Impact of Changes in the Components of ...

Changes in volume and prices primarily propel sales growth for a multinational corporation.... Read More

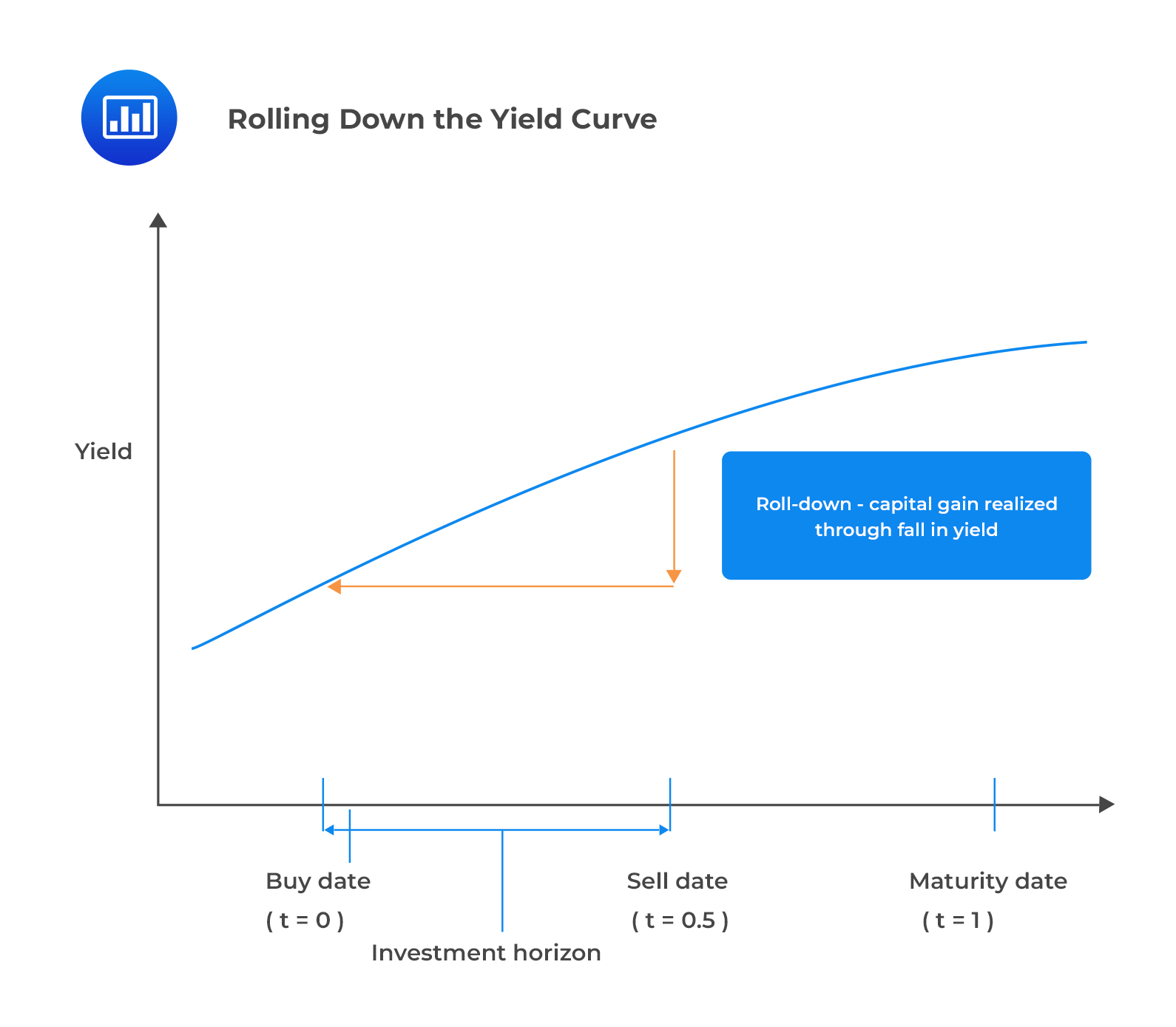

Riding the yield curve (rolling down the yield curve) is an active trading strategy where a bond trader buys bonds with a maturity longer than their investment horizon.

In an upward sloping curve, bonds with longer maturities earn higher yields relative to shorter maturities. Therefore, a longer maturity bond is valued at a successively lower yield and, thus, a higher price as it approaches maturity. Therefore, buying a longer maturity bond will yield higher returns due to price gains, provided that it is held for a period less than maturity.

If the upward sloping yield curve shape and level remain unchanged over the investment horizon, riding the yield curve will generate higher returns than a maturity matching strategy. The higher the difference between the forward rate and spot rate, the higher the total return.

For example, an investor with a six-month investment horizon may buy a one-year bond because it has a higher yield; the investor sells the bond at the six-month date but profits from the higher one-year yield.

Nonetheless, riding the yield curve is always risky because there can be no guarantees that the yield curve will remain unchanged over time. Additionally, riding the yield curve will not be as profitable as the buy and hold strategy when the interest rates rise.

Nonetheless, riding the yield curve is always risky because there can be no guarantees that the yield curve will remain unchanged over time. Additionally, riding the yield curve will not be as profitable as the buy and hold strategy when the interest rates rise.

Question

Riding the yield curve works best under certain conditions. Which of the following is least likely to be one of the conditions? The yield curve should:

- Be downward sloping.

- Be upward sloping.

- Remain unchanged.

Solution

The correct answer is A.

Riding the yield curve works for upward sloping yield curves and assumes that the yield curve will remain unchanged.

Reading 28: The Term Structure and Interest Rate Dynamics

LOS 28 (d) Describe the strategy of riding the yield curve.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.