpha and beta) enhances returns by maintaining the desired risk levels within the portfolio. This brings in the concept of alpha-beta separation, where a portfolio is divided into two, i.e., an alpha portfolio and a beta portfolio.

Alpha is considered statistically significant if it is positive; otherwise, it is insignificant.

Alpha is considered statistically significant if it is positive; otherwise, it is insignificant.

General Formula:

$$ \text{Alpha}=\text R – \text R_{\text f} – \text{beta} (\text R_{\text m}-\text R_\text f) $$

Where:

\(R\) represents the portfolio return;

\(\text R_\text f\) represents the risk-free rate of return;

\(beta\) is the systematic risk of the portfolio; and

\(\text R_\text m\) represents the market return, per benchmark.

Assume the actual return of a hypothetical hedge fund is 20%, the risk-free rate is 6%, beta is 0.8, and the market index return is 12%, we calculate alpha as:

$$ \begin{align*} \text{Alpha} & =\text R – \text R_{\text f} – \text{beta} (\text R_{\text m}-\text R_\text f) \\ \text{Alpha} & =20\%-6\%-0.8\left(12\%-6\%\right)=9.2\% \\ \end{align*} $$

The result implies that the investment outperformed the market index by 9.2%.

Managed futures and global macro strategies are the most pursued hedge funds. Managed futures hedge fund index provides a measure of the cumulative returns from managed futures hedge funds. The fund managers employ systematic trading programs that are dependent on past price data and market trends such as equities and bonds. Furthermore, high leverage is required since future contracts are used.

On the other hand, global macro is an investment style that is highly opportunistic and has the prospective of generating strong risk-adjusted returns in adverse markets. Moreover, just like the managed futures, it uses high leverage because of the future expected price movements in markets. The trading program for global macro can either be a systematic or discretionary trend.

The similarity between the global macro and managed futures is that both are trend followers.

A trend follower is said to have perfect foresight if the owner can buy an asset at a low price and sell it at a high price. The main determinant of trend following returns is market volatility.

The returns of a global macro strategy are generated by correct speculation of price movements across the markets as well as the flexibility to the changing demands and financial instruments. Global macro funds have similar return characteristics to a highly active portfolio of different hedge fund strategies. For this reason, their managers are said to be highly active asset allocators.

Long-term effects: Global macro funds affect the investor’s long-term investment performance since they affect future expected price movements.

High fees: Global macro funds are actively managed, and thus have higher investment threshold and higher fees.

Risk arbitrage, also known as merger arbitrage, speculates on a successful conclusion of mergers and acquisitions and exploits price inefficiencies arising from such events. On the other hand, distressed hedge funds strategy is event-driven. It involves investing in distressed firms that have filed for bankruptcy or are likely to do so soon.

Both the risk arbitrage and distressed strategies have non-linear return behaviors. In the distressed strategy, hedge fund managers look for assets that were not properly priced during the time of distress. They then liquidate those assets, and the proceeds are distributed to the owners according to their claims.

Deal risk: This occurs when plans to complete a merger fail due to the severity of the stock market decline.

Credit risk: A distressed hedge fund strategy has long exposure to the credit risk of those firms with low credit ratings. Additionally, securities are not traded in the public markets, making it hard to generate returns due to the increased exposure to credit risk.

Higher funding fees: Distressed hedge funds mostly consist of illiquid securities. Thus they incur higher funding costs during liquidation.

Effects on returns: For distressed hedge funds, the average returns are lowered during adverse market movements.

Tail risk: Tail risk refers to an investment’s most extreme downside performance periods. The tail risk is a large decrease in equity investments for merger arbitrage, while it is a large movement in the short-term rates for distressed hedge funds.

The fixed-income arbitrage hedge fund index provides the total returns from arbitrage funds with fixed incomes. Moreover, these funds control volatility by reducing exposures to the underlying market and interest rate risks through leveraging and shorting of capital. The strategy includes interest rate swaps, government securities and futures, volatility trading options, and mortgage-backed securities arbitrage sections.

The returns from fixed-income funds are generated by taking advantage of market inefficiencies and abnormalities in prices between any two or more related fixed-income securities.

Additionally, most fixed-income hedge funds rely on leverage for performance, which is aided by their exposure to credit market conditions.

High volatility: The fixed income volatility trades are bets that the volatility of interest rate caps is higher than the realized volatility of the future Eurodollar contracts.

Indirect default risk: The arbitrageur of the swap-spread strategy is exposed to indirect default risk. If the viability of several major banks were to become uncertain, market Libor rates would likely increase significantly. The arbitrageur paying Libor on a swap would suffer large negative cash flows from the strategy as the Libor rate responded to increased default risk in the financial sector

Convertible arbitrage is a relative value strategy in which long positions of convertible and sophisticated equity securities are created. The long equity positions are created by shorting market shares.

Convertible arbitrage funds make their returns by purchasing a broad portfolio of convertible securities and hedging the equity risks by shorting the required amount of stock.

Moreover, they earn their returns from a liquidity premium paid to hedge funds holding inventories of convertible bonds.

Pricing errors: When converting securities, there is a high possibility of making pricing errors. The risk can be managed by shorting corresponding stocks.

Long/short equity hedge funds represent approximately thirty to forty percent of all hedge funds. The managers of this strategy can freely move from value to growth, small to large capital, and net long to net short. Furthermore, there is diversification across sectors; thus, the exposures are widely spread.

Since there is diversification in the opinions and abilities of the managers, the returns of each manager are distinctive. If the fund manager makes good investments, the combination of a long and short portfolio will leverage the fund’s return upwards.

Underpricing: Most of the stocks are underpriced. This occurs as a result of trading on under-researched stocks.

Liquidity: The conditions for liquidity make small stocks, as well as foreign stocks, inappropriate for short sales.

The dedicated short bias hedge fund index gives the measure of total returns from dedicated short bias funds, which are characterized by more short positions than long positions.

This type of hedge fund generates its returns from maintaining excess short exposures. Due to the short bias, the managers borrow stocks from their counterparts and sell them at favorable prices.

There is a weak cash flow generation since there are more short positions than long positions, and to manage this underlying risk, the long positions must be equivalently compensated.

Emerging markets hedge funds trade in currencies of countries that are either developing or developed. Moreover, they trade in arbitrage, credit, event-driven, fixed income bias, and equity bias subsectors. Unlike the dedicated short bias, the emerging market index is subjected to a long bias.

Returns are earned from investing in currencies, debt instruments, and equities, among other financial instruments of developing markets.

Long bias: It is difficult to short securities in developing and less developed markets because of the lack of brokers willing to lend those short positions to hedge funds.

Equity-neutral funds are different from the earlier discussed niche strategies (dedicated short bias and emerging markets). Different neutral funds have different investment strategies, but they have a common objective of creating zero betas. As such, no risk factor can influence the return characteristics of this style.

Returns come from selecting the right stock (or sectors) to buy and which stocks (or sectors) to short.

Despite being market-neutral, these hedge funds still have a high-volatility risk profile.

The first hedge funds in history depended on long-bias funds evaluation tools since they could not access historical performance data. Therefore, investors would select investments based on the manager’s reputation, for example, the performance evaluation of the 27 large hedge funds identified by Fung and Hsieh prior to 2000.

To establish whether their performances were affected by systematic risks, the 27 large hedge funds were regressed against the eight-factor model for hedge fund indices analysis. The outcomes of the regression analysis indicated that the hedge funds had no significant exposures to stocks and bonds. Thus, it became clear that directional bets on non-linear factors drove returns to some extent.

An alpha of 1.48% and an average total return of 1.58% were recorded from the portfolio of 27 large hedge funds, thus showing that static exposures to risk factors do not affect total returns.

Therefore, unlike the US equity market, which has no persistent directional exposures, the 27 large hedge funds’ total returns are affected by persistent, significant vulnerabilities to developing markets.

A comparable experiment to the LHF27 was performed by investing in a similar portfolio of 50 top hedge funds using data captured between 2002 and 2010. The exercise was done in two ways:

Comparing Top\({50}\) and Top \({50}_{2010}\) gives the lower bound, the returns that investors can realize by investing in the top 50 large hedge funds and rebalancing on an annual basis, and the upper bound, the returns that investors can realize by investing in a foresight-assisted portfolio Top \({50}_{2010}\). The Top\({50}\) portfolio showed no statistically significant alpha in analyzing the portfolio characteristics, while the Top \({50}_{2010}\) portfolio had a statistically significant alpha of 0.53% at a 1% level.

Just like the LHF27, both Top\({50}\), and Top \({50}_{2010}\) portfolios have high exposures to emerging markets, although both showed no exposure to the US equities. Moreover, unlike the US equities, both the Top\({50}\) and Top \({50}_{2010}\) portfolios showed statistically significant alpha against the hedge fund indices. This is to mean that buying large hedge funds appears to realize superior performance relative to just investing in hedge fund indices.

Therefore, from the above discussions, it is evident that all the portfolios outperformed the equity market, and this answers the question of why institutional investors are attracted to hedge funds rather than equities.

In the hedge fund industry, some market events can cause stress to the utilized strategies causing the portfolio of hedge funds to converge in terms of risk factors.

From March to April of 1994, the first such market event was recorded. The occurrence was a result of an unanticipated increase in interest rates by the US Federal Reserve, which caused a drastic loss of money by seven of the ten style-specific sub-indices of Dow Jones Credit Suisse (DJCS) within two months. On the other hand, the exceptions, which included short-sellers and managed futures, risk arbitrage, and equity market neutral, generated positive returns to counter the losses.

The second event was the collapse of Long Term Capital Management (LTCM), a hedge fund with $126 billion in assets under management, which was recorded in August 1998. It occurred as a result of wholesale liquidation of risky assets and the effects of high leverage on the balance sheet of LTCM. In this event, eight out of ten niche hedge funds experienced losses. The exceptions were the short sellers and managed futures that generated positive returns.

Another event occurred in August 2007, when all nine-specialist style-sub-indices of DJCS experienced losses. The exception for this was the short-sellers who produced positive returns. Furthermore, all hedge fund styles lost money between July and October 2008, due to increased liquidation of leveraged positions. The only convergence was from the short-sellers.

It is worth noting that the profitability of hedge fund strategies arises from the proper use of leverage. Although the managed futures did not mitigate the losses of the 2008 crisis, they have always shown a positive performance profile against other strategies.

The problem of risk sharing asymmetry arises when the incentive fee, that is, approximately 20% of the returns, that hedge fund managers are given, entices them to accept risky trades. It occurs in extremes where new profits are only made from successful risky businesses.

In such instances, the manager is forced to take huge risks to increase the future loss-carried forward just in case of a failure. Therefore, when a risky business fails, the managers can reset the loss-carryforward burden by re-emerging as a new fund.

However, an opportunity cost exists for the manager, i.e., the damage incurred if the manager decides to close the fund. If the hedge fund is bigger both in size and age, it will be much more costly considering the reputation and value of the track record if the manager chooses to close it. Therefore, the high cost incurred for closing the hedge fund solves the principal-agent conflict. In this context, the principal is the investor, whereas the agent is the manager.

The risk-sharing asymmetry answers the question of why investors mostly prefer funds in which agents invest a proportionately large amount of their own wealth.

Practice Question

Emma, a risk manager at a global investment bank, is responsible for performing due diligence on hedge funds that her bank is considering investing in. As she sifts through a leading hedge fund database to analyze potential candidates, she reflects on the biases that might be present. Aware of the critical importance of her task, she recounts a meeting where she heard about a hedge fund that never reported poor performance, despite the prevalent market downturns. Another fund manager she met boasted about his fund’s consistent return curve with negligible volatility, which she found odd given the inherent riskiness of some of their positions.

Given the above scenario, which two biases are most likely being illustrated by the two hedge funds respectively?

A. Survivorship bias and Reporting bias

B. Instant history bias and Smoothing bias

C. Reporting bias and Instant history bias

D. Smoothing bias and Survivorship bias

Solution

The correct answer is B.

The first hedge fund, which seemingly never reported poor performance despite prevalent market downturns, is exhibiting Instant history bias. Hedge fund managers can choose when to report their performance, often reporting only when they achieve favorable results. The second hedge fund, which boasted about its fund’s consistent return curve with negligible volatility despite holding risky positions, is likely smoothing returns, which is a Smoothing bias.

A is incorrect. Survivorship bias refers to the overestimation of performance due to the removal of funds no longer reporting, and Reporting bias concerns funds choosing to disclose their performance out of their own free will. Neither of these biases align with the behaviors of the two hedge funds described in the vignette.

C is incorrect. Reporting bias involves funds choosing to disclose performance voluntarily, which does not specifically fit the scenario of the first hedge fund. While Instant history bias fits the first hedge fund, it doesn’t align with the second hedge fund’s behavior as described.

D is incorrect. While Smoothing bias aligns with the behavior of the second hedge fund, Survivorship bias, which pertains to the overestimation of performance due to removing non-reporting funds, does not fit the behavior of the first hedge fund in the vignette.

Things to Remember

- Survivorship bias may not only skew perceived historical returns but can also impact the perceived riskiness of an investment strategy. Funds that fail might have taken higher risks.

- When assessing hedge funds, a comprehensive view that accounts for non-reporting or closed funds provides a more accurate understanding of the entire industry’s risk and return profile.

- Reporting bias can give rise to asymmetric information. Potential investors might only see the ‘rosy’ picture, while negative results remain hidden.

- Constant diligence is essential. Even if funds report their performance, always question the consistency, methodology, and completeness of the data.

- Over-reliance on databases without understanding their inherent biases can lead to sub-optimal investment decisions.